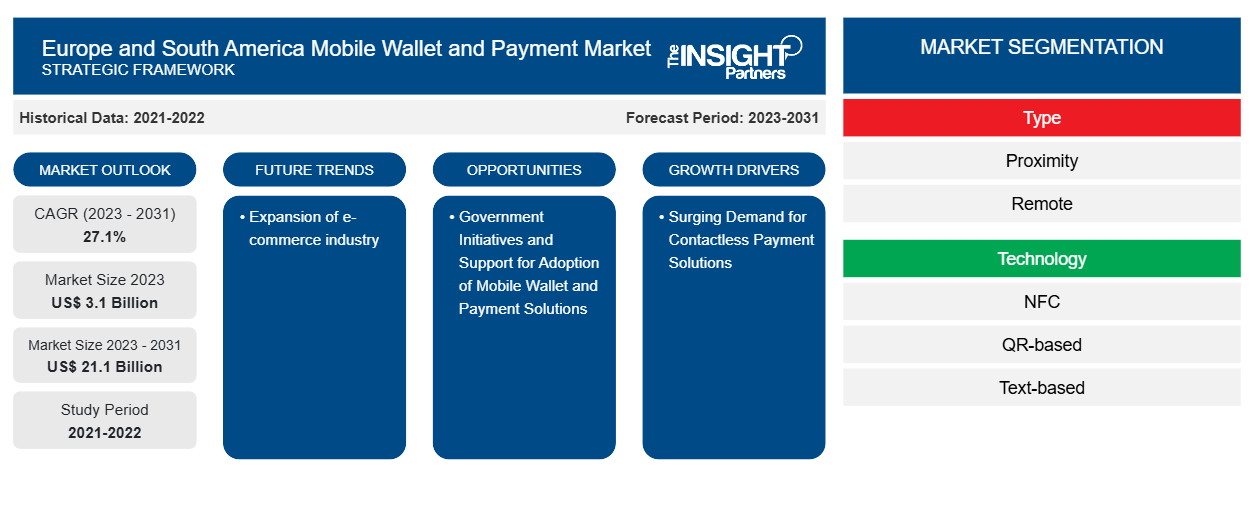

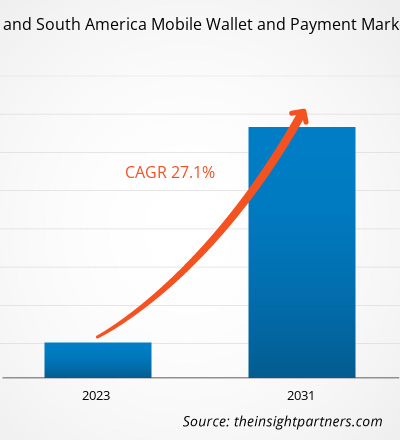

The Europe and South America mobile wallet and payment market size was valued at US$ 3.1 billion in 2023 and is expected to reach US$ 21.1 billion by 2031. The market is estimated to record a CAGR of 27.1% from 2023 to 2031. The expansion of the e-commerce industry is expected to be a significant trend in the market.

Europe and South America Mobile Wallet and Payment Market Analysis

Mobile wallet payment enables users to make financial transactions using smartphones, tablets, or other mobile devices. It allows users to send money or make payments through apps through methods such as cards, UPI, and QR codes (scanned mobile devices). Mobile payments involve securely communicating information between a mobile device and a merchant's payment system. This can be accomplished through NFC (i.e., Near-Field Communications), which allows contactless payments by tapping the cards against a suitable payment terminal. The mobile wallet and payment market has evolved dramatically over time. It began with simple SMS-based payment systems and has progressed to incorporate modern technologies such as NFC and biometrics for secure authentication. The implementation of UPI (i.e., Unified Payments Interface) has transformed mobile wallets and payments by allowing users to make smooth peer-to-peer transactions directly from bank accounts. The future of the mobile wallet and payment market is highly promising owing to continuous advancements in technologies, ease of use, and reinforcement of security measures. The emergence of mobile app payment gateways such as the Razorpay mobile app has allowed businesses to easily and securely accept UPI payments, NFC payments, and payments via POS terminals. Moreover, the evolution of the digital transactions landscape allows continuous progress in the Europe and South America mobile wallet and payment market

