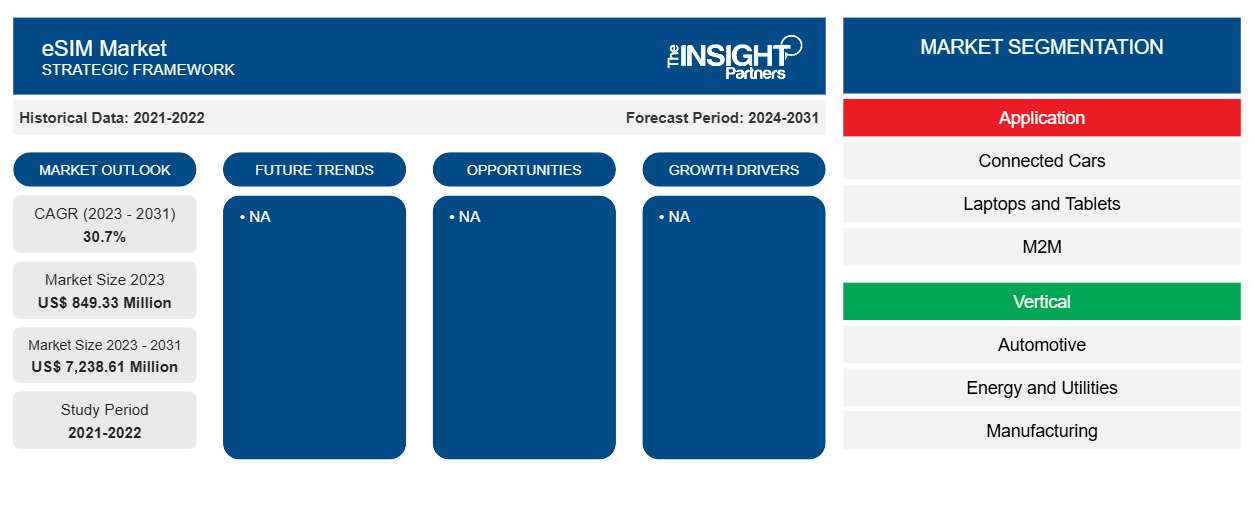

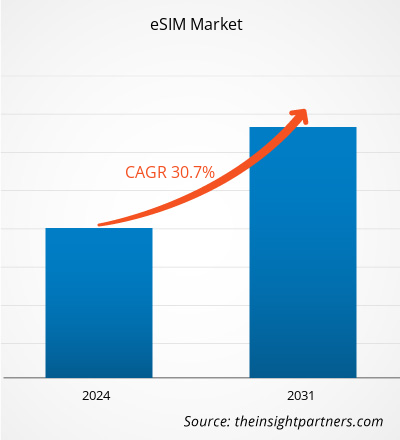

The eSIM Market size is projected to reach US$ 7,238.61 million by 2031 from US$ 849.33 million in 2023. The market is expected to register a CAGR of 30.7% in 2023–2031. The rising adoption of IoT technology among customers is likely to remain a key eSIM market trend.

eSIM Market Analysis

The eSIM market is growing at a rapid pace due to the growing focus on remote SIM provisioning for M2M and the rising demand for innovative consumer electronics devices among consumers. The market is expanding steadily, driven by favorable government regulations for M2M communication. Moreover, the rising demand for smart solutions is providing lucrative opportunities for market growth.

eSIM Market Overview

The eSIM, or embedded subscriber identity module, is a digital SIM card that is effortlessly integrated into a mobile device such as a tablet or smartphone. In contrast to traditional physical SIM cards, which may be removed and replaced, an eSIM is seamlessly incorporated into the device's hardware infrastructure and can be carefully programmed with a wide range of mobile network profiles. This functionality allows consumers to smoothly switch between carriers and easily launch or adjust their mobile plans without the requirement for physical SIM card replacement.

