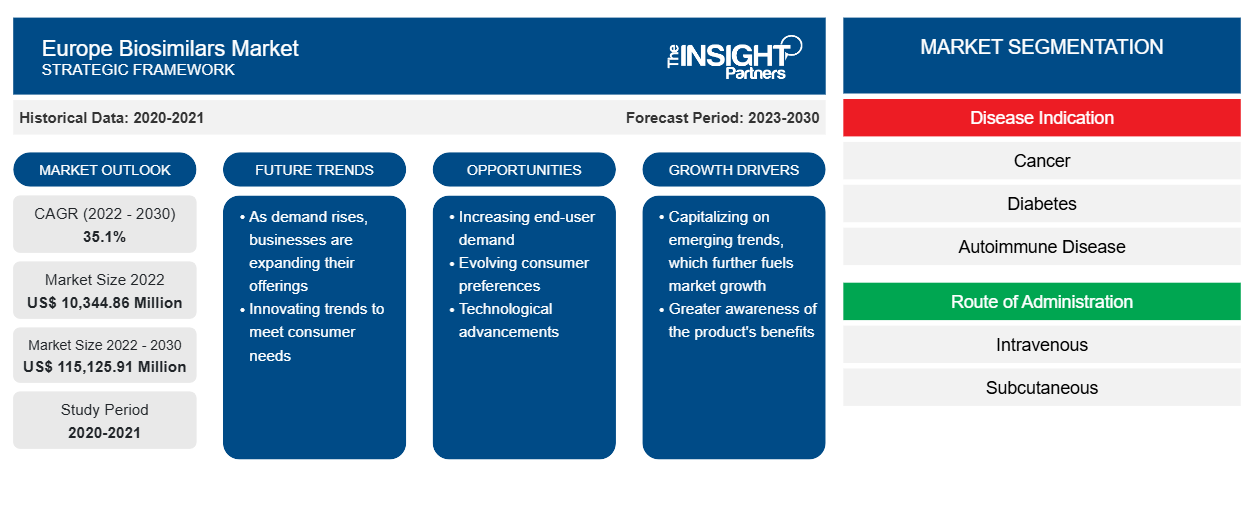

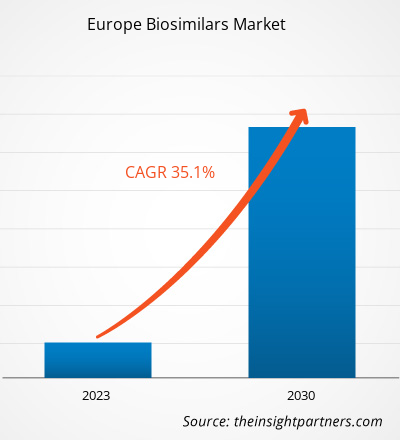

The Europe biosimilars market size is expected to grow from US$ 10,344.86 million in 2022 to US$ 115,125.91 million by 2030; it is estimated to grow at a CAGR of 35.1% from 2022 to 2030.

Analyst’s ViewPoint

One of the most impacting factors responsible for influential growth of Europe biosimilars market is the increasing prevalence of chronic diseases. Further, patent expiry of blockbuster biologics acts as a future trend for the market to grow during 2022–2030. According to the segmentation profiled in the report, based on disease indication, the cancer segment accounts the highest share; based on route of administration, the intravenous segment dominates the market accounting maximum share. In terms of drug class, the granulocyte colony-stimulating factor segment will account considerable share of the biosimilars market and will dominate the market during the forecast period. By distribution channel, the rheumatologists segment is likely to account for a maximum share during 2022–2030.

Biosimilars are safe and effective treatment options intended for many illnesses, such as chronic skin and bowel diseases (psoriasis, irritable bowel syndrome, Crohn's disease and colitis), arthritis, kidney conditions, and cancer. Also, biosimilars increase access to lifesaving medications at potentially lower costs.

Market Insights

Increasing Prevalence of Chronic Diseases

Increasing aging population, changing social behavior, and rising adoption of a sedentary lifestyle by people, along with accelerating urbanization, boost the prevalence of obesity and various chronic diseases, such as diabetes. Also, twin studies have long established that genes can cause chronic conditions such as cardiovascular disease (CVDs), diabetes, obesity, Alzheimer's disease (AD), and depression.

As per the World Health Organization (WHO) report, chronic diseases are a leading cause of mortality in Europe, with complex conditions such as diabetes accounting for a large burden. The European Chronic Disease Alliance 2022 report reveals that chronic diseases such as heart disease, stroke, cancer, chronic respiratory diseases, and diabetes are major causes of mortality in Europe, representing 77% of the total disease burden and 86% of all deaths.

Recognition of biosimilars as efficacious and safe agents by patients, specialists, primary care clinicians, and other healthcare professionals is propelling the demand for biosimilars. In addition, biosimilars help improve the quality of life for millions of patients while saving billions of dollars of the healthcare system per year. They are effective and cost-effective options in treating many diseases, including chronic skin conditions and bowel diseases such as Crohn's disease, psoriasis, irritable bowel syndrome, and colitis; diabetes; autoimmune disease; cancer; kidney conditions; and arthritis.

