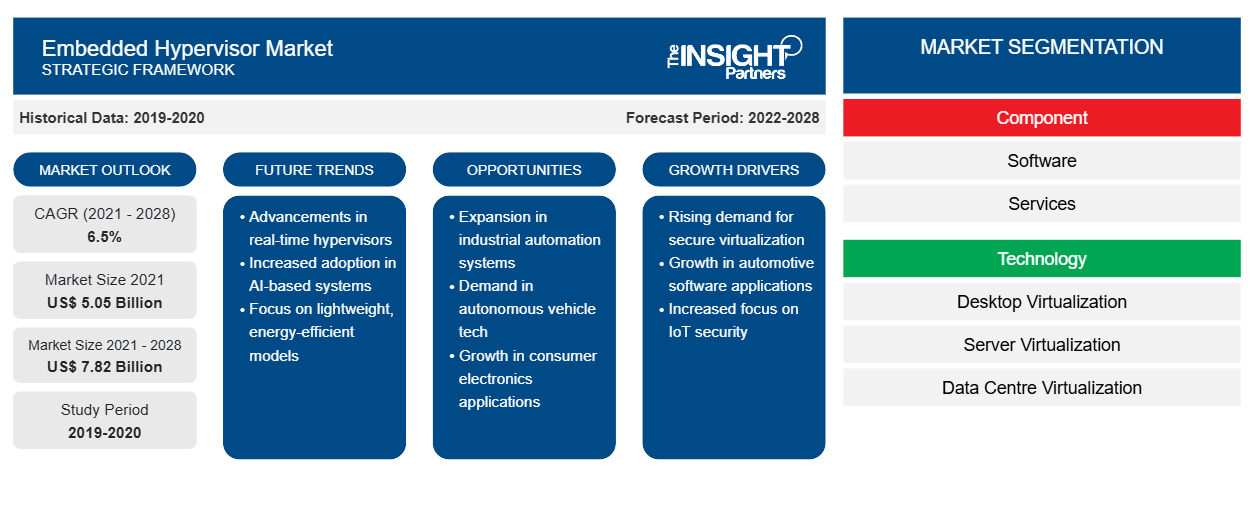

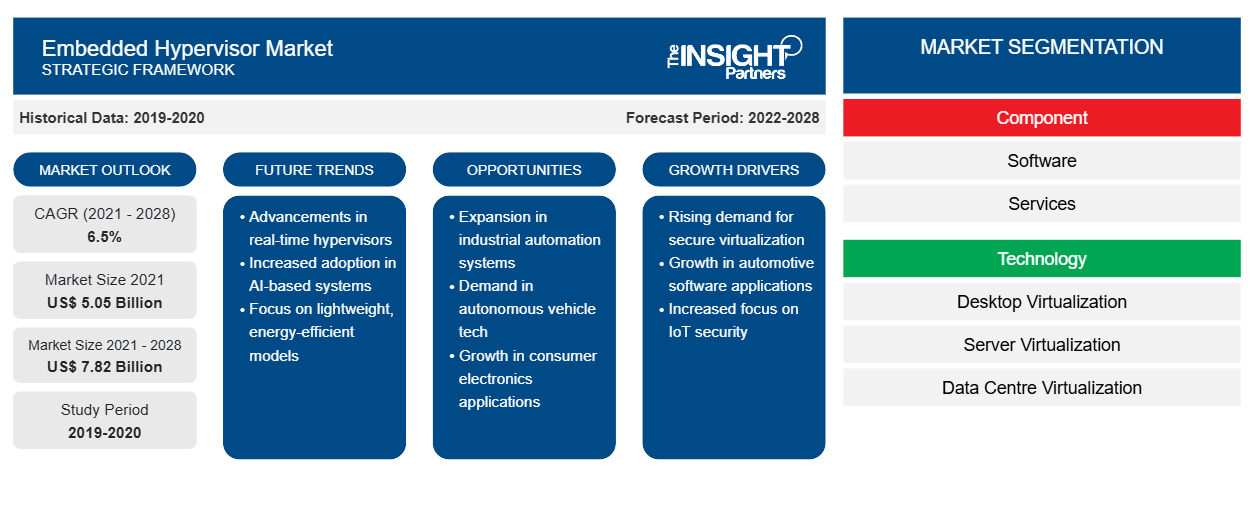

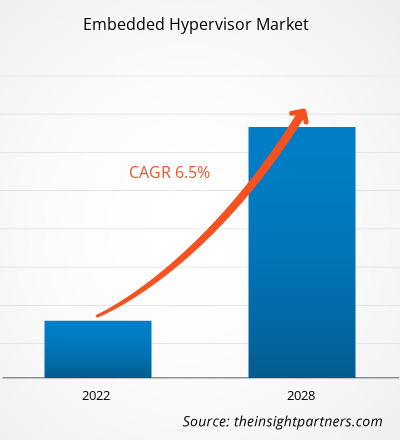

The embedded hypervisor market size is expected to grow from US$ 5046.7 million in 2021 to US$ 7823.2 million by 2028; it is estimated to grow at a CAGR of 6.5% during 2021–2028.

Industrial automation improves productivity and quality by mitigating errors and waste, increasing safety, and adding flexibility in the manufacturing process. In addition, integrating the real-time operating system (RTOS) with industrial automation enhances the process scheduling, memory management, and file management, allowing them to run as a single process. Thus, associated advantages and growing demand for RTOS in vertical industrial applications are fueling the demand for embedded hypervisors, which is driving the embedded hypervisor market growth.

Over the past two decades, automation in manufacturing has been a constant factor leading to transformation in the factory floor operations, manufacturing employment, and the dynamics of the manufacturing sector. Current trends in the manufacturing industry, such as robotics, machine learning, and artificial intelligence, enabled the machines to match or even outpace humans in a range of activities—including the cognitive activities required at various levels of manufacturing. Increased productivity ranges between 10% and 20% when automation is integrated on any lean assembly line. Further, Industry 4.0 is another trend that is anticipated to fuel the manufacturing sector in the coming years. The advent of Industry 4.0 and the Industrial Internet of Things (IIoT) would utilize the powers of collaborative robots and automated guided vehicles is propelling productivity in the manufacturing sector. Manufacturing of consumer electronics, healthcare-related products, automobiles, and defense industries are a few of the prominent industry verticals that have been prolific in the RTOS into the manufacturing assembly lines. Thus, these growth prospects in industrial automation are driving the adoption of RTOS, which is further augmenting the market dynamics for embedded hypervisors in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Embedded Hypervisor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Embedded Hypervisor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on North America Embedded Hypervisor Market

