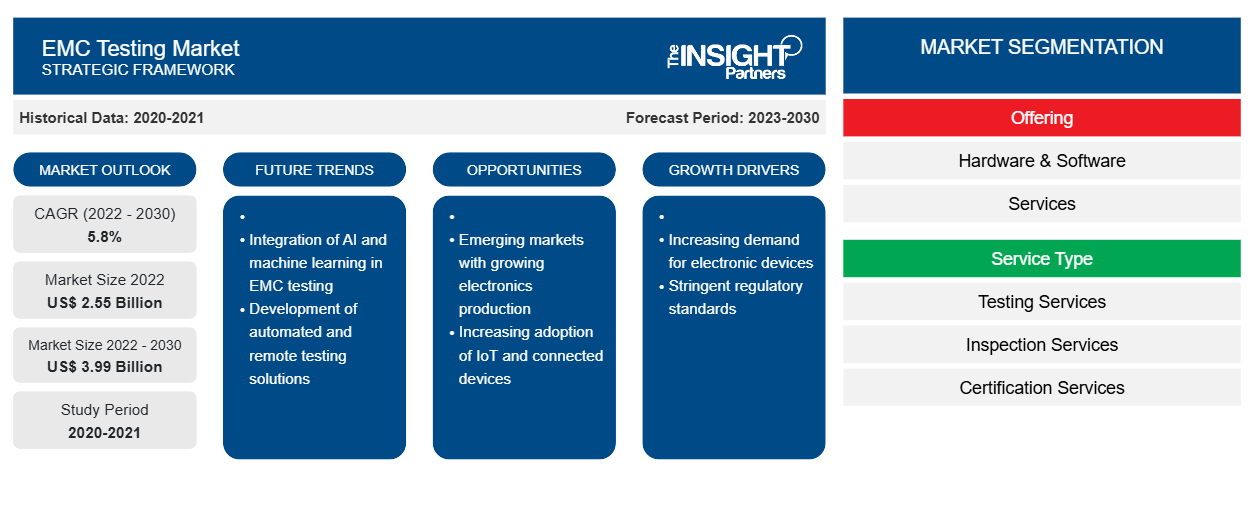

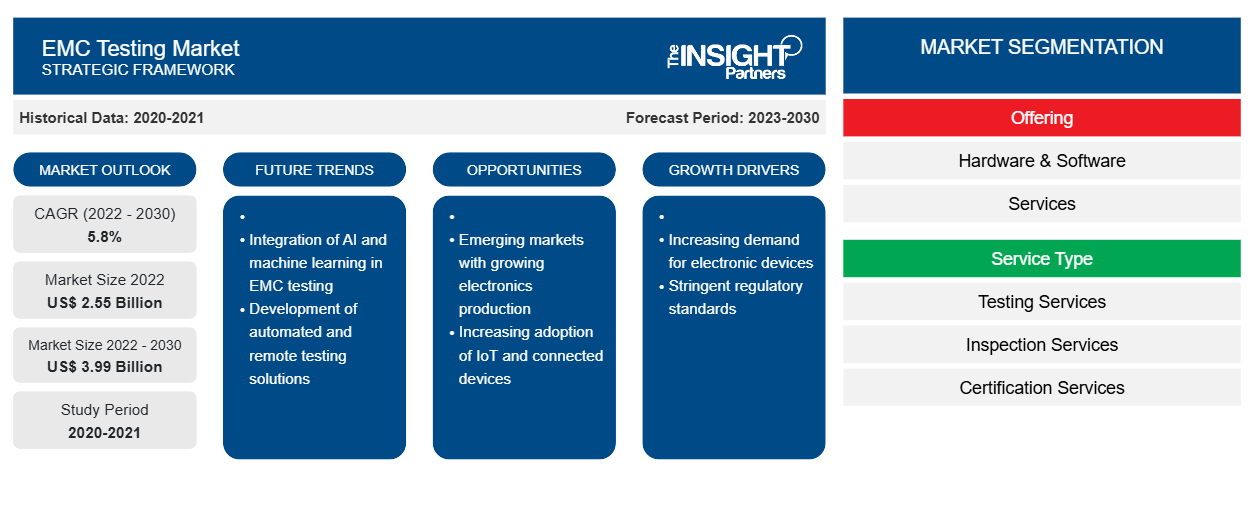

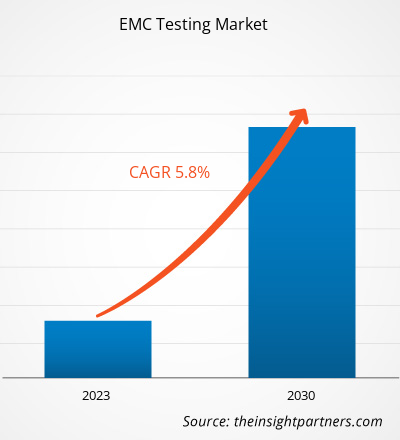

[Research Report] The EMC testing market size was valued at US$ 2.55 billion in 2022 and is expected to reach US$ 3.99 billion by 2030; it is estimated to record a CAGR of 5.8% from 2022 to 2030.

Analyst Perspective:

The growing use of smartphones, tablets, computers, HVAC systems, washing machines, television sets, and other consumer electronics is driving the market. Furthermore, the rising deployment of 5G networks presents significant opportunities for electromagnetic compatibility (EMC) testing market players. The electromagnetic compatibility (EMC) testing market is mainly ascribed to the heavy adoption of modern technologies in manufacturing and commercial activities. The automotive sector is the largest contributor to the growth of many European countries. Germany marks the presence of several well-known automotive manufacturers, including Daimler AG, VW, BMW, Porsche, Opel, and Audi. Significant investments by vehicle manufacturers in their EV production capabilities are driving The electromagnetic compatibility (EMC) testing market. Many APAC countries, such as China, South Korea, Japan, and India, are known for the mass production of electronic devices/components required for consumer electronics, telecommunication gadgets, automobile components, and other industrial machinery. Thus, The electromagnetic compatibility (EMC) testing market in this region is growing with the rising number of manufacturing facilities in India and China, as well as a strong availability of competent people and resources.

EMC Testing Market Overview:

Electromagnetic compatibility (EMC) is the significant potential of a system to evade the effects of electromagnetic interference. The demand for electronic products is increasing in the majority of sectors due to trends such as smart homes, digitization, connected devices, and the Internet of Things (IoT). Therefore, several industrialists and testing service providers perform EMC tests to validate and verify the compliance of various products toward electromagnetic interference (EMI). The electromagnetic compatibility (EMC) testing market primarily involves EMC testing service providers and EMC test equipment manufacturers.

