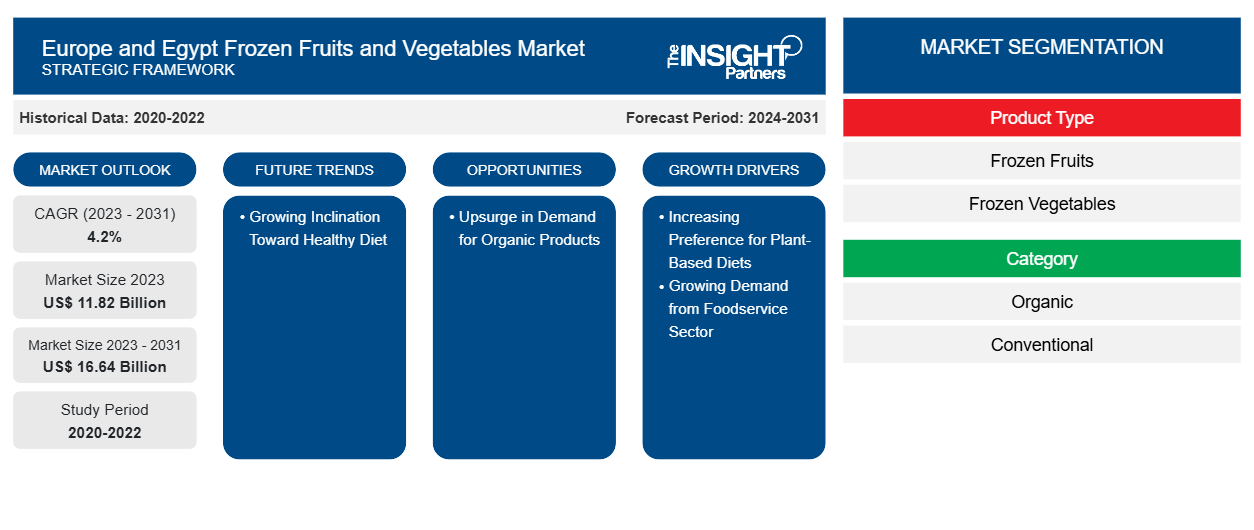

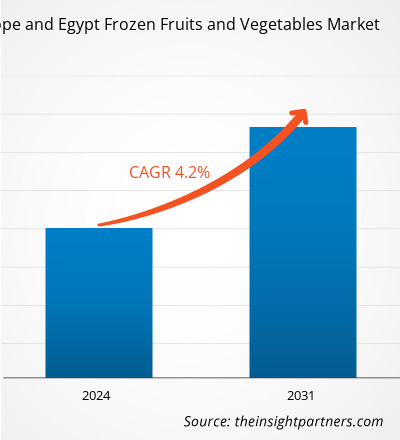

The Europe and Egypt frozen fruits and vegetables market is projected to grow from

US$ 11.82 billion in 2023 to US$ 16.64 billion by 2031. The market is expected to record a CAGR of 4.2% from 2023 to 2031.

Frozen fruits and vegetables include a variety of fruits and vegetables such as potatoes, carrots, peas, corn, tomatoes, broccoli, cauliflower, cabbage, artichokes, strawberries, raspberries, black currants, citrus fruits, apples, and stone fruits. Freezing increases the shelf life of fresh fruits and vegetables and makes them available all year round, eliminating the issues of seasonality, weather fluctuations, and crop yield. The demand for frozen fruits and vegetables is increasing across Europe and Egypt due to rising requirements from the food processing, foodservice, and retail sectors. With rising consumer preference for vegetarian and vegan food in European countries such as Germany, Poland, the UK, and Italy as well as Egypt due to the increasing awareness regarding the health benefits of plant-based diets, the demand for frozen fruits and vegetables across the supermarket is increasing. Also, food processors and foodservice operators, especially cafes and QSRs, rely on frozen fruits and vegetables to reduce their dependence on fresh produce and minimize the turnaround time (TAD). These factors significantly drive the Europe and Egypt frozen fruits and vegetables market growth.

