[Research Report]

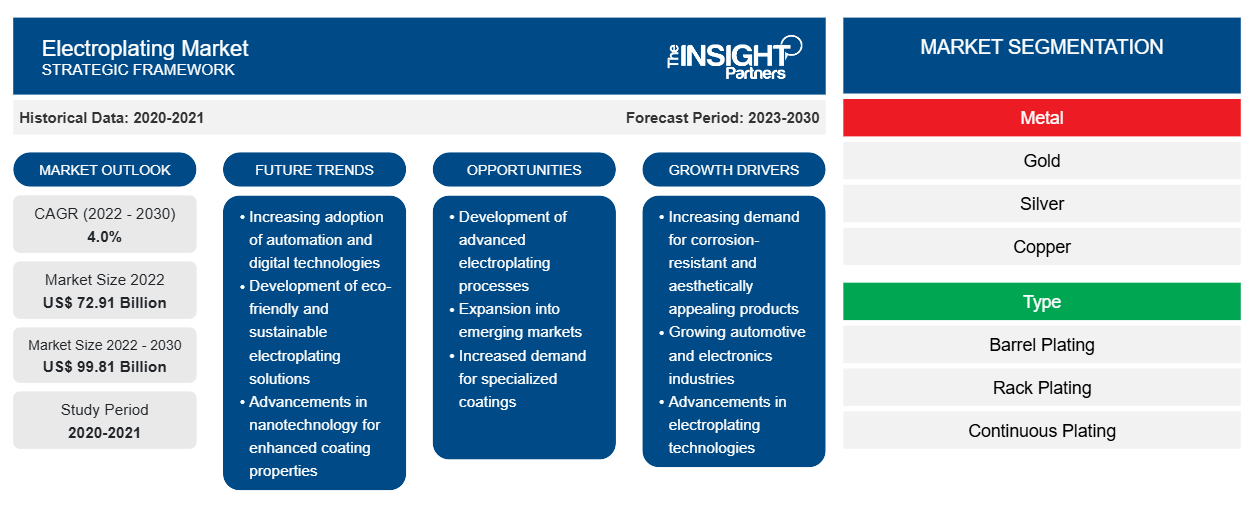

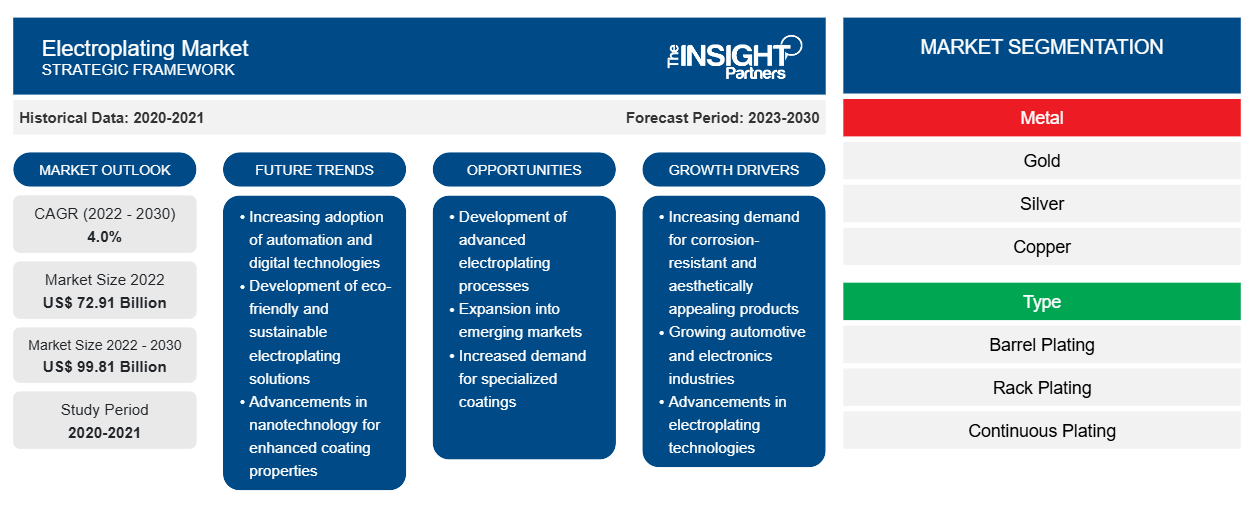

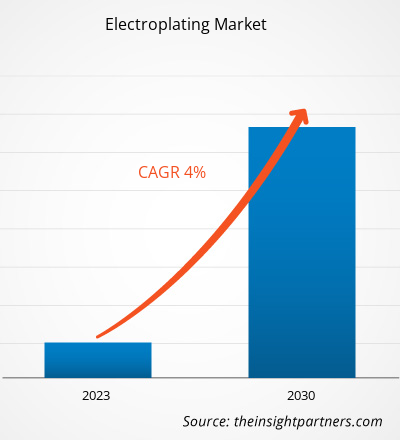

The electroplating market size is expected to grow from US$ 72,910.22 million in 2022 to US$ 99,807.73 million by 2030; it is estimated to register a CAGR of 4.0% from 2022 to 2030.

MARKET ANALYSIS

Electroplating, or galvanic electrodeposition, is an electrochemical metal finishing process. In this process, metal ions dissolved in the solution are deposited on a substrate with the help of electricity. The process helps create a protective coating over the substrate, which offers resistance to corrosion and enhances the overall appearance of the product. Under the mechanism, the electric current passes through a solution of the dissolved metal ions and the metal object to be plated. The process is used to plate or coat several ferrous and nonferrous metal objects and plastics by using metals such as copper, tin, zinc, gold, palladium, platinum, silver, chromium, and aluminum. The production of automotive and electronics components requires an electroplating technique, which is further driving the global electroplating market.

GROWTH DRIVERS AND CHALLENGES

Expansion of the electronics and automotive industries and high demand from various end users bolster the electroplating market growth. Electroplating has prevented manufacturers from spending high amounts on expensive metals to provide efficient and aesthetics-wise products. With the advent of electroplating, most of the manufacturers rely on comparatively lower cost metals and later perform electroplating on the product with other metals to give better protection from corrosion. Also, the advent of innovative electroplating technologies such as nanotechnology and dry plating methods has meant that the efforts of industry players to reduce their environmental footprint and improve waste management are being materialized. The major demand for electroplating is seen in the electrical and electronics industries. Rising demand for wires and semiconductors across the world due to the rise in adoption of IoT propels the global electroplating market growth. Increasing penetration of television, refrigerators, smartphones, washing machines, laptops, and other consumer electronics products favors the growth of the global electroplating market. Rising preference to lead a comfortable lifestyle and increasing disposable income boost the global automotive industry, which is directly helping the electroplating market to reach new heights. Furthermore, rising demand for electroplating from aerospace and defense applications for providing