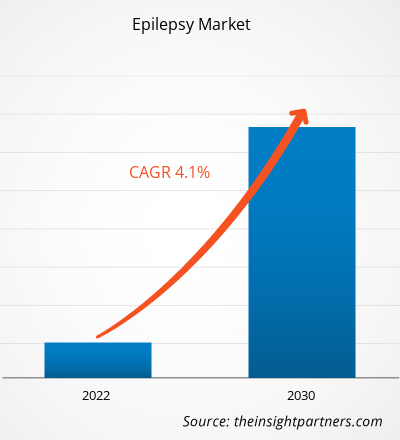

The epilepsy market size is projected to grow from US$ 7.7 billion in 2022 to US$ 10.7 billion by 2030; it is estimated to record a CAGR of 4.1% during 2022–2030. Key factors driving the market growth are rising prevalence of epilepsy and increasing investments in development of epilepsy therapies. However, recall of products may hinder the market growth to a certain extent.

Epilepsy Market Analysis

Epilepsy also known as seizure disorder, is a chronic noncommunicable disease that affects brain. Epilepsy affects people of all races, ethnic backgrounds, genders, and ages. According to the Centers for Disease Control and Prevention, it is estimated that 1.2% of people in the United States have active epilepsy.

Epilepsy Market Overview

Epilepsy may occur due to some genetic disorder or may be due to some acquired brain injury, such as a trauma or stroke. According to recent report published by the World Health Organization (WHO) in February 2023, epilepsy accounts for a significant share of the worldwide disease burden, affecting nearly fifty million people across the world. Moreover, 4–10 persons per 1,000 individuals are estimated to have active epilepsy (i.e., with the need for treatment or continuing seizures). Nearly 5 million people are diagnosed with epilepsy every year. High-income countries are estimated to report high epilepsy at a rate of 49 per 100,000 people annually. This number can reach 139 per 100,000 individuals in low- and middle-income countries. An upsurge in epilepsy incidence can be attributed to the higher count of road traffic injuries and birth-related injuries, and the elevated risk of endemic conditions such as neurocysticercosis or malaria. The WHO also states that approximately 70% of individuals with epilepsy can become seizure-free with the use of medications.

Treatments to control epilepsy include anti-epileptic medications, special diets (in addition to anti-seizure medications), and surgery; however, anti-epileptic drug therapy is the primary treatment prescribed for most patients. Thus, the rising prevalence of epilepsy worldwide drives market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Epilepsy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Epilepsy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Epilepsy Market Drivers and Opportunities

Increasing Investments in the Development of Epilepsy Therapies Favors Market

The healthcare sector is transforming with rapid technological developments and innovation, enhancing healthcare services and quality of care. The epilepsy market is characterized by several small and large companies and organizations implementing various growth strategies. The availability of funding enables companies and organizations to boost production levels, expand into new markets, invest in new/improved technologies, and allocate more resources to R&D. A few of the notable investments in the epilepsy market, contributing to the market progress, have been mentioned below

- In March 2023, the Swedish government decided to commission Vinnova, Sweden’s innovation agency, a total of US$ 7.7 million (80 million SEK) to establish a national innovation cluster for commercialization, skills development, and production capacity build-up for cell therapies and other advanced treatments such as gene therapy.

- In November 2022, Scientists at Aston University in the UK, working on a project to develop new drug treatments to prevent the beginning of childhood epilepsy, were awarded US$ 2.4 million (£2 million) to discover the disease mechanism in the brain and the ways of epilepsy prevention. This 3-year project funded by the Medical Research Council is a collaboration led by researchers in the College of Health and Life Sciences at Aston University, combined with Bristol University and Jazz Pharmaceutical.

Awareness Programs Conducted by Organizations – An Opportunity in Epilepsy Market

Growing awareness about epilepsy, its symptoms, and the importance of early diagnosis has led to a surge in patients seeking medical attention. Organizations such as the Epilepsy Foundation, Epilepsy Society, the American Epilepsy Society, and the Epilepsy Association of Central Florida play a crucial role in educating people about this disease. The involvement of these organizations has resulted in increased rates of diagnosis and a broader patient population requiring epilepsy treatment.

Numerous awareness campaigns are conducted by organizations globally to spread awareness regarding the disease condition and available treatment. In the US, Epilepsy Awareness Day or Purple Day is observed on March 26 every year to raise public understanding of the brain disorder, along with eliminating its fear and stigma. Similarly, November is reserved as National Epilepsy Awareness Month (NEAM) in the US every year to educate people about the condition and symptoms of epilepsy and raise funds for research related to managing this disease. The Epilepsy Foundation selects a theme that encourages people to collaborate and act to promote awareness and funds for epilepsy. In November 2021, the foundation launched the #RemoveTheFilter social media campaign to reduce fear associated with epilepsy and bring hope to those suffering from the condition.

Moreover, in partnership with SK Life Science Inc., the Epilepsy Foundation introduced a 30-minute on-demand course for people to learn the essentials of seizure first aid. The UK Sudden Unexpected Death in Epilepsy (SUDEP) Awareness Day is celebrated on October 23. The SUDEP action leads the international epilepsy community to recognize and raise awareness about sudden and unexpected death due to epilepsy. Thus, such initiatives and awareness campaigns increase epilepsy diagnoses and treatments, offering lucrative growth opportunities to the market.

