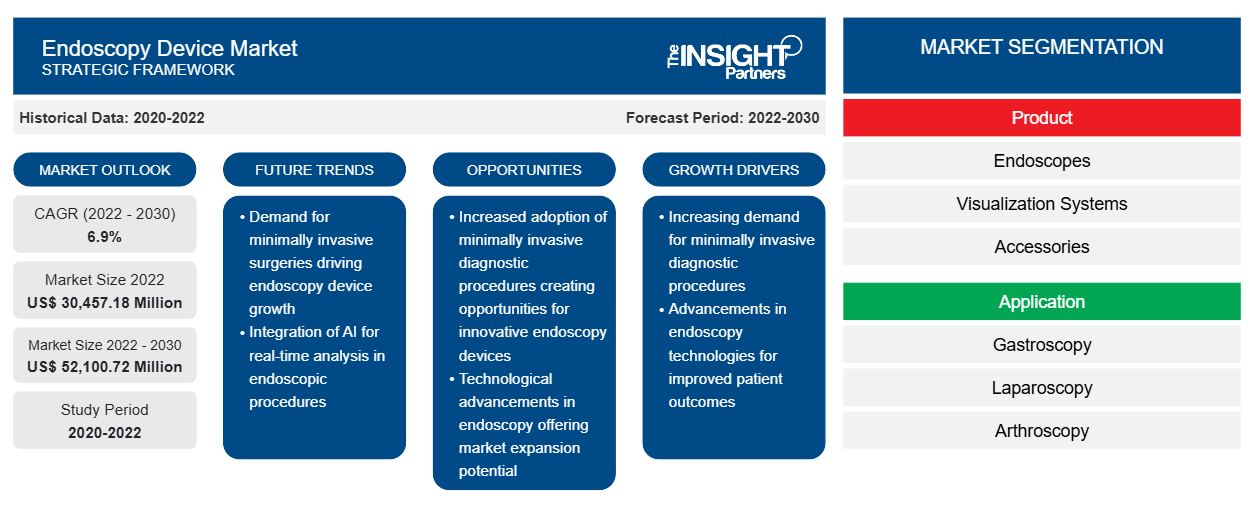

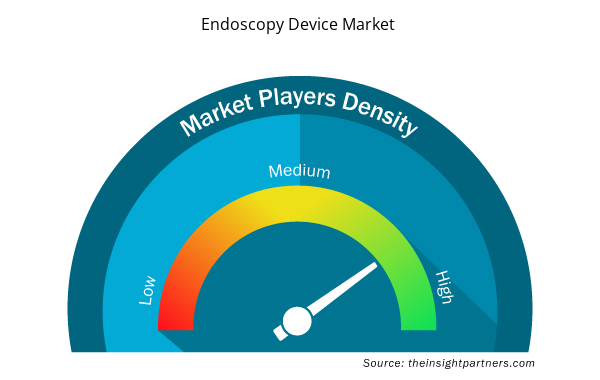

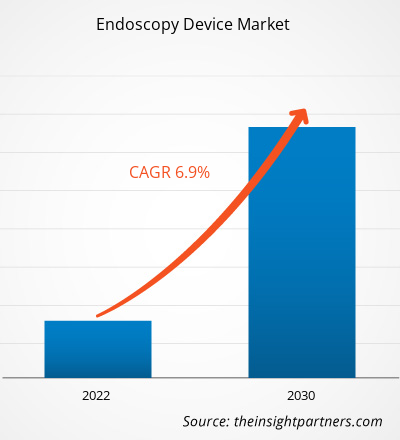

[Research Report] The Endoscopy Device market size is projected to grow from US$ 30,457.18 million in 2022 to US$ 52,100.72 million by 2030; it is estimated to record a CAGR of 6.9% during 2022–2030.

Market Insights and Analyst View:

Endoscopy is a minimally invasive surgical procedure employed to visualize internal organs of the human body; it is also used in surgeries performed on various organs. The procedure is performed with the help of a small flexible tube known as an endoscope. This tube is attached to a camera, enabling a clear view of the organ to be observed. Based on the area to be examined, various types of scopes are available; a few of these are arthroscopes, bronchoscopes, laparoscopes, and hysteroscopes. Various other devices and instruments are used in an endoscopy procedure for better visualization, sterilization, and enhanced-quality imaging.

