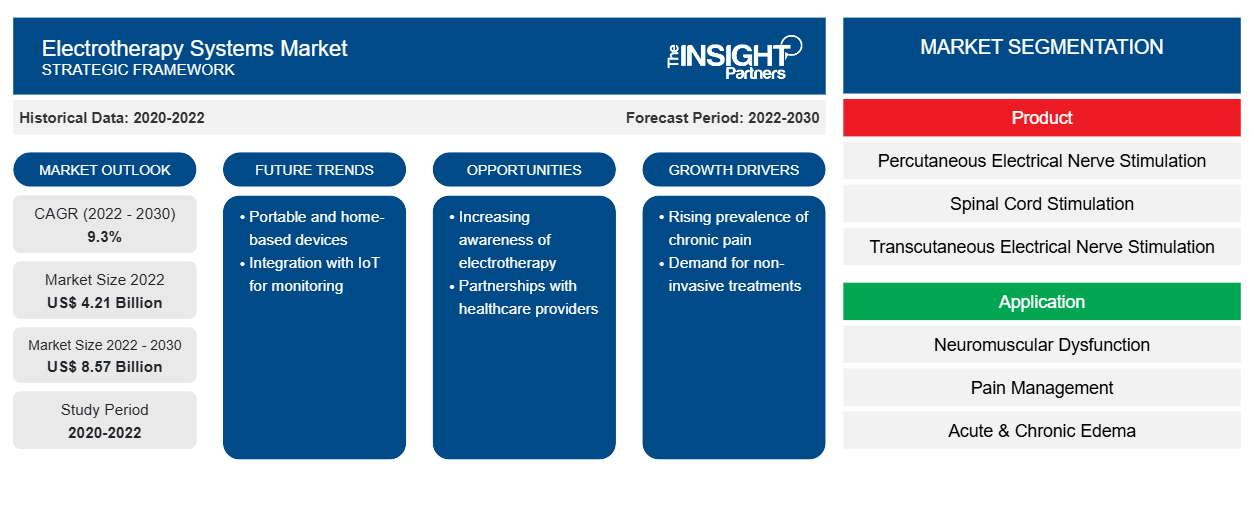

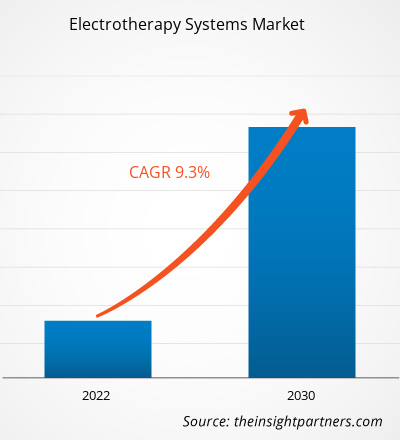

[Research Report] The electrotherapy systems market size was valued at US$ 4.21 billion in 2022 and is expected to reach US$ 8.57 billion by 2030. The market is estimated to register a CAGR of 9.3% from 2022 to 2030.

Market Insights and Analyst View:

The report includes growth prospects owing to the current electrotherapy systems market trends and their foreseeable impact during the forecast period.

An electrotherapy system is a medical device used to stimulate a patient's muscle function by passing electric currents through their tissues. Electrotherapy is useful in treating acute post-traumatic and post-surgical pain, facilitating wound healing and muscle spasm relaxation, preventing and mitigating disuse atrophy, aiding muscle rehabilitation, maintaining and increasing range of motion, and relieving acute post-traumatic and post-surgical pain. Electrotherapy units typically consist of a battery-operated device wired to adhesive electrode pads that make contact with the skin. Factors such as the increasing prevalence of sports injuries and strategic initiatives by manufacturers propel the electrotherapy systems market.

Market Drivers:

The increasing incidences of chronic diseases such as cancer, cardiovascular diseases, neurovascular diseases, and musculoskeletal diseases are likely to drive the growth of the pain management devices market. These diseases critically affect a person's health by lowering immunity and resulting in chronic pain. The incidences of chronic diseases are most commonly seen in adults and the geriatric population. For instance, according to the Centers for Disease Control and Prevention data between 2019 and 2021, the prevalence of chronic pain among US adults ranged from 20.5% to 21.8%, and high-impact chronic pain ranged from 6.9% to 7.8%. During 2021, an estimated 51.6 million US adults experienced chronic pain, and 17.1 million experienced high-impact chronic pain.

Furthermore, the incidences of chronic pain are commonly seen among athletes, sportspersons, and people living with past injuries. Chronic pain incidences increase the dependency of a person on others for various daily tasks. Therefore, pain management is essential to carry out normal daily routine. The electrotherapy systems provide relief for longer durations and also improve their health. Therefore, the increasing incidences of chronic diseases propels the electrotherapy systems market growth.

According to the report titled "Spinal Cord Injury Facts and Stats" published in July 2022, ∼17,700 Americans suffer from a spinal cord injury yearly, of which ∼78% are men with an average age of 43. As per estimates by the National Safety Council of the United States, nearly 3.2 million people in the US received treatments in emergency departments for injuries involving sports and recreational equipment in 2021. Therefore, the high incidence of spinal cord injuries propels the electrotherapy systems market growth.