Europe and South America Mobile Wallet and Payment Market Overview

A mobile wallet is a type of virtual wallet that contains credit card, debit, loyalty card information, tickets, and other digital assets. It is accessed through an app installed on mobile devices such as smartphones or tablets. A mobile wallet allows users to pay for everyday services directly from their smartphones or other mobile devices, eliminating the need to carry cash or cards. It is not only handy but also safer and faster and enables users to make contactless payments. Furthermore, wallets such as Google Pay and Apple Pay securely store credit card information and allow users to make payments both online and in stores. The rising demand for mobile wallets and payment reflects a substantial shift in financial transaction methods.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe and South America Mobile Wallet and Payment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe and South America Mobile Wallet and Payment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe and South America Mobile Wallet and Payment Market Drivers and Opportunities

Surging Demand for Contactless Payment Solutions Favors Market Growth

Contactless payment solutions have gained significant popularity in European and South American countries, as they eliminate the need to carry cash for making purchases. Contactless payments, which include NFC-based and QR code-based transactions, are becoming more popular among consumers in Europe and South America owing to their ability to accelerate financial transactions. The demand for quick, safe, and clean payment methods has surged significantly since the onset of the COVID-19 pandemic. These methods have transformed the checkout experience in both physical and digital stores, making transactions more convenient for consumers.

Government Initiatives and Support for Adoption of Mobile Wallet and Payment Solutions to Create Growth Opportunities in Market

Mobile wallet and payment solutions feature high accessibility, improve security, lower transactional costs, and accelerate payments for consumers and businesses. These solutions come with two-factor authentication (2FA), making transactions secure and seamless. Governments of different European and South American countries are taking initiatives to encourage the adoption of mobile wallets and payment solutions along with securing their businesses from financial risks by reducing additional financial costs. In March 2024, the European Commission (EU) implemented a new instant payments legislative proposal, which would be effective from December 2024 onward. Payment service providers in eurozone countries are expected to reach their first milestone nine months after the legislation goes into effect. The implementation of this instant payments legislation by the European Commission is likely to make transfers more secure and economical. The proposal mandates all payment service providers who offer regular euro credit transfers to enable immediate payments in the Single European Payments Area (SEPA).

Europe and South America Mobile Wallet and Payment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe and South America mobile wallet and payment market analysis are type, technology, and end user.

- Based on type, the market is categorized into remote and proximity. The proximity segment dominated the Europe and South America mobile wallet and payment market, with a larger share, in 2023.

- On the basis of technology, the market is divided into NFC, QR code, text-based, and others. The QR code segment dominated the market in 2023.

- Based on end user, the Europe and South America mobile wallet and payment market is segmented into personal and business. The personal segment dominated the market in 2023.

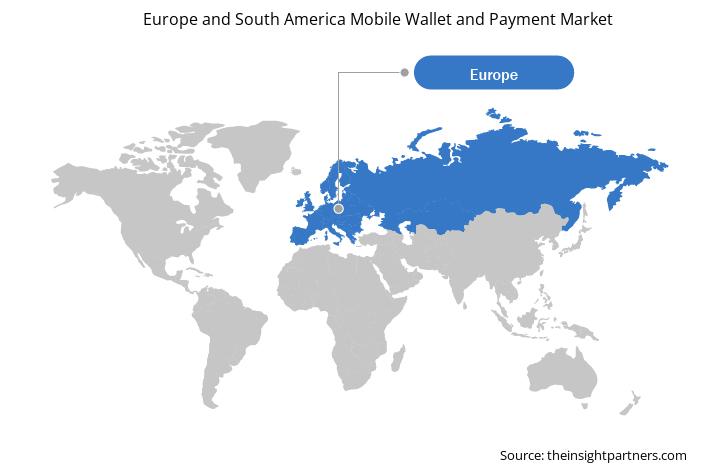

Europe and South America Mobile Wallet and Payment Market Share Analysis by Geography

