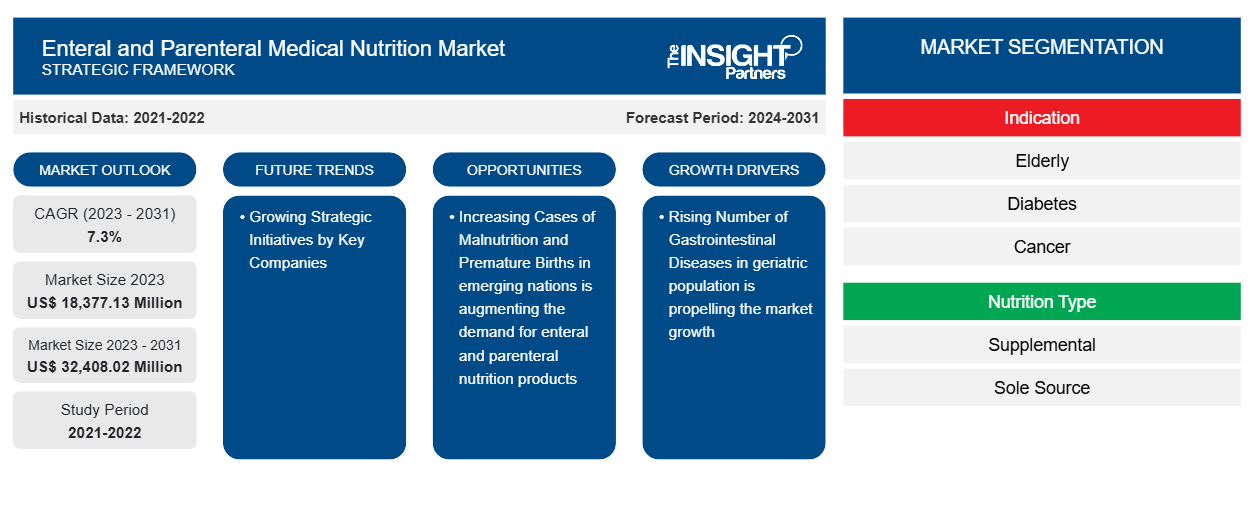

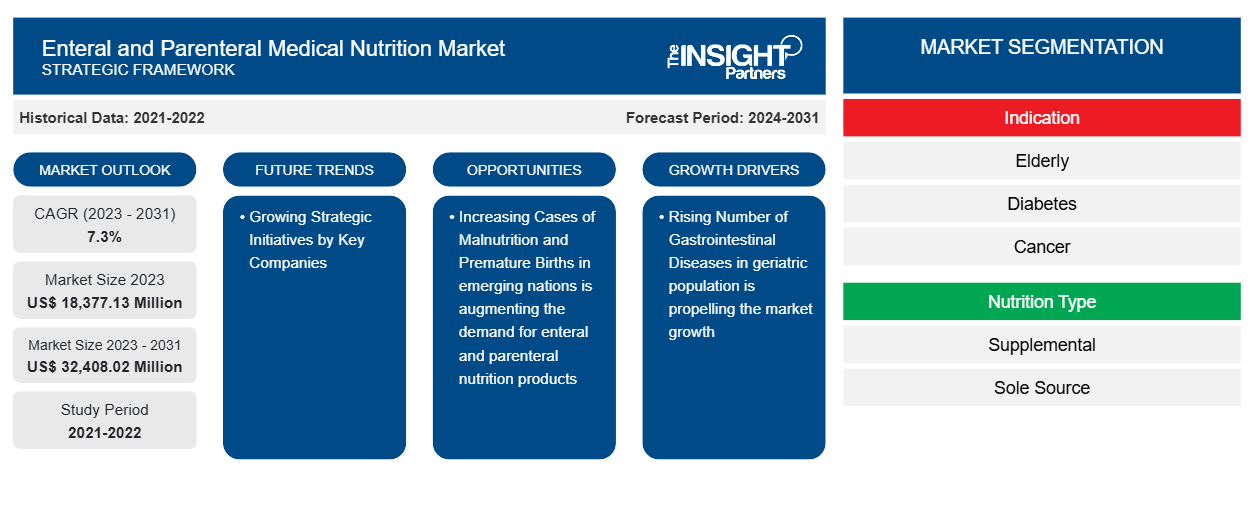

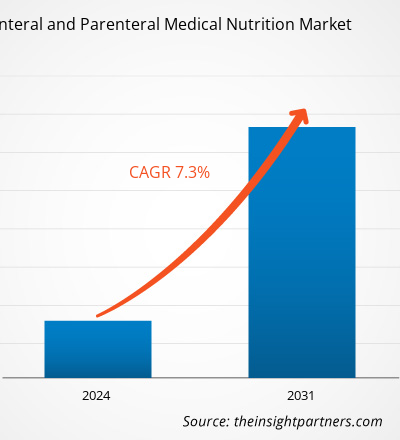

The enteral and parenteral medical nutrition market size is projected to reach US$ 32,408.02 million by 2031 from US$ 18,377.13 million in 2023. The market is expected to register a CAGR of 7.3% during 2023–2031. Specific formulations and plant-based nutritional products are likely to serve as key trends in the market.

