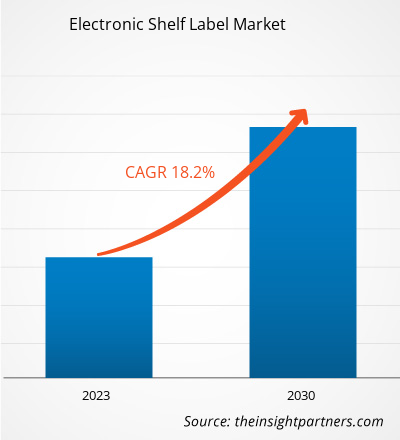

The electronic shelf label market size is projected to reach US$ 8.37 billion by 2030 from US$ 2.20 billion in 2022. The market is expected to register a CAGR of 18.2% during 2022–2030. The demand for automation solutions in the retail industry is likely to remain a key trend in the market.

Electronic Shelf Label Market Analysis

Factors such as an increasing number of supermarkets, malls, and stores, reduced labor availability, and trending retail automation demands are influencing the electronic shelf label market growth. However, the high installation charges and supporting infrastructure needed for the system are key challenges restraining the electronic shelf label market growth. Moreover, the world is moving ahead toward digitalization. As the ESL system has a low maintenance cost, the retail industry is widely adopting the system, owing to its benefits for retailers. This creates a big opportunity for the market players operating in the electronic shelf-label system market. Also, the Industry 4.0 integration and the emergence of advanced technologies for ESL, such as ePaper with multicolor and battery-free solutions, are anticipated to influence the electronic shelf label market positively.

Electronic Shelf Label Market Overview

Retailers use the electronic shelf label system for displaying product pricing on shelves. This system is gaining immense popularity as it has benefits such as product pricing being updated automatically whenever a price is changed from a central control server. The rising number of supermarkets, specialty stores, and hypermarkets are raising demand for the electronic shelf label market. The US, China, France, Germany, and Japan are the five leading countries contributing to the highest revenue share in the electronic shelf label market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Shelf Label Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Shelf Label Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electronic Shelf Label Market Drivers and Opportunities

Rise in Strategic Initiatives by Market Stakeholders to Favor the Market

Automation in the retail industry has benefitted retailers on a large scale by reducing human errors. In addition, the retail sector across the world is continuously growing. For example, according to the US government, retail sales in the US increased by 3.1% from US$ 5,402.3 billion in 2019 to US$ 5,570.4 billion in 2020. According to the India Brand Equity Foundation, the Indian retail sector is anticipated to reach US$ 2 trillion in value by 2032. The retail industry is increasingly emphasizing reducing total operational costs by removing manual operations in stores associated with stock, changing prices, and more. Therefore, the demand for automation solutions throughout the retail industry is rising. Furthermore, the concept of automation also includes the utilization of ESLS in retail stores to eliminate the maximum manual tasks, which will help in lowering overheads.

The market players in the electronic shelf label (ESL) market are launching ESL to cater to the growing demand for retail products. A few of the growth strategies are mentioned below.

- In January 2023, Ynvisible Interactive Inc. launched a large-format electronic shelf label display for grocery store retailers.

- In May 2023, Pricer & StrongPoint unveiled electronic shelf labels that can display graphics in yellow, red, black, and white. The use of high-resolution graphics and vibrant colors attracts more customers and increases store sales.

Thus, such strategic initiatives by market players drive the electronic shelf label market growth.

Demand for Real-Time Inventory Management

The need for real-time inventory management solutions increases the demand for electronic shelf labels among businesses. Traditional paper labels do not give businesses accurate and timely information about stock levels. This might result in difficulties such as out-of-stock products being incorrectly shown as available, which further causes customer dissatisfaction and reduces business sales. Electronic shelf labels can be incorporated into a retailer's inventory management system to provide real-time stock-level updates. This enables store personnel to quickly and readily detect when products need to be refilled, ensuring that customers are not disappointed due to unavailability.

Electronic Shelf Label Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electronic shelf label market analysis are component, hardware, product type, store type, and communication technology.

- Based on components, the electronic shelf label market is divided into hardware, software, and services. The hardware segment held a larger market share in 2022.

- By hardware, the market is segmented into displays, batteries, transceivers, microprocessors, and others. The display segment is expected to grow during the forecast period.