The mandatory EMC testing of medical equipment, standardization of electronic products globally, and increase in the brand proposition of companies are a few of the significant factors driving the EMC market. Moreover, an immense rise in the reach of smartphones has contributed to the accelerated introduction of technologies such as 4G, LTE, and 5G; test and measurement equipment such as EMC test equipment help ensure the quality and reliability of smartphones. EMC testing services help guarantee that goods meet regulatory requirements for quality, technical safety, and performance. In general, testing, which is performed in laboratories, allows producers to enhance the marketability of their products while lowering manufacturing costs during the pre-production phase. Inspection services are available for examining traded items to guarantee that they meet the buyers’ requirements.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EMC Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EMC Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EMC Testing Market Driver:

Surging Demand for Certification Services Fuel EMC Testing Market Growth

Electrical and electronic devices generate some form of unwanted interference/radiation that is unavoidable. As these gadgets are increasingly being used in proximity to one another, they are required to function normally without interfering with or being hampered by other devices. Thus, electromagnetic compatibility (EMC) is a critical feature of electrical and electronic devices. They require, however, release limited radiation and be impervious to a particular degree of electromagnetic radiation to ensure proper functioning. As different electronic devices play pivotal roles in the business environment, compliance demands pertaining to EMC and electromagnetic immunity (EMI) testing are becoming highly challenging with the introduction of new business rules. The ability of the EMC testing chamber(s) to be certified ensures that the items will be precisely measured for EMC approval. Certification services are expected to increase at a rapid pace during the forecast period. These services ensure the functionality and safety of products. They entail aspects such as safety and health, quality, environment, social responsibility, and customized audits. Businesses buy certification services to bind to present processes to improve their business performance with testing. Thus, a surge in demand for certification services propels the EMC testing market growth.

