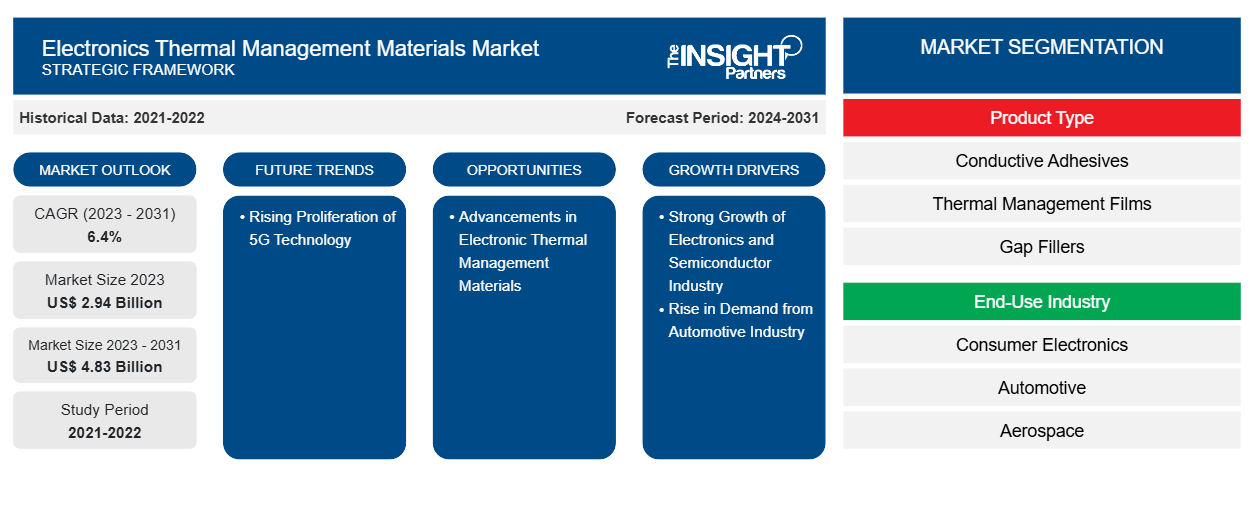

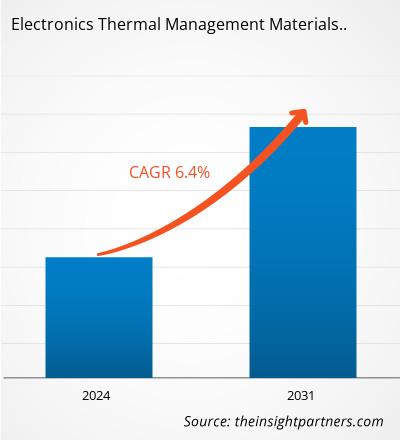

The electronics thermal management materials market size is projected to reach US$ 4.83 billion by 2031 from US$ 2.94 billion in 2023. The market is expected to register a CAGR of 6.4% during 2023–2031. Due to the strong growth of the electronics and semiconductor industry, electronics thermal management materials have gained traction worldwide.

Electronics Thermal Management Materials Market Analysis

The electronics thermal management materials market has gained significant traction as electronic devices become more powerful, compact, and heat-sensitive. Thermal management materials, including conductive adhesives, thermal gels, thermal greases, phase-change materials, and heat spreaders, play a crucial role in dissipating heat and ensuring the reliability and efficiency of electronic components. The market growth is driven by the increasing demand across sectors such as consumer electronics, automotive, telecommunications, and data centers. In particular, the rise of electric vehicles (EVs) and 5G infrastructure has intensified the need for advanced thermal management solutions to prevent overheating and extend device longevity. Key challenges include the need for materials that offer high thermal conductivity, mechanical stability, and compatibility with miniaturized electronics. Technological advancements in nanotechnology and material sciences are driving the development of innovative products, such as graphene-based TIMs and advanced phase-change materials, enhancing performance and energy efficiency.

