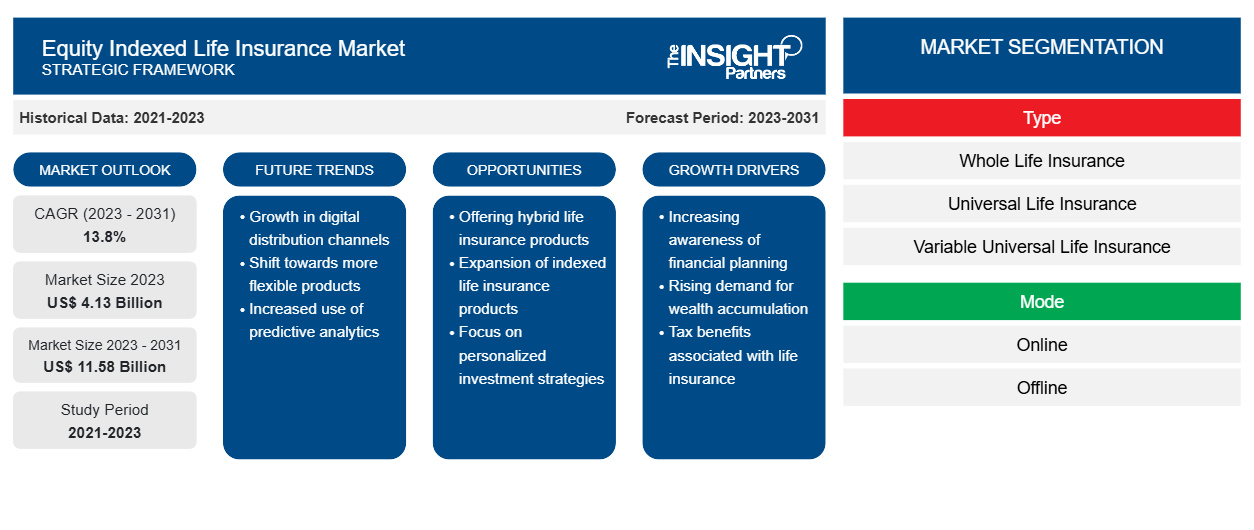

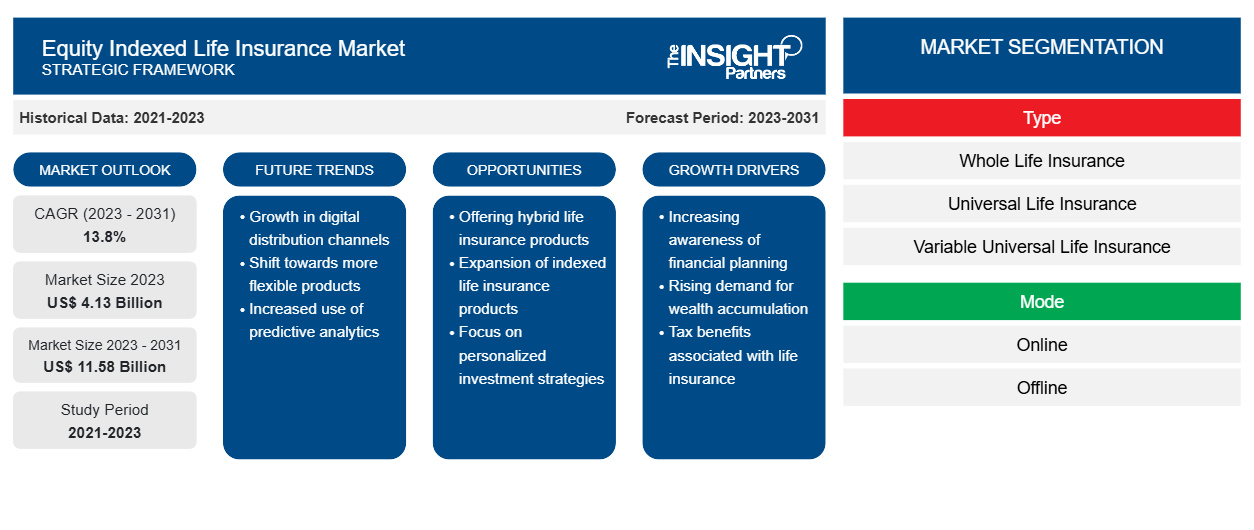

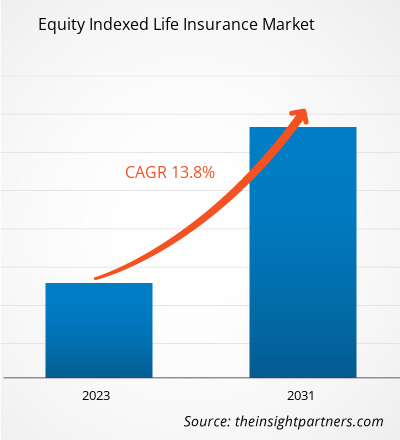

The equity indexed life insurance market size is expected to grow from US$ 4.13 billion in 2023 to US$ 11.58 billion by 2031; it is anticipated to expand at a CAGR of 13.8% from 2023 to 2031. The equity indexed life insurance market includes growth prospects owing to the current equity indexed life insurance market trends and their foreseeable impact during the forecast period. The equity indexed life insurance market is a large and expanding sector. The equity indexed life insurance market is growing due to increasing economic growth, rising consumer awareness and education, and increased insurance accessibility.

Equity Indexed Life Insurance Market Analysis

Equity indexed life insurance is a type of life insurance policy that combines features of both traditional life insurance and investment products. With equity indexed life insurance, a portion of one’s premium payments goes toward providing a death benefit to beneficiaries, similar to regular life insurance. However, another portion of one’s premium is invested in indexed accounts tied to stock market performance. The equity indexed life insurance market is driven by factors such as economic conditions, regulatory changes, and consumer demand for insurance and investment products.

Equity Indexed Life Insurance Market Industry Overview

- The equity indexed life insurance industry is a sector within the broader insurance market that offers a blend of life insurance protection and investment opportunities.

- These policies provide policyholders with the potential for higher returns compared to traditional life insurance policies because they allow them to participate in the gains of the stock market. However, they also come with a guaranteed minimum interest rate, safeguarding the investment against market downturns.

