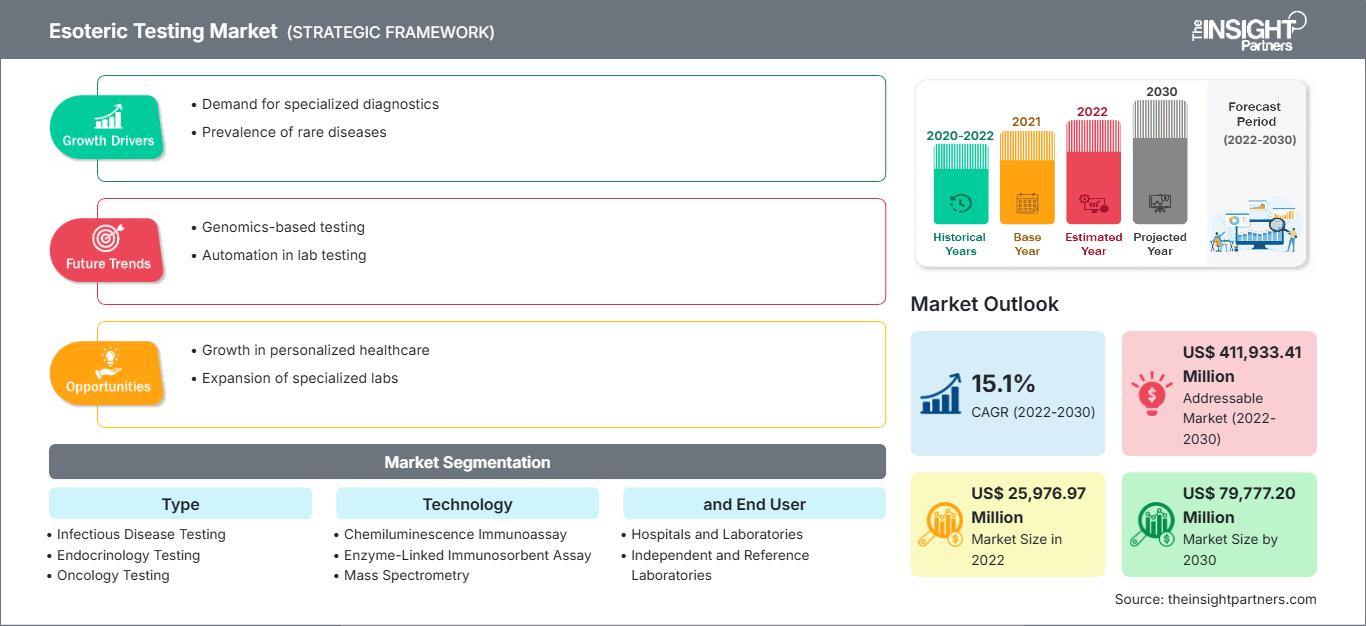

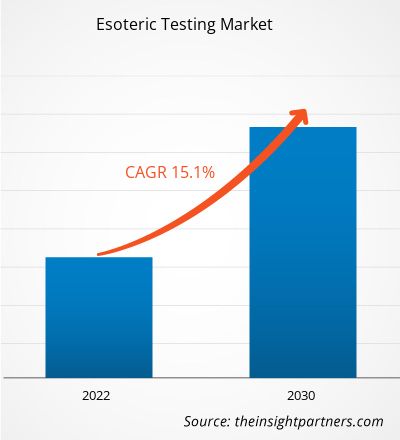

The esoteric testing market size is projected to grow from US$ 25,976.97 million in 2022 to US$ 79,777.20 million by 2030; the market is estimated to record a CAGR of 15.1% during 2022–2030.

Market Insights and Analyst View:

Esoteric testing is performed to test various samples for rare substances or molecules, and it is not performed as a part of routine testing. This segment of diagnostics requires highly skilled professionals along with advanced and complex equipment. They are principally performed in specialized laboratories wherein samples are either referred by physicians or hospitals (inpatient testing) or by patients themselves (outpatient testing). A few of these tests are currently based on the radioimmunoassay technique, which is both expensive and time-consuming. The COVID-19 pandemic provided significant growth prospects for the esoteric testing market in the last couple of years. The RT-PCR test is a common method that is in use for the qualitative identification of SARS-CoV-2 RNA extracted from upper and lower respiratory samples (obtained from nasopharyngeal or oropharyngeal swabs, sputum, etc.) collected from persons suspected of COVID-19.

Growth Drivers:

Rising Prevalence of Chronic Diseases Propels Esoteric Testing Market

Cancer Facts and Figures 2022, a report published by the American Cancer Society in January 2022, states that the US reported nearly 1.9 million new cases of cancer and 609,360 deaths related to the disease in 2022. According to a study published by the American Heart Association in 2021, more than 130 million adults in the US are likely to be suffering from some heart disease by 2035. The rising incidence of cancer along with a significant burden of other chronic diseases result in the need for precise diagnoses and treatments. As per the American Thyroid Association estimates, over 12% of the US population is expected to develop a thyroid condition in their lifetime. The surging incidence of hormonal disorders due to the widespread habit of consuming unhealthy food and the adoption of a sedentary lifestyle has led to endocrinology test uptake in North America. Endocrine tests are performed for the diagnosis of hormonal disorders such as pituitary thyroid adrenal bone, carcinoid and neuroendocrine, and parathyroid tumors.