The geographic scope of the Europe and South America mobile wallet and payment market report is mainly divided into two regions: Europe and South America. Europe dominated the market in 2023. The popularity of mobile payment and digital wallet services is on the rise in the region, with an upsurge in the involvement of internet users in online shopping. At present, laptops and desktop computers are the primary devices utilized for making purchases on the Internet; however, there is a prominent trend of using mobile devices such as smartphones and tablets for making these purchases. Further, the number of Europeans who are likely to conduct online transactions through their mobile devices is estimated to rise, propelling the demand for mobile payments and digital wallet solutions. Globally used e-wallets such as PayPal, Apple Pay, and Google Wallet have a significant market in Europe. However, local startups are quickly emerging rapidly to challenge these international giants. The use of digital wallets is also increasing with the growing consumer preference for making digital payments to complete cross-border transactions.

Europe and South America Mobile Wallet and Payment Market Regional Insights

The regional trends and factors influencing the Europe and South America Mobile Wallet and Payment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe and South America Mobile Wallet and Payment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe and South America Mobile Wallet and Payment Market

Europe and South America Mobile Wallet and Payment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.1 Billion |

| Market Size by 2031 | US$ 21.1 Billion |

| Global CAGR (2023 - 2031) | 27.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

Europe and South America Mobile Wallet and Payment Market Players Density: Understanding Its Impact on Business Dynamics

The Europe and South America Mobile Wallet and Payment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe and South America Mobile Wallet and Payment Market are:

- Apple Inc

- Alphabet Inc

- AT and T Inc

- Paypal Holdings Inc

- Samsung Electronics Co Ltd, Mastercard Inc

- Fitbit LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe and South America Mobile Wallet and Payment Market top key players overview

Europe and South America Mobile Wallet and Payment Market News and Recent Developments

The Europe and South America mobile wallet and payment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes critical corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Samsung Electronics Co Ltd announced a partnership on a newly launched Mastercard program—Wallet Express. The service provides banks and card issuers with a swift and cost-effective means of expanding their digital wallet offerings. (Source: Samsung Electronics Co Ltd, Press Release, December 2023)

- Samsung Electronics Co Ltd announced the availability of Samsung Wallet in eight new markets—Australia, Brazil, Canada, Hong Kong, India, Malaysia, Singapore, and Taiwan. Samsung Wallet is a secure, go-everywhere app to conveniently organize and use daily essentials. (Source: Samsung Electronics Co Ltd, Press Release, January 2023)

Europe and South America Mobile Wallet and Payment Market Report Coverage and Deliverables

The "Europe and South America Mobile Wallet and Payment Market Size and Forecast (2020–2030)" report provides a detailed analysis of the market covering below areas:

- Europe and South America mobile wallet and payment market size and forecast at regional and country levels for all the key market segments covered under the scope

- Europe and South America mobile wallet and payment market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Europe and South America mobile wallet and payment market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe and South America Mobile Wallet and Payment market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Military Rubber Tracks Market

- Helicopters Market

- Lyophilization Services for Biopharmaceuticals Market

- Mice Model Market

- Hot Melt Adhesives Market

- Influenza Vaccines Market

- Hair Extensions Market

- Latent TB Detection Market

- Emergency Department Information System (EDIS) Market

- Collagen Peptides Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to reach a value of US$ 21.10 billion by 2031.

Surging demand for contactless payment solutions and government initiatives and support for adoption of mobile wallet and payment solutions are driving the market growth.

The market is anticipated to expand at a CAGR of 27.1% during 2023-2031.

Google, Inc., Apple, Inc., American Express, PayPal Holdings, and Samsung Pay are major players in the market.

Expansion of e-commerce industry is a key trend in the market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies - Europe and South America Mobile Wallet and Payment Market

- Apple Inc

- Alphabet Inc

- AT&T Inc

- PayPal Holdings Inc

- Mastercard Inc

- Samsung Electronics Co Ltd

- American Express Co

- Visa Inc

- ACI Worldwide Inc

- Thales SA

Get Free Sample For

Get Free Sample For