Enteral and Parenteral Medical Nutrition Market Analysis

The growth of the market is mainly fueled by the growing investments from international players, improving government support in countries such as China, supportive initiatives and nutrition research, and advancing healthcare infrastructure. The macro and micronutrient formulations of enteral and parenteral nutrition and their applications vary based on different diseases, such as cancer and gastrointestinal diseases. Energy-dense formulae (>1 kcal/ml) are prescribed to increase calorie delivery in patients with gastrointestinal dysfunction. A rise in the number of people turning to plant-based food causes the demand for plant-based nutrition products worldwide. The Innova Consumer Survey 2020 revealed that diet variety, health, sustainability, and taste are among the most important reasons why people consider plant-based alternatives. Companies (Kate Farms, Functional Formularies, and Real Food Blends) in the market anticipate that a rising focus on healthy foods will change into a preference for healthier nutrition products. As a result, companies have developed more natural and plant-based enteral products. Moreover, the rising geriatric population, growing incidence of chronic diseases and neurological disorders, and product innovations by the market players are anticipated to support the market growth.

Enteral and Parenteral Medical Nutrition Market Overview

According to the Centers for Disease Control and Prevention (CDC) data, preterm birth in the US accounted for 10% of all births in 2020 and reached 10.5% in 2021, recording a yearly rise of 4%. According to the July 2022 data of the United Nations International Children's Emergency Fund, the prevalence of undernourishment increased 9.3% in 2020 from 8.0% in 2019; it again jumped to 9.8% in 2021. Similarly, as per a study titled “A multi-center survey on hospital malnutrition,” published in 2021, about 33% of patients in US hospitals were either malnourished or at nutritional risk, and approximately 11–45% of hospital patients and home care settings patients in England suffered from malnutrition. Thus, the enormous burden of malnutrition in children and adults, along with a high number of preterm births, fuels the demand for enteral and parenteral medical nutrition products, which in turn stimulates the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Enteral and Parenteral Medical Nutrition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Enteral and Parenteral Medical Nutrition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Enteral and Parenteral Medical Nutrition Market Drivers and Opportunities

Rising Number of Gastrointestinal Diseases to Favor Market Growth

Bowel obstruction, Crohn’s disease, ulcerative colitis, short bowel syndrome (SBS), and certain cancers are some examples of gastrointestinal diseases. As per the “Worldwide Prevalence and Burden of Functional Gastrointestinal Disorders, Results of Rome Foundation Global Study,” published in January 2021, functional gastrointestinal disorders have affected more than 40% of people across the world. Research conducted by Crohn’s & Colitis UK confirms that ~1 in every 123 people in the country had either Crohn’s disease or ulcerative colitis in 2022, accounting for ~0.5 million people living with IBD in the UK. Moreover, SBS occurs in ~3 per 1 million people yearly. Patients with gastrointestinal diseases are at an increased risk of nutritional degradation. They may also experience nutritional deterioration due to therapeutic dietary limitation and loss of appetite caused by anorexia or altered nutritional requirements, which can be due to the disease itself. Hence, medical nutrition is recommended for gastrointestinal disease patients as these patients cannot ingest food. The enteral and parenteral routes are ideal to provide them with essential nutrients. Therefore, the rising cases of gastrointestinal diseases drive the growth of the enteral and parenteral medical nutrition market.

Growing Strategic Initiatives by Companies

Companies operating in the enteral and parenteral medical nutrition market continuously focus on strategic developments, which help them advance their sales, enlarge their geographic reach, and improve their capacities to cater to a greater than existing customer base. Some of the noteworthy developments in the market are mentioned below:

- In January 2023, Nutricia introduced Fortimel Plant-Based Energy, which is the first plant-based, ready-to-drink oral nutritional supplement. The product is particularly designed to fulfill the nutritional needs of malnourished individuals or individuals at risk of malnutrition due to illness. With this launch, the company builds on Danone's (parent company) capability in plant nutrition to grow its Fortimel portfolio.

- In March 2022, Vygon acquired Macatt Medica (a distribution company located in Peru). Macatt Medica delivers most of Vygon’s products in Peru, including a variety of enteral nutrition products. With the acquisition, Macatt Medica became an entirely owned subsidiary of Vygon, assisting the latter's operations in South America.

