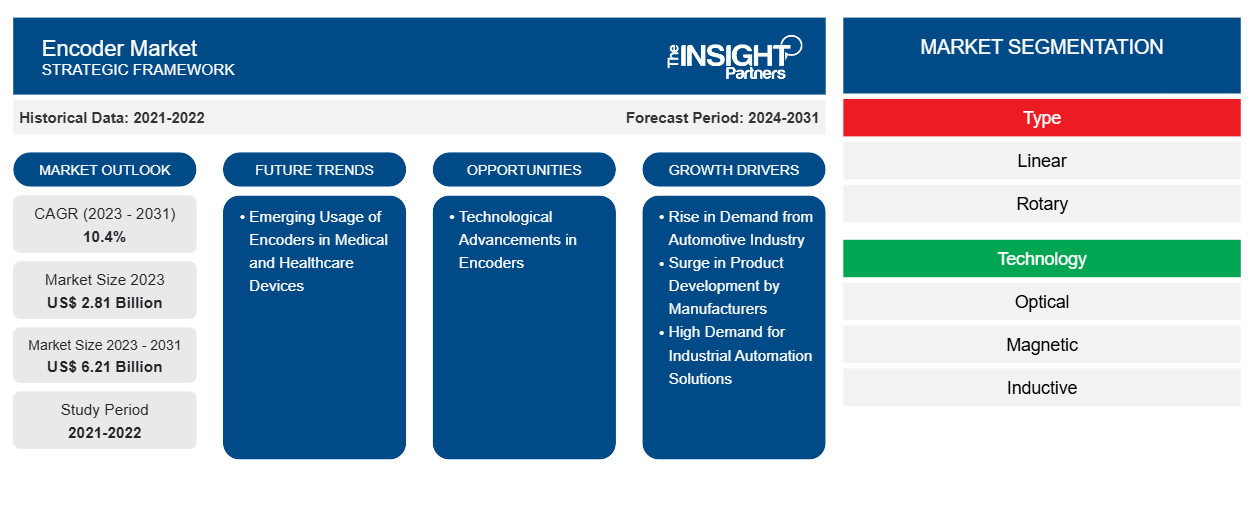

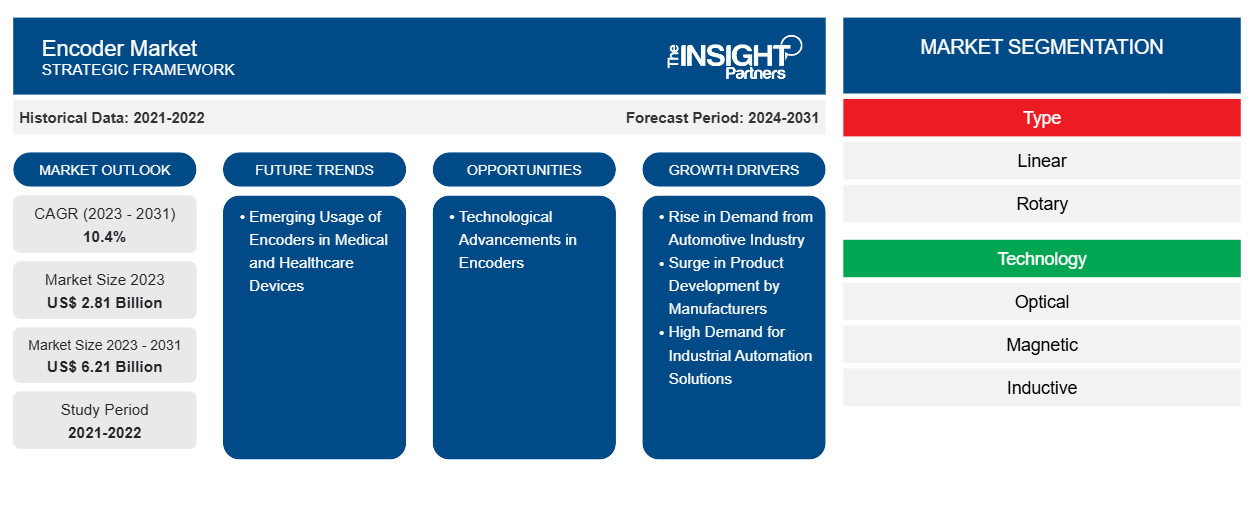

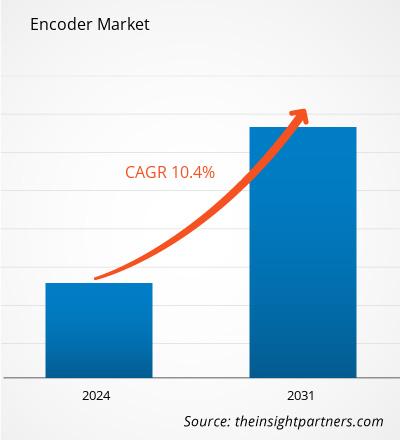

The encoder market size is projected to reach US$ 6.21 billion by 2031 from US$ 2.81 billion in 2023. The market is expected to register a CAGR of 10.4% during 2023–2031. The emerging usage of encoders in medical and healthcare devices is likely to bring in new trends in the market in the coming years.

Encoder Market Analysis

The rise in demand from the automotive industry; the high demand for industrial automation solutions among small, medium, and large enterprises; and manufacturers' focus on manufacturing new cars are a few of the significant factors driving the encoder market. Furthermore, increasing investment in robotics and industrial automation solutions increases the global demand for encoders. Additionally, technological advancement and integration of advanced technologies such as industrial Internet of Things (IIoT) technology, high-speed encoders, HD phased-array photo sensors, and a blue LED chip in encoders that reduce operating costs are expected to create opportunities for the market growth during the forecast period. Moreover, the rise in demand for customized encoders, manufacturers' focus on developing mini encoders, and an increase in research and development activities are propelling the encoder market.

Encoder Market Overview

An encoder is a device that transforms motion into an electrical signal that might be read by a motion control device such as a counter or PLC. It translates information from one format or code to another, usually by changing physical motion or position into a digital signal. The encoder sends out a feedback signal that can be used to calculate position, speed, and direction. This procedure is necessary for maintaining uniformity, speed, and compression in a variety of technical applications. Encoders play a critical role in translating mechanical movements into usable electrical data, which is required for accurate system control and automation. Encoders are critical components of modern technology that ensure precision and control in a wide range of applications, including industrial machinery and consumer electronics. This level of precision is essential for tasks requiring high accuracy, such as assembly lines and surgical robots. Encoders are used in consumer electronics devices such as mice and keyboards to translate user actions into digital signals that computers can handle, thereby improving user experience and engagement.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Encoder Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Encoder Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Encoder Market Drivers and Opportunities