proper finishing to the machinery is anticipated to foster the market growth of electroplating. The finishing mainly involves the process of coating metal that sticks to the surface of the material and provides a protective bond. Moreover, the process provides corrosion resistance, electrical conductivity, heat resistance, and friction wear to the machinery in the defense industry. Therefore, rising demand for electroplating in the defense industry propels the market growth. However, several governments and authorities are imposing certain regulations on the electroplating industry to curb the emission of harmful chemicals along with gases that are released into the atmosphere throughout the electroplating process. This is likely to become a key restraint for the global electroplating market. With the advantages of various types of electroplating comes the adverse aftermath of high pollution caused by these processes. The electroplating industry is constantly engaging with hazardous materials, which are harmful to humans and the environment.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electroplating Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electroplating Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Electroplating Market Forecast to 2030" is a specialized and in-depth study with a significant focus on market trends and opportunities. The report aims to provide an overview of the market with detailed market segmentation on the basis of metal, type, end use industry, and geography. The global electroplating market has witnessed significant growth over the past few years and is expected to continue this trend during the forecast period. The report provides key statistics on the use of electroplating worldwide, along with their demand in major regions and countries. It also provides a qualitative assessment of various factors affecting the market performance in major regions and countries. The report also includes a comprehensive analysis of the leading market players and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the significant revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global electroplating market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global electroplating market analysis is segmented on the basis of metal, type, and end use industry. In terms of metal, the market is segmented into gold, silver, copper, nickel, and others. Based on type, the market is segregated into barrel plating, rack plating, continuous plating, and line plating. By end-use industry, the market is segmented into automotive, electrical & electronics, aerospace & defense, medical, and others.