The introduction of eSIM in the automotive industry has allowed for greater flexibility in equipping trucks and automobiles with cellular connectivity through the implementation of additional functions. The automotive sector is planning to adopt the next generation of connected automobiles by supporting the GSMA Embedded SIM Specification for improved vehicle connectivity. This is intended to improve security for a variety of linked services. However, eSIM holds immense potential in the automotive industry and is anticipated to create growth opportunities during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

eSIM Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

eSIM Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

eSIM Market Drivers and Opportunities

Growing Focus on Remote SIM Provisioning for M2M to Favor Market

Remote provisioning allows users to download an operator profile to an in-market SIM and alter or delete subscriber identity module (SIM) profiles without physically accessing the SIM card. The eSIM card is an essential component for machine-to-machine (M2M) connections, which include simple and seamless mobile connections for all forms of linked devices. M2M requires pervasive connectivity across geographic regions. eSIM eliminates the inconvenience of changing service providers, increasing operational efficiency, and functions in a controlled and secure environment. The most recent eSIM cards ensure profile compatibility and provide a major platform for gamers to collaborate on common grounds.

Rising Demand for Smart Solutions – An Opportunity in eSIM

Various smart solutions, such as electric vehicles, smart cities, and smart meters, are increasingly being used around the world due to the flexibility and connection provided by loT infrastructure, accelerating smart cities and infrastructure growth in emerging nations. The evolution and expansion of networks, the lower cost of hardware components, including actuators and sensors, and the emergence of new business models are a few key factors that introduce services such as smart grid deployment, automatic security systems, connected cars, and many others. This resulting an increased investment in developing innovative intelligent solutions for customers. Thus, the increased need for smart solutions among numerous industries such as automotive, energy and utilities, manufacturing, retail, consumer electronics, transportation and logistics, and others are creating opportunities for eSIM market participants during the forecast period.

eSIM Market Report Segmentation Analysis

Key segments that contributed to the derivation of the eSIM market analysis are application and vertical.

- Based on application, the eSIM market is bifurcated into connected cars, laptops and tablets, M2M, smartphones, wearables, and others. The M2M segment held a larger market share in 2023.

- On the basis of vertical, the market is segmented into automotive, energy and utilities, manufacturing, retail, consumer electronics, transportation and logistics, and others. The consumer electronics segment held the largest share of the market in 2023.

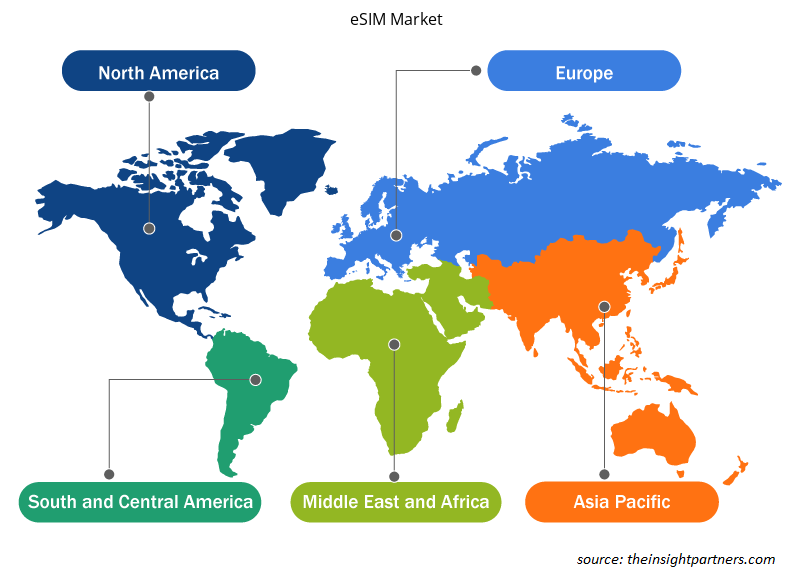

eSIM Market Share Analysis by Geography

The geographic scope of the eSIM market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. In terms of revenue, North America accounted for the largest eSIM market share, due to technological advancement.

