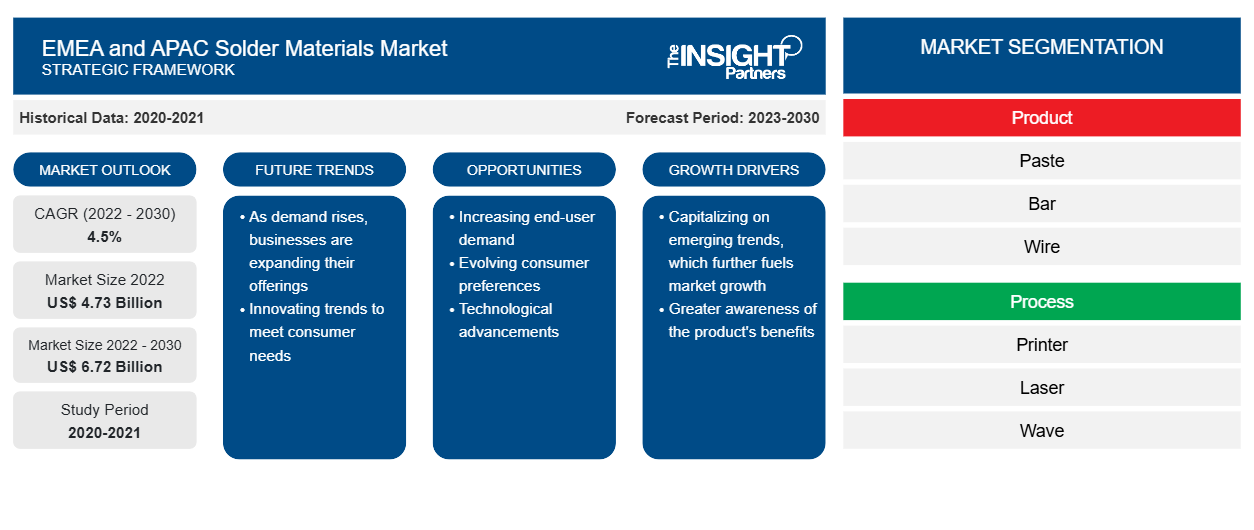

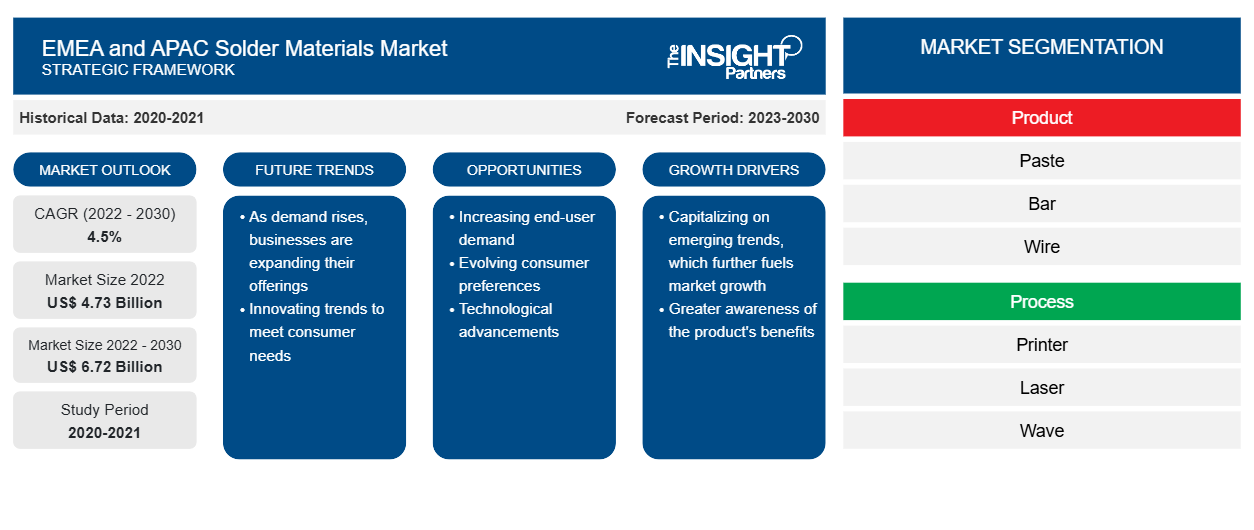

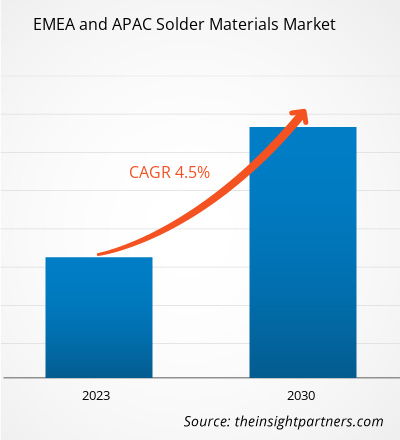

The EMEA and APAC solder materials market size is expected to reach US$ 6.72 billion by 2030 from US$ 4.73 billion in 2022; the market is estimated to register a CAGR of 4.5% from 2022 to 2030.

Market Insights and Analyst View:

The solder material encompasses a wide range of products used in electronics assembly and soldering processes. These materials play a crucial role in creating reliable electrical connections between electronic components and circuit boards. The expanding electronics industry, driven by rising demand for consumer electronics such as tablets, laptops, and smartphones, is driving the EMEA and APAC solder materials market

The EMEA and APAC solder materials market is experiencing significant growth, driven primarily by the surging demand from two key industries: automotive and telecommunication. Moreover, the trend toward miniaturization and more compact electronic devices requires solder materials capable of creating fine-pitch connections with high reliability. Ongoing research pertaining to the development of innovative solder materials, such as low-temperature solder alloys and no-clean fluxes, cater to evolving industry requirements.

Growth Drivers and Challenges:

The semiconductor industry is experiencing growth owing to the rise in demand for electronic devices and the proliferation of applications such as artificial intelligence, the Internet of Things, and automotive electronics. As a result of continuous innovation, semiconductor technology has evolved rapidly in the past few years, enabling the development of small, fast, and energy-efficient chips with better processing capabilities. Further, increased investment in the electrification of vehicles and the development of autonomous driving capabilities are creating lucrative business opportunities for semiconductor manufacturers.

Per the Semiconductor Industry Association, global semiconductor sales increased from US$ 45.6 billion in November 2022 to US$ 48.0 billion in November 2023. The year-to-year sales of semiconductors increased in Asia Pacific and other regions by 7.1% and Europe by 5.6%. Additionally, China registered a 7.6% growth in year-to-year sales of semiconductors in 2022. According to the customs data of China, the import value of chipmaking tools for the production of silicon wafers, integrated circuits, and flat-panel displays reached US$ 4.3 billion in October 2023.