Growth Drivers and Challenges:

Frozen fruits and vegetables have extended shelf life which offers convenience to various end users. In countries such as Germany, the UK, and Sweden, there is a surge in demand for frozen fruits and vegetables owing to a rise in the popularity of vegetarian and vegan lifestyles. In Egypt, the increasing preference for plant-based diets is influenced by cultural and religious factors and rising awareness regarding the health benefits of fruits and vegetables consumption. Frozen fruits such as mangoes, guavas, and strawberries are highly used in making traditional Middle Eastern desserts, including smoothies and fruit salads. Additionally, okra, peas, green beans, and other frozen vegetables are commonly used in Egyptian dishes such as tagines, stews, and side dishes, providing households with convenient options to prepare nutritious meals at home. The increasing preference for plant-based diets is a crucial driver of the growing demand for frozen fruits and vegetables in Europe and Egypt, offering convenient and nutritious options for consumers seeking to adopt healthier and more sustainable dietary habits. Thus, increasing demand for plant-based food contributes to the growing Europe and Egypt frozen fruits and vegetables market size.

Further, restaurants, cafes, hotels, and catering services strive to meet consumer preferences for high-quality ingredients. In such a scenario, frozen fruits and vegetables emerge as a practical solution to ensure consistency, convenience, and cost-effectiveness in their operations. In Europe, renowned chains such as Pret A Manger, Wagamama, and Nando's have integrated frozen produce into their menus to maintain standards and streamline kitchen operations across numerous locations.

One key advantage of using frozen fruits and vegetables in the food service industry is the preservation of freshness and nutritional value. Frozen produce is often picked and flash-frozen at its peak ripeness, locking in nutrients and flavors. This allows chefs and kitchen staff to access a wide range of frozen fruits and vegetables regardless of seasonal limitations, ensuring a consistent supply of ingredients for menu items. For instance, European restaurants can offer fruit smoothies, salads, and fruit-based desserts year-round by incorporating frozen berries, mango chunks, and pineapple slices into their recipes. These factors play an important role in determining the Europe and Egypt frozen fruits and vegetables market forecast.

Supply chain challenges stem from various factors such as seasonality, transportation issues, and storage constraints. Climate varies widely across Europe. Fluctuations in harvest seasons can lead to imbalances in supply and demand for frozen produce. For instance, adverse weather conditions or crop failures in one region may disrupt the availability of certain fruits or vegetables, causing price fluctuations and supply chain disruptions throughout the market. In Egypt, while the climate is generally stable, logistical challenges such as inadequate infrastructure and transportation networks can hinder the efficient movement of frozen products from farms to processing facilities and distribution centers. Thus, disruptions in supply chain hamper the Europe and Egypt frozen fruits and vegetables market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The Europe and Egypt frozen fruits and vegetables market analysis considers the following segments: product type, category, and end user. Based on product type, the market is segmented as fruits and vegetables. The fruits segment is further bifurcated into citrus fruits, berries, tropical fruits, and other frozen fruits. The vegetable segment is bifurcated into roots, cruciferous, leafy greens, and other frozen vegetables. The Europe and Egypt frozen fruits and vegetables market, by category, is segmented as organic and conventional. By end user, the market is bifurcated into foodservice, food retail, and food processing.

Segmental Analysis:

Based on category, the Europe and Egypt frozen fruits and vegetables market is segmented into organic and conventional. The conventional segment holds a significant Europe and Egypt frozen fruits and vegetables market share in 2023. Conventional frozen products are often more affordable than their organic counterparts, making them accessible to a broader range of consumers. Furthermore, freezing technologies and packaging innovations have improved the quality and shelf life of conventional frozen fruits and vegetables. This contributes to their growing popularity among consumers seeking convenient, cost-effective food options. Overall, the demand for conventional frozen fruits and vegetables is rising due to their convenience, affordability, and improved quality, meeting the needs of consumers with busy lifestyles. These factors boost the market growth for the segment.

Country Analysis:

The scope of the Europe and Egypt frozen fruits and vegetables market report focuses on Germany, France, Italy, the UK, Russia, Poland, , Ukraine, the Rest of Europe, and Egypt. In Europe, Germany holds significant Europe and Egypt frozen fruits and vegetables market share in 2023.

Consumers in Europe and Egypt have a growing emphasis on health and wellness, leading to an increased awareness of the importance of consuming a balanced diet rich in fruits and vegetables. With busy lifestyles and limited time for meal preparation, frozen produce offers a convenient and accessible solution for individuals looking to incorporate more fruits and vegetables into their daily diets. Moreover, frozen fruits and vegetables are harvested at peak ripeness and quickly frozen, locking in essential nutrients, vitamins, and antioxidants. This preservation process ensures that frozen produce retains its nutritional value, making it a viable alternative to fresh produce for health-conscious consumers seeking convenient and nutritious food options.