EMC Testing Market Segmental Analysis:

The EMC testing market is segmented on the basis of offering, service type, end-use, and geography. Based on deployment, the EMC testing market is divided into hardware & software, and services. The hardware & software segment held a larger market share in 2022, and the hardware & software segment is anticipated to record the highest share during the forecast period. Based on service type, the EMC testing market is categorized into testing services, inspection services, certification services, and others. The testing services segment held the largest share of the global EMC testing market, and is also anticipated to hold revenue compared to the other segments during the forecast period. Based on end-use, the EMC testing market is categorized into consumer appliances and electronics, automotive, it and telecommunications, others. The consumer appliance and electronics segment held the largest share of the global EMC testing market, and is also anticipated to record the highest share during the forecast period. Geographically, the market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Segmental Analysis:

Based on offering, the EMC testing market is bifurcated into hardware & software and services.The hardware and software segment held a larger EMC testing market share in 2022 and is anticipated to register a higher CAGR in the market during the forecast period. With the global increase in awareness pertaining to product safety and the rising uptake of electronic devices, EMC test system providers are experiencing substantial traction, especially from developing economies such as India, China, Vietnam, Taiwan, and South Korea. Initially, these systems mostly consisted of hardware solutions; however, over the period and with the increasing need for making EMC testing efficient, providers have started offering advanced software along with hardware. Comb generators, antennas, EMC generators, immunity test systems, masts, near field probes, pre-amplifiers, RF field probes, transient limiters, turntables, voltage interruption simulators, safety monitors, ferrite clamps, current probes, and RF power amplifiers are among key hardware used in EMC systems. Moreover, as electronics production is increasing at a steady rate, globally, electronics manufacturers are emphasizing developing in-house EMC testing units for streamlining their operations, which is driving the electromagnetic compatibility (EMC) testing market.. Several companies are developing smart excavators to increase the operational efficiency of mining operations.

EMC Testing Market Regional Analysis:

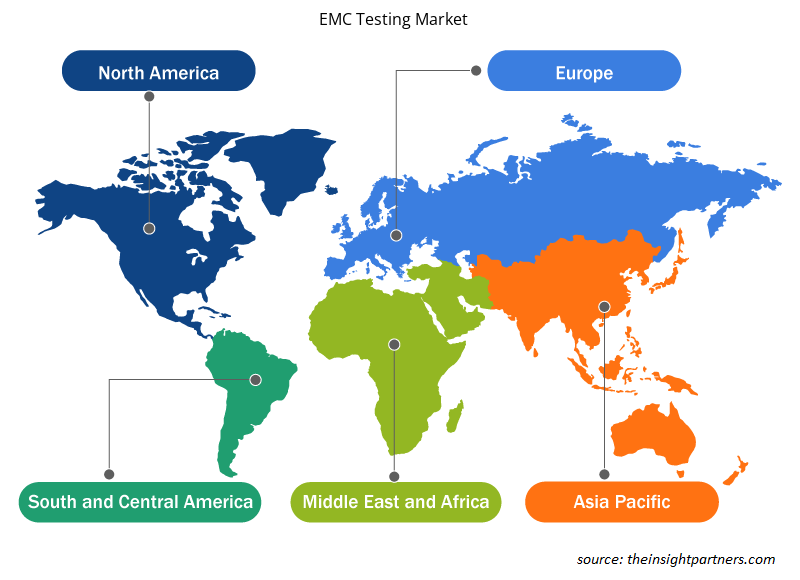

The EMC testing market is broadly segmented into five major regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America. APAC held the largest smart mining market share in 2022, followed by Europe and North America. The APAC EMC testing market is expected to register the highest CAGR during 2022–2030. Vast industrialization, favorable economic policies, positive economic development, low labor costs, foreign institutional investments (FIIs), and an increase in foreign direct investments (FDIs) contribute to the growth of the APAC electromagnetic compatibility (EMC) testing market. Furthermore, governments of developing countries in the region have been launching strategic initiatives, such as Make in India and Made in China 2025, to promote the growth of the domestic manufacturing sectors for making the respective countries capable of meeting the native demands and exporting surplus goods. Moreover, the rising disposable income in developing countries, such as India and China, leads to a large client base for high-tech consumer electronics such as smart wearables, smartphones, and electric vehicles, which is driving the EMC testing market. For instance, according to A.P.Moller–Mersk, China raises the EV penetration rate up to 27.6% in 2022. This rate is also expected to reach 16% by 2025 and 49% by 2035. China is expected to increase the overall production and sales volume of EVs up to 10 million by the end of 2023. The rising popularity of EVs among consumers is anticipated to create growth opportunities for the EMC testing market. EVs are continuously incorporating advanced technologies such as advanced driver assistance systems (ADAS), an autonomous system that increases the complexity of setting up electronic systems in the EVs, which mandates manufacturers to adopt EMC testing for increasing vehicle performance and reducing electromagnetic interference. EMC testing in EVs plays a vital role in ensuring consistent working with contemporary technologies in the automotive industry, which is anticipated to boost the EMC testing market during the forecast period.

