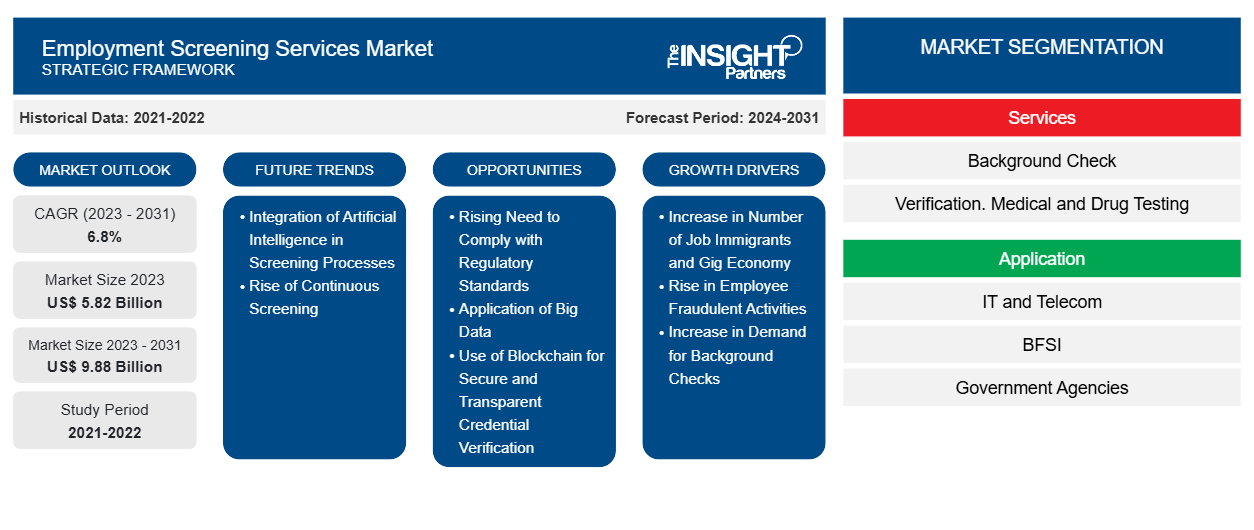

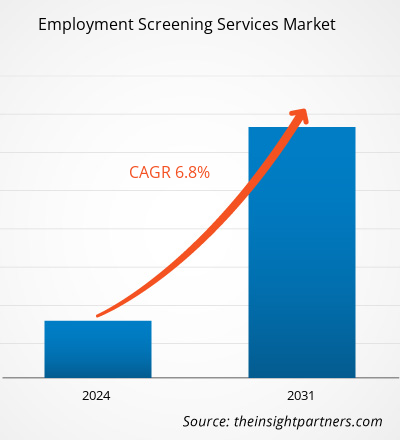

The employment screening services market size is expected to reach US$ 9.88 billion by 2031 from US$ 5.82 billion in 2023. The market is estimated to record a CAGR of 6.8% from 2023 to 2031. The integration of artificial intelligence in screening processes and the rise of continuous screening are expected to become key market trends.

Employment Screening Services Market Analysis

Employment screening services are most commonly used during the recruitment process to ensure potential hires are a good fit for the company in terms of skill, experience, and character. When considering internal candidates for promotions to sensitive or high-responsibility roles, screening can verify if the employee has maintained a clean record. Also, industries such as healthcare, finance, and transportation often require specific checks, including drug testing, credit checks, or license verification, to comply with regulatory standards. Some organizations conduct periodic re-screening of employees to ensure ongoing compliance with company policies or industry regulations. By opting for employment screening services, organizations can save time in the long run as these services offer them clarity on responsibilities that should be taken to ensure the appropriate candidates are hired in the right way, which, in turn, increases work quality and efficiency. The increase in the number of job immigrants and the gig economy and rising employee fraudulent activities are propelling the employment screening services market growth. The rising need to comply with regulatory standards and the introduction of big data are further expected to create new opportunities for the employment screening services market during the forecast period.

Employment Screening Services Market Overview

Employment screening services involve conducting background checks and verifications on potential employees during the hiring process. These services help employers confirm that a candidate's qualifications, history, and personal details align with the requirements of the job and the company's policies. Employment screening services confirm the authenticity of candidates' credentials, employment history, and educational background by conducting extensive background checks. By carefully screening applicants, only legitimate and skilled people are considered for jobs. This method helps identify and eliminate candidates who may have included false material on their resumes. By using these services, previous employers or listed references can be contacted to evaluate the candidate's work performance, reliability, and character. These services can review a candidate's financial history to assess risk, especially for roles in finance or positions of trust. It can screen candidates for illegal substance use, which is often required in safety-sensitive industries.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Employment Screening Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Employment Screening Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Employment Screening Services Market Drivers and Opportunities