North America has the highest acceptance and development rate of emerging technologies globally due to favorable government policies to boost innovation and reinforce infrastructure capabilities. Therefore, any impact on industries is projected to affect the region's economic development adversely. Notably, the US is one of the world's worst-affected countries, and the COVID-19 crisis led to a cascading impact on multiple industries, including IT, automotive, and telecommunication. These industries' operation was discontinued, which hampered the business dynamics in the first half of 2020.

The COVID-19 pandemic hastened the shift to a work-from-home model, which increased the demand for cybersecurity. Hence, the embedded hypervisor business has benefited from the pandemic. The embedded hypervisor market growth prospects after the COVID-19 pandemic, such as the adoption of IoT for sustainability, shift to cloud storage, growing penetration of AI, and secure remote access, are contributing to the use of embedded hypervisors in IoT, cloud computing, and AI platforms in the region.

Embedded Hypervisor Market Insights

Growing Adoption of Embedded Hypervisor in Vertical of Industrial Applications

Growing Adoption of Embedded Hypervisor in Vertical of Industrial Applications

Businesses across most industry verticals realized the importance of IoT, communications, and sensors; which paved the way for integrating sensors into the devices. Various business functions, such as supply chain planning & logistics, and manufacturing across industry verticals, including automotive, consumer electronic devices, healthcare, and aerospace & defense, can be optimized and thus enable increased profitability. The positive impact on the companies' balance sheets due to the integration of sensor-enabled devices into the business processes has led to its increased demand. The growth of the market in various end-use industry verticals is rising rapidly, with IoT gaining more prominence in the coming years.