EMC Testing Market Key Player Analysis:

Ametek Inc, Element Materials Technology Group Ltd, Bureau Veritas SA, Eurofins Scientific SE, Intertek Group Plc, TÜV NORD Group, Rohde & Schwarz GmbH & Co KG, SGS SA, TUV SUD AG, and UL, LLC are among the players operating in the EMC testing market. Several other major companies have been analyzed during this research study to get a holistic view of the EMC testing market ecosystem.

EMC Testing Market Regional Insights

EMC Testing Market Regional Insights

The regional trends and factors influencing the EMC Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses EMC Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for EMC Testing Market

EMC Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.55 Billion |

| Market Size by 2030 | US$ 3.99 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

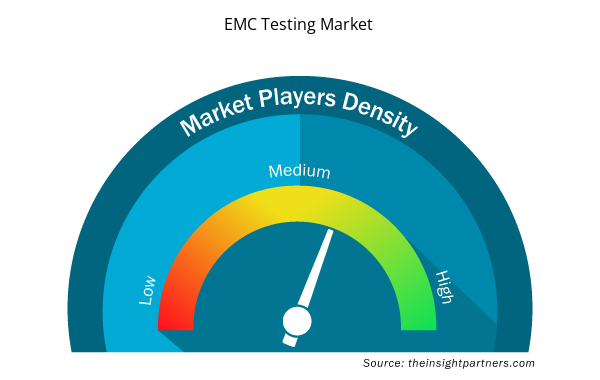

EMC Testing Market Players Density: Understanding Its Impact on Business Dynamics

The EMC Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the EMC Testing Market are:

- Ametek Inc

- Element Materials Technology Group Ltd

- Bureau Veritas Sa

- Eurofins Scientific Se

- Intertek Group Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the EMC Testing Market top key players overview

Recent Developments:

The EMC testing market players highly adopt inorganic and organic strategies. Following are a few major EMC testing market developments:

- In May 2023, Ametek CTS announced the launch of a comprehensive video series that delves into the new Power Wave range of power sources for EMC testing. This resource is designed to provide practical insights for engineer’s keen on expanding their knowledge of the Power Wave series.

- In January 2023, Global testing company Eurofins Scientific expanded its U.S. laboratory services to assist the produce industry. The laboratory testing company has also partnered with the Grower-Shipper Association of Central California to bring Eurofins' food safety and testing solutions to the produce industry. It plans to achieve this by bringing additional laboratories and technical services to the Salinas Valley in California, according to the release.

- In March 2022, Rohde & Schwarz demonstrated the new R&S EPL1000 EMI test receiver for reliable certification measurements with minimum test times at EMV 2023 Stuttgart. The R&S EPL 1000 is CISPR 16-1-1 compliant and suitable for certification measurements.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Nuclear Decommissioning Services Market

- Joint Pain Injection Market

- Europe Industrial Chillers Market

- Resistance Bands Market

- Constipation Treatment Market

- Nuclear Waste Management System Market

- Extracellular Matrix Market

- Small Internal Combustion Engine Market

- Photo Printing Market

- Long Read Sequencing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offering, Service Type, End-use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players, holding majority shares, in EMC testing market includes Bureau Veritas, Eurofins Scientifi, Intertek Group plc, SGS SA, Dekra SE.

The EMC testing market was US$ 2.55 billion in the year 2022 and is expected to grow at a CAGR of 5.8%, during 2022 - 2030.

India is anticipated to grow with the highest CAGR over the forecast period.

The Advancements in 5G Infrastructure can be a beneficial trend for the EMC testing market.

The surging demand for certification services can be one of the drivers of the EMC testing market.

The US held the largest market share in 2022, followed by China.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - EMC Testing Market

- Ametek Inc

- Element Materials Technology Group Ltd

- Bureau Veritas Sa

- Eurofins Scientific Se

- Intertek Group Plc

- Rohde & Schwarz Gmbh & Co Kg

- SGS SA

- TUV SUD AG

- UL, LLC

- NTS

Get Free Sample For

Get Free Sample For