Asia Pacific is projected to expand at a significant CAGR during the forecast period. The market in this region is segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. The presence of key smartphone players such as Huawei Technologies Co Ltd and Samsung Electronics Co Ltd have developed eSIM handsets, which accelerate the adoption of eSIM in the smartphone market. Moreover, eSIM is also represented as a future of SIM technology for connected devices. Additionally, various OEMs from countries such as China and India are creating eSIM solutions and forming collaborative development teams throughout the ecosystem to create tactical development paths. For example, in June 2021, IDEMIA, an eSIM manufacturing company, established a new production facility in India, which is expected to expand worldwide eSIM production capacity. According to German digital solutions firm Giesecke+Devrient (G&D), 25-30% of smartphones will feature eSIM functionality by the end of 2024. However, expansion of the smartphone industry associated with growing digitalization is creating opportunities for the market during the forecast period.

eSIM Market Regional Insights

eSIM Market Regional Insights

The regional trends and factors influencing the eSIM Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses eSIM Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for eSIM Market

eSIM Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 849.33 Million |

| Market Size by 2031 | US$ 7,238.61 Million |

| Global CAGR (2023 - 2031) | 30.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

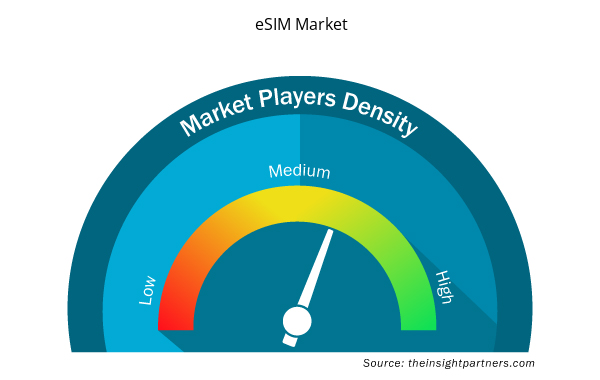

eSIM Market Players Density: Understanding Its Impact on Business Dynamics

The eSIM Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the eSIM Market are:

- DEUTSCHE TELEKOM AG

- Gemalto N.V.

- GieseckeDevrient GmbH

- IDEMIA

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS N.V.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the eSIM Market top key players overview

eSIM Market News and Recent Developments

The eSIM market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for eSIM and strategies:

- In February 2023, Amdocs Ltd collaborated with Drei Austria to launch an innovative eSIM solution, allowing the Austrian operator’s customers to enjoy the benefits of digital eSIM technology in a purely app-based experience. Drei Austria customers who use the up³ app can now manage their eSIM on devices produced by Apple, Google, Samsung, and more. (Source: Amdocs Ltd, Press Release, 2023)

- In December 2022, Grover announced the launch of its own mobile virtual network operator (MVNO) for tech rental customers, Grover Connect, in the US. With Grover Connect, US customers can easily activate any eSIM enabled technology device without any friction. The Grover eSIM is available to customers at check-out in the US and will be rolled out to its European markets in the near future. (Source: Grover, Press Release, 2022)

- In October 2022, Bharti Airtel Ltd launched “Always On” IoT connectivity solution in India. Airtel’s “Always On” solution comprises dual profile M2M eSim which allows an IOT device to always stay connected to a mobile network from different Mobile Network Operators (MNOs) in the eSIM. Airtel's solution is an AIS-140 compliant, dual profile M2M eSim, best suited for vehicle tracking providers, auto manufacturers, and any use-cases where equipment works in remote locations requiring ubiquitous connectivity. (Source: Bharti Airtel Ltd, Press Release, 2022)

eSIM Market Report Coverage and Deliverables

The “eSIM Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Vertical Farming Crops Market

- Electronic Health Record Market

- Fishing Equipment Market

- Trade Promotion Management Software Market

- Aesthetic Medical Devices Market

- Green Hydrogen Market

- Employment Screening Services Market

- Formwork System Market

- Personality Assessment Solution Market

- Semiconductor Metrology and Inspection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application ; Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global eSIM market was estimated to be US$ 849.33 million in 2023 and is expected to grow at a CAGR of 30.7% during the forecast period 2023 - 2031.

The growing focus on remote SIM provisioning for M2M and rising demand for innovative consumer electronics devices among consumers are the major factors that propel the global eSIM market.

The rising adoption of IoT technology among customers is anticipated to play a significant role in the global eSIM market in the coming years.

The key players holding majority shares in the global eSIM market are Deutsche Telekom AG, Thales SA, IDEMIA France SAS, Infineon Technologies AG, and NXP Semiconductors NV.

The global eSIM market is expected to reach US$ 7,238.61 million by 2031.

The incremental growth expected to be recorded for the global eSIM market during the forecast period is US$ 6,389.28 million.

Get Free Sample For

Get Free Sample For