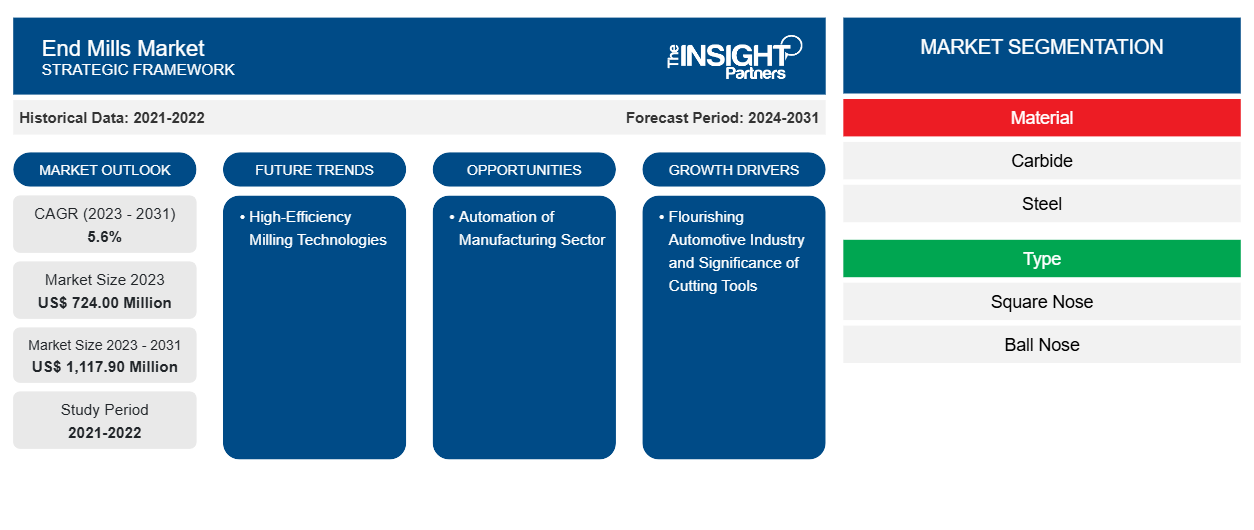

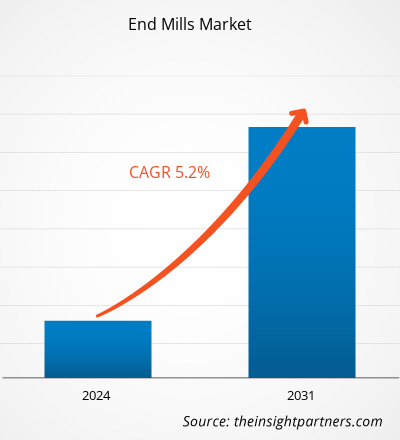

The end mills market size is projected to reach US$ 2,828.77 million by 2031 from US$ 1,888.47 million in 2023. The market is expected to register a CAGR of 5.2% during 2023–2031. The implementation of a plasma cutting torch combined with an end mill on the three-axis numerical control milling machine is likely to emerge as a new end mills market trend over the forecast period.

End Mills Market Analysis

End mill cutting can both remove large quantities of materials and refine surfaces to help finish the material. End milling can be employed in a wide range of applications, which makes it a flexible and versatile manufacturing process. Precision and accuracy are both important in manufacturing. Similar to the computer numerical control (CNC) milling process, end mill cutting is also guided by computer programming and software, aiding in highly accurate movements and results; greater accuracy can be achieved when software outputs are combined with human guidance. The importance of efficient and cost-effective manufacturing solutions is increasing with the rise of process automation across the manufacturing sector. Automated fabrication processes and high-end technologies such as CNC technology offer several advantages over traditional manufacturing techniques that need human intervention in many areas. The integration of computer-aided design and computer-aided manufacturing (CAD/CAM) systems with automated fabrication processes can streamline and automate jobs such as cutting, drilling, milling, welding, and bending, along with reducing the need for manual laborers and improving overall efficiency. Moreover, automated processes can enhance overall product quality by reducing errors and inconsistencies associated with manual production.

