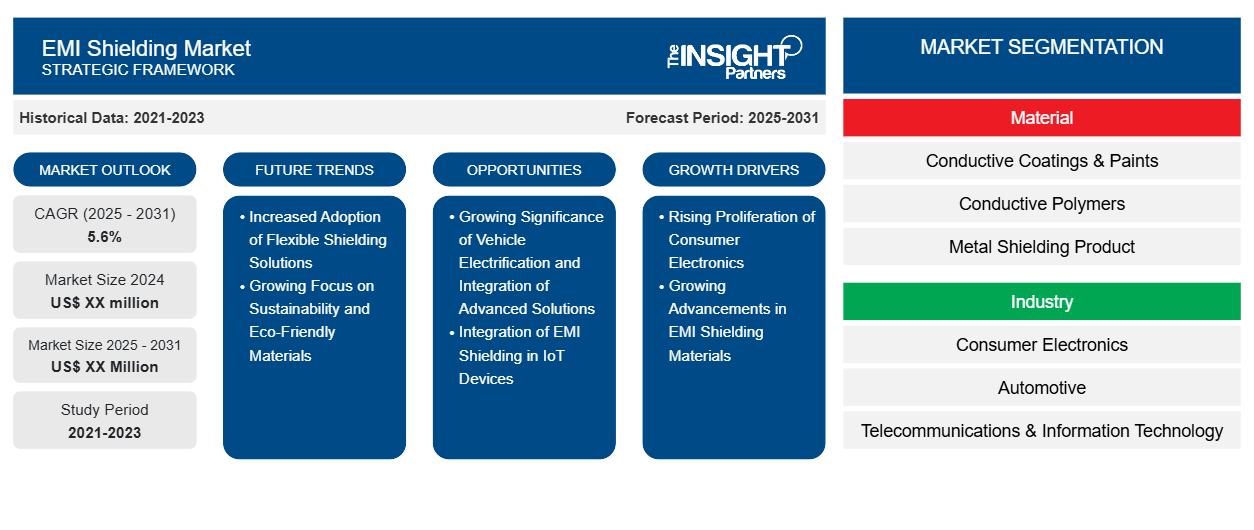

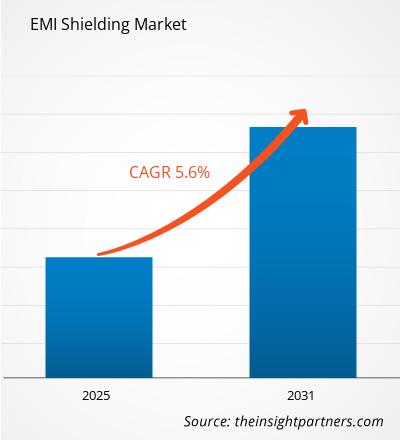

The EMI Shielding Market is expected to register a CAGR of 5.6% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The Report is Segmented by Industry (Consumer Electronics, Automotive, Telecommunications & Information Technology, Healthcare, Aerospace, Others). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report EMI Shielding Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

EMI Shielding Market Segmentation

Material

- Conductive Coatings & Paints

- Conductive Polymers

- Metal Shielding Product

- EMC/EMI Filters

- Others

Industry

- Consumer Electronics

- Automotive

- Telecommunications & Information Technology

- Healthcare

- Aerospace

- Others

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EMI Shielding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EMI Shielding Market Growth Drivers

- Rising Proliferation of Consumer Electronics: The proliferation of consumer electronics, including smartphones, laptops, and wearable devices, is a significant driver for the EMI shielding market. As these devices become more compact and feature-rich, they are increasingly susceptible to electromagnetic interference, which can disrupt their functionality. Consequently, manufacturers are compelled to integrate effective EMI shielding solutions to ensure device reliability and performance. This growing demand for high-quality electronics is expected to propel the EMI shielding market significantly in the coming years.

- Growing Advancements in EMI Shielding Materials: Innovations in materials science are leading to the development of more effective and lightweight EMI shielding solutions. New materials, such as conductive polymers and nanomaterials, offer enhanced shielding performance while reducing weight and bulk. These advancements are particularly important in sectors like aerospace and automotive, where weight reduction is critical for efficiency and performance. As manufacturers adopt these cutting-edge materials, the demand for advanced EMI shielding solutions is expected to grow, further driving market expansion.

EMI Shielding Market Future Trends

- Increased Adoption of Flexible Shielding Solutions: The trend towards miniaturization in electronic devices has led to a growing demand for flexible EMI shielding solutions. Manufacturers are increasingly seeking materials that can conform to various shapes and sizes without compromising performance. Flexible shielding materials, such as conductive fabrics and films, are becoming popular in applications ranging from smartphones to medical devices. This shift towards flexibility not only enhances design possibilities but also improves the overall user experience, making it a key trend in the EMI shielding market.