- The industry caters to individuals who seek life insurance coverage while also wanting to grow their savings through investments.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Equity Indexed Life Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Equity Indexed Life Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Equity Indexed Life Insurance Market Driver

Increased Insurance Accessibility To Drive The Equity Indexed Life Insurance Market

- Increasing accessibility to insurance products can significantly boost the equity indexed life insurance market. By making insurance easier to obtain, more people can participate in investment opportunities.

- Increased accessibility means more individuals can benefit from the potential returns and protection offered by equity indexed life insurance policies

- With a larger customer base, insurance companies are incentivized to innovate and compete more aggressively, leading to the development of new products, improved services, and potentially lower costs for consumers.

- Thus, increasing accessibility to insurance, including equity indexed life insurance, will drive market growth.

Equity Indexed Life Insurance Market Report Segmentation Analysis

- Based on mode, the equity indexed life insurance market is segmented into online and offline. The online segment is expected to hold a substantial equity indexed life insurance market share in 2023.

- The online segment is also expected to hold the highest CAGR over the forecast period.

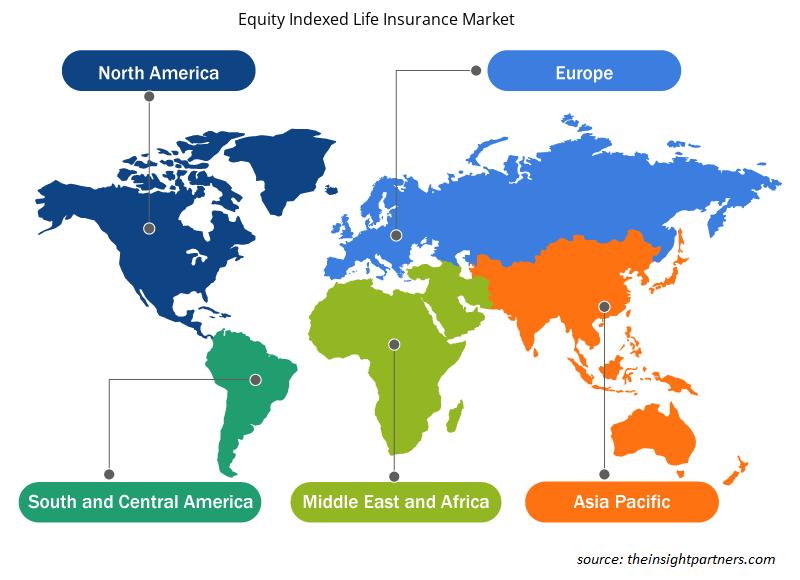

Equity Indexed Life Insurance Market Share Analysis By Geography

The scope of the equity indexed life insurance market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant equity indexed life insurance market share. The equity indexed life insurance market in North America has been experiencing steady growth. These policies offer a combination of life insurance protection and the potential for cash value accumulation linked to the performance of a stock market index. However, evolving market conditions might affect market growth in North America.