However, fluctuations in raw material prices pose a significant challenge to the growth of the solder material market. Solder materials are heavily reliant on various raw materials, including tin, silver, and copper. When the prices of these materials experience significant fluctuations, solder manufacturers face rising production costs. This can squeeze their profit margins and force them to raise their own prices, potentially deterring customers and hindering market growth. The prices of these raw materials are susceptible to various external factors, including geopolitical events, market demand, and supply chain disruptions. When raw material prices experience sudden or unpredictable fluctuations, it directly impacts the production costs of solder materials. Manufacturers may face increased expenses for sourcing essential metals, leading to higher overall production costs. These cost escalations can be challenging for businesses within the market to absorb, potentially limiting their competitiveness and profitability. All these factors pose a challenge to the EMEA and APAC solder materials market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EMEA and APAC Solder Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EMEA and APAC Solder Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

“The EMEA and APAC Solder Materials Market Analysis and Forecast to 2030” is a specialized and in-depth study with a significant focus on market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by product and process. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of solder materials in the EMEA and APAC. In addition, the EMEA and APAC solder materials market report provides a qualitative assessment of various factors affecting the market performance in the EMEA and APAC. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, EMEA and APAC solder materials market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The EMEA and APAC solder materials market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the EMEA and APAC solder materials market performance.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The EMEA and APAC solder materials market is segmented on the basis of product and process. Based on product, the market is segmented into paste, bar, wire, spheres, and others. The paste segment held a significant EMEA and APAC solder materials market share in 2022. Solder paste is used in the electronics industry for surface mount assembly processes. It is a mixture of powdered metals and flux. When heated during soldering, the paste melts, forming a bond between the components and the circuit board. It is used in through-hole pin-in paste components by printing solder paste in/over the holes. The solder paste is applied to the board by stencil printing or jet printing, and the components are put in place through a pick-and-place machine or by hand. However, the right amount of paste is necessary for these processes. During PCB production, printed circuit board (PCB) manufacturers usually test the solder paste deposits through solder paste inspection. The inspection systems measure the volume of the solder pads before the components are applied and the solder is melted.

