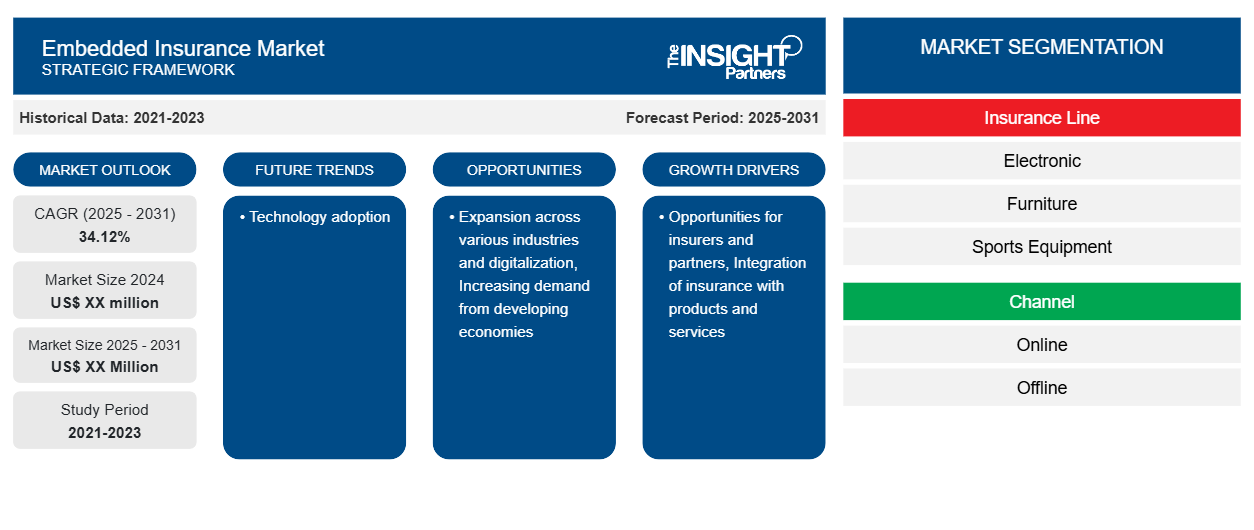

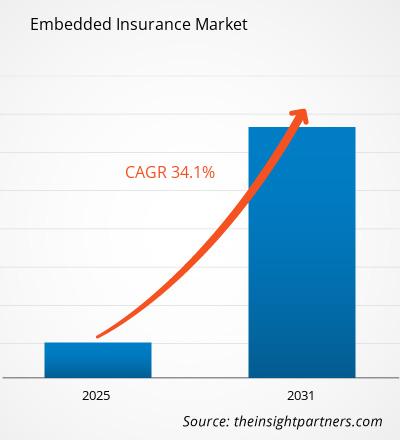

The embedded insurance market size is expected to grow at a CAGR of 34.12% from 2025 to 2031. The growth in e-commerce and mobile commerce, along with technological advancement in the industry, is driving the embedded insurance market growth. Embedded finance, among the upcoming trends on the financial services horizon, has the potential to have the greatest impact on the industry's development. Embedding large-scale insurance and banking products or services at the point of sale could disrupt long-time distribution channels during the rest of this decade. Still, it may also result in the creation of an altogether new set of partnerships with nonfinancial services partners.

Embedded Insurance Market Analysis

A number of factors are driving the growth of the embedded insurance business. First, it has provided a means of reaching new client segments and expanding insurance coverage by integrating insurance products into popular platforms with big user bases. This method has enabled insurers to use existing client relationships and provide insurance solutions at the time of need. In terms of market players, both traditional insurance companies and insurance technology startups are looking into embedded insurance potential. Traditional insurers tried to capitalize on their experience and established customer base, while insurance technology companies aspired to develop the sector with creative technology solutions and partnerships with platform providers.

Embedded Insurance Market Industry Overview

- Embedded insurance addresses the problem of underinsurance or lack of awareness by making coverage relevant and easily accessible to customers. Embedded insurance had the potential to increase client involvement and loyalty. Insurers might establish tailored and contextually relevant offers by seamlessly incorporating insurance into everyday products or services.

- Embedded insurance is a type of digital bundling that allows businesses to provide insurance plans as an add-on, typically as part of a digital sale. This means that the insurance product is not sold on an ad hoc basis to customers. Instead, it becomes available as a feature of their purchase.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Embedded Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Embedded Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Embedded Insurance Market Driver and Opportunities

Increasing Life Insurance Premiums to Drive the Embedded Insurance Market

- Life insurance policies have become increasingly accessible and affordable, making them appealing candidates for inclusion in embedded insurance solutions. Life insurance rates have become more competitive and accessible as a result of technological improvements, improved underwriting processes, and more competition among insurers, making them an attractive component of embedded insurance solutions.

- With the help of embedded insurance, non-insurance platforms can provide life insurance coverage to customers directly within their user experiences through partnerships with life insurance providers. This, in turn, is expected to drive market growth during the forecast period.