Increase in Number of Job Immigrants and Gig Economy

The increasing number of job immigrants and the growing gig economy are significantly driving the demand for employment screening services. As workforce dynamics shift globally, companies face unique challenges in verifying backgrounds, ensuring compliance, and mitigating risks. Globalization and economic migration have increased the number of individuals seeking employment in foreign countries. In 2023, the global flow of job immigrants increased, driven by both economic opportunities and labor shortages in high-income nations. For instance, the Congressional Budget Office (CBO) reported that in 2023 and 2024, the US experienced a significant uptick in immigration, with a net influx of 3.3 million people, well above the 1 million projected prior to the pandemic. Also, according to the European Commission, more than 37.7 million foreigners resided within the European Union and EFTA nations as of 2023. This has placed greater pressure on companies to conduct comprehensive background checks to verify international credentials and ensure compliance with local laws. Companies hiring foreign nationals face challenges in verifying qualifications, past employment, and criminal records across different countries. Employment screening services are vital for accessing global databases and validating international records. Employers must adhere to strict immigration and labor laws, such as verifying work visas, permits, and citizenship documentation. Screening services ensure compliance, reducing the risk of penalties or legal issues. As companies hire more H-1B visa holders in tech and other sectors, the demand for screening services has surged. Employers need to verify educational credentials from foreign institutions, ensuring compliance with US Department of Labor standards.

Additionally, the gig economy—characterized by freelance, short-term, or contract-based work—has exploded due to platforms such as Uber, DoorDash, Fiverr, and Upwork. These platforms require a constant requirement of independent workers, creating a growing need for employment screening services to ensure the trustworthiness and qualifications of workers. Various companies rely on gig workers who are using screening services. For instance, Amazon's delivery network, which relies on gig workers for last-mile deliveries, uses background screening to ensure drivers' safety and reliability.

Rising Need to Comply with Regulatory Standards

Companies face increased pressure to meet stringent laws across various sectors. Compliance with these regulations is crucial to avoid legal penalties, maintain operational transparency, and protect against financial and reputational damage. Many industries, such as healthcare, finance, education, and government, are subject to strict regulatory standards regarding background checks. For example, in the US, healthcare providers must comply with the Health Insurance Portability and Accountability Act (HIPAA) and Office of Inspector General (OIG) regulations, which mandate comprehensive background checks to ensure patient safety and prevent hiring individuals excluded from participating in federal health programs. For instance, in April 2023, OIG announced its plans to improve and update existing CPGs and to deliver new compliance program guidance documents (CPGs) specific to segments of the healthcare industry or entities involved in the healthcare industry that have emerged in recent years. Also, the Patriot Act and other anti-money laundering (AML) regulations require financial institutions to conduct thorough background checks on employees to prevent financial crimes such as money laundering and fraud. Compliance with the Financial Industry Regulatory Authority (FINRA) also requires firms to screen employees thoroughly before hiring.

Employment Screening Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the employment screening services market analysis are services, organization size, and application.

- Based on services, the employment screening services market is segmented into background screening, verification, and medical and drug testing. The verification segment dominated the market in 2023.

- In terms of organization size, the employment screening services market is segmented into small and medium-sized enterprises and large enterprises. The large enterprises segment dominated the market in 2023.

- Based on application, the market is segmented into IT and telecom, BFSI, government agencies, travel and hospitality, manufacturing, retail, healthcare, and others. The IT and telecom segment dominated the market in 2023.