Based on metal, the nickel segment held a significant global electroplating market share in 2022. Nickel plating is a hard-wearing, decorative finish that can be applied to various materials. It produces a brilliant, lustrous finish that ages over time to produce a slightly yellow color. By type, the barrel plating segment held the largest market share in 2022. Barrel plating is a method used to flatten large groups of small parts. In this process, the components are placed inside a barrel filled with an electrolyte solution. The electroplating process proceeds while the barrel is rotated, stirring the parts in such a way that they receive even finishes consistently. Based on end use industry, the electrical and electronics segment led the market with a significant market share in 2022. The electrical & electronics industry is considerably reliant on electroplating service providers as it helps increase product lifespan and makes it more resilient.

REGIONAL ANALYSIS

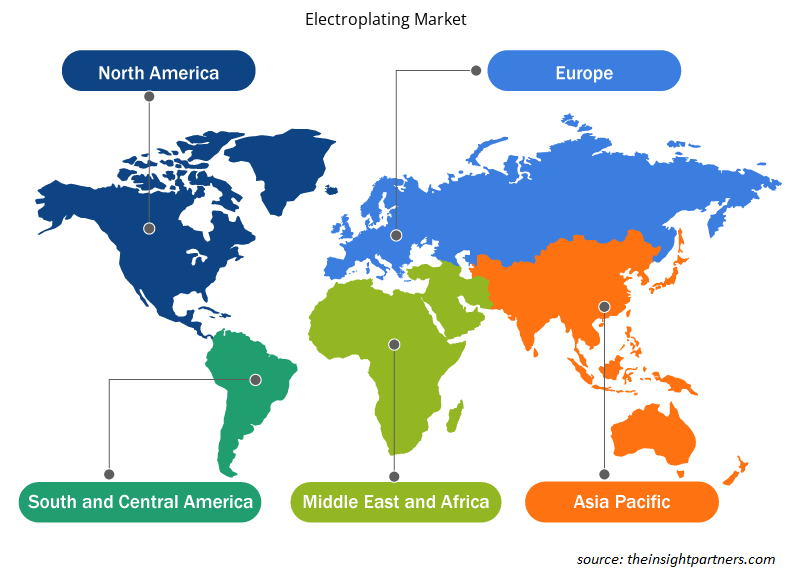

The global electroplating market report provides a detailed overview of the electroplating market size with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. APAC accounted for a significant global electroplating market share and was valued at ~US$ 44 billion in 2022. China is a major contributor to the market growth in this region. North America is also expected to witness notable growth, reaching ~US$ 13 billion by 2030. Furthermore, in Europe, there has been a widespread use of electroplating. The electroplating market forecast in Europe is expected to report a CAGR of ~4% from 2022 to 2030.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are a few prominent strategies adopted by the players operating in the global electroplating market.

In November 2023, Alleima AB, a global manufacturer of high-value-added products in advanced stainless steels and special alloys, announced its plans to expand its operations in Switzerland to meet the growing demand for plated components.

In 2020, Schlötter announced cooperation with Italtecno srl. to expand its portfolio of galvanic specialty chemicals and to offer sales and service for processes for aluminium surface treatment in the future.

Electroplating Market Regional Insights

Electroplating Market Regional Insights

The regional trends and factors influencing the Electroplating Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electroplating Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electroplating Market

Electroplating Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 72.91 Billion |

| Market Size by 2030 | US$ 99.81 Billion |

| Global CAGR (2022 - 2030) | 4.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Metal

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

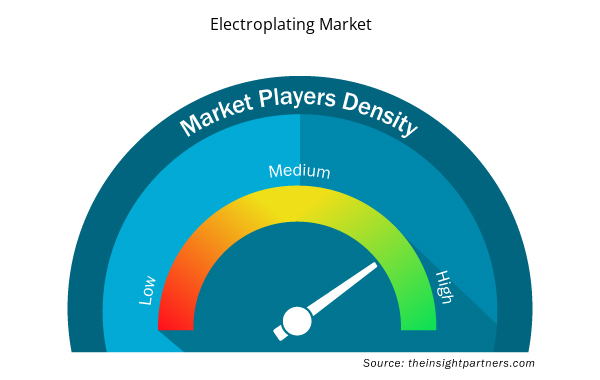

Electroplating Market Players Density: Understanding Its Impact on Business Dynamics

The Electroplating Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electroplating Market are:

- Allenchrome Electroplating Ltd

- Atotech

- Dr.-Ing. Max Schlötter GmbH & Co. KG

- Jing Mei Industrial Limited.