Growth Drivers:

Increasing Demand for Minimally Invasive Techniques

The growing demand for minimally invasive techniques in surgical procedures reflects a significant shift in medical practice and patient preferences. This trend is driven by the desire to minimize the invasiveness of procedures, reduce the associated risks, and promote faster recovery times. Endoscopy is a minimally invasive surgery procedure that involves a minimal incision size, shortened recovery time, and better visibility into the internal body cavity. A surgeon can visualize and work within the body cavity using an endoscope without making a large incision. Minimally invasive approaches typically involve smaller incisions, and the use of specialized instruments and technologies to access different organs, which can lead to shorter hospital stays and less scarring. Moreover, patients often experience less pain and a quicker return to their daily activities. Surgeons have embraced these techniques due to their potential benefits, and advancements in medical devices and surgical skills. As a result, healthcare institutions are investing in training their medical teams and acquiring the necessary equipment to meet the increasing demand for minimally invasive endoscopy surgeries, thereby providing patients with improved treatment options and enhanced overall healthcare experiences.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Endoscopy Device Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Endoscopy Device Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “endoscopy device market” is segmented on the basis of product, application, and end user. Based on product, the market is segmented into endoscopes, visualization systems, accessories, and other endoscopy devices. The market for the endoscopes segment is further subsegmented into flexible endoscopes, rigid endoscopes, robot-assisted endoscopes, and capsule endoscopes. The endoscopy device market for the visualization systems segment is further segregated into wireless displays and monitors, light sources, video processors, endoscopic cameras, video recorders, video converters, carts, transmitters and receivers, camera heads, and other instruments. The market for the other endoscopy devices segment is further segmented as electronic instruments and mechanical instruments. The market for the accessories segment is subsegmented into cleaning brushes, overtubes, surgical dissectors, light cables, fluid flushing devices, needle holders/needle forceps, mouthpieces, biopsy valves, and others. By application, the endoscopy device market is segmented into gastroscopy, laparoscopy, arthroscopy, otoscopy, urology endoscopy, bronchoscopy, laryngoscopy, and other applications. The market, based on end user, is segmented into hospitals, ambulatory surgical centers, and others.

Segmental Analysis:

By product, the endoscopes segment held the largest share of the endoscopy device market in 2022. The visualization systems segment is estimated to register the highest CAGR during 2022–2030. Visualization systems used in endoscopy procedures help in obtaining images and videos of enhanced quality. The visualization system in endoscopy procedures consists of components such as wireless displays and monitors, light sources, video processors, endoscopic cameras, video recorders, video converters, carts, transmitters and receivers, camera heads, and other instruments. Boston Scientific Corporation and KARL STORZ SE & Co. KG provide visualization systems in the endoscope devices market.

In terms of application, the gastroscopy segment held the largest share of the endoscopy device market in 2022. Further, the laparoscopy segment is expected to record the highest CAGR during 2022–2030. Gastroscopy (also known as upper endoscopy) involves examining the upper gastrointestinal tract, which includes the esophagus, stomach, and duodenum (the beginning part of the small intestine). It is used to diagnose conditions such as ulcers, tumors, inflammation, and gastroesophageal reflux disease (GERD). Endoscopy devices designed for gastroscopy include flexible endoscopes with advanced imaging capabilities provided by high-definition cameras and optical enhancements.

Based on end user, the hospitals segment held the largest share of the endoscopy device market in 2022. It is further expected to register the highest CAGR in the market during 2022–2030. Hospitals encompass a wide spectrum of medical facilities, ranging from community hospitals to large academic medical centers. They serve as major end users of endoscopy devices. The demand for endoscopy devices within hospital settings is mainly driven by a high footfall of patients into these facilities, which can be attributed to factors such as comprehensive care delivery, inpatient and outpatient services, and advanced procedures and interventions. Hospitals are equipped to perform complex endoscopic procedures, including surgeries, advanced imaging, and specialized therapeutic endoscopy. Endoscopes are also used to examine the interior of hollow organs or cavities inside the body. A few endoscopic examinations are particularly performed in hospital settings. For instance, cystoscopies are typically performed in hospital outpatient settings. Ureteroscopy procedures for managing or removing kidney stones are performed in operating rooms. Similarly, most ENT endoscopies, such as examining a patient’s nose or throat to assess breathing problems or swallowing difficulties, are performed in inpatient and outpatient hospital settings.