EMEA and APAC Solder Materials Market Share – by Product, 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

Based on region, the EMEA and APAC solder materials market is subsegmented into Europe, Asia Pacific, and the Middle East & Africa. The market in Europe was valued at more than US$ 700 million in 2022. Europe has long been a key player in the global electronics manufacturing sector, contributing to the increasing demand for solder materials. The region's thriving electronics industry, from consumer electronics to industrial machinery, relies on precise and reliable soldering processes to assemble electronic components. As a result, the market for solder materials has seen a consistent upswing, driven by the need for high-performance materials that can meet the stringent requirements of modern electronic manufacturing. The market in Europe is growing with a fast-changing semiconductor marketplace as governments worldwide increasingly adopt more restrictive policies on importing and using chips from overseas. The European Commission (EC) passed the EU Chips Act in April 2023, intending to double Europe's share in global chip production by 2030 by gathering US$ 47 billion in public and private investment. The plan included the expansion of advanced chip manufacturing technology and R&D facilities. Solder materials play a major role in semiconductor manufacturing by forming a bonding layer between a semiconductor element and a substrate electrode or a lead frame.

The automotive industry of the EU is considered a crucial industry as it significantly contributes to the region's GDP. EU is the leading producer of motor vehicles globally, and many premium automotive manufacturers, such as BMW and Volkswagen, are based in the region. The vehicle manufacturing sector in the region produces ~19.2 million cars, vans, buses, and trucks per year. Approximately 300 vehicle assembly and manufacturing facilities are located in ~26 countries across the region. According to the European Automobile Manufacturers' Association (ACEA), 21% of the cars worldwide are manufactured in the EU by companies such as BMW, Volkswagen, Audi, and Aston Martin. Germany holds the largest automotive market share in the region, i.e., 30%. The rapid inclination of automotive manufacturers to include automotive electronics due to the emergence of autonomous driving and advanced driver-assist systems has resulted in increased demand for electronic integrations in automobiles. This factor propels the demand for semiconductors, further driving the requirement for solder materials. All the factors mentioned above support the EMEA and APAC solder materials market growth.

Industry Developments and Future Opportunities:

A few initiatives by key players operating in the EMEA and APAC solder materials market, as per press releases, are listed below:

- In 2023, MacDermid Alpha launched a new next-generation ultra-low voiding solder paste - the ALPHA OM-362. This lead-free, zero-halogen, no-clean paste can deliver less than 10% voiding on bottom termination components (BTCs). The design characteristics of BTCs create void removal challenges during the soldering process, which can lead to ineffective thermal dissipation and mechanical strength in post-reflow applications. Low-voiding solder pastes are important in improving board-level reliability by reducing this effect.

- In 2022, Indium Corp added SiPaste C201HF to its portfolio of pastes for fine feature printing with a halogen-free, cleanable solder paste specifically formulated to accommodate fine feature printing, as seen with 01005 and 008004 components.

- In 2023, Nihon Superior Co Ltd partnered with FCT Solder for a license agreement for the SN100CV solder alloy. The company granted FCT Solder a license for its innovative alloy, SN100CV, which offers cost-effective solutions and outperforms SAC305 in reliability.

- In 2022, AIM Solder announced the acquisition of BLT Circuit Services, Ltd., a leading manufacturer and distributor of a comprehensive range of consumable products for the printed circuit and chemical milling industries.

Competitive Landscape and Key Companies:

Indium Corp, Fusion Inc, Element Solutions Inc, KOKI Co Ltd, Stannol GmbH & Co KG, AIM Metals & Alloys LP, Nihon Superior Co Ltd, GENMA Europe GmbH, and National Solder Co Ltd are among the key players profiled in the EMEA and APAC solder materials market report. The market players focus on providing high-quality products to fulfill customer demand.

EMEA and APAC Solder Materials Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.73 Billion |

| Market Size by 2030 | US$ 6.72 Billion |

| Global CAGR (2022 - 2030) | 4.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and Process

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - EMEA and APAC Solder Materials Market

- AIM Metals & Alloys LP

- KOKI Co Ltd

- Fusion Inc

- Stannol GmbH & Co KG

- National Solder Co (PTY) Ltd

- Nihon Superior Co Ltd

- GENMA Europe GmbH

- Indium Corp

- Element Solutions Inc

- Harima Chemicals Group Inc

Get Free Sample For

Get Free Sample For