According to the American Society of Clinical Oncology 2023 report, in the European Union (EU), the first biosimilar was approved in 2006, and since then, the European Medicines Agency (EMA) approved 99 biosimilars for a wide range of therapeutic areas. By 2020, biosimilar adoption in Europe achieved a positive impact on market competition, generating cost savings of US$ 5.7 billion.

As the prevalence of chronic diseases is increasing at a high rate in Europe, the demand for biosimilars in treating life-threatening illnesses has progressed rapidly over the last five years, which is driving the biosimilars market in Europe accounting considerable market share.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Disease Indication Insights

Based on disease indication, the Europe biosimilars market is segmented as cancer, diabetes, autoimmune diseases, and other disease indications. The cancer segment held the largest market share in 2022 and will account a significant CAGR in the biosimilars market during the forecast period. Biosimilars have been used in many disease areas, including oncology. They are safe and effective. Also, they lower drug costs and are accessible to more patients worldwide. The treatment of cancer continues to place a significant burden on healthcare systems, with the number of cancer cases continuing to rise due to an aging population.

According to the Centers for Disease Control and Prevention (CDC), each year in the UK, ~24,500 men and 10,000 women are diagnosed with cancer, and ~18,600 men and 9,000 women die from the disease. The incidence of cancer has been rising for several decades. Liver cancer is more common in other parts of the world than in the UK. Moreover, according to an article published in Chinese Clinical Oncology (CCO), hepatocellular cancer (HCC) is a leading cause of cancer death worldwide.

A few biosimilars have been approved to treat certain types of cancer, and some have been approved to help manage side effects. FDA-approved biosimilars can be used to treat breast, stomach, colorectal, and other cancers and can also be used to treat side effects of cancer treatments, such as low white blood cell counts that increase the risk of infections. Owing to the above-mentioned factors, the Europe biosimilars market for the segment is likely to propel during the forecast period.

Route of Administration Insights

Based on route of administration, the Europe biosimilars market is segregated as intravenous, subcutaneous, and others. The intravenous segment accounted the largest market share in 2022 and is expected to grow at the highest CAGR during the forecast period. Biosimilars are taken in the same form (injection or intravenous) and dose as the related biologic medication. Patients receiving chemotherapy or other IV therapies might prefer IV administration of trastuzumab to injection as they already have a central venous port in place. Avoiding an additional injection might be preferred over potential time savings. Owing to the above-mentioned factors, the Europe biosimilars market for the segment is likely to propel during the forecast period.

Drug Class Insights

In terms of drug class, the Europe biosimilars market is segmented as granulocyte colony-stimulating factor, insulin, TNF blockers & monoclonal antibodies, and others. The TNF blockers segment accounted the largest biosimilars market share in 2022. The tumor necrosis factor (TNF) blockers are drugs used to stop inflammation and treat inflammatory conditions such as rheumatoid arthritis (RA), psoriatic arthritis, juvenile idiopathic arthritis, inflammatory bowel disease (Crohn's and ulcerative colitis), ankylosing spondylitis, and psoriasis. TNF is currently targeted by four monoclonal antibodies: infliximab, adalimumab, golimumab, and certolizumab. All these agents are effective in the treatment of rheumatoid arthritis (RA), and clinical studies have established their clinical efficacy and their radiographic effectiveness.

Amgen Inc offers FDA-approved biosimilar products Avsola and Riabni for the treatment of RA. Thus, increase in cases of diseases and rise in product approval are driving the Europe biosimilars market for the segment.

Distribution Channel Insights

By distribution channel, the Europe biosimilars market is segmented as endocrinologists, immunologists, rheumatologists, oncologists, dermatologists, retina compounding, and others. The rheumatologists segment held the largest market share in 2022, and the endocrinologists segment will register highest CAGR during the forecast period. Confidence in biosimilars is growing among rheumatologists. The first biosimilar in rheumatology was commercially available through the launching of "Inflectra," an infliximab biosimilar (Remicade). There are four infliximab biosimilars approved, among which three are available in the market with two biosimilars approved. In a survey conducted, 76% of rheumatologists revealed that they were familiar with biosimilars, which was higher than 53% in 2020. Additionally, in 2020, rheumatologists were more comfortable prescribing biosimilars to patients, with 52% revealing that they were comfortable in 2022 compared to 41% in 2020. Therefore, in the coming years, rheumatologists will experience a new way of biosimilars with approved "Adalimumab" biosimilars and launching of the new innovative biosimilars such as "Amjevita" from Amgen, which is anticipated to launch in January 2023. Factors mentioned above will enhance the Europe biosimilars market growth for the segment accounting considerable market share.

