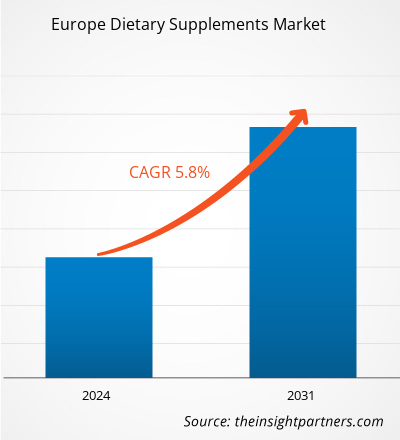

The Europe dietary supplements market size is projected to reach US$ 31.09 billion by 2031 from US$ 19.84 billion in 2023. The market is anticipated to record a CAGR of 5.8% during 2023–2031. The increasing popularity of beauty supplements is likely to remain among the key trends in the market.

Europe Dietary Supplements Market Analysis

The Europe dietary supplement market is witnessing a significant surge in demand, highlighting an attractive landscape for newcomers in the sector. This burgeoning interest among consumers in health and wellness products is creating ample opportunities for new brands and products to emerge into the market. With the growing awareness of health benefits associated with dietary supplements, more people are incorporating them into their daily routines, fueling the expansion of the market.

In recent years, people have become more conscious of their health and fitness due to the growing prevalence of various diseases, including cancer and cardiovascular disorders, and several medical conditions, such as diabetes, high blood pressure, obesity, and high cholesterol. This has boosted the demand for dietary supplements across Europe. Proteins play a crucial role in building bones, muscles, cartilage, skin, and blood. They help repair and build tissues as well as make enzymes and hormones. Amino acids are considered the building blocks of proteins. They are classified into essential or nonessential amino acids, which are required and produced by the body, respectively. Further, the growing health and diet awareness among consumers is increasing the demand for protein supplements, such as whey powders, and amino acid products, including citrulline, creatine, proline, and tyrosine, among consumers.

Europe Dietary Supplements Market Overview

The growing demand for dietary supplement products has encouraged key players to take various strategic initiatives to remain unique among all competitors. Several manufacturers are launching innovative dietary supplement products. For instance, Optimum Nutrition introduced Clear Protein—an innovative brand that uses cutting-edge technology to create a clear protein shake. Also, In 2024, AstroZhi introduced groundbreaking dietary supplements in the Irish, UK, and European markets. These supplements help manage the symptoms of COVID-19 infection.

Various dietary supplement manufacturers are engaged in collaborations to expand their customer base across Europe. For instance, in May 2024, dsm-firmenich and Indena collaborated to introduce dietary supplement solutions combining biotics and botanicals at Vitafoods Europe 2024, focusing on gut health, brain health, and healthy aging—which aims to drive the future of nutraceuticals.

Several manufacturers are focusing on mergers and acquisitions to significantly enhance their capabilities in producing food ingredients and dietary supplements, marking a significant step in the company's growth trajectory. For instance, in May 2024, Aliga Microalgae, a Danish food-tech company, acquired chlorella algae facilities in Holland, marking a move toward the commercialization of its chlorella algae products. The acquisition aims to increase the production capacity of food ingredients and dietary supplements.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Dietary Supplements Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Dietary Supplements Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Dietary Supplements Market Drivers and Opportunities

Rising Popularity of Dietary Supplements Favor Market Growth

Social media also plays a significant role in fitness motivation, thereby encouraging self-improvement. Social media platforms, such as Instagram, Twitter, and Pinterest, have boosted the popularity of the health & fitness industry, with many celebrities and influencers introducing users to new fitness regimes and dietary supplements. This highlights the benefits dietary supplements offer to consumer’s physical and mental health, in turn, aiding the dietary supplement demand. Moreover, increased interest in bodybuilding and athletics is boosting the intake of dietary supplements in Europe. Athletes are becoming more inclined toward dietary supplements for assistance in improving endurance and performance while also maintaining health. Thus, the rising popularity of dietary supplements drives the Europe dietary supplements market

Increasing Preference for Dietary Supplements with Organic and Vegan Claims to Create Significant Opportunities

The increasing number of organic and vegan consumers in Europe boosts the demand for dietary supplement products with organic and herbal ingredients. According to Berlin-based Veganz's survey they ranked five European countries by the number of vegans, with the UK leading with 3.2%. Italy followed with 2.3%, followed by Germany and Austria with 2.2%. Furthermore, Spain followed with 2.1%, and France had 2.0%. The vegan population in these countries is over five million. Organic dietary supplements contain vitamins, minerals, herbs, amino acids, or enzymes, all sourced from natural, organic environments to support overall health and wellness. These supplements enhance nutrient intake, improve health outcomes, and are environmentally friendly as they are free of harmful pesticides and chemicals. They are safe for long-term consumption and do not contain synthetic additives. Consumers are increasingly seeking clean, green, and natural products. As a result, many brands are adding several plant-based options to their product lineup.