- In terms of product type, the electronic shelf label market is segregated into LCD ESL and E-Paper-based ESL. The e-paper-based ESL segment is expected to grow during the forecast period.

- Based on store type, the market is divided into hypermarkets, supermarkets, non-food retail stores, specialty stores, and others. The hypermarkets segment is expected to grow during the forecast period.

- based on communication technology, the market is divided into radio frequency, infrared, near-field communication, and others. The radio frequency segment held a larger market share in 2022.

Electronic Shelf Label Market Share Analysis by Geography

The geographic scope of the electronic shelf label market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American industrial refrigeration equipment market is segmented into the US, Canada, and Mexico. The North American electronic shelf label market is propelled by the huge presence of retail stores and significant development in the retail sector. This region is home to most of the world's largest retailers. Canada and Mexico have their own largest retail chains, and both countries have retail companies that conduct business operations worldwide. The retail industry is responsible for almost two-thirds of the US GDP. The major US retail chains include Walmart, Albertsons Companies, CVS Health, Amazon, Walgreens Boots Alliance, Costco, Kroger Co., and Target.

Electronic Shelf Label Market Regional Insights

The regional trends and factors influencing the Electronic Shelf Label Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electronic Shelf Label Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electronic Shelf Label Market

Electronic Shelf Label Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.20 Billion |

| Market Size by 2030 | US$ 8.37 Billion |

| Global CAGR (2022 - 2030) | 18.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Components

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

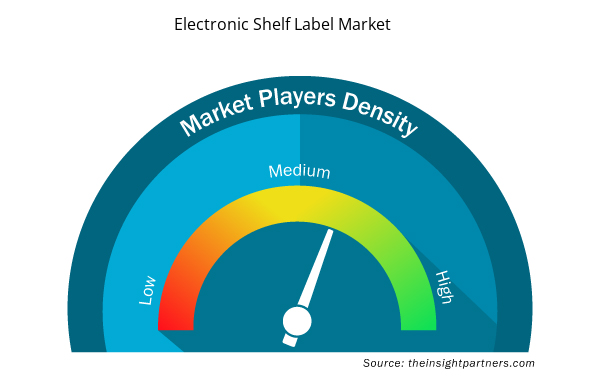

Electronic Shelf Label Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Shelf Label Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electronic Shelf Label Market are:

- LabelNest

- Displaydata Ltd

- Panasonic Holdings Corp

- M2C Communication DOO

- Hanshow Technology

- Opticon Sensors Europe BV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electronic Shelf Label Market top key players overview

Electronic Shelf Label Market News and Recent Developments

The electronic shelf label market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the electronic shelf label market are listed below:

- Hanshow held its "Revitalization and Excellence" new product launch at the Chongqing International Expo Center in China, where they officially unveiled the four-color Nebular Pro series of Electronic Shelf Labels (ESLs). (Source: Hanshow, Company Website, April 2023)

Electronic Shelf Label Market Report Coverage and Deliverables

The “Electronic Shelf Label Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Electronic shelf label market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electronic shelf label market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Electronic shelf label market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electronic shelf label market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Components, Hardware, Product Type, Store Type, and Communication Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global electronic shelf label market are LabelNest, Displaydata Ltd, Panasonic Holdings Corp, M2C Communication DOO, Hanshow Technology, Opticon Sensors Europe BV, Ses Imagotag SA, Samsung Electro-Mechanics Co Ltd, Diebold Nixdorf, Incorporated, and Pricer AB.

The global electronic shelf label market is estimated to register a CAGR of 18.2% during the forecast period 2022–2030.

The global electronic shelf label market is expected to reach US$ 8.37 billion by 2030.

North America dominated the electronic shelf label market in 2022.

The rise in strategic initiatives by market stakeholders is the major factors that propel the global electronic shelf label market.

The demand for automation solutions in the retail industry to play a significant role in the global electronic shelf label market in the coming years.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Electronic Shelf Label Market

- LabelNest

- Displaydata Ltd

- Panasonic Holdings Corp

- M2C Communication DOO

- Hanshow Technology

- Opticon Sensors Europe BV

- Ses Imagotag SA

- Samsung Electro-Mechanics Co Ltd

- Diebold Nixdorf, Incorporated

- Pricer AB

Get Free Sample For

Get Free Sample For