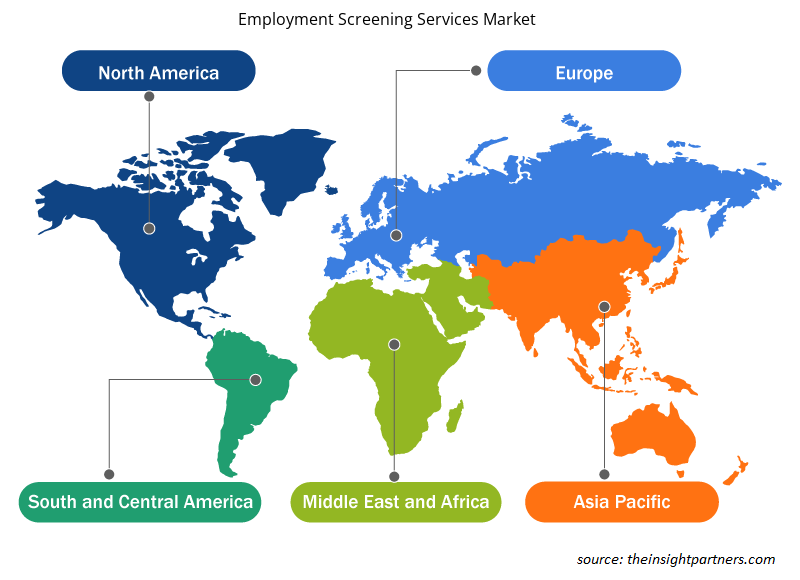

Employment Screening Services Market Share Analysis by Geography

- The employment screening services market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- A global surge in internet users and innovative changes in human resource management have created a rich atmosphere for the propagation of screening services. Many industries are currently stimulated by the candidate-driven employment market, wherein companies are keen to decrease the time-to-hire ratios. Hiring delays impact organizations in terms of time and cost. Companies these days are competing for the best candidates and, therefore, are putting more emphasis on crafting a positive onboarding experience, which also includes the background screening process of employees. Further, an increase in international recruitment has created new opportunities for organizations in different sectors. However, hiring candidates from overseas can lead to crucial legal and logistical difficulties for hiring departments. Organizations with high yearly incomes spend excessive amounts on the employment and onboarding processes. Such companies conduct an exhaustive background screening to deploy best practices in hiring and onboarding programs. Background screening costs much less to companies than the monetary loss incurred by drug abuse or any other crime at the workplace.

Employment Screening Services Market Regional Insights

The regional trends and factors influencing the Employment Screening Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Employment Screening Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Employment Screening Services Market

Employment Screening Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.82 Billion |

| Market Size by 2031 | US$ 9.88 Billion |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

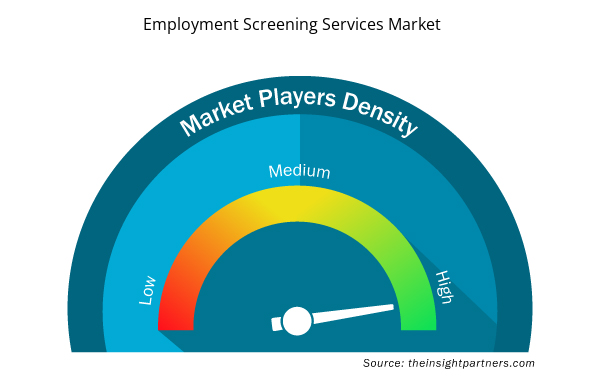

Employment Screening Services Market Players Density: Understanding Its Impact on Business Dynamics

The Employment Screening Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Employment Screening Services Market are:

- Acuity International

- HireRight LLC

- ADP, Inc.

- Pinkerton Consulting and Investigations Inc

- GoodHire

- Capita Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Employment Screening Services Market top key players overview

Employment Screening Services Market News and Recent Developments

The employment screening services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the employment screening services market are listed below:

- Accurate Background, the largest privately held global provider of compliant background checks, drug and health screening, and employment monitoring solutions, announced its plans to release a new mobile-first drug and health screening experience designed to create a better candidate experience.

(Source: Accurate Background, Press Release, April 2024)

- AuthBridge announced a new and improved version of iBRIDGE. iBRIDGE 2.0 is the next-gen background verification platform that will enable companies with seamless candidate onboarding and verification experiences for new-age talent. With this new product launch, clients of AuthBridge will be able to activate candidate verifications in seconds and deep dive into a candidate's documentation status with a single click.

(Source: AuthBridge, Press Release, January 2023)

Employment Screening Services Market Report Coverage and Deliverables

The "Employment Screening Services Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Employment screening services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Employment screening services market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Employment screening services market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the employment screening services market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Services, Application, Organization Size

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The incremental growth expected to be recorded for the global employment screening services market during the forecast period is US$ 3,937.40 million.

The global employment screening services market is expected to reach US$ 9881.83 million by 2031.

The key players holding majority shares in the global employment screening services market are Hireright Llc; Adp, Inc.; Capita Plc; First Advantage; Paychex Inc; and Automatic Data Processing Inc.

Integration of Artificial Intelligence in screening processes and rise of Continuous Screening, which is anticipated to play a significant role in the global employment screening services market in the coming years.

The global employment screening services market was estimated to be US$ 5821.27 million in 2023 and is expected to grow at a CAGR of 6.8 % during the forecast period 2023 - 2031.

Increase in number of job immigrants and gig economy, rise in employee fraudulent activities, and increase in demand for background checks are the major factors that propel the global employment screening services market.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Employment Screening Services Market

- Accurate Background Holdings LLC

- AuthBridge Research Services Pvt Ltd

- Capita Plc

- DataFlow LLC

- First Advantage Corp

- HireRight LLC

- Insperity

- Pinkerton Consulting & Investigations Inc

- Triton

- Verity Screening Solutions

- Acuity International

- Reveal Background LLC

- Veremark

- Cisive

- Reed Group

- Paychex Inc

- GoodHire

- ezyHire

- Automatic Data Processing Inc

- KPMG Assurance and Consulting Services LLP

Get Free Sample For

Get Free Sample For