- Growing Focus on Sustainability and Eco-Friendly Materials: There is a growing emphasis on sustainability within the EMI shielding market, with manufacturers increasingly focusing on eco-friendly materials and production processes. As consumers and regulatory bodies prioritize environmental responsibility, companies are exploring biodegradable and recyclable shielding materials. This trend not only aligns with global sustainability goals but also enhances brand reputation and market competitiveness. As the demand for green technologies rises, the EMI shielding market is likely to see a shift towards more sustainable practices.

EMI Shielding Market Opportunities

- Growing Significance of Vehicle Electrification and Integration of Advanced Solutions: The automotive industry is undergoing a transformation with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These technologies rely heavily on electronic components that require effective EMI shielding to function properly. As automakers increasingly integrate sophisticated electronics into their vehicles, the demand for high-performance EMI shielding solutions will rise. This presents a lucrative opportunity for manufacturers to develop specialized shielding materials tailored to the automotive sector, capitalizing on the industry's shift towards electrification and automation.

- Integration of EMI Shielding in IoT Devices: As the Internet of Things (IoT) continues to expand, the need for effective EMI shielding in connected devices is becoming more pronounced. IoT devices often operate in environments with multiple electronic signals, increasing the risk of interference. Manufacturers are recognizing the importance of incorporating EMI shielding into their IoT products to ensure reliable communication and functionality. This trend is driving innovation in shielding technologies tailored specifically for IoT applications, creating new opportunities within the market.

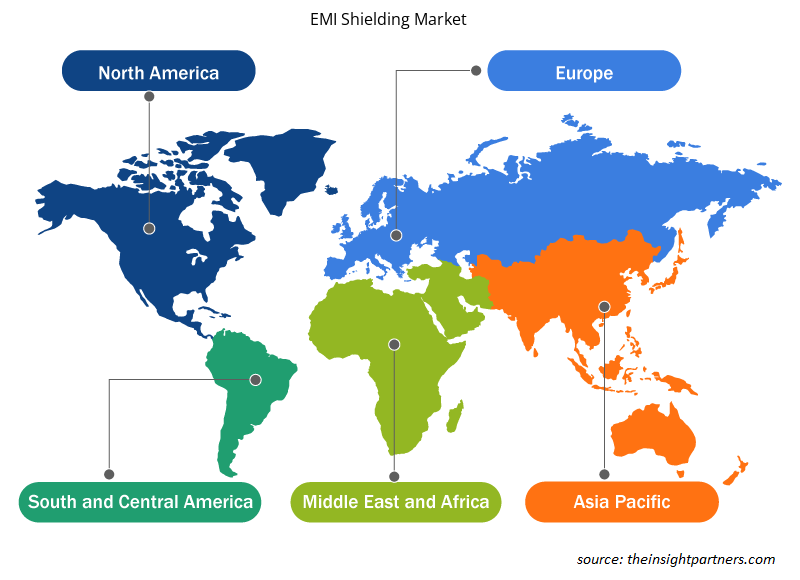

EMI Shielding Market Regional Insights

The regional trends and factors influencing the EMI Shielding Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses EMI Shielding Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for EMI Shielding Market

EMI Shielding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

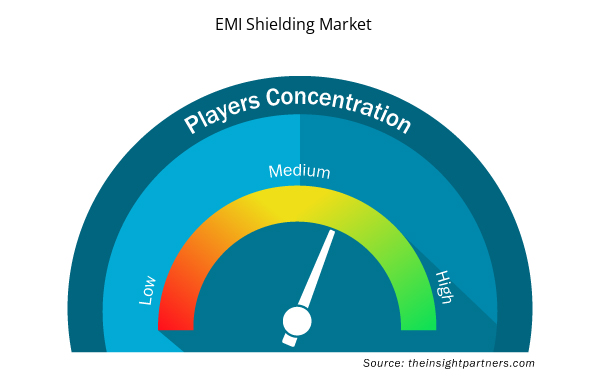

EMI Shielding Market Players Density: Understanding Its Impact on Business Dynamics

The EMI Shielding Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the EMI Shielding Market are:

- 3M Company

- ETS-Lindgren Inc.

- Henkel Corporation

- KGS Kitagawa Industries Co. Ltd.

- Laird plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the EMI Shielding Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the EMI Shielding Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the EMI Shielding Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Method, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

Electric Vehicle (EV) market expansion to play a significant role in the global EMI Shielding market in the coming years

Proliferation of electronic devices and growing aerospace and defense sector are the major factors driving the EMI Shielding market

The EMI Shielding Market is estimated to witness a CAGR of 5.6% from 2023 to 2031

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

1. 3M Company

2. ETS-Lindgren Inc.

3. Henkel Corporation

4. KGS Kitagawa Industries Co. Ltd.

5. Laird plc

6. Leader Tech, Inc.

7. PARKER HANNIFIN CORP

8. PPG Industries, Inc.

9. RTP Company

10. SCHAFFNER HOLDING AG

Get Free Sample For

Get Free Sample For