Electronics Thermal Management Materials Market Overview

The electronic thermal management materials market is experiencing robust growth, driven by the increasing demand across sectors such as consumer electronics, automotive, and telecommunications. As electronic devices become more powerful, compact, and complex, managing the heat generated by components becomes critical to ensure performance, reliability, and longevity. Thermal management materials are designed to efficiently dissipate heat, thus preventing overheating and improving device performance. In the consumer electronics sector, the rising adoption of devices such as smartphones, tablets, and gaming consoles is boosting the need for effective heat management solutions. The automotive industry is another significant driver, particularly with the growth of electric vehicles (EVs) and autonomous driving technologies, which involve high-powered electronics that demand efficient cooling solutions. Additionally, the telecommunications industry, especially with the expansion of 5G infrastructure, relies heavily on advanced thermal management materials to handle high-performance network equipment.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronics Thermal Management Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronics Thermal Management Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electronics Thermal Management Materials Market Drivers and Opportunities

Strong Growth of Electronics and Semiconductor Industry

The rapid expansion of the electronics and semiconductor industry has been a key driver of demand for electronic thermal management materials. As electronic devices become more powerful and compact, they generate higher heat levels, necessitating advanced thermal management solutions to maintain operational efficiency and extend device lifespan. These materials are essential for managing heat in components such as processors, memory modules, and power electronics in devices such as smartphones, laptops, and automotive electronics. In the semiconductor sector, where miniaturization and performance enhancement are crucial, effective heat dissipation has become vital to prevent overheating and ensure stable operation, fueling the demand for innovative thermal management materials. According to Invest India, the global electronics manufacturing services market is anticipated to reach US$ 1,145 billion by 2026, at a CAGR of 5.4% during 2021–2026. The India Brand Equity Foundation states that the Indian electronics manufacturing industry is anticipated to reach US$ 520 billion by 2025. In addition, the Internet of Things (IoT) has gained considerable popularity worldwide recently, with businesses acknowledging the significance of connectivity. IoT has enabled every device to be connected to the Internet. According to the International Data Corporation (IDC), 41.6 billion IoT devices will be capable of generating 79.4 zettabytes (ZB) of data in 2025.

Advancements in Electronic Thermal Management Materials

Advancements in electronic thermal management materials are poised to create significant growth opportunities by addressing the increasing thermal challenges in modern electronics. As devices become more powerful and compact, new materials with enhanced thermal conductivity, flexibility, and durability are essential to manage the higher heat loads effectively. For instance, innovations in graphene and carbon-based materials are offering ultra-high thermal conductivity and lightweight solutions, making them ideal for applications in high-performance electronics and EVs. These advancements enable manufacturers to design more efficient and compact thermal solutions, allowing for better device performance and longevity. Developments in phase-change materials and nanotechnology are also contributing to growth in this market. In October 2024, the University of Texas at Austin developed a new thermal interface material that could save 13% of cooling requirements or 5% overall data center energy usage, a significant savings if applied across the industry. According to researchers, cooling accounts for ~40% of data center energy usage, or 8 terawatt-hours annually. This material can remove 2,760 watts of heat from a small area of 16 square centimeters. It can cut the energy needed for the cooling pump, a significant piece of the overall electronics cooling structure, by 65%.

Electronics Thermal Management Materials Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electronics thermal management materials market analysis are product type and end-use industry.

- Based on product type, the electronics thermal management materials market is segmented into conductive adhesives, thermal management films, gap fillers, thermal gels, phase change materials, thermal greases, and others. The thermal greases segment held the largest market share in 2023.

In terms of end-use industry, the market is segmented into consumer electronics, automotive, aerospace, telecommunication, and others. In 2023, the automotive segment dominated the market.