Epilepsy Market Report Segmentation Analysis

Key segments that contributed to the derivation of the epilepsy market analysis are type, route of administration, treatment type, age group, and distribution channel.

- Based on type, the epilepsy market is divided into progressive myoclonic epilepsy, reflex epilepsy, generalized epilepsy, and others. The generalized epilepsy segment held a higher market share in 2022.

- Based on route of administration, the market is segmented into oral, parenteral, other route of administration.

- In terms of treatment type, the market is segmented into first generation drugs, second generation drugs, and third generation drugs.

- In terms of age group, the market is segmented into adult and children.

- In terms of distribution channel, the market is segmented hospital pharmacies, retail pharmacies, and other distribution channel

Epilepsy Market Share Analysis by Geography

The geographic scope of the epilepsy market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In North America, the epilepsy market is currently experiencing exponential growth during the forecast years. The US market dominates the global epilepsy market in 2022. The burgeoning number of cases of neurological diseases such as Alzheimer's disease, increasing awareness about neurological disorders, favourable results obtained in research activities, and growing investments in developing epilepsy drugs are among the main factors driving the overall epilepsy market growth in the US. In March 2020, Neurelis, Inc. announced the commercial availability of VALTOCO (diazepam nasal spray) to treat stereotypic, intermittent episodes of frequent seizures (i.e., acute repetitive seizures and seizure clusters) that are different from a usual seizure pattern observed in pediatric and adult patients. Similarly, in March 2022, the FDA approved Ztalmy (ganaxolone) to treat seizures related to cyclin-dependent kinase-like 5 (CDKL5) deficiency disorder (CDD) in patients aged 2 and older.

In August 2021, the CDC Epilepsy Program selected the Epilepsy Foundation as its funding recipient under a new cooperative agreement: Improving Systems of Care, Epilepsy Education, and Health Outcomes through National and Community Partnerships. The US$ 17.5 million in federal funds that would be allotted over the next 5 years would support the work of the Epilepsy Foundation and its partners in creating and maintaining a robust public health infrastructure, advancing health equity, improving quality of life, and achieving the best outcomes for all people living with the epilepsies. Therefore, the increasing prevalence of epilepsy, new drug launches, and research and funding initiatives bolster the epilepsy market size in the US.

Epilepsy Market Regional Insights

The regional trends and factors influencing the Epilepsy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Epilepsy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Epilepsy Market

Epilepsy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.7 Billion |

| Market Size by 2030 | US$ 10.7 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

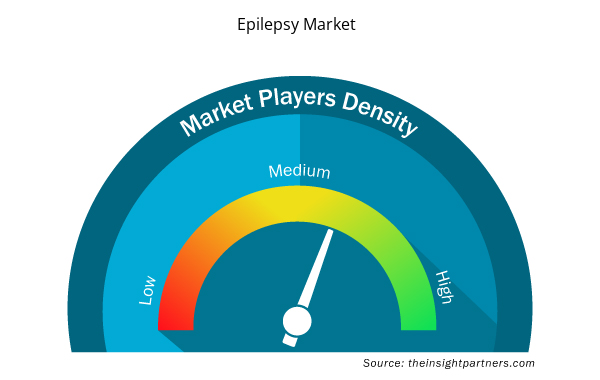

Epilepsy Market Players Density: Understanding Its Impact on Business Dynamics

The Epilepsy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Epilepsy Market are:

- Idexx Laboratories Inc.

- PBD Biotech Ltd

- Thermo Fisher Scientific Inc.

- Innovative Diagnostics SAS

- Neogen Corp

- Enfer Labs

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Epilepsy Market top key players overview

Epilepsy Market News and Recent Developments

The epilepsy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In May 2023, the biotechnology company Neuro3 Therapeutics (Neuro3), which focuses on finding and creating novel medications to treat illnesses of the central nervous system has signed an exclusive global license and option deal with Lundbeck. The agreement focuses on KCNQ2 ion channel activators, which have been clinically verified as targets for epilepsy treatment. According to clinical research, KCNQ2 channel activation may offer therapeutic alternatives for treating various neurological conditions, such as uncommon forms of epilepsy. (Source: Neuro3 Therapeutics company website)

Epilepsy Market Report Coverage and Deliverables

The “Epilepsy Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Epilepsy Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Epilepsy Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Epilepsy market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Epilepsy Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- USB Device Market

- Mice Model Market

- Airport Runway FOD Detection Systems Market

- Saudi Arabia Drywall Panels Market

- Sterilization Services Market

- Integrated Platform Management System Market

- Organoids Market

- Small Molecule Drug Discovery Market

- Ceramic Injection Molding Market

- Medical Second Opinion Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Route of Administration, Treatment Type, Age Group, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 4.10% during 2023–2031.

Abbott Laboratories, Pfizer Inc., Eisai Co Ltd., UCB SA, CombiGene AB, LivaNova Plc, Novartis AG, Medtronic Plc, GSK Plc, and H. Lundbeck AS

The high-throughput genetic sequencing technique enables a faster and more comprehensive analysis of DNA, thereby aiding the identification of genetic causes of conditions such as epilepsy are likely to remain a key trend in the market.

The rising prevalence of epilepsy and increasing investments in development of epilepsy therapies are the major factors fuelling the market growth of epilepsy over the years.

North America dominated the epilepsy market in 2023

Get Free Sample For

Get Free Sample For