The Federal Food, Drug, and Cosmetic Act includes electrical muscle stimulators (EMS) in the category of devices. The FDA is responsible for regulating the sale of all electrical muscle stimulators in the US per the legislation and the agency's rules. Thus, companies cannot lawfully sell their stimulators unless they have complied with all applicable FDA premarket regulatory procedures. The majority of electrical muscle stimulators that the FDA has evaluated are meant to be used in physical therapy and rehabilitation under a physician's supervision. Companies must demonstrate to the FDA that their EMS devices can be used in that environment both safely and effectively if they want to sell them to consumers directly. Before they can lawfully sell their products, companies that market EMS devices must adhere to the relevant FDA premarket regulatory criteria. Thus, stringent regulatory specifications for electrotherapy products limit the electrotherapy systems market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electrotherapy Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electrotherapy Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The electrotherapy systems market analysis has been carried out by considering the following segments: product, application, and end user.

Segmental Analysis:

The electrotherapy systems market, by product, is segmented into percutaneous electrical nerve stimulation (PENS), transcutaneous electrical nerve stimulation (TENS), spinal cord stimulation (SCS), micro-current therapy, interferential current therapy (IC), electro-acupuncture (EA), pulsed short wave diathermy (PSWD), transcutaneous spinal electroanalgesia (TSE), and others. The spinal cord stimulation segment held the largest share of the market in 2022. It is likely to register the highest CAGR during 2022–2030. Spinal cord stimulation has been in use in medical facilities for years. Cervical and lumbar radiculitis, failed back surgery syndrome, complex regional pain syndrome, and neuropathy are a few of the conditions that can be assisted by the therapy. Spinal cord stimulation is an efficacious, safe, and cost-effective method of chronic pain management. Newer spinal cord stimulation technologies are being introduced to treat an extended range of clinical indications, including visceral and ischemic pain, with the potential for further improved efficacy.

By application, the market is segmented into neuromuscular dysfunction, pain management, acute and chronic edema, sports injury treatment, iontophoresis, urine and fecal incontinence, and others. The pain management segment held the largest share of the electrotherapy systems market share in 2022. It is likely to register the highest CAGR during 2022–2030. The market growth of this segment is attributed to the burgeoning prevalence of trauma and sports injuries. According to data released by the World Health Organization in March 2022, nearly 30 million children and teenagers participate in organized sports and more than 3.5 million injuries are reported every year. Furthermore, it was also estimated that 570,000 people faced traumatic pain in the US in 2021. An upsurge in the occurrence of back pain and neck pain also results in a heightened demand for electrotherapy to treat chronic pain.

By end user, the electrotherapy systems market is segmented into hospitals, clinics, long-term care centers, rehabilitation centers, and others. In 2022, the hospitals segment accounted for the largest electrotherapy systems market share.

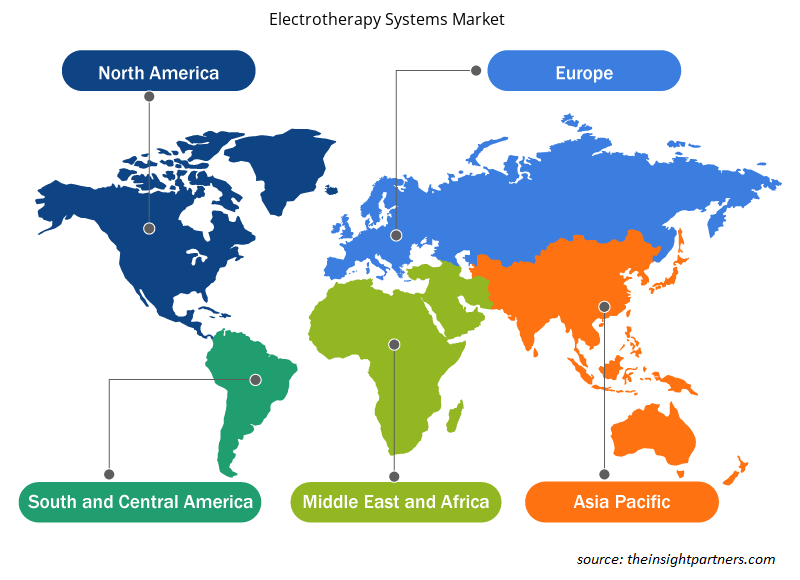

Regional Analysis:

The scope of the electrotherapy systems market report includes North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). In terms of revenue, North America dominated the electrotherapy systems market in 2022. Population aging is a major factor that can be associated with the elevated demand for electrotherapy in the region. According to WHO data released in December 2022, 73 million individuals in North America are estimated to be of age 65 or above by 2053. The same source states that 17% of the US population above 65 years of age are experiencing back discomfort and spinal injuries.

