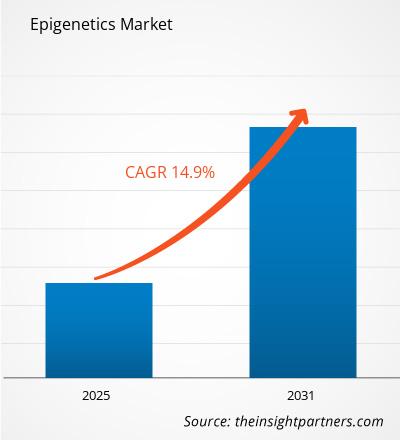

The epigenetics market size is projected to reach US$ 35.84 billion by 2031 from US$ 11.12 billion in 2024. The market is expected to register a CAGR of 18.3% during 2025–2031.

Epigenetics Market Analysis

The market's growth is driven by the rising global prevalence of cancer, advancements in epigenetic technologies, and the expanding role of personalized medicine. Integration of AI and machine learning in epigenetic analysis and epigenetic reprogramming for aging and longevity interventions contributes to market development. Advancements in aging and longevity interventions and growth in biomarker and diagnostic development are expected to create ample opportunities for the epigenetics market growth.

Epigenetics Market Overview

The epigenetics market is expanding with increasing research into gene regulation and disease mechanisms. Epigenetics is about the changes in gene expression that are passed on to different generations but do not change the DNA sequences. These changes are mostly achieved by DNA methylation, histone modification, and non-coding RNA regulation. The field has been very influential in cancer, neurological, and autoimmune diseases, where epigenetic biomarkers and therapy have attracted great attention for their diagnostic and therapeutic potential. The increasing innovations are due to the combination of next-generation sequencing (NGS), chromatin analysis, and bioinformatics. More and more pharmaceutical and biotechnology companies are placing bets on epigenetic drug development, especially in cancer immunotherapy and rare disease treatment. The academic research institutions are important in the basic understanding and translational applications. The epigenetics market is driven by clinical integration and commercialization due to the increasing need for personalized medicine and the continuous support from government and private funding for genomic research.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

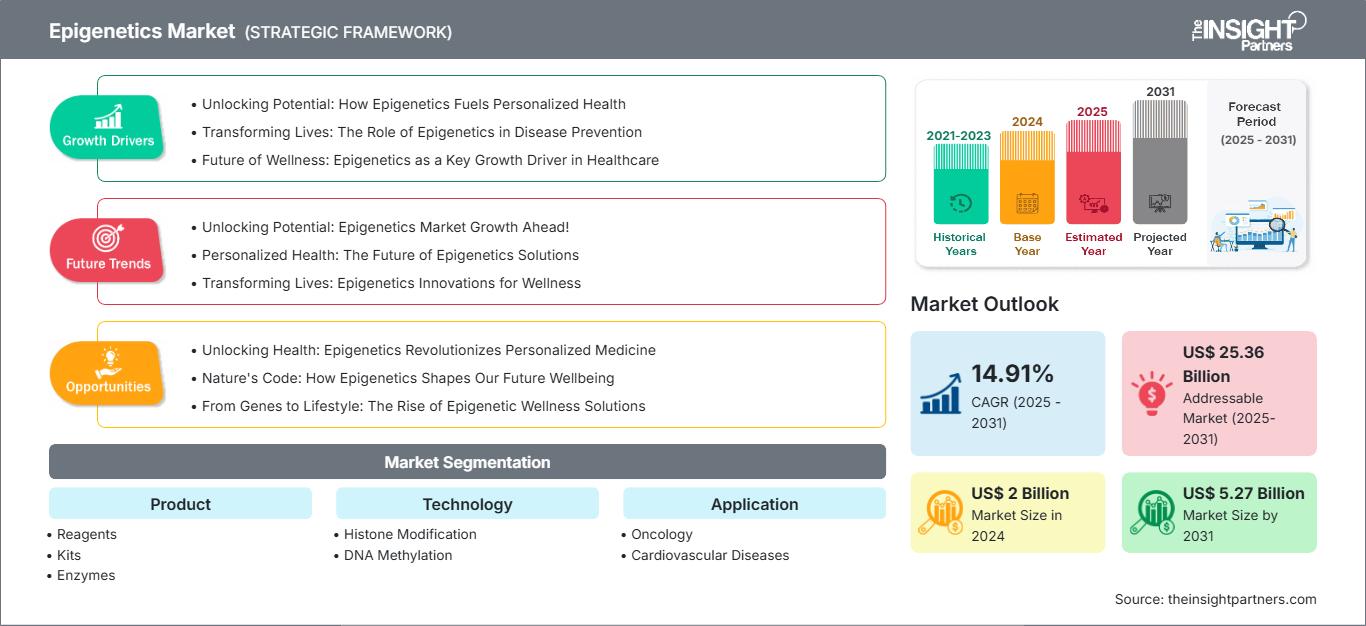

Epigenetics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Epigenetics Market Drivers and Opportunities

