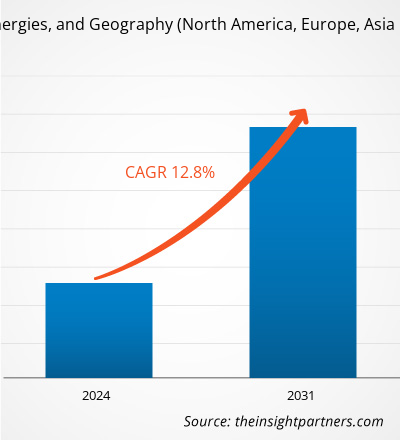

The energy storage infrastructure market is projected to reach US$ 426.66 billion by 2031 from US$ 256.39 billion in 2021; it is estimated to grow at a CAGR of 6.7% from 2021 to 2031. In terms of capacity, the market is anticipated to reach 11.30 thousand megawatts by 2031 from 4.40 thousand megawatts in 2021, registering a lucrative CAGR of 12.8% from 2021 to 2031.

The integration of energy storage technologies could lead to a revolutionary transformation in the energy efficiencies capabilities of the power grid in long term. Factors such as a surge in power generation from renewable energy sources and an increase in demand for stabilizing the energy requirements from the power grid are set to be the major contributors to the growth of the energy sector. Moreover, recent advancements in energy storage technologies have encouraged the adoption of renewable energy sources across various residential as well as commercial end users globally. As a result, investment in energy storage technologies and infrastructure, especially in batteries technologies, has gained substantial traction among major investors and government organizations.

The energy storage infrastructure market has witnessed several notable developments in terms of technology modernization, price reduction, government policy rollout, and storage technology R&D investments in the past decade. For instance, the prices of battery technologies, which remained the most popular energy storage technology globally, plummeted to almost 80–85% in the last 10 years. Furthermore, several innovative technology start-ups have developed promising prototypes for potential disruptive energy storage technologies. However, the commercialization of energy storage technologies for scalable storage needs for longer periods remains a challenge for all the market players.

The energy storage infrastructure market comprises several leading, internationally prominent companies along with niche start-ups. However, the overall competencies of these companies are mainly consolidated around a specific technology such as mechanical, thermal, electromechanical, electromagnetic, chemical among other technologies. Scalability and commercial viability of new energy storage technology are the major focus areas, as well as existing challenges, the respective technologies possess individually. A few of the leading energy storage technology companies currently dominating the market are ABB Ltd., Tesla, General Electric, Simmens, LG Chem, and SunPower.

Impact of COVID-19 on Energy Storage Infrastructure Market

The COVID-19 pandemic led to disruptions in the overall supply chain and logistics of the renewable energy sector, including industries such as solar power and wind. Unlike other sectors, the renewable energy sectors in different countries failed to obtain any form of financial relief or aid from their respective governments during the prolonged lockdown periods. Consequently, the energy storage technologies market also plummeted owing to a lack of demand from renewable energy installation sites. Additionally, the energy requirements also fell sharply during the early stages of the lockdown. Government-imposed restrictions to control the COVID-19 spread also had a profound negative impact on the requirement for energy storage solutions. Furthermore, a decline in manufacturing and industrial production led to a momentary decrease in electricity demand. Also, several governments and corporates missed their annual renewable energy goals during the pandemic. Hence, numerous countries and international organizations were compelled to extend the preset deadlines for achieving their renewable energy goals and targets.

Lucrative Regions for Energy Storage Infrastructure Providers

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Energy Storage Infrastructure: Market Insights

Technological Advancements and Cost Optimization to Bolster Energy Storage Infrastructure Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Energy Storage Infrastructure: Market Insights

Technological Advancements and Cost Optimization to Bolster Energy Storage Infrastructure Market

Though energy storage technologies have been around for more than decades globally, their popularity and commercial viability gained tremendous momentum after batteries emerged as a popular option for energy storage. Furthermore, an exponential rise in the sales of electric vehicles contributed significantly to the rising demand for battery-technology-based energy storage infrastructure. On the other hand, the growing importance of grid modernization to enhance the overall performance and efficiencies of the electrical grid among public utilities in developed economies is also gaining traction. Subsequently, the government of numerous countries has allocated special programs and funds for the modernization of their public utilities for establishing superior energy storage capabilities in the coming years. As the countries continue to embrace the adoption of renewable energy for sustainable growth in the coming years, the batteries technology is expected to lead the energy storage technologies. Attractive financial incentives and policies offered by governments, coupled with competitive battery production costs, continue to lure substantial investments into the global energy storage infrastructure market during the forecast period. Simultaneously, numerous industry-leading market players such as Tesla, Hitachi, and Reliance Industries are investing significantly in the development of large-scale energy storage solutions.