Europe Dietary Supplements Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe dietary supplements market analysis are type, form, and distribution channel.

- Based on type, the Europe dietary supplements market is segmented into vitamins, minerals, proteins and amino acids, probiotics, blends, and others. The vitamins segment held the largest market share in 2023.

- By form, the market is categorized into tablets, capsules and softgels, powders, and others. The capsules and softgels segment held the largest share of the market in 2023.

In terms of distribution channel, the Europe dietary supplements market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. In 2023, the specialty stores segment dominated the market.

Europe Dietary Supplements Market Share Analysis by Country

The country scope of the Europe dietary supplements market report is mainly divided into Germany, France, Italy, the UK, Spain, and the Rest of Europe.

In 2023, Italy held the largest share of the Europe dietary supplements market and is projected to continue its dominance during the forecast period. The dietary supplement market in Italy is experiencing a remarkable surge, primarily driven by the modern lifestyle's role in the rising incidence of health issues such as diabetes, obesity, and high blood pressure. Recently, consumers have recognized the need for preventative health measures and have started to settle toward lifestyle choices that reduce the harmful impacts of such conditions. Thus, there is a shift in consumer behavior, which resulted in a considerable increase in the dietary supplement market in Italy. The market growth in the country is a reflection of a broader trend toward preventative healthcare and wellness, with dietary supplements playing a pivotal role in supporting this transition. The surge in consumption of food nutrition products prompted consumers to prioritize their health and strengthen their immune systems. For instance, according to a survey conducted by FederSalus, from 2014 to 2020, the value of sales of food supplements in Italy grew from USD 2571.21 million to USD 4131.60 million.

Europe Dietary Supplements Market Regional Insights

The regional trends and factors influencing the Europe Dietary Supplements Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe Dietary Supplements Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe Dietary Supplements Market

Europe Dietary Supplements Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 19.84 Billion |

| Market Size by 2031 | US$ 31.09 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

Europe Dietary Supplements Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Dietary Supplements Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe Dietary Supplements Market are:

- Glanbia Plc

- Herbalife Nutrition Ltd

- Amway Corp

- Bayer AG

- Arkopharma SAS

- Pfizer Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe Dietary Supplements Market top key players overview

Europe Dietary Supplements Market News and Recent Developments

The Europe dietary supplements market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Europe dietary supplements market are listed below:

- Bayer Consumer Health has introduced new formats for its Berocca brand of vitamin and mineral supplements in the UK. Previously only available in effervescent form, UK consumers can now enjoy Berocca Immuno Gummies and Berocca Multi-Action Gummies exclusively via Amazon's UK website. (Source: Bayer AG, Press Release, December 2023)

- dsm-firmenich, innovators in nutrition, health, and beauty, and Indena, the leading developer of high-quality and scientifically sound active botanical ingredients for the pharmaceutical and health food market, will introduce dietary supplement solutions combining biotics with botanicals in enjoyable delivery formats, offering enhanced flavor and taste experience, at Vitafoods Europe 2024. (Source: Koninklijke DSM N.V., Press Release, May 2024)

Europe Dietary Supplements Market Report Coverage and Deliverables

The “Europe Dietary Supplements Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Europe dietary supplements market size and forecast for all the key market segments covered under the scope

- Europe dietary supplements market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Europe dietary supplements market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe dietary supplements market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rising popularity of dietary supplements and strategic initiatives by key market players drive the market.

Rising popularity of beauty supplements and nutricosmetics is the key trend in the market.

Glanbia Plc, Herbalife Nutrition Ltd, Amway Corp, Bayer AG, Arkopharma SAS, Pfizer Inc, Otsuka Holdings Co Ltd, GSK Plc, NOW Health Group Inc, and Nestle Health Science SA are among the leading market players.

The market is expected to register a CAGR of 5.8% during 2023–2031.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Europe Dietary Supplements Market

- Glanbia Plc

- Herbalife Nutrition Ltd

- Amway Corp

- Bayer AG

- Arkopharma SAS

- Pfizer Inc

- Otsuka Holdings Co Ltd

- GSK Plc

- NOW Health Group Inc

- Nestle Health Science SA

Get Free Sample For

Get Free Sample For