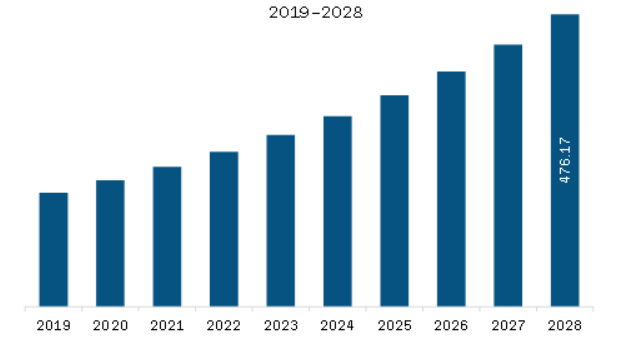

The laboratory information management systems (LIMS) market in Europe is expected to grow from US$ 228.16 million in 2021 to US$ 476.17 million by 2028; it is estimated to grow at a CAGR of 11.1% from 2021 to 2028.

Laboratory automation is emerging as an approach to minimize human involvement in laboratory processes. The automation of routine laboratory procedures with the help of dedicated workstations and system software helps increase laboratory efficiency and enables researchers to concentrate on important tasks along with avoiding human errors. Laboratories are increasingly adopting laboratory information management systems (LIMS) to maintain stringent regulatory compliance, uplift efficiency and productivity, and drive data security and integrity. According to a study published in the Journal of Lab Automation, the error incidences in fully automated, semi-automated, and manual operations are 1–5%, 1–10%, and 10–30%, respectively. The growing use of digital workstations, automated analyzers, and total laboratory automation (TLA) allows laboratory personnel to reassign activities and contribute a greater value to operations. Moreover, high volumes of data generated by laboratory systems is triggering the demand for effective data processing, analysis, and sharing methods, thereby highlighting the need of efficient and cost-effective solutions such as the LIMS. Laboratory management departments are facing many challenges with a rising population submitting larger number of samples to laboratories and a lack of personnel to process those samples. These challenges are compelling them to maintain their laboratory operations, as laboratories have to maintain control over the influx of samples as well as find the way to improve workflow to deliver patient results in a timely manner. Further, growing demand for data integration is another factor contributing to the laboratory information management systems market growth. With pharmaceutical and biotechnological industries spending huge amounts on research and development activities, the scientific communities are generating huge volumes of data. The appropriate processing and interpretation of the collected data requires data integration solutions. For instance, in 2000, Quest Diagnostics, a prominent independent testing laboratory, started providing their consumers with a direct access to test results through the TheDailyApple.com website owned and managed by Caresoft Inc. It offers direct-to-consumer test result, thereby ensuring confidentiality and anonymity of patients. Manual processes and paper records may allow unauthorized access to data, which increases the chances of data manipulation, and hence, managing data integrity is a big challenge faced by laboratories dependent on manual operations. Increasing adoption of electronic health record (EHR) systems in outpatient clinics and hospitals, to mitigate the risks associated with manual operations, would fuel the demand for LIMS. The systems also allow the use of laboratory data to offer safe and high-quality patient care. Thus, the growing focus on effective clinical workflow management, leading to the rise in automation if laboratory processes, is driving the laboratory information management systems market growth.

The European economy is severely affected due to the exponential growth of COVID-19 cases in the region. Spain, Italy, Germany, France, and the UK are among the most affected European countries. As number of patients in European healthcare setting has increased dramatically due to this outbreak, laboratories are at risk of diagnostic error. However, LIMS solutions help companies and organizations to run their laboratories remotely and from multiple locations. With the outbreak of the COVID-19 pandemic, most laboratories conducted their data-oriented processes from home using cloud-hosted, remote-based LIMSs. Several laboratories, CROs, research institutes, and pharma and biotech companies have worked uninterruptedly during the pandemic, thereby increasing productivity. Therefore, web-hosted solutions help achieve long operational life, decrease ownership cost, and offer excellent investment returns. Since the pandemic’s onset, prominent players in the laboratory information systems landscape are collaborating with public and private sector organizations to employ advanced technologies for implementing COVID-19 testing capabilities. For instance, LabWare Technologies has collaborated with the National Health Service to provide laboratory management software to healthcare settings across the United Kingdom.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe laboratory information management systems (LIMS) market. The Europe laboratory information management systems (LIMS) market is expected to grow at a good CAGR during the forecast period.

Europe Laboratory Information Management Systems (LIMS) Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Laboratory Information Management Systems (LIMS) Market Segmentation

Europe Laboratory Information Management Systems (LIMS) Market – By Type

- Standalone

- Integrated

Europe Laboratory Information Management Systems (LIMS) Market – By Deployment

- Web-Based Delivery Mode

- Cloud-Based Delivery Mode

- On-Premise Delivery Mode

Europe Laboratory Information Management Systems (LIMS) Market – By Component

- Software

- Services

Europe Laboratory Information Management Systems (LIMS) Market – By Application

- Sample Management

- Workflow Automation

- Records Management

- Decision Making

- Enterprise Resource Planning

- Logistics Management

Europe Laboratory Information Management Systems (LIMS) Market – By End-User

- Pharmaceutical Companies

- Contract Research Organisations

- Hospitals & Clinics

- Others

Europe Laboratory Information Management Systems (LIMS) Market – By Country

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Europe Laboratory Information Management Systems (LIMS) Market – Companies Mentioned

- THERMO FISHER SCIENTIFIC INC.

- Abbott

- Illumina, Inc.

- LabLynx, Inc.

- LabVantage Solutions, Inc.

- Accelerated Technology Laboratories, Inc.

- LabWare

- Autoscribe Informatic

Europe Laboratory Information Management Systems (LIMS) Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 228.16 Million |

| Market Size by 2028 | US$ 476.17 Million |

| Global CAGR (2021 - 2028) | 11.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

- THERMO FISHER SCIENTIFIC INC.

- Abbott

- Illumina, Inc.

- LabLynx, Inc.

- LabVantage Solutions, Inc.

- Accelerated Technology Laboratories, Inc.

- LabWare

- Autoscribe Informatics

Get Free Sample For

Get Free Sample For