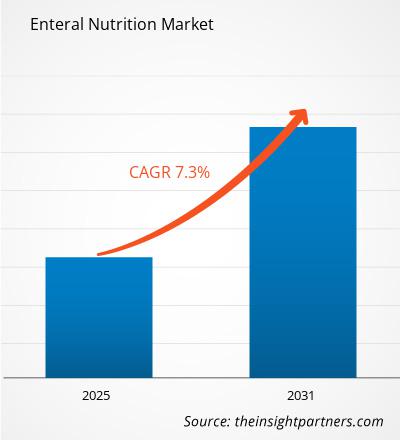

The enteral nutrition market size is projected to reach US$ 17,330.87 million by 2031 from US$ 10,584.80 million in 2024. The market is expected to register a CAGR of 7.3% during 2025–2031. Specific formulations and plant-based nutrition products are likely to bring in new market trends during the forecast period.

Enteral Nutrition Market Analysis

Gastrointestinal diseases include Crohn’s disease, bowel obstruction, ulcerative colitis, short bowel syndrome, microscopic colitis, and certain cancer types. These diseases often lead to malabsorption of nutrients due to inflammation, damage, or dysfunction of the intestines. According to the “Worldwide Prevalence and Burden of Functional Gastrointestinal Disorders, Results of Rome Foundation Global Study,” published in January 2021, functional gastrointestinal disorders have affected more than 40% of people across the world. Additionally, Crohn’s disease is a complex, chronic disorder primarily affecting the digestive system. It is the most common disease in North America and Europe. Research conducted by Crohn’s & Colitis UK shows that ~1 in every 123 people in the UK had either Crohn’s disease or ulcerative colitis in 2022, accounting for nearly 0.5 million people living with IBD in the UK.

According to the study “Tackling the Burden of Digestive Disorders in Europe,” published in 2023, over 332 million people are estimated to be living with a digestive disorder in European countries. As per the Guts UK, a nonprofit organization, digestive diseases that affect the gut, liver, and pancreas cause 1 in 8 deaths in the country. Similarly, short bowel syndrome (SBS) occurs in ~3 per 1 million people yearly. As per the article titled “Understanding Short Bowel Syndrome: Current Status and Future Perspectives," published in 2020, the prevalence of SBS has surged by more than twofold in the last 40 years. The prevalence of SBS was ~300 cases per 10 million in the US and ~14 cases per 10 million in Europe. Patients with gastrointestinal diseases are at an elevated risk of nutritional deterioration as they are asked to fast before undergoing diagnostic tests. They may also face nutritional deterioration due to therapeutic dietary restrictions and loss of appetite caused by anorexia or altered nutritional requirements, which can be a result of the disease itself. Thus, patients suffering from chronic diseases or those undergoing treatments for the same may require enteral nutrition to meet their daily nutrient needs.