Electrotherapy Systems Market Regional Insights

Electrotherapy Systems Market Regional Insights

The regional trends and factors influencing the Electrotherapy Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electrotherapy Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electrotherapy Systems Market

Electrotherapy Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.21 Billion |

| Market Size by 2030 | US$ 8.57 Billion |

| Global CAGR (2022 - 2030) | 9.3% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electrotherapy Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Electrotherapy Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electrotherapy Systems Market are:

- BTL

- DJO LLC.

- Omron Healthcare Inc.

- Abbott

- Boston Scientific Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electrotherapy Systems Market top key players overview

Competitive Landscape and Key Companies:

The electrotherapy systems market report is focused on prominent players in the market. These include BTL, DJO LLC, Omron Healthcare Inc, Abbott, Boston Scientific Corporation, Medtronic, Nevro Corp, Phoenix Healthcare, Eme srl, and Pure Care. These companies focus on new technologies, upgrading existing products, and market expansions to meet the growing consumer demand worldwide. The electrotherapy systems market forecast can help stakeholders plan their growth strategies.

- In January 2022, Medtronic plc, a global leader in healthcare technology, received approval from the US Food and Drug Administration (FDA) for its Intellis (rechargeable) and Vanta (recharge-free) neurostimulators for the treatment of chronic pain associated with diabetic peripheral neuropathy (DPN). This new indication offers DPN patients access to Medtronic's industry-leading SCS portfolio of rechargeable and recharge-free solutions, including multiple programming options to personalize patient therapy, unrestricted MRI access, and unrivaled battery chemistry and performance, along with the Medtronic TYRX Neuro Absorbable Antibacterial Envelope.

- In March 2021, the FDA approved an application by Medtronic plc for the revised commercial labeling for its Intellis platform with Differential Target Multiplexed (DTM) programming. The new labeling was meant to include study outcomes from a multicenter randomized control trial, mentioning superior back pain relief conferred by DTM SCS compared to conventional SCS.

- In September 2020, Boston Scientific launched the WaveWriter Alpha portfolio of SCS systems in Europe. The four MRI conditional, Bluetooth-enabled implantable pulse generators (IPGs) launched in this portfolio offer greater personalization based on patient needs. The products also include rechargeable and non-rechargeable options, and access to waveforms covering multiple areas of pain.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific is expected to be the fastest growing region in the electrotherapy systems market. The electrotherapy systems market in Asia Pacific is growing due to expanding pool of patients with neurology-associated pain disorders, and the growing concerns over the prevalence of neuropathy and other related conditions, subsequently increasing in demand for electrotherapy.

The electrotherapy systems market, based on end user, segmented into hospitals, clinics, long-term care centers, rehabilitation centers, and others. In 2022, the hospitals segment dominated the electrotherapy systems market share and is expected to register the highest CAGR during 2022–2030.

The electrotherapy systems market, based on application, is segmented into neuromuscular dysfunction, pain management, acute and chronic edema, sports injury treatment, tissue repair, iontophoresis, urine and fecal incontinence, and others. The pain management segment held the largest share of the market in 2022 and is likely to register the highest CAGR in the electrotherapy systems market during 2022–2030.

The electrotherapy systems market, based on product, is segmented into percutaneous electrical nerve stimulation (PENS), transcutaneous electrical nerve stimulation (TENS), spinal cord stimulation (SCS), micro-current therapy, interferential current therapy (IC), electro-acupuncture (EA), pulsed short wave diathermy (PSWD), transcutaneous spinal electroanalgesia (TSE), and others. The spinal cord stimulation (SCS) segment held a larger share of the market in 2022 and is likely to register a higher CAGR in the electrotherapy systems market during 2022–2030.

The electrotherapy systems market majorly consists of the players such as BTL, DJO LLC, Omron Healthcare Inc, Abbott, Boston Scientific Corporation, Medtronic, Nevro Corp, Phoenix Healthcare, Eme srl, and Pure Car among others.

US holds the largest market share in electrotherapy systems market. Approximately, 30 million children and adolescents participate in youth sports in the United States, leading to an increase in the number of sports injuries among America's young athletes. It is estimated that, More than 3.5 million kids below the age of 14 years receive medical treatment for sports injuries every year, accounting for nearly 40 percent of all sports-related injuries treated in hospitals.

The factors that are driving growth of the market are increasing prevalence sports injury and strategic initiative by manufacturers.

An electrotherapy system is a medical device used to stimulate a patient's muscle function by passing electric currents through their tissues. Electrotherapy is useful in treating acute post-traumatic and post-surgical pain, facilitating wound healing and muscle spasm relaxation, preventing and mitigating disuse atrophy, aiding muscle rehabilitation, maintaining and increasing range of motion, and relieving acute post-traumatic and post-surgical pain. Electrotherapy units typically consist of a battery-operated device wired to adhesive electrode pads that make contact with the skin.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Electrotherapy Systems Market

- BTL

- DJO LLC.

- Omron Healthcare Inc.

- Abbott

- Boston Scientific Corporation

- Medtronic

- Nevro Corp.

- Phoenix Healthcare

- Eme srl

- Pure Care

Get Free Sample For

Get Free Sample For