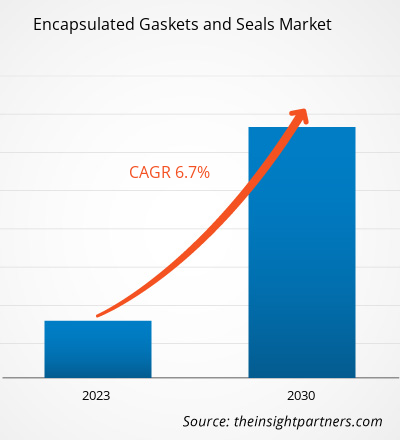

[Research Report] The encapsulated gaskets and seals market size was valued at US$ 360.05 million in 2022 and is expected to reach US$ 603.50 million by 2030; it is estimated to register a CAGR of 6.7% from 2022 to 2030.

Market Insights and Analyst View:

Encapsulated gaskets and seals are specialized components used to prevent leakage and maintain a secure seal in various applications. These gaskets consist of a soft, compressible core material, often made of rubber or elastomers, surrounded or encapsulated by a tougher material such as PTFE or metal. The encapsulation provides the gasket with enhanced durability, chemical resistance, and the ability to withstand extreme temperatures. The softer core material ensures effective sealing by conforming to irregularities in mating surfaces, while the outer layer protects against wear, abrasion, and harsh environmental conditions. Commonly employed in industries such as manufacturing, automotive, and aerospace, encapsulated gaskets and seals play a crucial role in preventing fluid or gas leakage, contributing to the overall efficiency and reliability of machinery and systems. Their design versatility allows them to adapt to diverse sealing requirements, making them a preferred choice in determining engineering applications. All these factors are contributing to the growing encapsulated gaskets and seals market share.

Growth Drivers and Challenges:

Stringent government regulations related to environmental protection and safety are among the key drivers of the encapsulated gaskets and seals market. The rising awareness of the importance of preventing leaks and reducing environmental impact has further fueled the market expansion. Moreover, technological advancements in material science have played a pivotal role in enhancing the performance characteristics of encapsulated gaskets and seals. The development of innovative materials, such as advanced elastomers and high-performance polymers, has resulted in gaskets with improved durability, chemical resistance, and temperature tolerance, widening their applicability. Encapsulated gaskets and seals are used to seal flanges in pipelines and equipment within the oil & gas industry infrastructure. Gaskets provide a secure and leak-resistant seal between connected flanges, preventing the escape of fluids and gases. In oil and gas wellheads, where pressure and temperature conditions can be extreme, encapsulated gaskets and seals are used to seal critical connections. During the construction and maintenance of pipelines, encapsulated gaskets and seals are used to secure the connections between pipeline segments, as well as in tanks and vessels that are used for storing and transporting oil and gas. Thus, all these factors are driving the encapsulated gaskets and seals market.

However, various alternatives, including traditional gaskets, O-rings, and other types of seals, compete with encapsulated gaskets and seals in meeting specific industrial requirements. While encapsulated gaskets offer unique advantages, such as enhanced chemical resistance and durability, substitutes provide end users with alternative options based on their specific needs, cost considerations, and preferences. Traditional gaskets, often made of materials such as rubber or fiber, remain prevalent in certain applications due to their simplicity and lower cost. End users may opt for these alternatives in scenarios where chemical resistance or extreme environmental conditions are not critical factors. O-rings, which come in various materials such as elastomers or metals, also serve as versatile sealing solutions for many applications. Their simplicity, ease of installation, and compatibility with diverse environments make them viable substitutes, especially in industries where encapsulation may be perceived as an unnecessary feature. These factors could limit the encapsulated gaskets and seals market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Encapsulated Gaskets and Seals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Encapsulated Gaskets and Seals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Encapsulated Gaskets and Seals Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities across the globe. The report aims to provide an overview of the market with detailed market segmentation by material and end use. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of encapsulated gaskets and seals globally. In addition, the global encapsulated gaskets and seals market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The encapsulated gaskets and seals market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