Storage Technology-Based Market Insights

Based on type, the global energy storage infrastructure market is segmented into mechanical, electromechanical, chemical, and others. The others segment includes electromagnetic and thermal energy storage technologies. Although the energy storage infrastructure market is significantly dominated by hydro-pumped-based mechanical technologies, battery-based electromechanical technologies have gained unprecedented attention from investors in the last decade. Moreover, the rising popularity of electric vehicles has further multiplied the demand for battery-based energy storage infrastructure solutions in developed and developing economies.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

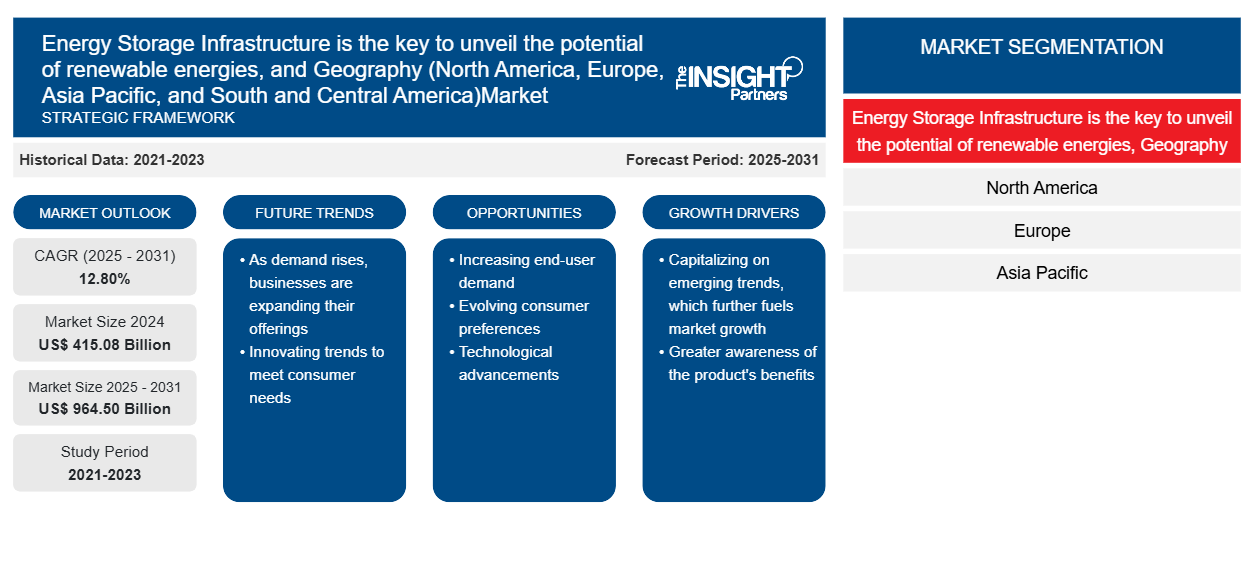

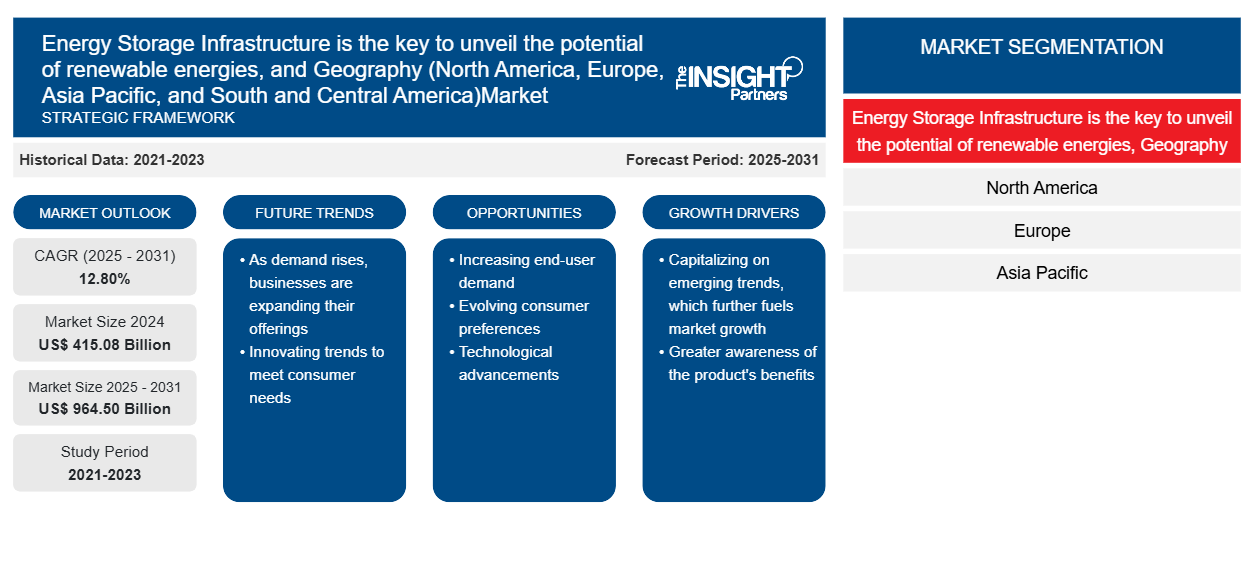

Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Players operating in the energy storage infrastructure market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In January 2022, Hydrostor Inc., a Canadian energy company, received funds of up to US$ 250 million from Goldman Sachs, a leading investment company, for the development of superior compressed air energy storage facilities across the US and Australia in the coming years.