Market Drivers:

- Rising Global Prevalence of Cancer: The increasing prevalence of cancer is the major factor driving the market growth. This situation is resulting in a lot of new inventions in diagnostics, targeted therapies, and biomarkers such as MGMT and GSTP1 methylation, which are paving the way for more personalized medicine and early detection by means of cheap and highly sensitive liquid biopsies.

- Advancements in Epigenetic Technologies: Innovations to CRISPR-based epigenome editing, AI integration, and multi-omics technologies are increasing the precision of gene regulation, leading to therapeutic breakthroughs in cancer, HIV, and chronic diseases. These innovations are facilitating clinical translation and opening up the possibilities for collaborative research.

- Expanding Role in Personalized Medicine: Epigenetics supports personalized medicine as it allows the exact and patient-specific diagnostics and treatments by the use of biomarkers, AI modeling, and CRISPR editing. Consequently, improving the treatment efficacy and increasing the possibility of disease prevention for various diseases such as cancer, metabolic, and neurological disorders.

Market Opportunities:

- Advancements in Aging and Longevity Interventions: Epigenetic changes in the areas of aging and lifespan are mainly facilitated by the use of different interventions such as caloric restriction, NMN, rapamycin, and partial reprogramming, which lead to reversible DNA and histone modifications, thus reducing the epigenetic age, increasing the lifespan, and lessening the occurrence of age-related diseases.

- Expansion in Lifestyle and Environmental Health Modifications: Epigenetics helps in the prevention of lifestyle diseases by means of diet, exercise, and mindfulness. Interventions such as Mediterranean diets, HIIT, and stress reduction change methylation patterns, thereby enhancing metabolism, inflammation, and longevity.

- Growth in Biomarker and Diagnostic Development: Epigenetics is transforming the field of non-invasive diagnostics by the use of methylation-based biomarkers and liquid biopsies, thus allowing the earliest and most accurate detection of cancer and cardiovascular disease. Innovations such as NGS, MS-HRM, and point-of-care instruments are contributing to the development of personalized medicine.

Epigenetics Market Report Segmentation Analysis

The epigenetics market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Products and Services:

- Kits And Reagents: The segment of epigenetic technologies is the main driver of research and diagnostics by means of sophisticated reagents and kits for methylation, histone, and RNA analysis. This is accompanied by an increasing number of local Chinese suppliers who are challenging the situation of tariffs and the worldwide supply-chain changes.

- Instruments and Accessories: The epigenetics instruments portion of the market is rapidly expanding, which includes NGS and qPCR systems. The growth is majorly propelled by government support for biotech, cancer research, and the uptake of advanced platforms from Illumina, Thermo Fisher, and BGI Genomics.

- Enzymes: Epigenetic enzymes such as DNMTs and HDACs are the main contributors to the research, diagnostics, and oncology therapies, along with the increasing demand for CRISPR and NGS, which is supported by home and international companies providing the integrated enzyme-based kits and solutions.

- Services: There is a fast expansion of epigenetic services such as sequencing, methylation profiling, and ChIP-seq analysis. These services provide researchers with accurate, high-throughput data and professional assistance through a project-based approach, thereby eliminating the need for an in-house infrastructure.

By Application:

- Oncology

- Non-Oncology

By Technology:

- DNA Methylation Analysis

- Chromatin Immunoprecipitation Sequencing (ChIP-Seq)

- Cleavage Under Targets and Tagmentation (CUT and Tag)

- Assay for Transposase-Accessible Chromatin with Sequencing (ATAC-Seq)

- Histone Modification Analysis

- RNA Epigenetics

- Single-cell Epigenomic Assays

- Others

By End-User Industry:

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

- Academic and Research Institutes

- Others

Each end user in the Epigenetics market has distinct handling, safety, and regulatory needs, shaping equipment selection and operational protocols.

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The epigenetics market in Asia Pacific is expected to witness the fastest growth. The surging demand for effective diagnostics and treatments, driven by rising cancer incidences and expanding healthcare infrastructure, is likely to drive the market.

