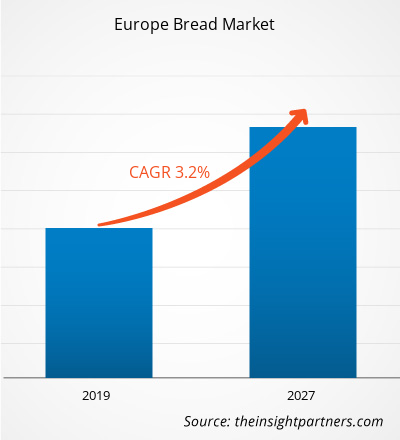

The Europe bread market is accounted to US$ 91,115.1 Mn in 2018 and is expected to grow at a CAGR of 3.2% during the forecast period 2019 – 2027, to account to US$ 120,549.8 Mn by 2027.

Bread is among the household staples and there has been an increasing demand for greater variety of bread such as loaves, baguettes, rolls, burger buns, sandwich bread, ciabatta among others. The increasing use of these products by B2B industries such as HORECA, QSRs, cafes and others along with the household has driven the growth of market. Rest of Europe is dominating the Europe bread market followed by Germany. The rest of the European countries include Sweden, Poland, Bulgaria, Netherlands, Finland and Spain along with other European countries. Bulgaria, Netherlands, Finland and Spain are among the major bread market in Europe. Increasing disposable income and presence of industrial and craft bakers have supported the growth of market in these countries. In addition, the growing consumer inclination towards organic, clean label products will be providing great opportunities for local bakers in these countries which will be contributing to the growth of bread market during the forecast period.

Europe Bread Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Strong growth in organised and unorganised distribution or retail network

The availability of a wide range of bread and related products at a reasonable rate has attracted consumers to buy from supermarkets and hypermarkets. Not only the household, but the B2B consumers also prefer to buy bread form these channels due to cost-effectiveness. Apart from this, improvement in the distribution channels in emerging countries like India has encouraged middle-class people to spend more on these food products. The artisanal bakery is among the important distribution channel for the bread market as these bakeries are famous for special and tailor-made bread such as multigrain bread, bread with fruits, nuts, and spices. These bakeries have helped the local bakers to cater to the consumer demand of specialty and functional bread effectively.

Product Type Insights

Based on product type, the Europe bread market is bifurcated as loaves, baguettes, rolls, burger buns, sandwich bread, ciabatta, and others. The loaves segment dominated the Europe bread market. A loaf is a type of bread with elongated and rounded structure. It is common to bake bread in a rectangular-shaped bread pan, which is also called as a loaf pan, as some kinds of bread dough tend to collapse and spread out during the baking process. Dough with a denser viscosity can be hand-molded into the preferred loaf shape and baked on a flat oven tray. The form of the dough with a diluter viscosity can be preserved with a bread pan of which the sides are higher than the unbaked dough.

Nature Insights

Based on product form, the Europe bread market is bifurcated as conventional and organic. The conventional segment dominated the Europe bread market. There are various preservatives that are used in conventional bread, such as Genetically Modified Organisms (GMOs). The GMOs are non-natural organisms that can affect the ecosystem. Other preservatives used are hydrogenated acid and artificial colors. These preservatives are generally added as shelf-life extenders for the bread. Approximately only 12% of whole food ingredients are found in conventional bread. The nutritional values of conventional bread sum up to a small amount of approximately 27% - 28%. These preservatives are also added to enhance the bread textures and dough conditioning.

Distribution Channel Insights

The Europe Bread market is bifurcated based on distribution channel into hypermarkets and supermarkets, convenience stores & retail stores, online, and others. The convenience stores & retail stores segment accounted for the largest share in the Europe bread market. Convenience stores are the stores that are located in a limited area and is small in size as compared to hypermarkets & supermarkets. The main difference between a convenience store and a hypermarket or a supermarket is that the convenience stores are open till late at night. This adds an added bonus for the sales of a product, in this case, bread. The extended availability at nights and the early openings of the convenience stores in the morning are very beneficial for the people who are in a hurry and are shopping in haste. The convenience stores have limited staff and are located at almost every locality. These factors have attracted the consumers to the convenience stores and have boosted the sales of the bread significantly.

Rest of Europe Bread Market by Type

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EUROPE BREAD MARKET SEGMENTATION

Europe Bread Market – By Product Type

- Loaves

- Baguettes

- Rolls

- Burger Buns

- Sandwich Bread

- Ciabatta

- Others

Europe Bread Market – By Nature

- Conventional

- Organic

Europe Bread Market – By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience and Retail Stores

- Online

- Others

Europe Bread Market – By Country

- Australia

- China

- India

- Japan

- Rest of APAC

Company Profiles

- Associated British Foods plc

- Cargill, Incorporated

- Barilla G. e R. Fratelli S.p.A

- Aryzta AG

- Rich Products Corporation

- Britannia Industries

- CSC Brands, L.P.

- Finsbury Food Group Plc

- Goodman Fielder

- Premier Foods Group Limited

Europe Bread Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 91,115.1 Million |

| Market Size by 2027 | US$ 120,549.8 Million |

| Global CAGR (2019 - 2027) | 3.2% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Extracellular Matrix Market

- Electronic Toll Collection System Market

- Emergency Department Information System (EDIS) Market

- Enzymatic DNA Synthesis Market

- Smart Mining Market

- Batter and Breader Premixes Market

- Virtual Pipeline Systems Market

- 3D Audio Market

- Green Hydrogen Market

- Biopharmaceutical Contract Manufacturing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Nature, Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Europe Bread Market

- Associated British Foods plc

- Cargill, Incorporated

- Barilla G. e R. Fratelli S.p.A

- Aryzta AG

- Rich Products Corporation

- Britannia Industries

- CSC Brands, L.P.

- Finsbury Food Group Plc

- Goodman Fielder

- Premier Foods Group Limited

Get Free Sample For

Get Free Sample For