Rise in Demand from Automotive Industry

Cars are increasingly being equipped with a range of advanced and digital technologies to make driving safer and more comfortable for users. Encoders play an important role in the automobile industry, improving the precision, performance, and safety of many vehicle systems. In modern and electric cars, encoders are employed in a variety of applications, including electric power steering (EPS) systems, motor control systems, anti-lock braking systems (ABS), traction control systems, headlight position control, and battery systems, among others. In EPS systems, encoders are used to monitor the steering wheel's position by ensuring exact control and response. Similarly, in ABS and traction control systems, encoders are employed to detect and prevent wheel slide, which supports enhancing vehicle stability. For instance, according to the International Energy Agency’s (IEA) annual Global Electric Vehicle Outlook 2024, nearly 14 million electric cars were sold worldwide in 2023, which is 3.5 million higher than in 2022, a 35% year-on-year increase; this brings the total number of cars on the roads to be 40 million. This growth in the number of cars shows that the electric cars’ share of the overall car market has risen to 18% in 2023, up from 14% in 2022. The increasing sales of electric cars worldwide boost the adoption of encoders among automotive manufacturers for motor control in electric and hybrid vehicles. These encoders provide exact feedback on motor speed, position, and direction, allowing for better energy efficiency and improved performance. The dependability and accuracy of feedback provided by encoders are critical for users and manufacturers to enhance vehicle handling, achieve safety regulations, and enhance autonomous driving technology. Further, the advancement in the automotive industry and increasing development in automation and electrification surge the demand for high-precision encoders. High-precision encoders are employed in autonomous driving systems such as adaptive cruise control, which uses wheel speed and position to manage acceleration and braking. Therefore, the growing demand for encoder ICs from the automotive industry drives the encoder market.

