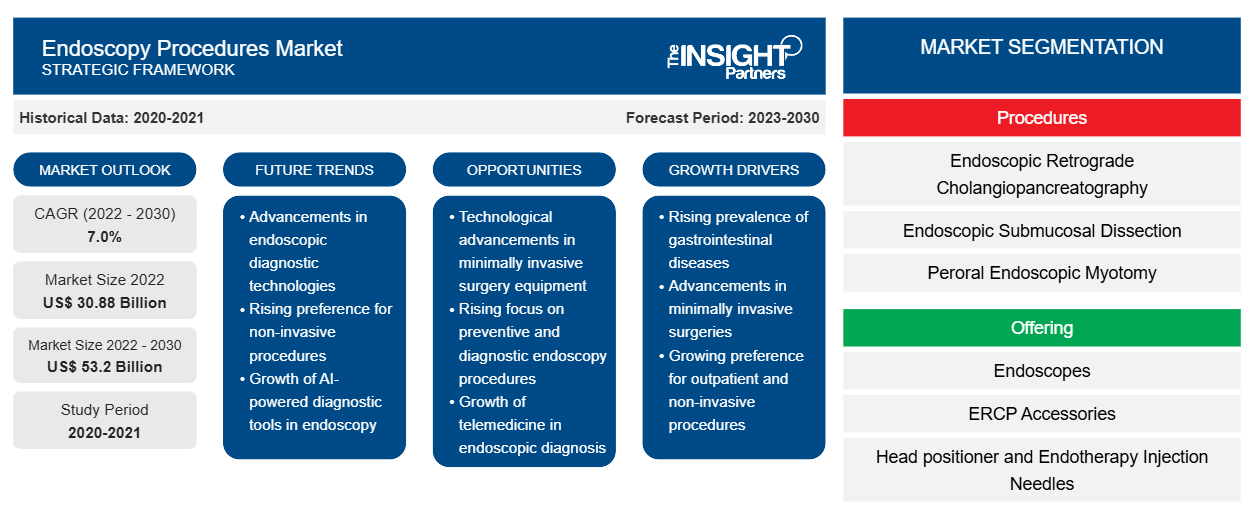

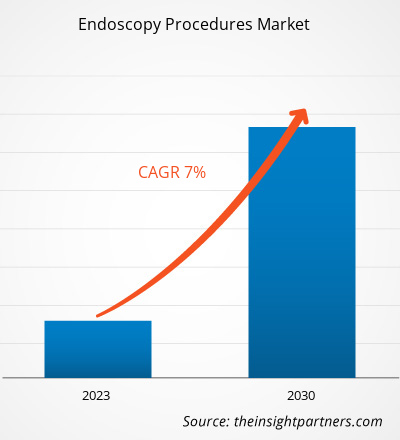

[Research Report] The endoscopy procedures market size was valued at US$ 30,877.37 million in 2022 and is projected to reach US$ 53,196.65 million by 2030. It is estimated to register a CAGR of 7.0% during 2022–2030.

Market Insights and Analyst View:

Endoscopic procedures are minimally invasive medical technique that involve inserting a thin, flexible tube into the body through natural openings or small incisions. These procedures allow doctors to visualize and operate on internal organs, tissues, and structures without the need of major surgeries. Endoscopy is majorly used for diagnosing and treating various conditions in areas such as gastrointestinal tract, respiratory systems and many more. Factors driving the growth of the endoscopy procedures market are growing preference for minimally invasive surgeries and increasing prevalence of cancer. The cost of the endoscopy machines can vary significantly based on the type of endoscope, the complexity of the equipment, the brand, the features it offers. The risks of infections associated with endoscopic procedures could hamper the growth of the market during the forecast period.

Growth Drivers:

Cancer is a major global public health problem and the leading cause of death in North America. Increasing gastrointestinal disorders and cancer cases in North America also accelerate the adoption of endoscopes and market growth. According to the American Cancer Society, colorectal cancer is the second most common cause of death in the US. The risk of developing this disease during the course of life is 4.3% in men and 4.0% in women. The American Cancer Society anticipated deaths of nearly 52,580 people in 2022 due to colorectal cancer in the US.