Steady progress in the development of autonomous vehicles is being witnessed, with a few renowned car manufacturers collaborating with technologically advanced companies. Autonomous vehicles evolved on the platform built by ADAS (Advanced Driver Assistance Systems) for instance companies such as Ford, General Motors, Nissan, Tesla, Mercedes, and Honda, have been investing billions of dollars in the R & D of these cars. Also, technology giants, including Apple, IBM, and Intel, collaborated with the leading automotive manufacturers to remain competitive. It is anticipated that autonomous cars will be on roads and commercialized. The emergence of a ADAS (Advanced Driver Assistance Systems) such as adaptive braking, self-parking, backup cameras, and automatic cruise control further increases the safety of passengers in vehicles. Shared mobility services are another trend in the automobile ecosystem. Highly advanced sensors are anticipated to be integrated into these vehicles for efficient communications. Therefore, these automotive electronic trends are expected to offer lucrative opportunities for the embedded hypervisor market players over the forecast period.

The rise in internet activities globally and increased security compulsion are the trending key factors of the market. As the number of people using the internet grows, so does the rate of cybercrimes. The number of internet users is increasing, thus making it critical to protect personal information. The growing instances of unethical practices and the cybersecurity threat are fueling the adoption of embedded hypervisors. In addition, the increasing adoption of software-driven solutions and the rising demand for consumer electronics are a few of the trending factors that propel the deployment of embedded hypervisors. Thus, such trending factors are fueling the embedded hypervisor market growth.

Component-Based Market Insights

Based on component, the embedded hypervisor market is segmented into solution and services. In 2021, the solution segment accounted for the largest embedded hypervisor market share.

Technology - Based Market Insights

Embedded hypervisor market analysis by technology, the embedded hypervisor market is segmented into desktop virtualization, server virtualization, and data center virtualization. In 2021, the desktop virtualization segment accounted for the largest embedded hypervisor market share.

Enterprise Size -Based Market Insights

Embedded hypervisor market analysis by enterprise size, the embedded hypervisor market is segmented into small and medium enterprises, and large enterprises. In 2021, the large enterprises segment accounted for a larger embedded hypervisor market share.

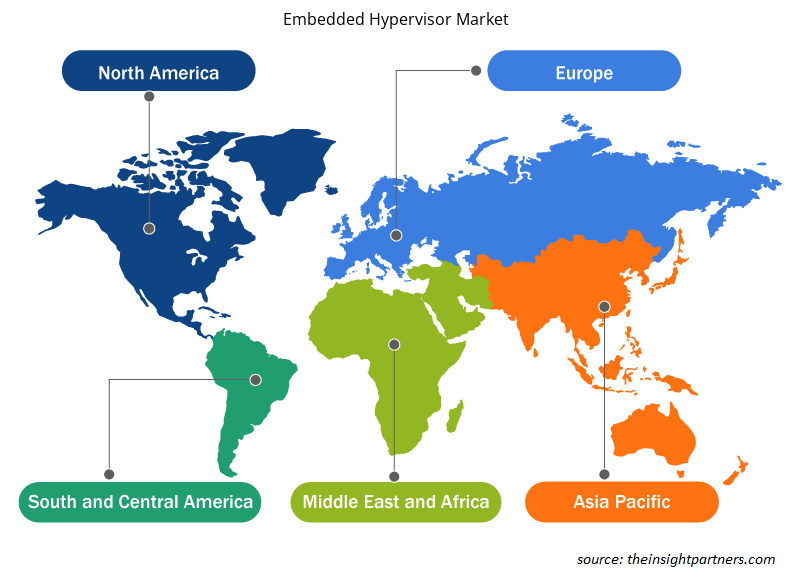

Embedded Hypervisor Market Regional Insights

Embedded Hypervisor Market Regional Insights

The regional trends and factors influencing the Embedded Hypervisor Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Embedded Hypervisor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Embedded Hypervisor Market

Embedded Hypervisor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5.05 Billion |

| Market Size by 2028 | US$ 7.82 Billion |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Embedded Hypervisor Market Players Density: Understanding Its Impact on Business Dynamics

The Embedded Hypervisor Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Embedded Hypervisor Market are:

- Citrix Systems Inc.