Increasing Demand from Developing Economies to Create Lucrative Market Opportunities

- Asia Pacific region has seen substantial expansion in digitization and e-commerce, with a vast populace using online platforms for a variety of purposes. This digital shift has opened up chances for insurance companies to collaborate with e-commerce platforms, ride-hailing applications, financial technology companies, and other digital service providers to easily provide insurance coverage within their platforms.

- Asia has a high rate of smartphone adoption, with a substantial share of the population accessing the internet via mobile devices. This extensive mobile usage opens up a handy channel for delivering embedded insurance solutions, allowing customers to access insurance products and services via mobile apps and websites. This, in turn, is expected to create lucrative growth opportunities.

Embedded Insurance Market Report Segmentation Analysis

The key segments that contributed to the derivation of the embedded insurance market analysis are the insurance line and channel.

- The market is segmented by insurance line into electronics, furniture, sports equipment, travel insurance, and others.

- The market is segmented by online and offline channels.

- The development of digital platforms and technical advancements is driving the expansion of Embedded Insurance, which allows for seamless integration and distribution of insurance products across many channels expected to boost the growth of the online channel segment during the forecast period.

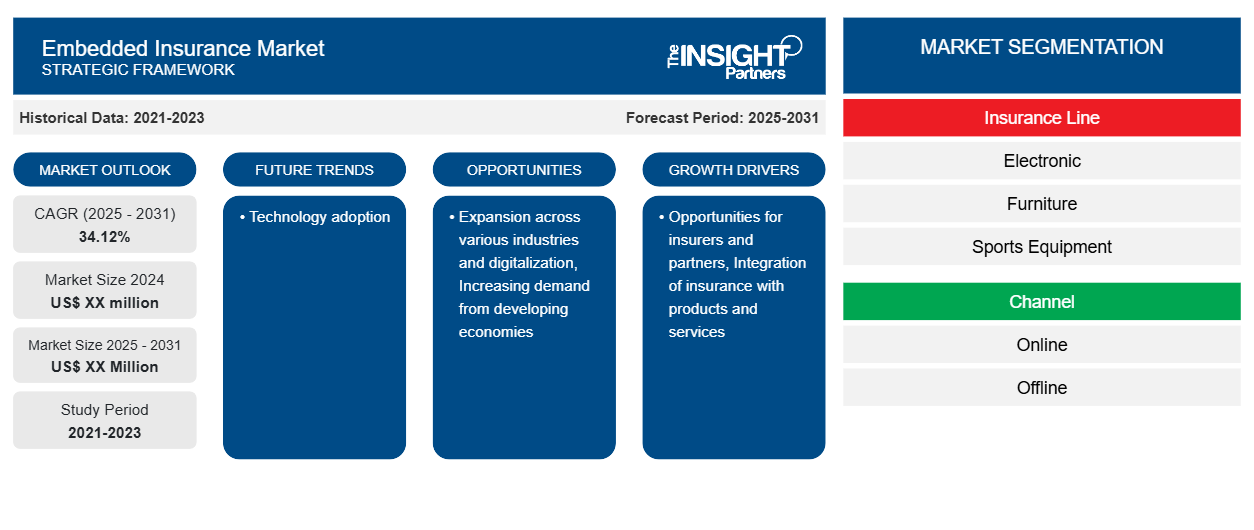

Embedded Insurance Market Share Analysis By Geography

- The scope of the embedded insurance market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- Asia Pacific is one of the substantial markets. The region is home to one-third of the world's population and has one of the fastest-growing economies. The majority of insurance enterprises are emerging in China and India. This is primarily owing to a huge uninsured population and the rapid expansion of the fintech industry. This, in turn, is anticipated to boost the market growth in this region during the forecast period.

Embedded Insurance Market Regional Insights

The regional trends and factors influencing the Embedded Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Embedded Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Embedded Insurance Market

Embedded Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 34.12% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insurance Line

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Embedded Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Embedded Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Embedded Insurance Market are:

- Lemonade

- Metromile

- Slice

- Hippo

- Root Insurance

- Cover Genius

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Embedded Insurance Market top key players overview

Embedded Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the embedded insurance market. Some of the recent key market developments are listed below:

- November 2023: NJJ, a telecommunications conglomerate, collaborated with Bolttech, an Insurtech company, to offer mobile device insurance for mobile operators. [Source: Bolltech, Company Website]

Embedded Insurance Market Report Coverage & Deliverables

The embedded insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Embedded Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Surgical Gowns Market

- Industrial Valves Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Real-Time Location Systems Market

- Artificial Intelligence in Defense Market

- GMP Cytokines Market

- Ketogenic Diet Market

- Truck Refrigeration Market

- Emergency Department Information System (EDIS) Market

- Single Pair Ethernet Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players holding majority shares are Lemonade, Metromile, Slice, Hippo, and Root Insurance So

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

The global embedded insurance market was estimated to grow at a CAGR of 34.12% during 2023 - 2031.

Expansion across various industries and digitalization and technology adoption in the global embedded insurance market.

Opportunities for insurers and partners and integration of insurance with products and services are the major factors that propel the global embedded insurance market.

Get Free Sample For

Get Free Sample For