Epigenetics Market Regional InsightsThe regional trends and factors influencing the Epigenetics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Epigenetics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Epigenetics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 11.12 Billion |

| Market Size by 2031 | US$ 35.84 Billion |

| Global CAGR (2025 - 2031) | 18.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Products and Service

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Epigenetics Market Players Density: Understanding Its Impact on Business Dynamics

The Epigenetics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Epigenetics Market top key players overview

Epigenetics Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in Latin America, the Middle East, and Africa also have many untapped opportunities for epigenetics providers to expand.

The epigenetics market grows differently in each region owing to the increasing prevalence of oncology and other conditions, increasing research and development activities, along regulatory approvals. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- The increase in cancer cases, advanced genomics research, and the widespread use of precision medicine and personalized therapeutics are the main factors that are leading the epigenetics market

- Trends: Integration of AI and machine learning with epigenomic data

2. Europe

- Market Share: Substantial share due to early adoption of Epigenetics

-

Key Drivers:

- The increasing prevalence of chronic and age-related diseases, and extensive research and development in oncology and epigenetic therapies.

- Trends: Rising adoption of multi-omics approaches

3. Asia Pacific

- Market Share: Fastest-growing region with rising market share every year

-

Key Drivers:

- The demand for epigenetic technologies and diagnostics is driven by a rapidly expanding biotech sector, government investments in genomics and precision medicine, an aging population, and the rising prevalence of cancer and metabolic disorders.

- Trends: Rapid growth in epigenetic research infrastructure, government-funded precision medicine initiatives

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- The increasing awareness of cancer diagnostics, the rising prevalence of chronic diseases, the improving healthcare infrastructure, and the increasing adoption of molecular and epigenetic technologies.

- Trends: Emergence of contract research organizations (CROs) offering epigenetic services, increased investment in molecular diagnostics

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Increasing chronic and lifestyle-related diseases, expanding diagnostic infrastructure, government healthcare initiatives, rising research investments, and the adoption of precision medicine and epigenetic tools.

- Trends: Expansion of genomic and epigenomic research centers, increased healthcare funding

Epigenetics Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players, such as Promega Corp, QIAGEN NV, Thermo Fisher Scientific Inc., and Agilent Technologies Inc., which are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Advanced security features

- Value-added services such as Analytics & predictive maintenance, real‑time operational analytics, and installation

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- To target cancer, neurological, and rare diseases, pharmaceutical and biotech companies are heavily investing in drug discovery and biomarker identification. AI and machine learning applications serve as powerful tools for advanced data analysis, which raises research productivity and makes personalized therapeutics possible.

- The improvements of next-generation sequencing (NGS) and liquid biopsy methods are leading to non-invasive testing and early disease identification. Precision medicine initiatives are the main reason for the rapid expansion of epigenetic biomarkers and companion diagnostics.

- The collaboration between academia, industry, and technology providers is the main factor behind the rapid commercialization of epigenetic tools and therapeutics. The move towards emerging markets, particularly Asia Pacific, is taking advantage of the increased research and development spending and the improvements in the healthcare infrastructure. The segment is experiencing ongoing innovation and hence benefiting from the development and adoption of novel reagents and diagnostic instruments as the main growth drivers.

Other companies analysed during the course of research:

- Illumina

- Bio-Rad Laboratories

- PerkinElmer

- New England Biolabs

- Zymo Research

- Diagenode

- PacBio

- Oxford Nanopore Technologies

- EpiCypher

- Guardant Health

- Base Genomics

- Bioneen

- Element Biosciences

- Epizyme

- CellCentric

- ValiRx

- Cayman Chemical

- Sigma-Aldrich

- Epigenomics AG

- F. Hoffmann-La Roche AG

- Abbott Laboratories

Epigenetics Market News and Recent Developments

- Chroma, Nvelop merge to marry genetic medicine ‘cargo’ to delivery Epigenetic editing startup Chroma Medicine is merging with Nvelop Therapeutics in a deal that will also bring in US$75 million in funding to develop in vivo genetic medicines.

Epigenetics Market Report Coverage and Deliverables

The "Epigenetics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Epigenetics Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Epigenetics Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Epigenetics Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Epigenetics Market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the epigenetics market?

Which are the leading players operating in the epigenetics market?

What would be the estimated value of the epigenetics market by 2031?

Which region dominated the epigenetics market in 2024?

What are the factors driving the epigenetics market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For