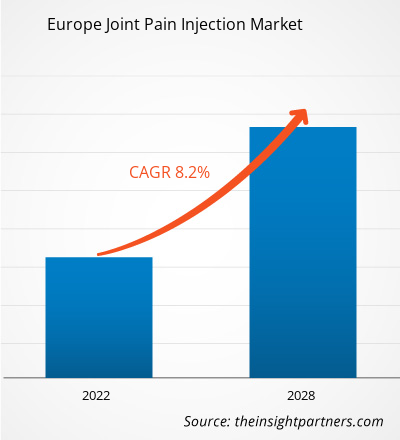

The Europe joint pain injection market is expected to grow from US$ 595.20 million in 2021 to US$ 1,035.54 million by 2028; it is estimated to grow at a CAGR of 8.2% from 2021 to 2028.

Companies operating in the joint pain injection market are undertaking an increasing number of research and development activities to introduce more innovative products. The injection has the ability to restore the viscosity and elasticity of synovial fluid, thereby decreasing pain and inflammation as well as increasing mobility of the affected organ and reducing friction between bones. Additionally, in November 2017, Flexion Therapeutics Inc. launched Zilretta, an intra-articular injection for OA knee pain. It is a non-opioid medicine that has Flexion’s proprietary microsphere technology and offers pain relief for 12 weeks among the patients with osteoarthritis of knee. Furthermore, in July 2019, Teva Pharmaceutical Industries Ltd. launched 1% Sodium Hyaluronate used to treat of patients with OA-related knee pain; the product is especially prescribed to patients who have failed to respond to conservative non-pharmacologic therapy and simple analgesics. Such increasing number of product developments and launches are emerging as an important trend in the joint pain injection market

Several European countries witnessed an unprecedented rise in the number of COVID-19 cases, which led to the discontinuation of several business operations and manufacturing activities of various healthcare products, including joint pain injections, which negatively impacted the joint pain injection market. Also, the pandemic has halted the adoption of new medical device policy and delayed clinical trials and disrupted processes. Two consecutive waves of coronavirus had devastating impact on economic activities in the Europe. Implementation of social distancing and lockdown policies led to closing of orthopedic hospitals and patient visits for elective orthopedic surgeries. This factor negatively impacted the adoption of joint pain injection. In addition, disrupted supply chains, extended lockdowns, and cancelling of orthopedic medical procedures have also negativity affected the growth of the joint pain injection market. The hospitals in the region are cancelling other surgical procedures to keep healthcare facilities free for COVID-19 patients. Moreover, increasing COVID-19 infection in healthcare workers is leading to shortage of staff. These factors are negatively impacting the growth of the joint pain injection market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Joint Pain Injection Market Segmentation

Europe Joint Pain Injection Market – By Drugs

- Hyaluronic Acid

- Corticosteroid

- Others

Europe Joint Pain Injection Market – By Joint Type

- Knee

- Foot and Ankle

- Shoulder and Elbow

- Hip

- Others

Europe Joint Pain Injection Market – By Distribution Channel

- Retail Pharmacies

- Hospitals Pharmacies

- Others

Europe Joint Pain Injection Market – By Country

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Europe Joint Pain Injection Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 595.20 Million |

| Market Size by 2028 | US$ 1,035.54 Million |

| Global CAGR (2021 - 2028) | 8.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Drugs

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Drugs, Joint Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Chugai Pharmaceutical Co., Ltd.

- Bioventus Inc.

- Fidia Pharma USA Inc.

- Seikagaku Corporation

- Ferring B.V.

- Sanofi

- Anika Therapeutics, Inc.

- Teva Pharmaceutical Industries Ltd.

Get Free Sample For

Get Free Sample For