End Mills Market Overview

An end mill is a cutting tool that is used in milling operations. They are commonly employed in milling machines, which employ rotary cutters to remove material from a workpiece. End mills are mostly made of high-speed steel (HSS) or carbide, and come in various shapes and sizes. They are available in solid and indexable milling styles. End mills are versatile tools as they can cut a range of materials, including wood, metal, plastic, and composites. They are used in industries such as manufacturing, aerospace, and automotive.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

End Mills Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

End Mills Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

End Mills Market Drivers and Opportunities

Flourishing Automotive Industry and Significance of Cutting Tools Fuel Market Growth

The automotive industry is an ever-evolving, multifaceted field that requires a variety of cutting tools to generate and develop parts that are assembled to produce a vehicle. Cutting tools are essential in the production and fabrication of all car-related products, from engine parts to transmission components and from body panels to interior trims. These cutting tools are primarily used in a broad range of manufacturing procedures, including turning, drilling, and milling, which are required to confirm the quality and safety of vehicles.

Milling helps create elaborate shapes and features for a variety of automotive components. End mills are the cutting tools made of high-speed steel or carbide. These tools are available in various shapes, sizes, and materials, each designed and developed for specific applications. With suitable cutting tools, such as end mills, automotive manufacturers look for techniques to enhance production proficiencies, reduce costs, and improve output quality. As a result, they deploy end mills that confer high precision, elasticity, and automation capabilities in their facilities. Thus, automotive industries across the world broadly on end mills for applications such as component fabrication, assembly, and surface finishing. In this industry, end mills are used mainly in the manufacturing of engine parts, body panels, and chassis components.

Automation of Manufacturing Sector to Create Growth Opportunities in Market

The mounting demand for automation in the manufacturing industry steers the expansion of the end mills market. End milling machines can perform multiple tasks at once, lowering the requirement for manual laborers and enhancing overall productivity. Additionally, advancements in technology have been instrumental in the growth of the end mills market. The integration of CNC technology has made it possible to manufacture precise cuts and shapes with ease, augmenting the popularity of end mills in the manufacturing sector. CNC technology has also helped automate the milling process, in turn, increasing overall efficiency. Companies such as Boeing, Ford, Airbus, Caterpillar, Toyota, Apple, and Samsung have managed to enhance their productivity with such advancements in their manufacturing operations. Thus, the adoption of automated fabrication procedures and the use of advanced technology presents significant opportunities for the growth of the end mills market over the forecast period.

End Mills Market Report Segmentation Analysis

Key segments that contributed to the derivation of the end mills market analysis are material, diameter size, and end-use industry.

- Based on material, the end mills market is segmented into carbide, steel, and others. The carbide segment held the largest market share in 2023.

- Based on type, the end mills market is segmented into square nose, ball nose, and others. The square nose segment held the largest market share in 2023.

- Based on diameter size, the market is divided into upto 4 mm, 4–6 mm, 6–8 mm, 8–12 mm, and above 12 mm. The upto 4 mm segment held the largest share of the market in 2023.

- Based on end-use industry, the market is divided into automotive, heavy machinery, semiconductor and electronics, medical and healthcare, energy, aerospace, and others. The automotive segment held the largest share of the market in 2023.

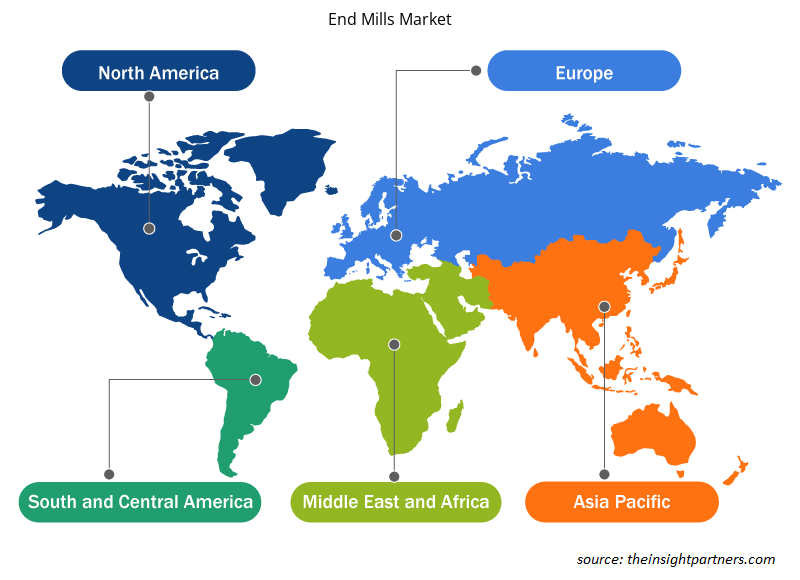

End Mills Market Share Analysis by Geography

The geographic scope of the end mills market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. Asia Pacific holds a key market position owing to a strong industrial base and technological advancements in major countries in this region. China dominates the end mills market in Asia Pacific. Industries such as automotive, aerospace, defense, and machinery manufacturing require advanced cutting, shaping, and forming solutions to meet the growing demand for precision components, which propels the need for metal working machines in Asia Pacific. Moreover, the defense and aerospace sectors in China and India are among the key enablers of the end mills market growth owing to the large-scale use of metal components and structures.

