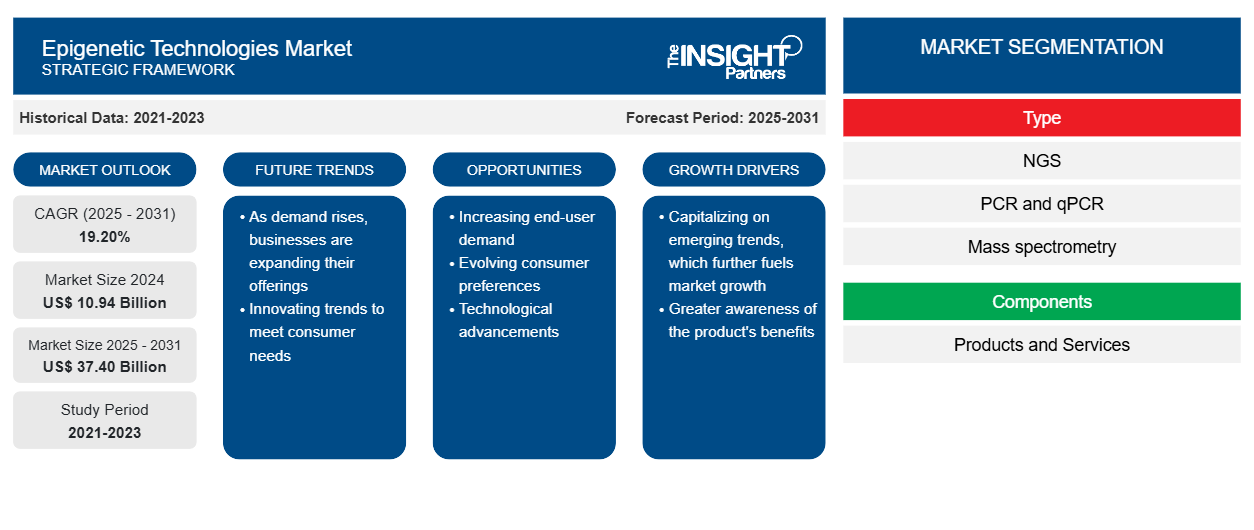

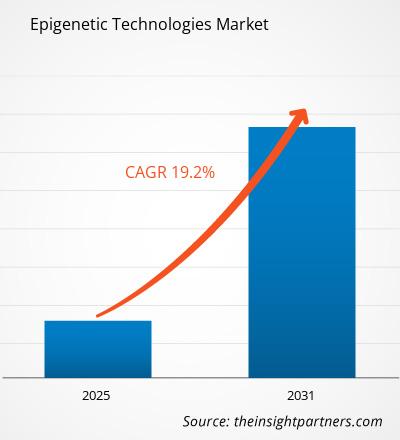

[Research Report] The epigenetic technologies market size was valued at US$ 7,697.56 million in 2022 and is expected to reach US$ 22, 922.65 million by 2031; it is estimated to register a CAGR of 19.20% from 2022 to 2031.

Market Insights and Analyst View:

Epigenetics is the study of changes in gene expression caused by environmental factors rather than changes in the DNA sequence itself. It refers to inheritable changes in an organism's traits that occur independently of its genetic material. This involves DNA methylation and histone modifications, which can be analyzed using various techniques. These changes cause variations in an organism's phenotype instead of genotype, and they are essential for development as they respond to environmental stimuli.

Key factors driving the epigenetic technologies market growth include the surge in the use of epigenetics technologies for drug development and increasing funding, investment, and approvals for research and development in the field of epigenetics. However, standardization regarding epigenetics-based diagnostics and a scarcity of experienced practitioners is projected to impede market expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Epigenetic Technologies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Epigenetic Technologies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers and Restraints:

The field of epigenetic drug discovery offers numerous possibilities for detecting novel therapeutic agents. Epigenetic drug development targets noncoding RNA expression, DNA methylation, and histone modifications. Epigenetic mechanisms are important for gene transcription, maintaining genomic stability, and enabling normal cell growth, development, and differentiation. However, epigenetic dysregulation can lead to the onset and progression of various human diseases, such as cancer, cardiovascular diseases, metabolic diseases, and neurological diseases. According to the World Health Organization (WHO), cancer caused almost 10 million deaths in 2021, representing one in six deaths. The most common cancers include breast, lung, colon, rectum, and prostate cancers. Epigenetics is a field with promising tools that can serve various purposes such as prevention, diagnosis, and treatment; by developing drugs that target specific epigenetic mechanisms responsible for regulating gene expression, it is possible to effectively apply epigenetic tools to treat various diseases, including cancer. According to the article published by the American Cancer Society in December 2022, epigenetic modifications, specifically shifts in DNA methylation and histone mark patterns, play a crucial role in tumor progression and metastasis. These cancer-specific events have proven useful tools for diagnosing, monitoring, and determining treatment options to assist with clinical decision-making. Additionally, the epigenetic machinery's ability to reverse modifications, in contrast to genetic changes' irreversibility, has made it an attractive target for drug development.