Regional Analysis:

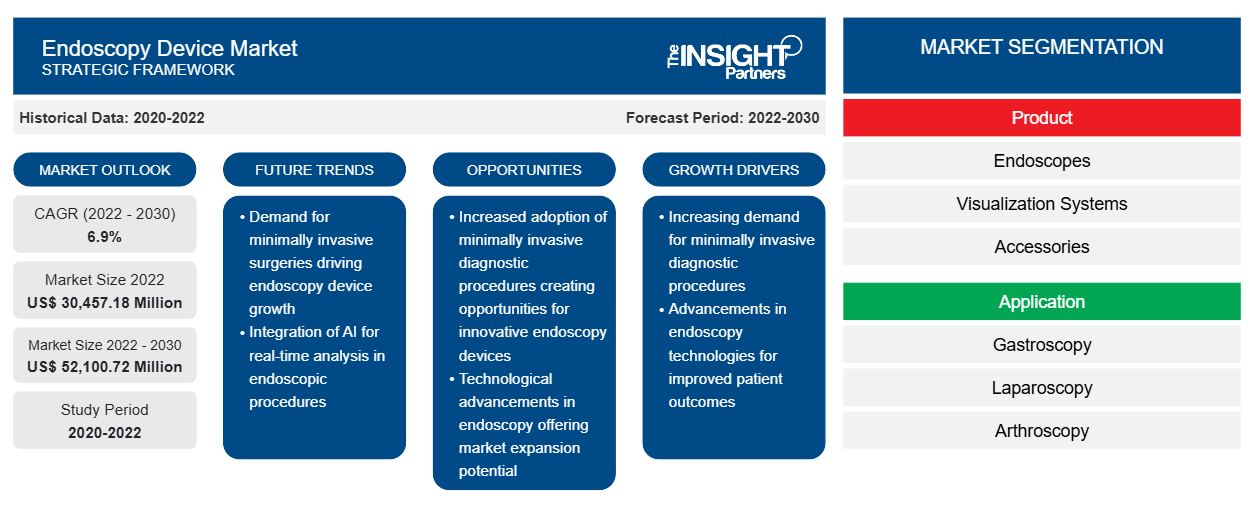

Based on geography, the endoscopy device market is segmented into Asia Pacific, Europe, the Middle East & Africa, North America, and South & Central America. In 2022, North America held the largest share of the global market. Asia Pacific is anticipated to register the highest CAGR in the endoscopy device market during 2022–2030.

The endoscopy device market in North America is split into the US, Canada, and Mexico. The US is the largest market for endoscopy device in this region. The market is majorly driven by the surging preference for minimally invasive surgeries and increasing prevalence of cancer. Other factors such as the introduction of advanced equipment in healthcare, a higher number of hospitals, and the implementation of strategic government policies also aid in promoting the expansion of the endoscopy device market. Additionally, the need for automated systems due to the increasing patient population and crunch of healthcare resources are expected to fuel the adoption of endoscopy systems in the US. Emphasis on using technologically advanced endoscopy devices equipped with high-definition cameras and light sources is also prominently expected to fuel the market growth during the estimated period.

Endoscopy Device Market Regional Insights

Endoscopy Device Market Regional Insights

The regional trends and factors influencing the Endoscopy Device Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Endoscopy Device Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Endoscopy Device Market

Endoscopy Device Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 30,457.18 Million |

| Market Size by 2030 | US$ 52,100.72 Million |

| Global CAGR (2022 - 2030) | 6.9% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

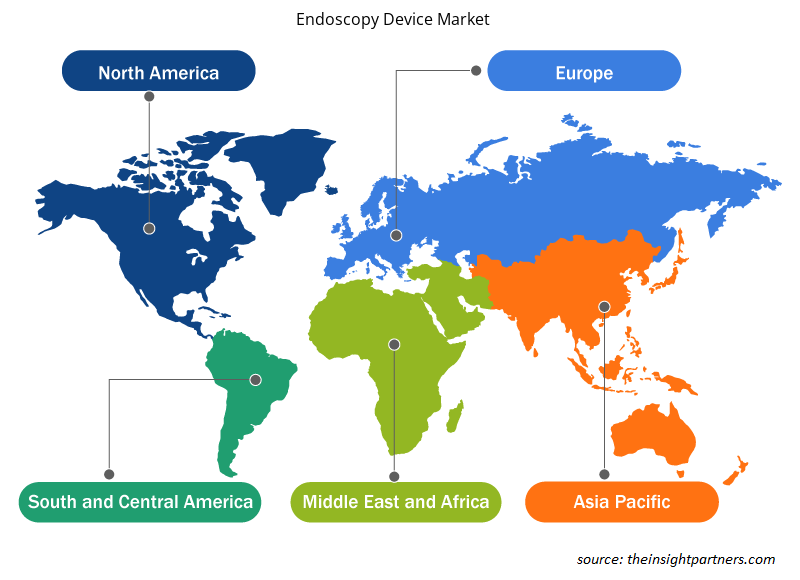

Endoscopy Device Market Players Density: Understanding Its Impact on Business Dynamics