Equity Indexed Life Insurance Market Regional Insights

The regional trends and factors influencing the Equity Indexed Life Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Equity Indexed Life Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Equity Indexed Life Insurance Market

Equity Indexed Life Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.13 Billion |

| Market Size by 2031 | US$ 11.58 Billion |

| Global CAGR (2023 - 2031) | 13.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

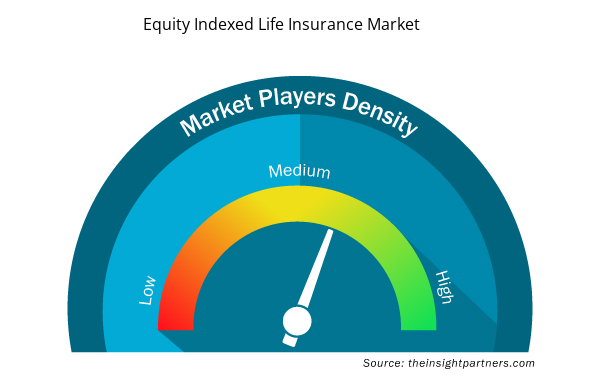

Equity Indexed Life Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Equity Indexed Life Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Equity Indexed Life Insurance Market are:

- Prudential Financial, Inc

- Penn Mutual

- American International Group, Inc

- Equitable Holdings, Inc

- MetLife Services and Solutions, LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Equity Indexed Life Insurance Market top key players overview

The "Equity Indexed Life Insurance Market Analysis" was carried out based on type, mode, distribution channel, and geography. On the basis of type, the market is segmented into whole life insurance, universal life insurance, variable universal life insurance, indexed universal life insurance, and others. On the basis of mode, the market is segmented into online and offline. Based on distribution channels, the market is segmented into insurance companies, agencies and brokers, and banks. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Equity Indexed Life Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the equity indexed life insurance market. A few recent key market developments are listed below:

- In January 2024, Ameritas and Ethos introduced a new index, universal life insurance, providing customers with the speed and convenience of a web-based process alongside the guidance of an agent. The new index universal life insurance will be offered exclusively through Ethos.

[Source: Ameritas, Company Website]

- In February 2024, Private life insurers Bajaj Allianz Life and non-banking finance corporation - microfinance institution (NBFC-MFI) Satin Creditcare Network Limited announced a strategic partnership with insurance broker Coverfox to boost life insurance accessibility in rural areas. Through this strategic partnership, customers of Satin Creditcare will be able to secure their loans with Bajaj Allianz Life’s insurance plans.

[Source: Bajaj Allianz Life, Company Website]

Equity Indexed Life Insurance Market Report Coverage & Deliverables

The equity indexed life insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Equity Indexed Life Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Mode, Distribution Channel and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The increasing economic growth and rising consumer awareness and education are the major factors that propel the global equity indexed life insurance market.

The global equity indexed life insurance market is expected to reach US$ 11.58 billion by 2031.

Product innovation is anticipated to play a significant role in the global equity indexed life insurance market in the coming years.

The key players holding majority shares in the global equity indexed life insurance market are Prudential Financial, Inc; American International Group, Inc; Symetra Life Insurance Company; AXA; and MetLife Services and Solutions, LLC.

The global equity indexed life insurance market was estimated to be US$ 4.13 billion in 2023 and is expected to grow at a CAGR of 13.8% during 2023 - 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Prudential Financial, Inc

- Penn Mutual

- American International Group, Inc

- Equitable Holdings, Inc

- MetLife Services and Solutions, LLC

- Symetra Life Insurance Company

- Protective Life Corporation

- John Hancock

- Mutual of Omaha Insurance Company

- Progressive Casualty Insurance Company

Get Free Sample For

Get Free Sample For