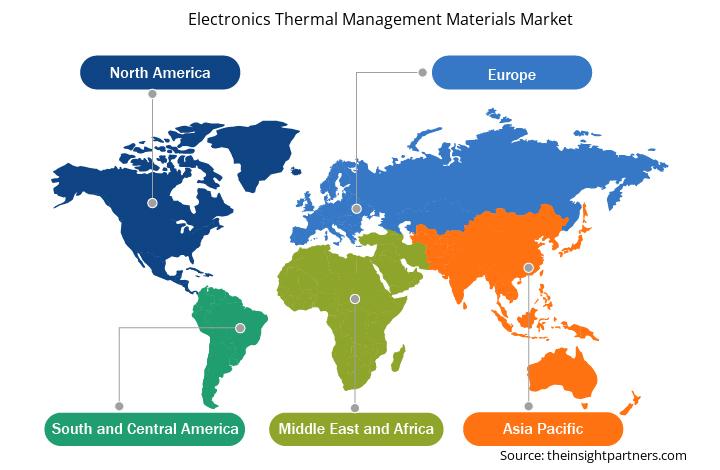

Electronics Thermal Management Materials Market Share Analysis by Geography

The geographic scope of the electronics thermal management materials market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Asia Pacific dominated the electronics thermal management materials market. Asia Pacific is one of the prominent markets for utilizing electronic thermal management materials owing to the growing automotive, electronics, and semiconductors industries. The region is home to a few of the world's largest producers of semiconductors and electronics, with countries such as South Korea, China, and Taiwan leading the global market. An increasing number of on-fleet vehicles in countries such as China, India, and South Korea propels the demand for printed circuit boards (PCBs) and semiconductors, further bolstering the need for electronic thermal management materials. With China's evolution into a high-skilled manufacturing hub, developing countries such as South Korea, India, Taiwan, and Vietnam are attracting several businesses that plan to relocate their low to medium-skilled manufacturing facilities to neighboring countries, which results in reduced labor costs. As per the study by the Semiconductor Industry Association, ~75% of global semiconductor capacity is based in East Asia. Semiconductor companies will benefit from a cost advantage of 25% to 50% with the start of manufacturing activities in the region. The development of more powerful, compact, and energy-dense electronic devices generates substantial heat within confined spaces, making effective thermal management crucial to maintaining these devices' performance, reliability, and longevity. As a result, thermal management materials have become essential components in modern electronics manufacturing. Moreover, Asia Pacific is a global leader in consumer electronics, with major companies such as Samsung, Sony, and Xiaomi at the forefront of innovation. The consumer demand for portable and high-performance devices, such as smartphones, tablets, and wearables, is pushing manufacturers to develop compact devices with higher processing power. This miniaturization trend increases the heat density within devices, necessitating the use of advanced thermal management materials that can handle higher thermal loads in smaller form factors. Investments in electronics production facilities across Asia, especially in China and South Korea, have accelerated the adoption of thermal management solutions to meet the technical demands of these compact, high-performance devices.

Electronics Thermal Management Materials Market Regional Insights

The regional trends and factors influencing the Electronics Thermal Management Materials Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electronics Thermal Management Materials Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electronics Thermal Management Materials Market

Electronics Thermal Management Materials Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.94 Billion |

| Market Size by 2031 | US$ 4.83 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

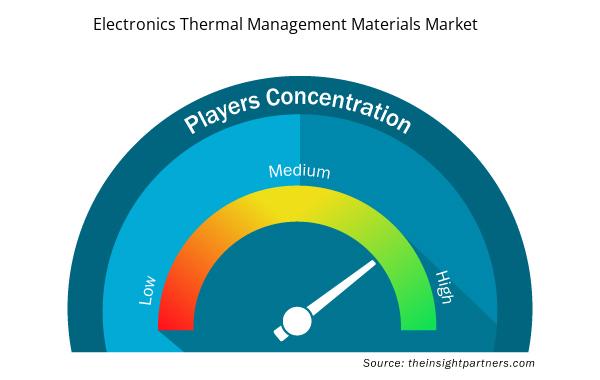

Electronics Thermal Management Materials Market Players Density: Understanding Its Impact on Business Dynamics

The Electronics Thermal Management Materials Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electronics Thermal Management Materials Market are:

- DuPont de Nemours Inc

- Henkel AG & Co KGaA

- Electrolube Ltd

- Tecman Speciality Materials Ltd

- Momentive Performance Materials Inc

- 3M Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electronics Thermal Management Materials Market top key players overview

Electronics Thermal Management Materials Market News and Recent Developments

The electronics thermal management materials market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the electronics thermal management materials market are listed below:

- Momentive Technologies acquired a ceramics powder company, strengthening its thermal fillers for thermal interface materials. (Source: Momentive Technologies, Press Release, January 2024)

- Heico Companies LLC acquired Wakefield Solutions Inc an electronics thermal management specialist, to enhance its expertise in electronics cooling technologies. (Source: Heico Companies LLC, Press Release, February 2023)

- Dow and Carbice formed a strategic partnership to offer a multi-generational thermal interface material for high-performing electronics in various industries, including mobility, industrial, consumer, and semiconductors. (Source: Dow, Press Release, October 2023)

Electronics Thermal Management Materials Market Report Coverage and Deliverables

The "Electronics Thermal Management Materials Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Electronics thermal management materials market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electronics thermal management materials market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Electronics thermal management materials market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electronics thermal management materials market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rapid expansion of the electronics and semiconductor industry has been a key driver of demand for electronic thermal management materials. As electronic devices become more powerful and compact, they generate higher heat levels, necessitating advanced thermal management solutions to maintain operational efficiency and extend device lifespan.

In the automotive industry, electronic thermal management materials have become increasingly vital as vehicles evolve to incorporate more advanced electronic systems, particularly with the surge in electric vehicles (EVs) and hybrid models. These materials are essential for ensuring the optimal performance, safety, and reliability of electronic components that generate substantial heat during operation, such as power electronics, battery packs, electric motor controllers, infotainment systems, and advanced driver-assistance systems (ADAS).

An increasing number of on-fleet vehicles in countries such as China, India, and South Korea propels the demand for printed circuit boards (PCBs) and semiconductors, further bolstering the need for electronic thermal management materials. With China's evolution into a high-skilled manufacturing hub, developing countries such as South Korea, India, Taiwan, and Vietnam are attracting several businesses that plan to relocate their low to medium-skilled manufacturing facilities to neighboring countries, which results in reduced labor costs.

Based on product type, the electronics thermal management materials market is segmented into conductive adhesives, thermal management films, gap fillers, thermal gels, phase change materials, thermal greases, and others. In 2023, the thermal greases segment held the largest market share. Thermal greases, also known as thermal pastes or thermal compounds, are highly effective materials used to enhance heat transfer between heat-generating components and their cooling solutions, such as heat sinks or spreaders.

Advancements in electronic thermal management materials act as a significant future opportunity for the market. Advancements in electronic thermal management materials are poised to create significant growth opportunities by addressing the increasing thermal challenges in modern electronics. As devices become more powerful and compact, new materials with enhanced thermal conductivity, flexibility, and durability are essential to manage the higher heat loads effectively.

The major players operating in the global electronic thermal management materials market are DuPont de Nemours Inc, Henkel AG & Co KGaA, Electrolube Ltd, Tecman Speciality Materials Ltd, Momentive Performance Materials Inc, 3M Co, European Thermodynamics Ltd, Honeywell International Inc, Parker Hannifin Corp, Wacker Chemie AG, Sur-Seal Corp, Graco Inc, Robnor ResinLab Ltd, Master Bond Inc, and Marian Inc.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Electronic Thermal Management Material Market

- DuPont de Nemours Inc

- Henkel AG & Co KGaA

- Electrolube Ltd

- Tecman Speciality Materials Ltd

- Momentive Performance Materials Inc

- 3M Co

- European Thermodynamics Ltd

- Honeywell International Inc

- Parker Hannifin Corp

- Wacker Chemie AG

- Sur-Seal Corp

- Graco Inc

- Robnor ResinLab Ltd

- Master Bond Inc

- Marian Inc

Get Free Sample For

Get Free Sample For