By material, the market is segmented into silicon, neoprene, Viton, Teflon, and others. In terms of end use, the market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The chemical segment registered a significant encapsulated gaskets and seals market share in 2022. The chemical industry relies extensively on encapsulated gaskets and seals to meet the demanding requirements of its processes, where temperatures and high pressure are commonplace. Encapsulated gaskets serve as critical components in various applications within the chemical sector, preventing leaks and ensuring operations' safety and efficiency. In chemical processing, where the risk of chemical exposure is prevalent, encapsulated gaskets play a crucial role in preventing the escape of hazardous substances. The encapsulation process involves layering materials such as Viton and Teflon, enhancing the gaskets' resistance to a wide range of corrosive chemicals. This robust chemical compatibility ensures that the seals maintain their integrity, reducing the potential for leaks that could lead to equipment failure or environmental hazards. The seals contribute to overall operational safety by preventing leaks that could lead to equipment failure or environmental hazards. The encapsulated gaskets and seals market plays a pivotal role in addressing the unique challenges of the chemical industry, offering solutions that prioritize both safety and operational efficiency in this dynamic and critical sector. All these factors are driving the encapsulated gaskets and seals market for the chemical segment.

Regional Analysis:

The market scope focuses on five key regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market was dominated by Asia Pacific, which accounted for ~US$ 100 million in 2022. The upward trajectory of the encapsulated gaskets and seals market trends is propelled by the region's expanding industrialization, particularly in sectors such as oil & gas, automotive, and pharmaceuticals, where reliable sealing mechanisms are paramount. Key drivers of this market growth include the increasing awareness among industries about the critical role of high-quality sealing components in preventing leaks and optimizing operational efficiency. Major players in the market are responding to this demand by introducing innovative formulations and materials, contributing to a dynamic and competitive landscape in Asia Pacific. This trend is particularly evident as manufacturers strive to meet the diverse needs of applications ranging from aerospace to chemical processing. All these factors are driving the encapsulated gaskets and seals market in Asia Pacific.

Europe is expected to register a CAGR of over 7.0% from 2022 to 2030. The encapsulated gaskets and seals market in Europe is majorly driven by a combination of technological advancements, stringent regulatory standards, and the region's robust industrial infrastructure. Encapsulated gaskets and seals play a crucial role in preventing leaks and ensuring the integrity of mechanical systems across various sectors, including automotive, chemical, pharmaceutical, and oil & gas. Further, North America is expected to reach around US$ 120 million by 2030. In North America, companies extract crude oil on private and public land and offshore waters. Ongoing energy exploration and production efforts in the region have amplified the requirement for durable encapsulated gaskets and seals to withstand these harsh conditions.

Industry Developments and Future Opportunities:

A few initiatives taken by the key players operating in the encapsulated gaskets and seals market are listed below:

- In December 2023, Trelleborg acquired a South Korean manufacturer of precision seals for semiconductor production equipment.

- In January 2023, Seal & Design acquired Rochester-based Chamberlin Rubber Company.

Encapsulated Gaskets and Seals Market Regional Insights

Encapsulated Gaskets and Seals Market Regional Insights

The regional trends and factors influencing the Encapsulated Gaskets and Seals Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Encapsulated Gaskets and Seals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Encapsulated Gaskets and Seals Market

Encapsulated Gaskets and Seals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 360.05 Million |

| Market Size by 2030 | US$ 603.50 Million |

| Global CAGR (2022 - 2030) | 6.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

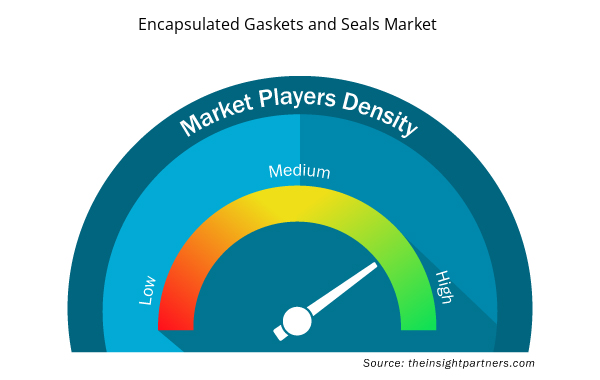

Encapsulated Gaskets and Seals Market Players Density: Understanding Its Impact on Business Dynamics

The Encapsulated Gaskets and Seals Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Encapsulated Gaskets and Seals Market are:

- Trelleborg AB

- Marco Rubber & Plastics LLC

- Gasco Inc

- VH Polymers

- AS Aston Seals SPA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Encapsulated Gaskets and Seals Market top key players overview

COVID-19 Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units of encapsulated gaskets and seals companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Most industrial manufacturing facilities were shut down during the pandemic, decreasing the consumption of these gaskets and seals. In addition, the COVID-19 pandemic has caused fluctuations in encapsulated gaskets and seals prices. However, various industries revived their operations after supply constraints were resolved, which led to a revival of the encapsulated gaskets and seals market. Moreover, the rising demand for these gaskets and seals from the chemical industry is substantially promoting the encapsulated gaskets and seals market growth.