According to Globocan 2020, the incidence of stomach cancer in Canada was 3,505 in 2020, which is expected to reach 5,230 by 2040. According to Statistics Canada, lung cancer is the most commonly diagnosed cancer and the leading cause of death in Canada than colorectal, pancreatic, and breast cancers combined. In 2021 alone, ~21,000 Canadians died of lung cancer. The high mortality rate from lung cancer reflects its low survival rate.

Lung cancer incidence and mortality rates dramatically increase with age. Incidence rates peak among Canadians aged 75–84 years (396 per 100,000 people), while mortality rates are largely observed among Canadians aged 85 years and older (366 per 100,000 people). Overall, the lung cancer incidence rate is 1/10 higher among men than women, and the mortality rate is almost 1/3 higher among men than women. However, for Canadians younger than 55, rates are higher among women than men.

Western countries, such as the US and Canada, report a high GI incidence rate due to increasing obesity in the adult population and less consumption of dietary fiber. As per the Centers for Disease Control and Prevention, December 2022, ~37.2 million cases of digestive system diseases are recorded in physician offices in the US.

IBD is a term for two conditions—ulcerative colitis and Crohn's disease. Moreover, in the last few years, cases of IBD have increased worldwide due to a sedentary lifestyle; changing dietary habits; stress; and poor nutritional choices, including a high intake of ultra-processed foods and trans-fats. As per the Crohn’s & Colitis Foundation of America, around 70,000 new cases of IBD are diagnosed every year in the US. Further, chronic inflammation and reduced immunosurveillance caused due to IBD may contribute to the development of gastric cancer.

This rising burden of cancer in Canada indicates the high requirement for endoscopic devices, thereby driving the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Endoscopy Procedures Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Endoscopy Procedures Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Endoscopy Procedures Market” is segmented on the basis of procedure, offering, product type, and end user. Based on procedure, the market is categorized into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In terms of offering, the market is segmented into endoscopes, ERCP accessories, visualization system, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostats clip, polyps traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others. The endoscopy procedures market, by product type, is bifurcated into disposable and reusable. The endoscopy procedures market, by end user, is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. The endoscopy procedures market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on procedure, the endoscopy procedures market is segmented into is endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In 2022, the arthroscopy and bronchoscopy segment held the largest share of the market. The endoscopic retrograde cholangiopancreatography (ERCP) segment is expected to grow at the fastest rate during the forecast period. Arthroscopy is a minimally invasive endoscopic offering for the diagnosis and surgical treatment of joint injuries. The essence of offering lies in the fact that the arthroscope is inserted into the joint cavity through 2 small incisions, which allows the surgeon to fully examine the joint, obtain information about its condition and identify the presence of intra-articular damage. Arthroscopy allows arthroscopic treatment of injuries of the knee joint.

This technique allows you to remove the damaged part of the meniscus, restore ligaments, damaged cartilage and perform many other surgical interventions. Bronchoscopy is an endoscopic offering for examining the upper and lower (trachea, bronchi) respiratory tract using a bronchoscope.

Based by offering, the market is segmented into endoscopes, ERCP accessories, visualization system, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostats clip, polyps traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others. In 2022, the endoscopes segment held the largest share of the market. The ERCP accessories segment is expected to grow at the fastest rate during the forecast period.

Based on end user, the market is divided into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. In 2022, the hospitals and clinics segment held the largest share of the market. The diagnostic laboratories segment is expected to grow at the fastest rate during the forecast period. Several endoscopic procedures are performed in hospitals and clinics, which can be used to diagnose and treat digestive disorders, including peptic ulcers, polyps, cancers, and blockages of the bile ducts caused by stones, inflammation, and tumors. The endoscopic clinics are specialized in treating bleeding issues from intestines, pre-cancerous abnormalities such as Barrett's esophagus, and familial adenomatous polyposis syndromes. The clinics also specialize in evaluating and developing new forms of endoscopes and endoscopic techniques. Thus, the factors mentioned above are driving the growth of the hospitals and clinics segment of the endoscopy procedure market.