Further, a rise in the incidences of chronic diseases and the introduction of specialized testing kits for dedicated therapeutic fields would support the rapid expansion of the esoteric testing market in the coming years. According to the WHO report from October 2021, 1 out of every 6 people worldwide would be aged 60 or more by 2030. People aged 60 and above are expected to spike from 1 billion in 2020 to 1.4 billion by 2050. As the geriatric population becomes more susceptible to genetic and chronic diseases, there will be a significant increase in demand for esoteric tests over the forecast period.

As per the CDC, in September 2022, a total of 420 new West Nile virus disease cases were reported to the CDC, of which 65% were neuroinvasive diseases and 35% were non-neuroinvasive diseases. These rare diseases can be easily detected using esoteric tests for infectious diseases, boosting the market growth for esoteric testing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Esoteric Testing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “esoteric testing market” is segmented on the basis of type, technology, and end user. Based on type, the market is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. In terms of technology, the esoteric testing market is divided into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. In terms of end user, the market is categorized into hospitals and laboratories, and independent and reference laboratories.

Segmental Analysis:

The esoteric testing market, by type, is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. The oncology testing segment held the largest market share in 2022. The infectious disease testing segment is anticipated to register the highest CAGR during 2022–2030.

Based on technology, the esoteric testing market is segmented into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. The chemiluminescence immunoassay segment held the largest market share in 2022. The enzyme-linked immunosorbent assay segment is anticipated to register the highest CAGR of 18.7% during 2022–2030.

Based on end user, the esoteric testing market is segmented into hospitals and laboratories, and independent and reference laboratories. The hospitals and laboratories segment held a larger share of the market in 2022. It is further expected to register a higher CAGR of 15.2% during 2022–2030.

Regional Analysis:

The global esoteric testing market is segmented into Asia Pacific, Europe, the Middle East & Africa, North America, and South & Central America. In 2022, North America held the largest share of the market. Asia Pacific is expected to register the highest CAGR in the esoteric testing market during 2022–2030.

The esoteric testing market in North America is split into the US, Canada, and Mexico. The market in the US is majorly driven by the soaring prevalence of chronic diseases and growing awareness regarding the early detection of medical conditions. Esoteric tests are generally performed for the analysis of rare and unique substances that are not included in regular tests. For performing these tests, clinical laboratories require expertise in relevant specialties. Therefore, large commercial laboratories outsource these complex tests to reference and esoteric testing laboratories. A few of the labs performing esoteric testing in the US are Quest Diagnostics Incorporated, Mayo Medical Laboratories, ARUP Laboratories, Myriad Genetics, Genomic Health, Foundation Medicine, and Laboratory Corporation of America. The number of laboratories having the capability to perform these specialized tests is further increasing in the country.

As per an article published by the Endocrine Society in January 2022, hypogonadism is a common condition among males in the US, with a higher prevalence in older and obese men as well as in men with type 2 diabetes; 35% of men aged more than 45 and 30–50% of men with type 2 diabetes or obesity are estimated to have hypogonadism. Moreover, as per the US Census Bureau’s estimation, the incidences of hypogonadism in men aged 65 years and more grew from ~35 million in 2000 to ~55 million by 2020. The number is further estimated to rise to ~87 million by 2050. The surging prevalence of this condition is associated with the growing geriatric population in the US. As per Statista, 51,642 adults in the US died from liver disease in 2020. Chronic liver disease/cirrhosis was ranked 12th among the leading causes of mortality in the US in 2020; an increase in the incidences of alcoholic cirrhosis is a major risk factor for this disease.

Thus, the burgeoning cases of hypogonadism, hepatic cirrhosis, and other similar diseases are driving the growth of the global esoteric testing market.

Esoteric Testing Market Regional InsightsThe regional trends and factors influencing the Esoteric Testing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Esoteric Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Esoteric Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 25,976.97 Million |

| Market Size by 2030 | US$ 79,777.20 Million |

| Global CAGR (2022 - 2030) | 15.1% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Esoteric Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Esoteric Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Esoteric Testing Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the esoteric testing market are listed below:

- In March 2022, Waters Corporation launched the Xevo TQ Absolute system, a compact benchtop tandem mass spectrometer. This highly sensitive, latest mass spectrometer quantifies negatively ionizing compounds with up to 15-fold greater sensitivity than its predecessor, with a 45% smaller size and up to 50% less electricity and gas consumption.

- In February 2021, Quest Diagnostics collaborated with Grail for its Galleri multicancer blood tests. Quest Diagnostics had plans to provide phlebotomy services using the Galleri multicancer early-detection blood tests.

Competitive Landscape and Key Companies:

Georgia Esoteric & Molecular Laboratory LLC, Laboratory Corp of America Holdings, Quest Diagnostics Inc., National Medical Services Inc., OPKO Health Inc., ARUP Laboratories Inc., bioMONTR Labs, Athena Esoterix LLC, Stanford Hospital & Clinics, and Foundation Medicine Inc. are among the prominent companies in the esoteric testing market. These companies focus on the introduction of new technologies, upgrading of existing products, and expansion of their geographic reach to meet the growing consumer demand worldwide.

Frequently Asked Questions

What is Esoteric Testing Market?

What are the driving factors for the Esoteric Testing Market?

Which segment is dominating the Esoteric Testing Market?

Who are the major players in the Esoteric Testing Market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For