North America accounts for a significant share of the end mills market owing to the vital manufacturing economies such as the US, Canada, and Mexico. The US was the second-largest manufacturing powerhouse in the world in 2021, with a 16% share of the total manufacturing output. Growth of the end mills market in Canada and Mexico is attributed to the rise in investments toward the establishment of manufacturing bases. The strong focus on prominent North American countries on research and development, automation, and digitalization has the potential to propel the demand for metalworking machines, which would further benefit the market in the future.

End Mills Market Regional Insights

The regional trends and factors influencing the End Mills Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses End Mills Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for End Mills Market

End Mills Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,888.47 Million |

| Market Size by 2031 | US$ 2,828.77 Million |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

End Mills Market Players Density: Understanding Its Impact on Business Dynamics

The End Mills Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the End Mills Market are:

- NS Tool USA, Inc.

- TOWA Corporation

- SDK Tool (China) Co., Limited

- Karnasch Professional Tools GmbH

- Hoffmann Group USA

- Kodiak Cutting Tools

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the End Mills Market top key players overview

End Mills Market News and Recent Developments

The end mills market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the end mills market are listed below:

Mikron Tool and NS TOOL strengthened their partnership in the US and Canada. NS TOOL is a Japanese tool manufacturer specializing in precision tools for mold and die, and automotive applications; it has more than 15 years of experience in the US market. The wide product portfolio of NS TOOL includes high-quality solid carbide tools, with a focus on end mills for the mold and die, and automotive industries. The diameters of these tools range from .0004" (0.01 mm) for micromachining up to .984" (25.0 mm). (Source: NS TOOL, Press Release, January 2024)

The Hoffmann Group offers ISCAR's complete tool range throughout Europe and supplies it from its central warehouse, LogisticCity, located in Nuremberg. The underlying agreement was signed by the Hoffmann SE, representing the Hoffmann Group, and ISCAR Ltd. in March 2023. The company´s offering comprises a full range of tools for all machining tasks, including more than 40,000 products for grooving, turning, drilling, milling, and tool clamping. (Source: Hoffmann Group, Press Release, April 2023)

End Mills Market Report Coverage and Deliverables

The "End Mills Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- End mills market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- End mills market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- End mills market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the end mills market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific dominated the global end mills market. The surge in the automotive across Asia Pacific countries propels the demand for end millss.

NS Tool USA, Inc., TOWA Corporation, SDK Tool (China) Co., Limited, Karnasch Professional Tools GmbH, Hoffmann Group USA, Kodiak Cutting Tools, Harvey Tool Company, Fullerton Tool Company, Inc., Precision Technology Co., Ltd, Union Tool Co., Osg Usa, Inc, Kyocera Sgs Precision Tools, Inc., and IZAR CUTTING TOOLS S.A.L are the key market players operating in the global end mills market.

Growing automotive industries is one of the factors that is driving the demand of the end mills market. The automotive industry is an ever-evolving, multifaceted field that requires a variety of cutting tools to generate and develop parts that are assembled to produce a vehicle. Cutting tools are essential in the production and fabrication of all car-related products, from engine parts to transmission components and from body panels to interior trims. These cutting tools are primarily used in a broad range of manufacturing procedures, including turning, drilling, and milling, which are required to confirm the quality and safety of vehicles.

The importance of efficient and cost-effective manufacturing solutions is increasing with the rise in demand for process automation across the manufacturing sector. Automated fabrication processes and high-end technologies such as computer numerical control (CNC) technology offer several advantages over traditional manual manufacturing techniques. The integration of computer-aided design and computer-aided manufacturing (CAD/CAM) systems with automated fabrication processes can streamline and automate jobs such as cutting, drilling, milling, welding, and bending, along with reducing the need for manual laborers and improving overall efficiency.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - End Mills Market

- NS Tool USA, Inc.

- TOWA Corporation

- SDK Tool (China) Co., Limited

- Karnasch Professional Tools GmbH

- Hoffmann Group USA

- Kodiak Cutting Tools

- Harvey Tool Company

- Fullerton Tool Company, Inc.

- Precision Technology Co., Ltd

- Union Tool Co.

- Osg Usa, Inc.

- Kyocera Sgs Precision Tools, Inc.

- IZAR CUTTING TOOLS S.A.L.

Get Free Sample For

Get Free Sample For