Regional Analysis:

Based on geography, the endoscopy procedures market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. The US is estimated to hold the largest endoscopy procedures market share during the forecast period. The rising healthcare expenditure is estimated to increase the adoption of various equipment for patient care, fueling the demand for endoscopy procedure products. According to the Global Burden of Disease Study published in October 2020, there is a high burden of various diseases in the US, such as colorectal cancer, cirrhosis, chronic kidney diseases, heart diseases, and cancer. Additionally, according to the US Department of Health and Human Services, 2021, chronic kidney disease (CKD) affects 1 in 7 US adults—i.e., an estimated 37 million Americans. The US endoscopy procedure market has recently witnessed several technological advancements and breakthroughs. The country has a broad pool of global endoscopy product manufacturers such as Boston Scientific Corp, PENTAX Medical, Stryker Corporation, and Steris Corporation. Therefore, the endoscope product approvals in the US fueled the market growth. In February 2023, Boston Scientific Corporation received US Food and Drug Administration (FDA) 510(k) clearance of the LithoVue Elite Single-Use Digital Flexible Ureteroscope System, the first ureteroscope system with the ability to monitor intrarenal pressure in real-time during ureteroscopy procedures. Thus, the need for facility and device sterilization rises with the surge in surgical procedures.

Endoscopy Procedures Market Regional Insights

The regional trends and factors influencing the Endoscopy Procedures Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Endoscopy Procedures Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Endoscopy Procedures Market

Endoscopy Procedures Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 30.88 Billion |

| Market Size by 2030 | US$ 53.2 Billion |

| Global CAGR (2022 - 2030) | 7.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Procedures

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

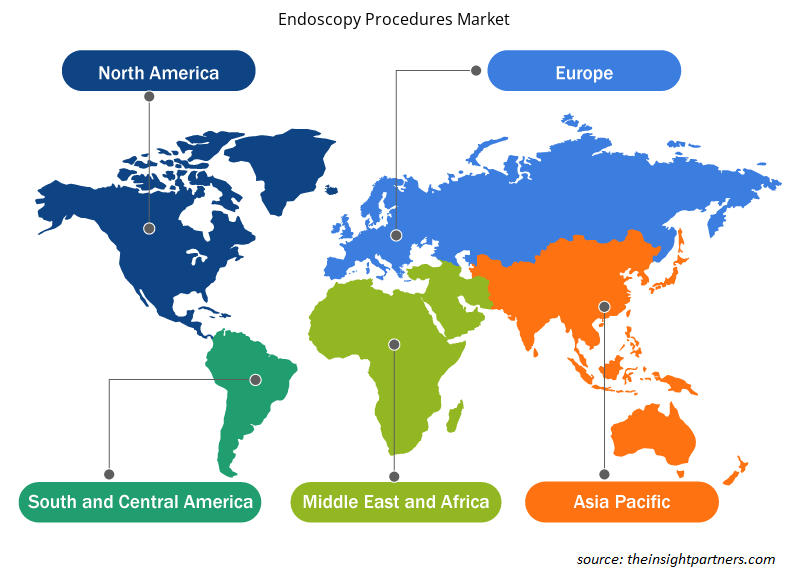

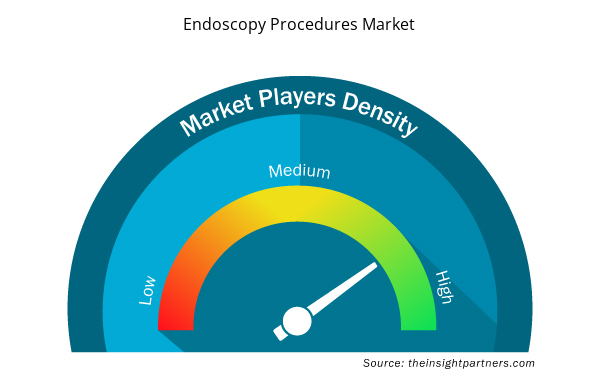

Endoscopy Procedures Market Players Density: Understanding Its Impact on Business Dynamics