Coagulation analyzers Market, by Disease Indication – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis

The European biosimilars market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. The growth in the region is driven by growing cardiovascular diseases, increasing thoracic surgeries, increasing incidence of pneumothorax well-developed healthcare infrastructure, an increase in lung transplantation and active key players in the region. Germany accounts maximum share for the Europe biosimilars market. Biosimilars introduce competition and increase the affordability of biologics, which ultimately deliver savings and value-added services to support patient care and the healthcare community. Healthcare professionals can treat more patients with high-quality biologics while reducing spending. For example, in Germany, according to Sandoz, the number of daily therapeutic doses of an anti-TNF medicine increased by 29% (from 17.18 to 22.18 million) after introducing biosimilars in 2022.

Germany has achieved acceptance of biosimilars with payers, providers, and patients as an integral part of appropriate medicine use. There is full reimbursement from a price set by the company, including immediate patient access to biosimilars. The structure of hospital tendering by multiple buying groups and separate hospital chains allows for competition among manufacturers to be maintained in Germany. For instance, in November 2018, the German Health Ministry introduced a draft bill on safety in the supply of pharmaceuticals. The Gesetz für Mehr Sicherheit in der Arzneimittelversor-gung (GSAV) bill aims to provide a legal framework for the automatic substitution of biosimilars by pharmacists in Germany.

Due to the huge potential for cost savings, the German Health Ministry introduced a new law to increase the adoption of biosimilars. As few European Union (EU) countries allow pharmacist substitution of biosimilars, this would represent a significant change in practice, particularly for Germany. Additionally, in Germany, a law passed in 2019 foresees the automatic substitution of biosimilars in pharmacies beginning in 2022, provided the Federal Joint Committee (the highest decision-making body of the self-governance of health insurers and providers) has determined the interchangeability of the medicines in question, and the prescribing physician has not explicitly excluded it. Therefore, with the growing government initiatives for adopting biosimilars in Germany, the Europe biosimilars market is expected to grow during the forecast period 2022-2030.

Europe Biosimilars Report Scope

Report Attribute

Details

Market size in 2022

US$ 10,344.86 Million

Market Size by 2030

US$ 115,125.91 Million

Global CAGR (2022 - 2030)

35.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Disease Indication - Cancer

- Diabetes

- Autoimmune Disease

- Other Disease Indication

By Route of Administration - Intravenous

- Subcutaneous

By Drug Class - Granulocyte Colony-Stimulating Factor

- Insulin

- TNF Blockers and Monoclonal Antibodies

By Distribution Channel - Hospital Pharmacies

- Compounding Pharmacies

- Retail Pharmacies

- Online Pharmacies

Regions and Countries Covered

Europe - UK

- Germany

- France

- Russia

- Italy

- Rest of Europe

Market leaders and key company profiles

Amgen Inc

Celltrion Inc

Sanofi SA

Biocon Ltd,

Samsung Bioepis Co Ltd

Elli Lilly and Co

Sandoz AG

Teva Pharmaceitical Industries Ltd

Pfizer Inc

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10,344.86 Million |

| Market Size by 2030 | US$ 115,125.91 Million |

| Global CAGR (2022 - 2030) | 35.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Disease Indication

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Visualization and 3D Rendering Software Market

- Occupational Health Market

- Enzymatic DNA Synthesis Market

- Europe Surety Market

- Electronic Toll Collection System Market

- Point of Care Diagnostics Market

- Aesthetic Medical Devices Market

- Workwear Market

- Legal Case Management Software Market

- Glycomics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Disease Indication, Route of Administration, Drug Class, Distribution Channel, and Region

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing prevalence of chronic diseases and rising approvals of biosimilars are the driving factors responsible for the overall market growth.

Biosimilars are safe and effective treatment options intended for many illnesses, such as chronic skin and bowel diseases (psoriasis, irritable bowel syndrome, Crohn's disease and colitis), arthritis, kidney conditions, and cancer. Also, biosimilars increase access to lifesaving medications at potentially lower costs.

Amgen Inc, Celltrion Inc, Sanofi SA, Biocon Ltd, Samsung Bioepis Co Ltd, Elli Lilly and Co, Sandoz AG, Teva Pharmaceutical Industries Ltd, Pfizer Inc, and Dr. Reddy's Laboratories Ltd, among others are among the leading companies operating in the global Europe biosimilars market.

Based on disease indication, the cancer segment took the forefront lead in the Europe market by accounting largest share in 2020 and is expected to continue to do so till the forecast period.

The intravenous segment dominated the global Europe biosimilars market and accounted for the largest revenue in 2022.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Europe Biosimilars Market

- Amgen Inc

- Celltrion Inc

- Sanofi SA

- Biocon Ltd,

- Samsung Bioepis Co Ltd

- Elli Lilly and Co

- Sandoz AG

- Teva Pharmaceitical Industries Ltd

- Pfizer Inc

- Dr. Reddy's Laboratories Ltd

Get Free Sample For

Get Free Sample For