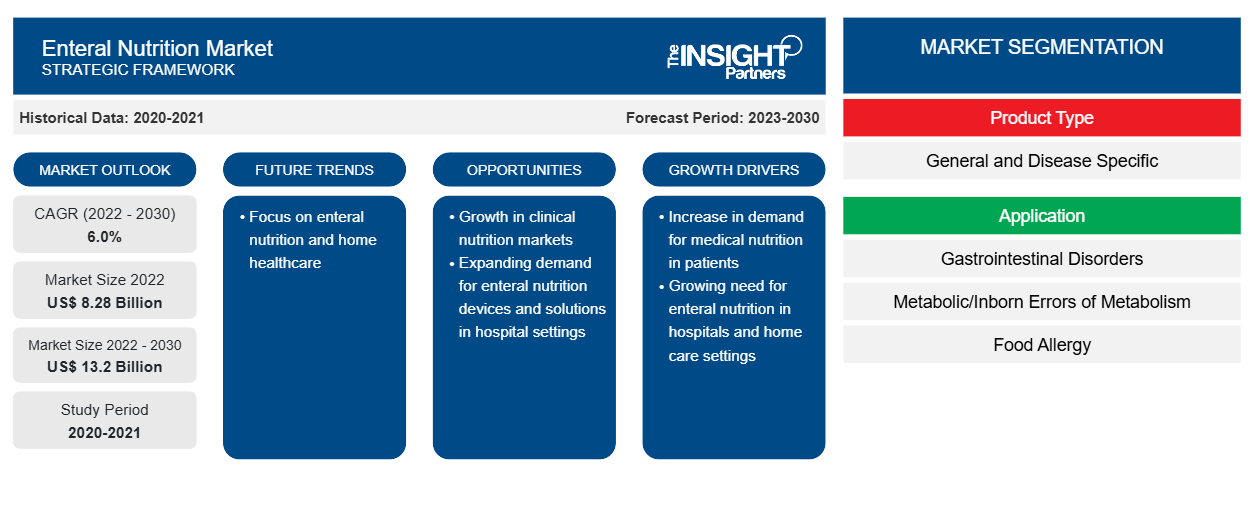

Enteral Nutrition Market Overview

The enteral nutrition market is rapidly expanding due to the rising incidence of chronic diseases such as cancer and diabetes, neurological disorders, and gastrointestinal diseases; rising aging population; increasing prevalence of malnutrition; and advancements in enteral feeding products, such as innovative feeding tubes, pumps, and formulas. Prominent players operating in the market are focusing on innovation and collaboration for enhanced product availability. However, the high cost of enteral nutrition products may hamper the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Enteral Nutrition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Enteral Nutrition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Enteral Nutrition Market Drivers and Opportunities

Rising Cases of Malnutrition and Premature Births Result in Elevated Demand for Enteral Nutrition

Undernutrition, overweight or obesity, vitamin or mineral deficiency, and poor diet-related noncommunicable diseases are all categorized under malnutrition. As per World Health Organization (WHO) data, ~1.9 billion adults were overweight or obese, whereas 462 million were underweight in 2021. Additionally, 39 million children under the age of 5 were overweight, 149 million had slow growth and development owing to the chronic lack of access to nutritious food, and 45 million were wasted (too thin for height). ~45% of deaths among children aged less than 5 are associated with undernutrition. Additionally, the European Society for Clinical Nutrition and Metabolism (ESPEN) and the WHO in Milan, Italy, conducted a joint 46th ESPEN Congress in September 2024. The Congress reported that malnutrition affects 30–50% of hospitalized patients, 40% of oncology patients, 30–70% of older adults, 24% of hospitalized cardiovascular or pulmonary disease patients, and 38–78% of patients in intensive care units in Europe.

As per the July 2022 data by the United Nations International Children's Emergency Fund (UNICEF), the prevalence of undernourishment reached 9.3% in 2020 from 8.0% in 2019; it further jumped to 9.8% in 2021. As per the “A multi-center survey on hospital malnutrition,” published in 2021, ~33% of hospital patients in the US were either malnourished or at risk of malnutrition, and nearly 11–45% of patients in hospitals and home care settings in England suffered from malnutrition. Nutritional support can be delivered through enteral means, depending on the need, which is an essential and appropriate way of treating most malnutrition cases. Thus, the massive burden of malnutrition in children and adults drives the demand for enteral nutrition formulae and products.

Strategic Initiatives by Market Players to Create Lucrative Opportunities in Market

Companies operating in the enteral nutrition market continuously focus on strategic developments such as collaborations, expansions, agreements, partnerships, and innovative product formulations. These strategies help them increase their sales, expand their geographic area, and enhance their capacity to cater to a larger than existing customer base. Several of the noteworthy developments in the enteral nutrition market are mentioned below.

- In May 2024, Danone completed the acquisition of Functional Formularies, a leading whole-food tube feeding business in the US. Through this acquisition, Danone has plans to strengthen its Medical Nutrition portfolio in the US by further expanding its enteral tube feeding ranges.

- In January 2023, Nutricia launched Fortimel PlantBased Energy, its first plant-based, ready-to-drink oral nutritional supplement. The product is specifically formulated to fulfill the nutritional needs of malnourished populations or people at risk of malnutrition due to illness. Following the launch of Fortimel, the company plans to build on Danone's (parent company) expertise in plant nutrition to expand its Fortimel portfolio. The new product has been made available by Nutricia in the Netherlands, Denmark, Norway, Spain, Finland, and the Czech Republic.