- Klein Plating Works Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electroplating Market top key players overview

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the world. The crisis disturbed supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of raw materials. It caused delays in production and increased costs, negatively impacting the electroplating market.

The global marketplace is recovering from the losses as governments of different countries have announced relaxation in the restrictions. Manufacturing activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Thus, the global electroplating market is anticipated to grow strongly during the forecast period.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Allenchrome Electroplating Ltd; Atotech; Dr.-Ing. Max Schlötter GmbH & Co. KG; Jing Mei Industrial Limited.; Klein Plating Works Inc; Precision Plating Company; Sharretts Plating Co., Inc.; Summit Corporation of America; Toho Zinc Co., Ltd; and Cherng Yi Hsing Plastic Plating Factory Co., Ltd are a few of the major players operating in the global electroplating market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hydrogen Storage Alloys Market

- Cell Line Development Market

- Small Molecule Drug Discovery Market

- Aircraft MRO Market

- Carbon Fiber Market

- Electronic Shelf Label Market

- Biopharmaceutical Tubing Market

- Small Internal Combustion Engine Market

- Artwork Management Software Market

- Fixed-Base Operator Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Metal, Type, End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Ongoing industrialization across the globe, along with the increasing disposable income of consumers in the developed countries, is fueling the demand for electroplating across the electronics, automotive, and jewelry industry. With the rise in demand for high-performance automobile components having excellent resistance to corrosion to enhance the appearance of exterior automobile parts, including emblems, door handles, hood ornaments, and wheel rims, is driving the demand for electroplating. These factors are driving the electroplating market growth.

In 2022, Asia Pacific accounted for the largest share of the global electroplating market. The electroplating market in Asia Pacific comprises several developing economies such as China, India, Japan, South Korea, and Australia. These emerging countries are witnessing an upsurge due to growth in urbanization, increasing manufacturing industries coupled with growing industrialization, and the impact of social media, which offers ample opportunities for key market players in the electroplating market.

In 2022, the electrical and electronics segment held the largest market share. The electrical and electronics industry is considerably reliant on electroplating service providers as it helps increase product lifespan and makes it more resilient. The electrical & electronics industry uses precious and non-precious plated components for various end-use applications to improve characteristics such as solder-ability, wear resistance, corrosion resistance, and the electrical conductivity of components and parts of electronic products.

In 2022, the barrel plating segment held the largest market share. Barrel plating is a method used to flatten large groups of small parts. In this process, the components are placed inside a barrel filled with an electrolyte solution. The electroplating process proceeds while the barrel is rotated, stirring the parts in such a way that they receive even finishes consistently. Barrel plating is best used for small, durable parts, but offers a cheap, efficient, and flexible solution.

The major players operating in the electroplating market are Allenchrome Electroplating Ltd; Atotech; Dr.-Ing. Max Schlötter GmbH & Co. KG; Jing Mei Industrial Limited.; Klein Plating Works Inc; Precision Plating Company; Sharretts Plating Co., Inc.; Summit Corporation of America; Toho Zinc Co., Ltd; and Cherng Yi Hsing Plastic Plating Factory Co., Ltd.

In 2022, the nickel segment held the largest market share. Nickel plating is a hard-wearing, decorative finish that can be applied to various materials. Nickel plating produces a brilliant lustrous finish that ages over time to produce a slightly yellow color. Nickel electroplating is used for a number of functional and aesthetic purposes. Nickel plating can help protect against corrosion, improve wear resistance, and increase the thickness of the surface.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Electroplating Market

- Allenchrome Electroplating Ltd

- Atotech

- Dr.-Ing. Max Schlötter GmbH & Co. KG

- Jing Mei Industrial Limited.

- Klein Plating Works Inc

- Precision Plating Company

- Sharretts Plating Co., Inc.

- Summit Corporation of America

- Toho Zinc Co., Ltd

- Cherng Yi Hsing Plastic Plating Factory Co.

Get Free Sample For

Get Free Sample For