- In October 2021, the US government announced its plan to fund energy storage-based research to boost the lithium battery supply chain. The research focuses on ensuring the availability of electric vehicle batteries along with boosting the efficiencies of the existing energy storage infrastructure. The Department of Energy of the US also announced its plans for establishing public–private partnerships for minimizing the gaps in the lithium battery supply chain within the country.

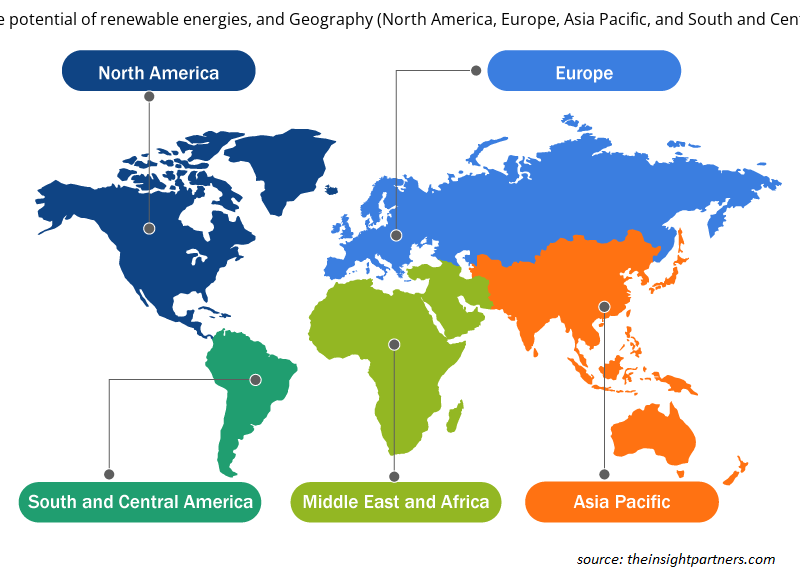

The energy storage infrastructure market is segmented on the basis of storage technology and geography. Based on storage technology, the market is segmented into mechanical, electromechanical, chemical, and others. By geography, the energy storage infrastructure market is segmented into five major regions North America (US and Canada), Europe (UK, Germany, and France), Asia (China, Japan, and India), the Middle East (Saudi Arabia and UAE), and Rest of the World. In terms of capacity, China is expected to continue to dominate the energy storage infrastructure market during 2022-2031, following heavy investments in encouraging the adoption of renewable energy by the central government. In terms of competitive positioning, several leading technology companies, as well as innovative niche start-ups, continue to dominate the global energy storage infrastructure market with their business offerings. The report briefly overviews their performances, along with their key developments. A few of the companies profiled in the energy storage infrastructure market study are ABB Ltd; Tesla Inc.; LG Chem Ltd.; Hitachi Energy Ltd.; Toshiba Infrastructure Systems & Solutions Corporation; Panasonic Corporation; BYD Co. Ltd.; Samsung SDI Co., Ltd.; EcoFLow; and Sonnen GmbH.

Report ScopeEnergy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market Regional Insights

The regional trends and factors influencing the Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market

Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 415.08 Billion |

| Market Size by 2031 | US$ 964.50 Billion |

| Global CAGR (2025 - 2031) | 12.80% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Energy Storage Infrastructure is the key to unveil the potential of renewable energies, Geography

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market Players Density: Understanding Its Impact on Business Dynamics

The Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market are:

- abb ltd.

- byd co. ltd.

- ecoflow

- Hitachi Energy Ltd.

- LG Chem Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America)Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America) Market Scope and Analysis

- Energy Storage Infrastructure is the key to unveil the potential of renewable energies, and Geography (North America, Europe, Asia Pacific, and South and Central America) Market Size and Share

- Nurse Call Systems Market

- Portable Power Station Market

- Webbing Market

- Energy Recovery Ventilator Market

- Hydrogen Compressors Market

- Cut Flowers Market

- Semiconductor Metrology and Inspection Market

- Third Party Logistics Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Intraoperative Neuromonitoring Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Energy and Power : READ MORE..

- abb ltd.

- byd co. ltd.

- ecoflow

- Hitachi Energy Ltd.

- LG Chem Ltd.

- Panasonic Corporation

- SAMSUNG SDI CO.,LTD.

- sonnen GmbH

- Tesla Inc.

- Toshiba Infrastructure Systems & Solutions Corporation

Get Free Sample For

Get Free Sample For