Therefore, the introduction of innovative ready-to-drink or ready-to-use nutritional supplements, the development of innovative products targeting various health issues, and strategic moves such as expansions and acquisitions allow companies in the enteral nutrition market to create new or improved products and new businesses to remain competitive in the market. Thus, such strategic growth initiatives create significant growth opportunities in the market.

Enteral Nutrition Market Report Segmentation Analysis

Key segments that contributed to the derivation of the enteral nutrition market analysis are type, application, and end user.

- Based on product type, the enteral nutrition market is categorized into nasogastric, nasoenteral, sipping, and other. The nasogastric segment held the largest share of the market in 2024.

- In terms of application, the enteral nutrition market is segmented into gastrointestinal disorders, renal disease, liver disease, oncology, neurology, and others. The gastrointestinal disorders segment held the largest market share in 2024.

- By age group, the enteral nutrition market is bifurcated into adult and pediatric. The adult segment accounted for a larger market in 2024.

- Based on distribution channel, the enteral nutrition market is segmented into hospital pharmacies, retail stores, and e-commerce. The hospital pharmacies segment held the largest market share in 2024.

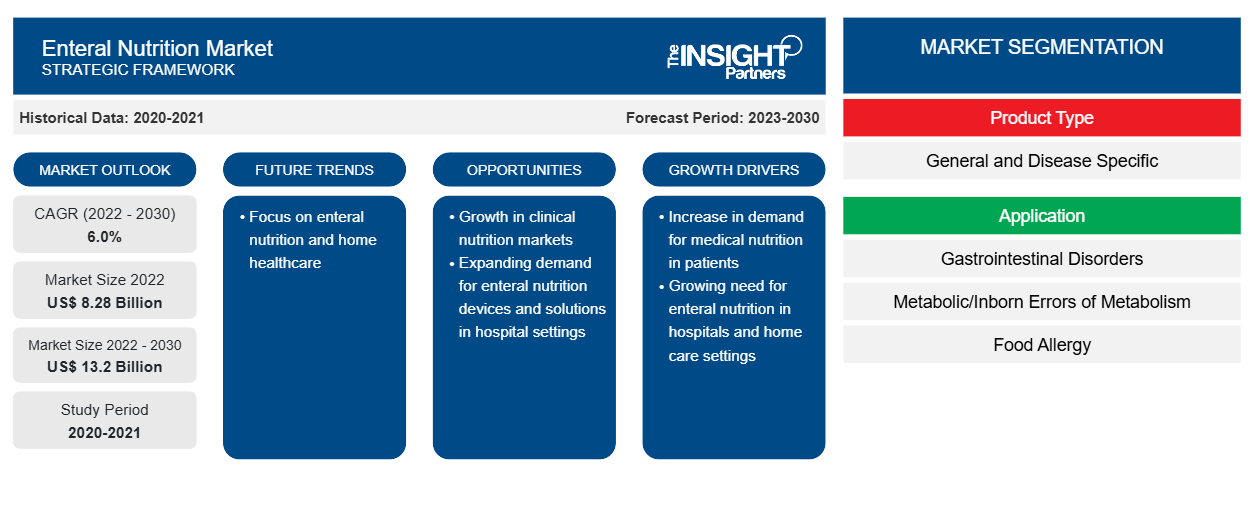

Enteral Nutrition Market Share Analysis by Geography

The geographic scope of the enteral nutrition market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2024. It is expected to continue its dominance in the global market during the forecast period. The US is the largest market for enteral nutrition products across the globe. The market growth in the US can be associated with the burgeoning demand for medical nutrition products, particularly among aging populations and patients with chronic diseases. Additionally, the rising prevalence of obesity and diabetes has contributed to an upsurge in the number of patients needing enteral nutrition, as these conditions can result in complications that impair normal feeding and digestion. According to the International Diabetes Federation (IDF) Diabetes Atlas, 10th Edition 2021, the number of people diagnosed with diabetes in the country was 32,215 in 2021, and it is expected to rise to 36,289 by 2045.