Therefore, the development of advanced products targeting numerous health issues and strategic moves allow companies in the market to create new or better products and new businesses to remain competitive in the market. Such strategic growth initiatives provide significant growth opportunities in the market.

Enteral and Parenteral Medical Nutrition Market Report Segmentation Analysis

Key segments that contributed to the derivation of the enteral and parenteral medical nutrition market analysis are indication, nutrition type, form, product type, route of administration, age group, and distribution channel.

- Based on indication, the enteral and parenteral medical nutrition market is divided into elderly, gastrointestinal disorders, diabetes, cancer, respiratory disorders, renal disease, liver failure, Alzheimer’s disease, dementia, post-COVID-19, and others. The elderly segment held the largest share of the market in 2023. The gastrointestinal disorders segment is anticipated to register the highest CAGR during the forecast period.

- By nutrition type, the market is bifurcated into supplemental and sole source. The supplemental segment held a larger share of the market in 2023. The sole source segment is projected to register a higher CAGR during the forecast period.

- Based on form, the enteral and parenteral medical nutrition market is categorized into liquid, powder, and semi-solid. The liquid segment held the largest market share in 2023. The powder segment is anticipated to register the highest CAGR during the forecast period.

- By product type, the market is segmented into general and disease-specific. The general segment held a larger share of the market in 2023 and is projected to register a higher CAGR during the forecast period.

- Based on the route of administration, the market is categorized into oral, tube feed, and parenteral. The parenteral segment held the largest share of the market in 2023. The oral segment is estimated to register the highest CAGR during the forecast period.

- By age group, the market is segmented into above 60 years, 18-60 years, 3-18 years, and below 3 years. The above 60-year segment held the largest market share in 2023. The 18-60 years segment is projected to register the highest CAGR during the forecast period.

- By distribution channel, the market is divided into hospital pharmacies, e-commerce, retail stores, and others. The hospital pharmacies segment held the largest share of the market in 2023. The e-commerce segment is anticipated to register the highest CAGR during the forecast period.

Enteral and Parenteral Medical Nutrition Market Share Analysis by Geography

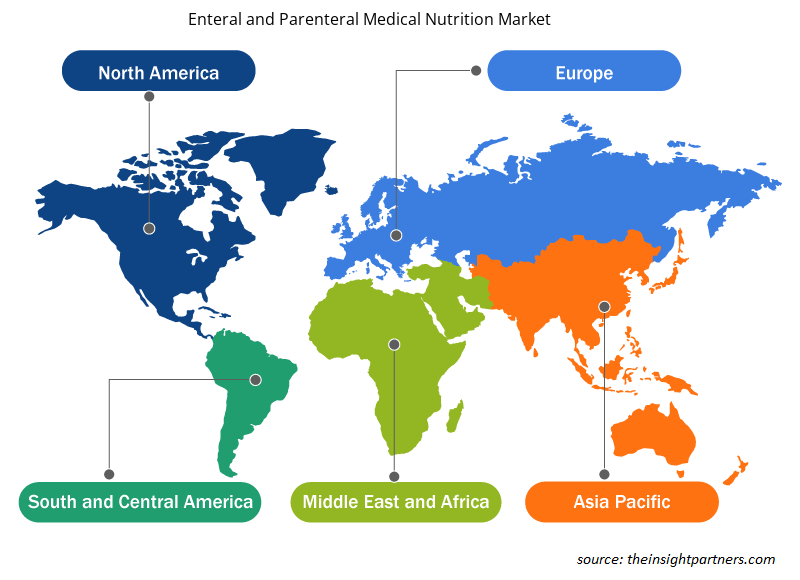

The geographic scope of the enteral and parenteral medical nutrition market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the enteral and parenteral medical nutrition market. The growth of the market in this region is attributed to the rising prevalence of chronic diseases, growing strategic developments by market players, and increasing preference for enteral and parenteral nutrition, as well as an upsurge in knowledge among individuals about the benefits of medical nutrition. According to an article titled “Trends in Parenteral Nutrition,” on average, ~34,000 patients receive parenteral nutrition annually in the US. Enteral tube feeding can be prescribed for treating more than 350 disease conditions in children. In addition, the US government is taking several initiatives to boost the enteral and parenteral medical nutrition market. For instance, the Feeding Tube Awareness Foundation is creating awareness about adopting feeding tubes and the benefits associated with them. The Canadian Digestive Health Foundation states millions of Canadians live with digestive disease. ~20 million Canadians, i.e., two of every three people, suffer from digestive disorders yearly.