Technological Advancements in Encoders

The increasing demand for industrial automation, energy efficiency, and sustainable solutions among industries is boosting the need for technologically advanced encoders worldwide. Integrating advanced technologies such as industrial Internet of Things (IIoT) and advanced products, including high-speed encoders, HD phased-array photo sensors, and a blue LED chip, with encoders can provide advanced monitoring and control features, which might further enable real-time data collection and analysis. For instance, MELEXIS launched MLX90382, a high-speed encoder IC for industrial automation, robotics, and mobility solutions. MLX90382 is an absolute magnetic encoder IC integrated with a monolithic magnetic position sensor. It combines a hall magnetic front end, an analog-to-digital converter, on-chip digital signal processing with zero latency, and multiple output drivers, making the device suitable for electric motor-driven applications, such as robotic arms, industrial weaving machines, and automated packaging machines. The MLX90382's miniature size, stray field immunity, and support for both on-axis and off-axis sensing allow for smooth integration into micro-motors. These encoders are designed to fulfill the industry's need for high-speed feedback that is essential to correct the functioning and safety of electric motor-driven applications.

According to Valin Corporation data of December 2022, IIoT provides substantial benefits to encoders by improving data accessibility, performance, and reliability. IIoT offers real-time monitoring and remote diagnostics, allowing workers to continuously track encoder conditions and performance by eliminating downtime. For instance, Kubler's Sendix industrial ethernet encoder with an integrated OPC UA interface is highly suitable for IIoT applications. It is capable of automating control-independent communication to a cloud solution or another higher-level system. The configuration of the encoder via the Internet allows cross-system communication and eliminates faults quickly and efficiently in the event of a failure. For instance, Kubler Industrial Ethernet encoders integrated with the Profinet, EtherCAT, or EtherNet/IP interfaces support the OPC UA interface, thereby increasing versatility and allowing data to be transmitted to the control, web server, or cloud simultaneously. Integrating encoders with IIoT-enabled systems allows data from these devices to be gathered, processed, and stored on cloud-based platforms, offering important insights into equipment patterns and operational efficiencies.

Thus, technological advancements in encoders are expected to create opportunities for the encoder market growth during the forecast period.

Encoder Market Report Segmentation Analysis

Key segments that contributed to the derivation of the encoder market analysis are type and technology.

- Based on type, the encoder market is divided into linear and rotary. The rotary segment held a larger share of the market in 2023.

- Based on technology, the encoder market is segmented into optical, magnetic, inductive, and others. The optical segment held the largest share of the market in 2023.

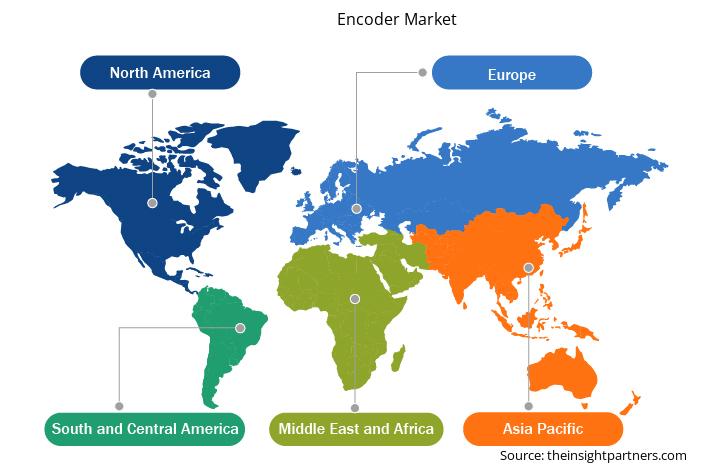

Encoder Market Share Analysis by Geography

The geographic scope of the encoder market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East and Africa, and South and Central America.

North America held a significant market share in 2023. The US, Canada, and Mexico are among the major economies in North America. The region contributes a noteworthy share to the global encoder market owing to the growing investments by industries toward the adoption of robots. For instance, according to the International Federation of Robotics (IFR) data published in April 2024, industries in the US, Canada, and Mexico are investing heavily in adopting and installing robots for automating industrial processes. Automotive, electrical, electronics, and manufacturing are the major industries investing significantly in robotics technologies, increasing the demand for encoders to navigate the position, speed, and motion of robotic parts.

The US is the world's second-largest producer of cars and light vehicles after China. Automobile market sales in the US increased by 1%, with a record of 14,678 robots installed in 2023, which increased by 47% with 14,472 units installed in 2022. In 2023, automobile and component manufacturers account for 33% of all industrial robot deployments in the country. Similarly, in 2023, robot installations in Canada increased by 43% to 4,616 units. The automobile industry accounted for 55% of the country's robot installations, and sales of the automobile sector increased by 99%, with 2,549 units installed in 2023. Additionally, the number of robots installed in Mexico's manufacturing industry reached 5,868 units in the automotive industry in 2023. The automobile industry is the country's largest adopter of robots, accounting for 69% of total installations in which sales totaled 4,068 units in 2023. The growing expansion of the automotive industry and the increasing installation of robots surged the adoption of encoders in the automotive production lines. Encoders are used in automotive manufacturing lines to maintain consistent precision, decrease errors, and ensure repetitive actions for robots. Robots in the automotive industry are responsible for duties such as part installation, coating application, and intricate welding operations. Encoders allow robots to react in real-time to any positional differences by optimizing the efficiency and quality of processes.