Competitive Landscape and Key Companies:

Trelleborg AB, Marco Rubber & Plastics LLC, Gasco Inc, VH Polymers, AS Aston Seals SPA, Seal & Design Inc, MCM SPA, Polymax Ltd, Vulcan Engineering Ltd, and ROW Inc are among the key players profiled in the encapsulated gaskets and seals market report. The global market players focus on providing high-quality products to fulfill customer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Emergency Department Information System (EDIS) Market

- Smart Water Metering Market

- Water Pipeline Leak Detection System Market

- Equipment Rental Software Market

- Redistribution Layer Material Market

- Small Satellite Market

- Sports Technology Market

- Compounding Pharmacies Market

- Visualization and 3D Rendering Software Market

- Aesthetic Medical Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Teflon segment is expected to register the highest CAGR in the encapsulated gaskets and seals market from 2022 to 2030. Teflon, a brand name for polytetrafluoroethylene (PTFE), holds a prominent position in the encapsulated gaskets and seals market due to its unique set of properties. Renowned for its non-stick nature, exceptional chemical resistance, and low friction characteristics, Teflon has become a sought-after material for applications where stringent sealing requirements are paramount. Its remarkable resistance to a wide range of chemicals, including corrosive substances and solvents, makes it an ideal choice for industries such as chemical processing and petrochemicals, where exposure to aggressive fluids is common. All these factors are expected to drive the Teflon segment growth from 2022 to 2030.

The oil & gas segment held the largest share of the global encapsulated gaskets and seals market in 2022. Encapsulated gaskets and seals play a pivotal role in the oil & gas industry, where harsh operating conditions demand robust sealing solutions to ensure the integrity of equipment and prevent leakage. These specialized gaskets find extensive use in various components such as valves and flanges throughout the industry's infrastructure, contributing to safety, reliability, and efficiency. In oil & gas exploration and production, encapsulated gaskets and seals are utilized in wellhead equipment, valves, flanges, and other critical connections. These factors led to the dominance of oil & gas segment in 2022.

The Viton segment held the largest share in the global encapsulated gaskets and seals market in 2022. Viton is a high-performance elastomer in the encapsulated gaskets and seals market. Widely recognized for its exceptional resistance to extreme temperatures, chemicals, and fluids, Viton has become a preferred choice for applications demanding resilience in harsh environments. Viton's remarkable heat resistance allows it to maintain its sealing effectiveness across a broad temperature spectrum, making it particularly valuable in industries where thermal stability is paramount. These factors led to the dominance of the Viton segment in 2022.

The rising awareness of the importance of preventing leaks and reducing environmental impact has further fueled the market’s expansion. Moreover, technological advancements in material science have played a pivotal role in enhancing the performance characteristics of encapsulated gaskets and seals. The development of innovative materials, such as advanced elastomers and high-performance polymers, has resulted in gaskets with improved durability, chemical resistance, and temperature tolerance, widening their applicability. Encapsulated gaskets and seals are used to seal flanges in pipelines and equipment within the oil & gas industry infrastructure. Gaskets provide a secure and leak-resistant seal between connected flanges, preventing the escape of fluids and gases. All these factors drive the encapsulated gaskets and seals market growth.

A few players operating in the global encapsulated gaskets and seals market include Trelleborg AB, Marco Rubber & Plastics LLC, Gasco Inc, VH Polymers, AS Aston Seals SPA, Seal & Design Inc, MCM SPA, Polymax Ltd, Vulcan Engineering Ltd, and ROW Inc.

In 2022, Asia Pacific held the largest share of the global encapsulated gaskets and seals market. The upward trajectory of encapsulated gaskets and seals market is propelled by the region's expanding industrialization, particularly in sectors such as oil and gas, automotive, and pharmaceuticals, where reliable sealing mechanisms are paramount. Major players in the market are responding to this demand by introducing innovative formulations and materials, contributing to a dynamic and competitive landscape in Asia Pacific. All these factors led to the dominance of the Asia Pacific region in 2022.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Encapsulated Gaskets and Seals Market

- Trelleborg AB

- Marco Rubber & Plastics LLC

- Gasco Inc

- VH Polymers

- AS Aston Seals SPA

- Seal & Design Inc

- MCM SPA

- Polymax Ltd

- Vulcan Engineering Ltd

- ROW Inc

Get Free Sample For

Get Free Sample For