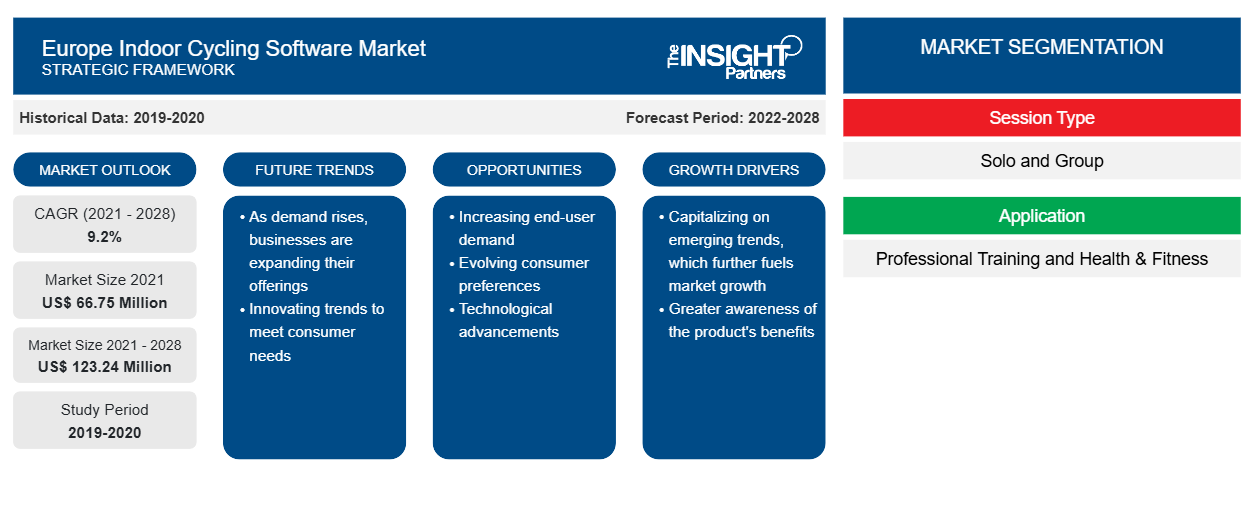

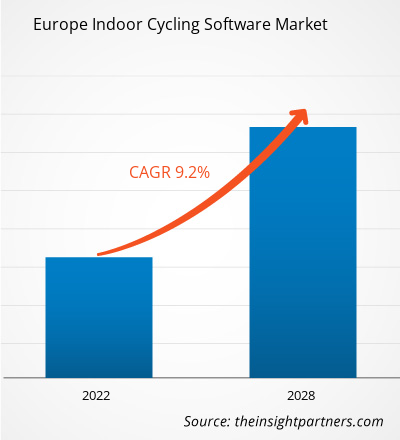

The Europe indoor cycling software market is expected to grow from US$ 66.75 million in 2021 to US$ 123.24 million by 2028; it is estimated to grow at a CAGR of 9.2% during 2021–2028.

Indoor cycling is a convenient and effective technique to exercise and train at home or gyms and fitness facilities. People are placing a great emphasis on health and fitness due to various issues such as sedentary lifestyles, poor eating habits, high pollution levels, and an increase in the number of lifestyle diseases. Furthermore, global health issues have been exacerbated by the COVID-19 epidemic. As a result of these considerations, the popularity of indoor workout equipment, such as indoor bikes, has skyrocketed. Individuals, athletes, fitness studios, gyms, and other end-users are increasing their need for indoor bikes, trainers, and other associated equipment, which drives the growth of the Europe indoor cycling software market.

Based on session type, the Europe indoor cycling software market is bifurcated into solo and group. Based on application, the Europe indoor cycling software market is bifurcated into professional training and health and fitness. Based on subscription, the Europe indoor cycling software market is bifurcated into monthly subscriptions and annual subscriptions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Indoor Cycling Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Indoor Cycling Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Europe Indoor Cycling Software Market

The COVID-19 pandemic has prompted people across Europe to rethink their behavior while working, interacting with others, and moving. With numerous major countries such as Germany, the UK, and France, Europe is a critical zone for growth. The region offers lucrative opportunities for the growth of the Europe indoor cycling software market due to the widespread usage of innovative technological solutions across numerous sectors. All of these mentioned countries have a considerable number of businesses, particularly in the healthcare and fitness and training industries. A few of the primary factors driving the growth of the indoor cycling software market in Europe are the large presence of businesses using indoor cycling and the high acceptance of such software among professional trainers. Consequently, despite the COVID 19 outbreak, demand for indoor cycling software is expected to increase in the future. Russia, the UK, Spain, Italy, Germany, Turkey, and France are among the major countries affected by the COVID-19 outbreak. To control the spread of the novel coronavirus, governments in several European nations have implemented lockdowns/movement restrictions in various areas for several weeks. However, numerous European major countries are gradually loosening their limitations. Constraints on people's movement and outdoor activities propel the demand for indoor cycling equipment and software across the region, contributing to the growth of Europe indoor cycling software market.Europe Indoor Cycling Software Market InsightsSurging Adoption of Indoor Cycling Equipment Amid COVID-19 Boost The Demand For Europe Indoor Cycling Software Market