The Endoscopy Device Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Endoscopy Device Market are:

- Boston Scientific Corp

- Medtronic Plc

- Stryker Corp

- Johnson & Johnson

- Karl Storz SE & Co KG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Endoscopy Device Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the endoscopy device market are listed below:

- In February 2023, Boston Scientific Corp announced that the FDA has approved its LithoVue Elite Single-Use Digital Flexible Ureteroscope System. It is the first ureteroscope system can monitor intrarenal pressure in real-time during ureteroscopy procedures. The LithoVue Elite Single-Use Digital Flexible Ureteroscope System comprises of StoneSmart Connect Console that has upgraded the device to offer upgraded image quality, control features, and streamlined integration.

- In September 2023, Ambu expanded its gastroenterology portfolio with the announcement of the Ambu aScope Gastro Large and Ambu aBox 2, two new larger-sized gastroscopy solutions that will be available in Europe. In addition to being the first gastroscope in the world with a 4.2 mm operating channel, which enables gastroenterologists to achieve strong suction performance during procedures in the ICU and endoscopy unit, the Ambu aScope Gastro Large is also the first endoscope ever manufactured of bioplastic materials.

- In September 2022, Medtronic plc announced that the US Food and Drug Administration has approved the Nexpowder endoscopic hemostasis system. The hemostasis system is supplied worldwide by Medtronic and is separately developed by NEXTBIOMEDICAL CO., LTD (Korea). Using a catheter with patented powder-coating technology, a noncontact, nonthermal, and nontraumatic hemostatic powder is sprayed to operate the Nexpowder system

- In September 2023, Stryker Corp announced the launch of the 1788 platform, which is the next generation of minimally invasive surgical cameras. The camera platform is enhanced with upgraded technology to be used in advanced surgery across multiple specialties. The camera provides a vibrant image with balanced lighting that improves visualization of blood flow and critical anatomy and can visualize multiple optical imaging agents.

Competitive Landscape and Key Companies:

Boston Scientific Corp, Medtronic Plc, Stryker Corp, Johnson & Johnson, Karl Storz SE & Co KG, Olympus Corp, Ambu AS, Conmed Corp, B Braun SE, and PENTAX Medical are among the prominent companies operating in the endoscopy device market. These companies focus on new technologies, existing products advancements, and geographic expansions to meet the globally growing consumer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The endoscopy devices market by user was metameric into hospitals and ambulant surgical centers and alternative end users. The hospitals section command the most important share of the market, by application. The section is additionally anticipated to grow at a gradual rate throughout the forecast amount, thanks to availableness of compensation for endoscopy procedures.

The marketplace for endoscopy devices is anticipated to grow within the returning years, due to the technological advancements created by the players in operation within the market. These technological advancements have created the procedure of endoscopy easier also because the results obtained are a lot of correct and accurate.

The outstanding players in operation in endoscopy devices market are STRYKER, Medtronic, KARL STORZ SE & Co. KG, Ethicon US, LLC., Olympus Corporation, Richard Wolf GmbH, Boston Scientific Corporation, Smith & Nephew, Cook, and FUJIFILM Holdings Corporation.

The market is calculable to grow with a CAGR of 7.5% from 2018-2025.

North America is that the largest geographic market and it's expected to be the most important revenue generator throughout the forecast amount. North America's market is driven by the factors like, bureau approvals (FDA) obtained by the Endoscopy Devices market players also as rising prevalence of cancer cases.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Endoscopy Device Market

- Boston Scientific Corp

- Medtronic Plc

- Stryker Corp

- Johnson & Johnson

- Karl Storz SE & Co KG

- Olympus Corp

- Ambu AS

- Conmed Corp

- B Braun SE

- PENTAX Medical

Get Free Sample For

Get Free Sample For