Furthermore, the presence of major market players is likely to have a positive effect on the growth of the enteral and parenteral medical nutrition market in the coming years. In February 2021, Amsino Medical Group received the FDA 510(k) clearance for its Puggle enteral feeding pump and feeding set for pediatric and adult patients. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Enteral and Parenteral Medical Nutrition Market Regional Insights

The regional trends and factors influencing the Enteral and Parenteral Medical Nutrition Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Enteral and Parenteral Medical Nutrition Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Enteral and Parenteral Medical Nutrition Market

Enteral and Parenteral Medical Nutrition Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 18,377.13 Million |

| Market Size by 2031 | US$ 32,408.02 Million |

| Global CAGR (2023 - 2031) | 7.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Indication

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

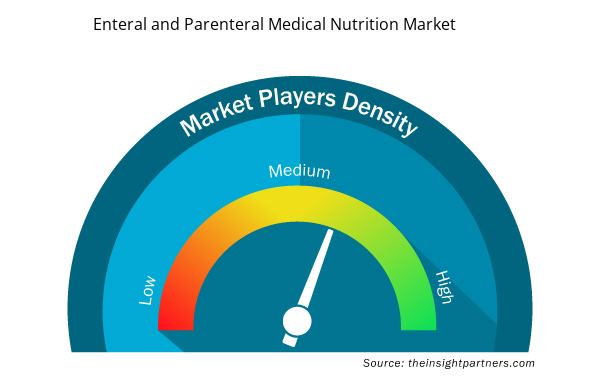

Enteral and Parenteral Medical Nutrition Market Players Density: Understanding Its Impact on Business Dynamics

The Enteral and Parenteral Medical Nutrition Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Enteral and Parenteral Medical Nutrition Market are:

- Abbott Laboratories

- Nestle SA

- Nutricia International BV

- Medtrition Inc

- Fresenius Kabi AG

- B. Braun SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Enteral and Parenteral Medical Nutrition Market top key players overview

Enteral and Parenteral Medical Nutrition Market News and Recent Developments

The enteral and parenteral medical nutrition market is evaluated by gathering qualitative and quantitative data post post-post-primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the enteral and parenteral medical nutrition market are listed below:

- Fresenius Kabi’s SMOFlipid lipid injectable emulsion received US Food and Drug Administration (FDA) approval. The emulsion is used to provide parenteral nutrition to pediatric patients, including term and preterm neonates, which makes it the first and only four-oil lipid emulsion for parenteral nutrition patients of every age. (Source: Fresenius Kabi, Press Release, March 2022)

- Abbott launched Similac 360 Total Care, the company's next generation of infant formula with human milk oligosaccharides (HMO). It is the first and only infant formula in the US with a blend of five various prebiotic HMOs (only found together in breast milk). Similac 360 Total Care is developed to provide nutrition to support whole health and progress in babies, including the development of the immune system, digestive system, and brain. (Source: Abbott, Press Release, November 2021)

Enteral and Parenteral Medical Nutrition Market Report Coverage and Deliverables

The “Enteral and Parenteral Medical Nutrition Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Enteral and parenteral medical nutrition market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Enteral and parenteral medical nutrition market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Enteral and parenteral medical nutrition market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the enteral and parenteral medical nutrition market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Volumetric Video Market

- Biopharmaceutical Contract Manufacturing Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Animal Genetics Market

- Dealer Management System Market

- Railway Braking System Market

- 3D Mapping and Modelling Market

- Latent TB Detection Market

- Enteral Nutrition Market

- Medical Enzyme Technology Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Indication, Nutrition Type, Product Type, Route of Administration, Age Group, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Belgium, Brazil, Canada, Chile, China, Colombia, Egypt, France, Germany, India, Indonesia, Iran, Israel, Italy, Japan, Mexico, Netherlands, Peru, Poland, Saudi Arabia, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, United Arab Emirates, United Kingdom, United States, Vietnam

Frequently Asked Questions

North America region dominated the enteral and parenteral medical nutrition market in 2023.

The increase in the prevalence of gastrointestinal diseases and growing cases of malnutrition and premature births are the most influential factors responsible for market growth.

Abbott Laboratories, Nestle SA, Nutricia International BV, Medtrition Inc, Fresenius Kabi AG, B. Braun SE, Smartfish AS, Nutrisens SAS, AYMES International Ltd, Medifood International SA, Easy Line Ltd, Charing Cross Scientific AS, Baxter International Inc, and Medica Nutrition Inc. are the market players in the enteral and parenteral medical nutrition market.

The estimated value of the enteral and parenteral medical nutrition market accounted for US$ 32,408.02 million in 2031.

The global enteral and parenteral medical nutrition market is estimated to register a CAGR of 7.3% during the forecast period 2023–2031.

Get Free Sample For

Get Free Sample For