- IBM Corporation

- Microsoft

- VMware, Inc

- Wind River Systems, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Embedded Hypervisor Market top key players overview

Industry -Based Market Insights

Embedded hypervisor market analysis by industry, the embedded hypervisor market is segmented into BFSI, IT and Telecom, Aerospace and Defense, Automotive, Healthcare, Transportation, Others. In 2021, the BFSI segment accounted for the largest embedded hypervisor market share.

The players operating in the embedded hypervisor market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In January 2021, Citrix Systems, Inc. acquired Wrike, Inc., and worked on updating its unified digital workspace technology portfolio, which includes desktop and application virtualization tools and content collaboration software.

- In March 2020, VMware launched VMware Partner Connect, the new, dramatically simplified, and flexible program designed to enable partners to do business with VMware in a way that aligns to their business models under a single unified contract. VMware Partner Connect empowers partners with the flexibility to meet customer needs, making VMware technologies and services opportunities more accessible. Partners now have an enhanced experience that delivers simplicity, choice and innovation, while recognizing and rewarding partners based on the value they bring to customers.

Company Profiles

- Citrix Systems, Inc.

- IBM Corporation

- Microsoft Corporation

- VMware, Inc.

- Wind River Systems, Inc.

- NXP Semiconductors

- Thales Group

- Fent Innovative Software Solution; S.L.

- Lynx Software Technologies

- Siemens AG

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Technology, Enterprise Size, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The key companies operating in the embedded hypervisor market that are profiled in the report include Citrix Systems, Inc., IBM Corporation, Microsoft Corporation, VMware, Inc., Wind River Systems, Inc., NXP Semiconductors, Thales Group, Fent Innovative Software Solution, S.L., Lynx Software Technologies, and Siemens AG.

Based on application, the global embedded hypervisor market is segmented into the BFSI, IT and Telecom, Aerospace and Defense, Automotive, Healthcare, Transportation, and Others. The BFSI segment accounted for the largest share of the embedded hypervisor market in 2020. Moreover, the Aerospace and Defense segment is projected to grow at a faster pace during the forecast period.

The growing adoption of embedded hypervisor in vertical of industrial applications along with significant advancement in technology are the key trends attributed to the growth of embedded hypervisor market.

Based on technology, the global embedded hypervisor market is segmented into desktop virtualization, server virtualization, and data center virtualization. The desktop virtualization segment accounted for the largest share of the embedded hypervisor market in 2020.

Increasing popularity of cloud computing & virtualization technology is holding potential growth opportunity for the market growth. Virtualization technologies play a crucial role in efficiently delivering Infrastructure-as-a-Service (IaaS) solutions for cloud computing and provide a virtual environment for storage, memory, and networking. Hence, increasing spending for adopting advanced technologies and the growing popularity of cloud computing technology are paving new opportunities for deploying embedded hypervisors in the ecosystem, which is anticipated to drive the market growth over the forecast period.

The major factors driving the growth of the embedded hypervisor market is growing demand for safety & security systems of modules, increasing investment in IoT devices in the manufacturing sector, and increase in preference for real-time operating system in industrial automation sector. Furthermore, growing adoption of embedded hypervisor in vertical of industrial applications is also to increase the market growth.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Embedded Hypervisor Market

- Citrix Systems Inc.

- IBM Corporation

- Microsoft

- VMware, Inc

- Wind River Systems, Inc.

- NXP Semiconductor

- Thales Group

- Fent Innovation software solution, S.L

- Lynx Software Technologies, Inc.

- Siemens

Get Free Sample For

Get Free Sample For