Moreover, adopting high-throughput technologies, including next-generation sequencing (NGS) and mass spectrometry (MS) into clinical laboratories, as well as the development of epigenetic biomarkers, will aid in the introduction of new epigenetics-based in vitro diagnostic (IVD) tests, thereby expanding its clinical applications. According to an article published by ScienceDirect in 2021, two complementing PCR-based strategies such as methylation-sensitive and methylation-specific techniques. Enrichment assays have also been developed to identify low-abundance methylation or unmethylated DNA, which can be employed in noninvasive blood testing.

Therefore, the increase in cases of cancer and genetic disorders has, in turn, led to the rise in research and development of various epigenetic technologies for drug discovery and development to treat these diseases.

Furthermore, the growing use of epigenetics in non-oncology applications such as drug development for infectious diseases and autoimmune diseases and the growing patient pool for customized treatment provide profitable potential for the industry; hence, there is a big epigenetics market opportunity for major firms to invest in.

However, standardization concerns regarding epigenetics-based diagnostics and a scarcity of experienced practitioners are projected to impede market expansion.

Market Scope and Segmentation

The global epigenetics technologies market is segmented based on type, components, applications, technique, end users, and geography. The epigenetics technologies market is segmented based on type into NGS, PCR and QPCR, Mass spectrometry, Sonication, and others. The epigenetics technologies market is bifurcated based on components into products and services. Based on application, the market is segmented into oncology, metabolic diseases, immunology, cardiovascular disorders, and others. Based on techniques, the market is segmented into DNA methylation, histone modification, and regulation by noncoding RNAs. Based on end users, the market is segmented into Contract Research Organizations, academic and research institutions, and pharmaceutical and biotech industries. The epigenetics technologies market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The epigenetics technologies market, by type, is segmented into NGS, PCR and QPCR, Mass spectrometry, Sonication, and others. The NGS held the largest market share in 2022 and is anticipated to register the highest CAGR in the market from 2022 to 2031. Next-generation sequencing (NGS) is a powerful sequencing technology for high throughput, scalability, and speed. This technology is utilized for determining the order of nucleotides across entire genomes or specific regions of DNA or RNA. NGS has completely transformed the biological sciences, enabling researchers to perform a broad range of applications and study biological systems at an unprecedented level.

The epigenetics technologies market is bifurcated based on components into products and services. The product segment is further sub-segmented into enzymes, instruments, kits, and reagents. Similarly, the services segment is further categorized into ChIP-Seq, CUT&Tag, DNA methylation sequencing, ATAC-Seq, gene expression, chromatin structure mapping, IP-mass spec, and single-cell services. The services segment held the largest market share in 2022, and the product segment is expected to register the highest CAGR in the market during 2022-2031.

Based on application, the market is segmented into oncology, metabolic diseases, immunology, cardiovascular disorders, etc. The oncology segment held the largest epigenetics technologies market in 2022. However, the cardiovascular segment is expected to register the highest CAGR in the market during 2022-2031. According to WHO, Cardiovascular diseases (CVDs) cause 17.9 million deaths annually owing to poor lifestyle choices such as unhealthy diet, lack of exercise, smoking, and excessive alcohol consumption. According to an article published by the European Journal of Preventive Cardiology in August 2022, CVDs are often influenced by inherited genetic variations. Certain risk factors, such as dyslipidemia, hypertension, diabetes, and obesity, are also linked to genetic traits. Researchers have identified hundreds of single-nucleotide polymorphisms (SNPs) associated with coronary artery disease. Still, these SNPs can only explain a small portion of CVD's heritability, suggesting that gene-gene interaction and/or epigenetic mechanisms contribute more than genetic variation. Experimental evidence supports a strong connection between epigenetic changes and the risk of CVD.

Based on techniques, the market is segmented into DNA methylation, histone modification, and regulation by noncoding RNAs. DNA methylation segments will hold the highest market share from 2022 to 2031.

Based on end users, the market is segmented into hospitals and clinics, academic and research institutions, and pharmaceutical and biotech industries. Academic and research institutions will hold a significant market share in 2022 owing to a rise in research studies and government investments in biotechnology. However, the pharmaceutical and biotech industries segment is expected to register the highest CAGR in the market during 2022-2031.

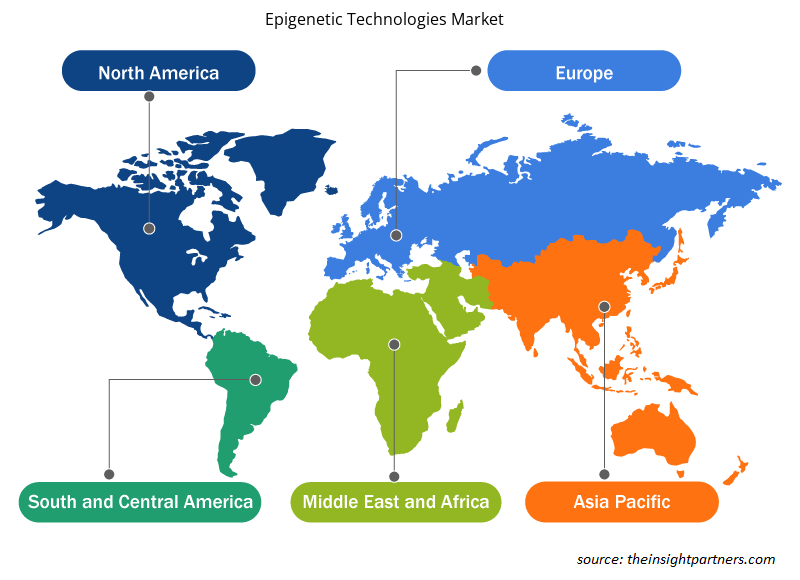

Regional Analysis:

Based on geography, the global epigenetic technologies market is segmented into five key regions: North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa. North America is estimated to hold a larger market share during 2022–2031, owing to rising cancer prevalence and healthcare costs. The North American epigenetic technologies market is segmented into the US, Canada, and Mexico. The market growth is attributed to the increasing number of clinical trials due to ongoing drug development studies, availability of advanced epigenetics products, and various factors such as a technologically advanced healthcare system. The US has emerged as a leading clinical research destination.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global epigenetic technologies market are listed below:

- In November 2023, QIAGEN launched the Microbiome WGS SeqSets, a comprehensive and user-friendly workflow for efficient and reproducible microbiome research. The workflow simplifies sample extraction and next-generation sequencing (NGS) library preparation and user-friendly bioinformatics analysis for non-experts making analysis more accessible.

- In November 2023, EpiCypher launched a fully automated CUT&RUN assay called autoCUT&RUN, allowing for high-throughput chromatin feature mapping. This technology is a significant breakthrough in epigenomic profiling, as it is based on EpiCypher's industry-leading CUTANA CUT&RUN kits. The autoCUT&RUN assay enables scaled research, advancing therapeutic development and biomarker discovery.

- In April 2023, Cambridge Epigenetix, rebranded as Biomodal, introduced their new duet multiomics solution, combining genetic and epigenetic data from a single low-volume sample. The duet multiomics solution is the first single-base-resolution sequencing technique that allows for the simultaneous phased reading of genomic and epigenetic information in a single sample using current sequencing equipment and a single procedure.

- In September 2021, Active Motif collaborated with Proteintech Group. Active Motif received an investment from Proteintech Group, an original manufacturer of antibodies, nanobodies, and recombinant proteins. Active Motif has announced that it plans to use the funds to augment its R&D capabilities and expand its commercial reach. With Proteintech as a strategic partner, the company stands to gain a cash boost, access to high-quality antibodies, and an expanded distribution network.

- In April 2022, PacBio, a leading producer of high-quality, highly accurate sequencing systems, game-changing Sequel IIe and Sequel II Systems, and detection capabilities for DNA methylation. PacBio's unique and highly efficient HiFi sequencing method includes access to the epigenome, a second layer of genomic information frequently overlooked due to inherent limitations of standard sequencing technologies.

Competitive Landscape and Key Companies:

Illumina Inc., BioRad Laboratories, QIAGEN N.V., Thermo Fisher Scientific Inc., Abcam Plc, PerkinElmer, Inc., Agilent Technologies Inc., Zymo Research Corporation, Merck Millipore, Active Motif, Inc. are among the prominent players operating in the epigenetic technologies market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

Report ScopeEpigenetic Technologies Market Regional Insights

The regional trends and factors influencing the Epigenetic Technologies Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Epigenetic Technologies Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Epigenetic Technologies Market

Epigenetic Technologies Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 10.94 Billion |

| Market Size by 2031 | US$ 37.40 Billion |

| Global CAGR (2025 - 2031) | 19.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

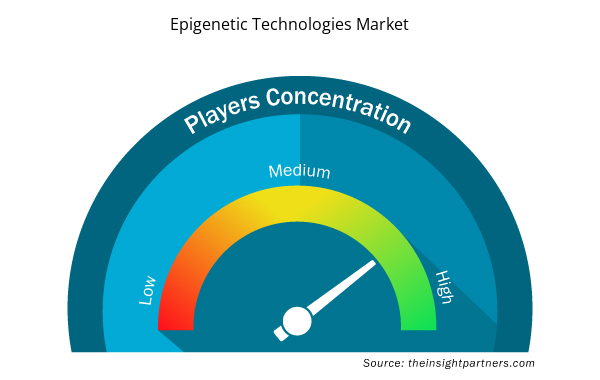

Epigenetic Technologies Market Players Density: Understanding Its Impact on Business Dynamics

The Epigenetic Technologies Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Epigenetic Technologies Market are:

- Illumina Inc.

- BioRad Laboratories

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Abcam Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Epigenetic Technologies Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Components, Application, Techniques, End Users, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

- Illumina Inc.

- BioRad Laboratories

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Abcam Plc

- PerkinElmer, Inc.

- Agilent Technologies Inc.

- Zymo Research Corporation

- Merck Millipore

- Active Motif, Inc.

Get Free Sample For

Get Free Sample For