Encoder Market Regional Insights

The regional trends and factors influencing the Encoder Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Encoder Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Encoder Market

Encoder Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.81 Billion |

| Market Size by 2031 | US$ 6.21 Billion |

| Global CAGR (2023 - 2031) | 10.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

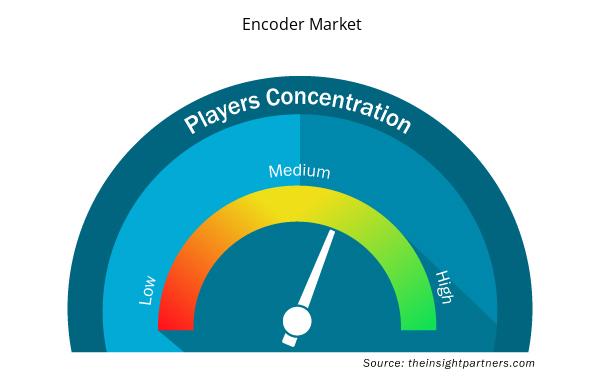

Encoder Market Players Density: Understanding Its Impact on Business Dynamics

The Encoder Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Encoder Market are:

- Asahi Kasei Microdevices Corp

- Vishay Intertechnology Inc

- Sick AG

- Honeywell International Inc

- ROHM Co Ltd

- Allegro MicroSystems Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Encoder Market top key players overview

Encoder Market News and Recent Developments

The encoder market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the encoder market are listed below:

- OMRON Automation, a prominent provider of advanced industrial automation solutions in India, aims to reinforce its business strategy centered around i-Belt, the company’s data-driven co-creation solution service. Known for its expansive portfolio spanning Smart Sensors, Robots, Vision, Machine Safety, PLCs, Servos, and Drives, OMRON is set to further enrich its end-to-end solution lineup by integrating with i-Belt data-based service. (Source: OMRON, Press Release, August 2023)

- Microchip Technology Inc. announced a multi-year initiative of over US$ 300 million to expand its presence in India. Through this investment, the company aims to establish semiconductor research, chip design, and equipment engineering hubs in the country. In the same month, Microchip Technology Inc. inaugurated a research and development center in Hyderabad. According to the company, the semiconductor market in India is likely to reach US$ 64 billion by 2026 from US$ 22.7 billion in 2019. (Source: Microchip Technology Inc., Press Release, July 2024)

Encoder Market Report Coverage and Deliverables

The "Encoder Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Encoder market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Encoder market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Encoder market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the encoder market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type; Technology; End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global encoder market is estimated to register a CAGR of 10.4% during the forecast period 2023–2031.

The global encoder market is expected to reach US$ 6.21 billion by 2031.

The key players holding majority shares in the global encoder market are Asahi Kasei Microdevices Corp, Vishay Intertechnology Inc, Sick AG, Honeywell International Inc, ROHM Co Ltd, Allegro MicroSystems Inc, Autonics Corporation, On Semiconductor Corp, Texas Instruments Inc, Analog Devices Inc, Microchip Technology Inc, STMicroelectronics NV, Broadcom Inc, OMRON Corp, and Panasonic Holdings Corp.

Emerging usage of encoders in medical and healthcare devices to play a significant role in the global encoder market in the coming years.

Asia Pacific dominated the encoder market in 2023.

Rise in demand from automotive industry, surge in product development by manufacturers, and high demand for industrial automation solutions are the major factors that propel the global encoder market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Encoder Market

- Asahi Kasei Microdevices Corp

- Vishay Intertechnology Inc

- Sick AG

- Honeywell International Inc

- ROHM Co Ltd

- Allegro MicroSystems Inc

- Autonics Corporation

- On Semiconductor Corp

- Texas Instruments Inc

- Analog Devices Inc

- Microchip Technology Inc

- STMicroelectronics NV

- Broadcom Inc

- OMRON Corp

- Panasonic Holdings Corp

Get Free Sample For

Get Free Sample For