The Endoscopy Procedures Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Endoscopy Procedures Market are:

- Stryker Corp

- Fujifilm Holdings Corp

- Merit Medical Systems Inc

- Smith & Nephew Plc

- Arthrex Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Endoscopy Procedures Market top key players overview

Endoscopy Procedures Market Opportunity:

The field of endoscopy in North America has witnessed various technological advancements and product launches. Such advancements are not only expected to help in the accurate diagnosis of a condition but also will help improve the safety of endoscopic procedures. Some recent technological advancements and product launches in the endoscopy devices market are listed below:

- In April 2021, Olympus announced the addition to its US bronchoscopy portfolio of the 510(k)-cleared H-SteriScope Single-Use Bronchoscopes, a line of five premium endoscopes for use in advanced diagnostic and therapeutic procedures. The introduction of the H-SteriScope portfolio has been a collaboration between Veran Medical Technologies, Inc., a wholly owned Olympus subsidiary, and Hunan Vathin Medical Instrument Co., Ltd.

- In April 2021, Ambu Inc. received Health Canada authorization for the aScope 4 Cysto, the company's unique flexible cystoscope platform for urology. Ambu’s aScope 4 Cysto is a cost-effective, high-quality flexible endoscope featuring excellent maneuverability and optics. Unlike traditional reusable endoscopes, single-use eliminates the significant capital, repair, and cleaning costs required to ensure a patient-ready instrument for every procedure. Each aScope 4 cystoscope is sterile from the package and ready when needed, enabling facilities to improve workflow efficiencies and reallocate staff from complex, time-consuming endoscope cleaning to more productive activities.

Competitive Landscape and Key Companies:

A few of the prominent endoscopy equipment manufacturers operating in the global endoscopic procedures market are Steris Plc, Conmed Corp, Olympus Corp, Boston Scientific Corp, PENTAX Medical , Erbe Elektromedizin Gmbh, Micro-Tech Nanjing Co Ltd, Merit Medical Systems Inc, Cook Medical LLC, Stryker Corp, and Johnson & Johnson. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. For instance, in June 2022, Stryker opened its new research and development facility, Stryker’s Global Technology Centre, at the International Tech Park, Gurgaon. The 150,000-square-foot facility further supported the company’s mission to make healthcare better.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Procedures, Offering, Product Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Endoscopy is a minimally invasive procedure used to examine a person's digestive tract through the mouth, anus, or in small incisions. The procedure uses an endoscope, a flexible tube with a light and camera attached. Most endoscopes are thin tubes with powerful light and a tiny camera at the end. Endoscopy helps in diagnosing the body parts such as the esophagus, stomach, colon, ears, nose, throat, heart, urinary tract, and abdomen.

Factors such as minimally invasive surgeries and increasing prevalence of cancer are the key factors driving the market.

The endoscopy procedures market was valued at US$ 30,877.37 million in 2022.

The endoscopy procedures market majorly consists of the players, including Stryker Corp; Fujifilm Holdings Corp, Merit Medical Systems Inc, Smith & Nephew Plc, Arthrex Inc, Steris Plc; Conmed Corp, Olympus Corp, Boston Scientific Corp, Cook Medical Llc..

The endoscopy procedures market, by procedure, is endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In 2022, the arthroscopy and bronchoscopy segment held the largest share of the market.

The endoscopy procedures kits market is expected to be valued at US$ 53,196.65 million in 2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Endoscopy Procedure Market

- Stryker Corp

- Fujifilm Holdings Corp

- Merit Medical Systems Inc

- Smith & Nephew Plc

- Arthrex Inc

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- Cook Medical Llc

Get Free Sample For

Get Free Sample For