Europe is one of the largest importers of frozen vegetables, especially frozen mixed vegetables and peas. Owing to the growing preference for organic and vegan diets, the demand for several seasonal vegetables and fruits is high in Europe. However, the availability of fresh produce is impacted by factors such as spoilage during transportation and warehousing, lack of domestic production, and high prices. Therefore, European food processors and foodservice operators depend on frozen seasonal vegetables and fruits, which drives the Europe and Egypt frozen fruits and vegetables market growth significantly.

Moreover, innovative packaging solutions and portion-controlled servings make it easier for consumers to manage their calorie intake and adhere to healthy eating guidelines. By leveraging this trend and offering a wide range of nutritious, convenient, and flavorful frozen fruit and vegetable products, companies in Europe and Egypt can tap into a growing market and position themselves as leaders in promoting health and wellness through frozen foods. Thus, growing inclination toward healthy diets is expected to create new Europe and Egypt frozen fruits and vegetables market trends during the forecast period.

Industry Developments and Future Opportunities:

As per company press releases, initiatives taken by key players operating in the Europe and Egypt frozen fruits and vegetables market are listed below:

- In May 2021, Bonduelle Group launched three new products—lentils, chickpeas, and bulgur—in the frozen foods segment under Bonduelle. The company claims that these new convenience products are natural, 100% France origin, and contain no additives or preservatives. The product packaging contains a QR code that links to various recipes.

Competitive Landscape and Key Companies:

Greenyard, Bonduelle Group, General Mills Inc, Conagra Brands Inc, Goya Foods Inc, Nature's Touch Frozen Foods, Crop's Fruit NV, Dole Packaged Foods LLC, CROP’S UK, and Foodnet Ltd are among the prominent players profiled in the Europe and Egypt frozen fruits and vegetables market report. These market players adopt strategic development initiatives to expand their businesses, further driving the market.

Report ScopeEurope and Egypt Frozen Fruits and Vegetables Market Regional Insights

The regional trends and factors influencing the Europe and Egypt Frozen Fruits and Vegetables Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe and Egypt Frozen Fruits and Vegetables Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe and Egypt Frozen Fruits and Vegetables Market

Europe and Egypt Frozen Fruits and Vegetables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11.82 Billion |

| Market Size by 2031 | US$ 16.64 Billion |

| Global CAGR (2023 - 2031) | 4.2% |

| Historical Data | 2020-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

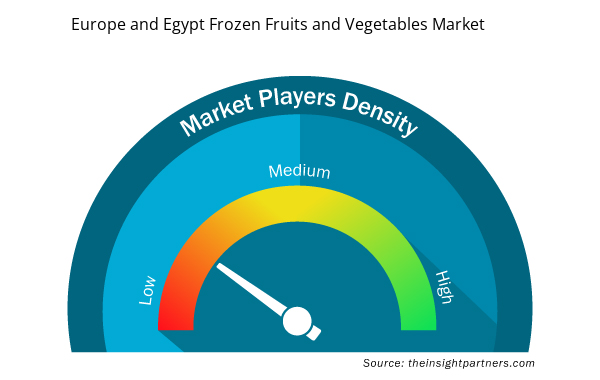

Europe and Egypt Frozen Fruits and Vegetables Market Players Density: Understanding Its Impact on Business Dynamics

The Europe and Egypt Frozen Fruits and Vegetables Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe and Egypt Frozen Fruits and Vegetables Market are:

- Greenyard

- Bonduelle SA

- General Mills Inc

- Conagra Brands Inc

- Goya Foods Inc

- Nature's Touch Frozen Foods

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe and Egypt Frozen Fruits and Vegetables Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Europe and Egypt Frozen Fruits and Vegetables Market

- Greenyard

- Bonduelle Group

- General Mills Inc

- Conagra Brands Inc

- Goya Foods Inc

- Nature's Touch Frozen Foods

- Crop's Fruit NV

- Dole Packaged Foods LLC

- CROP’S UK

- Foodnet Ltd

Get Free Sample For

Get Free Sample For