Enteral Nutrition Market Regional Insights

The regional trends and factors influencing the Enteral Nutrition Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Enteral Nutrition Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Enteral Nutrition Market

Enteral Nutrition Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 10,584.80 Million |

| Market Size by 2031 | US$ 17,330.87 Million |

| Global CAGR (2025 - 2031) | 7.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

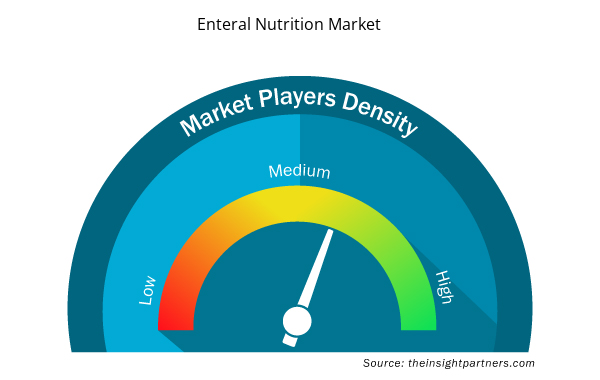

Enteral Nutrition Market Players Density: Understanding Its Impact on Business Dynamics

The Enteral Nutrition Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Enteral Nutrition Market are:

- Nestlé

- Danone S.A.

- Abbott Laboratories

- FrieslandCampina

- Fresenius SE and Co. KGaA

- B. Braun SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Enteral Nutrition Market top key players overview

Enteral Nutrition Market News and Recent Developments

The enteral nutrition market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below are a few of the key developments witnessed in the enteral nutrition market:

- Arla Foods Ingredients launched a new whey protein hydrolysate with a better taste profile than comparable ingredients for peptide-based medical nutrition. The highly hydrolyzed whey protein ingredient—Lacprodan DI-3092—allows 10 g of high-quality single-source protein to be packed into 100 ml. This number is significantly higher than the market standard of 6–7 g per 100 ml. Additionally, it is designed to taste great with minimal bitterness, helping overcome a key challenge in medical nutrition. (Arla Foods, November 2024)

- Kate Farms launched its first Pediatric Blended Meals innovation, bringing the first plant-based, organic, whole-food blended meal option designed for ease and convenience into the market. Kate Farms Pediatric Blended Meals are designed for children aged 1–13 to help support their healthy growth and development, and these products can be used for both tube and oral feeding. Available in three flavors to provide ingredient variety and reflect a typical three-meal day and feature an innovative reclosable single-serve pouch for quicker and less messy connections to common tube feeding devices. (Source: Kate Farms, Press Release, January 2024)

Enteral Nutrition Market Report Coverage and Deliverables

The "Enteral Nutrition Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Enteral nutrition market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Enteral nutrition market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Enteral nutrition market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the enteral nutrition market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Semiconductor Metrology and Inspection Market

- Online Exam Proctoring Market

- Visualization and 3D Rendering Software Market

- Small Molecule Drug Discovery Market

- Playout Solutions Market

- Non-Emergency Medical Transportation Market

- Mesotherapy Market

- Gas Engine Market

- Portable Power Station Market

- Vessel Monitoring System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, Age Group, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 7.3% during 2025–2031.

The enteral nutrition market value is expected to reach US$ 17,330.87 million by 2031.

The plant-based products are likely to emerge as new, significant growth trends in the market in the coming years.

Nestlé, Danone S.A., Abbott Laboratories, FrieslandCampina, Fresenius SE and Co. KGaA, B. Braun SE, Dr. Schär AG, Arla Food, Reckitt Benckiser, Perrigo Company PLC, Fonterra Co-operative Group Limited, Kate Farms, and Nutritional Medicinals, LLC are among the main players in the market.

An increasing aging population and the rising prevalence of gastrointestinal diseases are among the most significant factors fueling the market growth.

North America dominated the market in 2024.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Enteral Nutrition Market

- Nestlé

- Danone S.A.

- Abbott Laboratories

- FrieslandCampina

- Fresenius SE and Co. KGaA

- B. Braun SE

- Dr. Schär AG

- Arla Food

- Reckitt Benckiser

- Perrigo Company PLC

- Fonterra Co-operative Group Limited

- Kate Farms

- Nutritional Medicinals, LLC

Get Free Sample For

Get Free Sample For