Indoor cycling dominates the fitness sector. Cycling and workout enthusiasts have been the major consumers of the indoor cycling. People prefer this cardio workout as they don't want an expensive cycling studio membership or a high-priced bike to achieve a rigorous workout session. However, due to the shuttering of gyms amid the COVID-19 pandemic, home workout practices have become increasingly popular. Cyclists are also preferring home workouts as alternatives to their typical fitness regimens. As a result, European businesses have seen a significant increase in sales. For instance, Wattbike reported a 110% rise in web sessions in March 2020, along with a 250% increase in sales activity. In April, it recorded a 300% increase in web sessions and a 350% surge in sales activity. Similarly, several businesses leveraged the COVID-19 situation to persuade individuals to stay active while being at home for prolonged periods. After British Cycling, a national governing body, suspended all sanctioned cycling events and imposed restrictions on club riding, RGT Cycling made all its premium features available for free to all indoor bikers from December 2020, which led to a rise in the adoption of indoor cycling equipment in Europe.Session Type-Based Europe Indoor Cycling Software Market Insights

Based on session type, the Europe indoor cycling software market is bifurcated into solo and group. The market participants are investing heavily in offering integrated indoor cycling experiences to enhance the experience of individual riders in a solo or group sessions. For example, in 2019, Bkool launched an integrated realistic direct drive indoor smart trainer with a flexible stand that allows the rider to swing up to 6° on the bike, thus providing enhanced overall rider experience.Application-Based Europe Indoor Cycling Software Market Insights

Based on application, the Europe indoor cycling software is bifurcated into professional training and health and fitness. The vendors of indoor cycling software are continually upgrading their solutions to deliver via apps and provide an explicit training goal for personalized workout classes. It allows riders to do workouts by subscribing to a training plan tailored to the target events for the rider. The indoor cycling software is majorly adopted by professional trainers and health & fitness centers to conduct group and solo sessions.Subscription -Based Europe Indoor Cycling Software Market Insights

Based on subscription, the Europe indoor cycling software market is bifurcated into monthly subscription and annual subscription. Customer billing offers many benefits on a recurring basis. Therefore, many organizations that used the pay-once, use-for-forever model earlier, now switch to the subscription business model. With a recurring billing model and high revenues and customer lifetime values (CLVs), the business could see substantial and continued growth in the coming years. Players operating in the Europe indoor cycling software market adopt various strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key market players are listed below:- In 2020, IRONSTAR partnered with Rouvy to add a few unique bike courses to the digital cycling platform.

- In 2020, Tour des Stations announced a multi-year partnership with Rouvy. As an official training partner, Rouvy will offer up to 11 main climbs of the Tour des Stations on its platform.

By Session Type

- Solo

- Group

By Application

- Professional Training

- Health and Fitness

By Subscription

- Monthly Subscription

- Annual Subscription

Company Profiles

- BKOOL, S.L.

- Body Bike International A/S

- Garmin Ltd.

- Kinomap

- Wahoo Fitness

- Strava, Inc.

- SpiviTech Ltd.

- VirtualTraining s.r.o.

- Stages Indoor Cycling LLC

- Zwift Inc

Europe Indoor Cycling Software Market Regional Insights

The regional trends and factors influencing the Europe Indoor Cycling Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe Indoor Cycling Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe Indoor Cycling Software Market

Europe Indoor Cycling Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 66.75 Million |

| Market Size by 2028 | US$ 123.24 Million |

| Global CAGR (2021 - 2028) | 9.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Session Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

Europe Indoor Cycling Software Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Indoor Cycling Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe Indoor Cycling Software Market are:

- BKOOL, S.L.

- Body Bike International A/S

- Garmin Ltd.

- Kinomap

- Wahoo Fitness

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe Indoor Cycling Software Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hydrogen Storage Alloys Market

- Medical Enzyme Technology Market

- Electronic Shelf Label Market

- Ceramic Injection Molding Market

- Medical Audiometer Devices Market

- Hair Extensions Market

- Ceiling Fans Market

- Medical and Research Grade Collagen Market

- Travel Vaccines Market

- Wind Turbine Composites Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Session Type, Application, and Subscription

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

France, Germany, Italy, Russian Federation, United Kingdom

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Europe Indoor Cycling Software Market

- BKOOL, S.L.

- Body Bike International A/S

- Garmin Ltd.

- Kinomap

- Wahoo Fitness

- Strava, Inc.

- SpiviTech Ltd.

- VirtualTraining s.r.o.

- Stages Indoor Cycling LLC

- Zwift Inc.

Get Free Sample For

Get Free Sample For