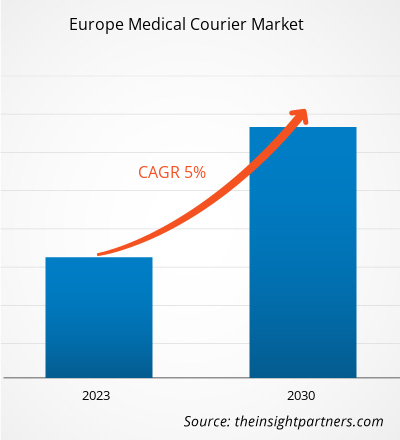

Europe medical courier market size is projected to grow from US$ 2,163.44 million in 2022 to US$ 3,207.44 million by 2030; it is estimated to record a CAGR of 5.0% during 2022–2030.

Market Insights and Analyst View:

Medical courier allows the movement from one place to another, often from the blood and urine collection point to the clinics or labs where the tests are to take place. Usually, such samples are time-sensitive and require prompt transfer between doctors, clinics, and hospitals. Multinational medical couriers are expected to boost the growth of the Europe medical courier market as these companies strive to expand their consumer base and penetrate deeper into the market. Large companies are known for superior customer care services, such as 24x7 access. The increased health awareness amongst the general public results in an increased demand for testing services, thereby boosting the demand for medical courier services. Furthermore, the globalization of the healthcare industry, which involves exchanging medical expertise and working on research projects with clinical researchers, fuels the demand for the Europe medical courier market.

Growth Drivers:

Surgery is one of the most important treatments offered by the National Health Service (NHS) in secondary care in the UK. According to Europe Blood Alliance, approximately 25 million units of blood are transfused annually in Europe. The source also stated that European Patients need between 67,000 and 70,000 units of blood and blood components every day.

In recent years, road traffic has increased significantly in the Europe, leading to a surge in road accidents and fatalities, further driving the demand for hospital supplies. For instance, as per data by Independer, in 2020, European road accidents caused nearly 26,000 fatal casualties and over 1.3 million injuries. As per the Department for Transport June 2021 report published by the UK government, 115,333 casualties of all severities were reported in 2020, of which 22,014 were seriously injured and 91,847 were slightly injured casualties.

Furthermore, in February 2023, NHS announced that an estimated 780,000 additional surgeries and outpatient appointments would be provided at 37 new surgical hubs, 10 expanded existing hubs, and 81 new theatres dedicated to elective care as part of its biggest and most ambitious catch-up plan. Under the Targeted Investment Fund, almost 600 new beds (584) specifically for elective care, dozens of elective theatres delivering state-of-the-art treatment, and nearly 90 more critical care beds nationwide will be provided. Since the elective recovery plan was published in 2022 the NHS has offered 13.5 million elective appointments and treatments—9% higher than 2022. Further, elective care was delivered to 70,000 more patients in November compared to the pre-pandemic period.

Thus, with rising road accidents, the demand for blood transfusion and surgical hubs is also surging, thus propelling the market for medical couriers in Europe.

Report Segmentation and Scope:

The “Europe Medical Courier Market” is segmented on the basis of the product type, destination, service, end users. Based on product type, the market is segregated into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. In terms of destination, the Europe medical courier market is segmented into domestic and international. The Europe medical courier market, by service type, is bifurcated into standard services and rush and on-demand services. Based on end user, the market is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The Europe medical courier market, based on region, is segmented into Germany, France, Italy, UK, Russia, and Rest of Europe.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The Europe medical courier market, by product type, is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The lab specimens segment is anticipated to register the highest CAGR of 7.4% in the market during the forecast period. Many labs and medical facilities have in-house delivery services to handle lab specimens. However, many labs and medical facility centers outsource medical logistics services offered by independent shipping and delivery companies. Lab specimens are critical products that need a temperature-controlled environment. While transporting lab specimens, it is essential to ensure safe and compliant collection, pickup, and delivery. Various guidelines are published by regulatory bodies in the Europe for the safe transport of lab specimens

Europe Medical Courier Market, by Product Type – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on destination, the Europe medical courier market is segmented into domestic and international. The domestic segment held the largest market share in 2022 and international is anticipated to register the highest CAGR of 6.4% during the forecast period. Factors such as same-day deliveries, multi-drop courier services, overnight deliveries, and foraying of new players are contributing to the growth of the domestic segment. In addition, online purchasing in Europe has grown exponentially and ranks third in the world. According to the data published by Local Government Association in May 2022, 25% of the products are purchased and returned online, and nearly 3 billion parcels are sent yearly. Among this, a substantial share is estimated to be shared by healthcare and medical products. Also, the adoption of digitalization for purchasing medicines and healthcare products online has upsurged and is expected to grow in the coming years, which is likely to expand the growth of the market during the forecast period.

Based on service type, the Europe medical courier market is segmented into standard services and rush and on-demand services. The standard services segment held a larger market share in 2022 and rush and on-demand services are anticipated to register the highest CAGR of 6.1% during the forecast period. Standard services for medical products are similar to traditional standard courier services that deliver products in a predefined time. Standards services are generally non-emergency services; therefore, they are more cost-effective, responsive, and flexible than other courier services, including same-day delivery, rush-hour deliveries, and others. Under standard services, deliveries are prioritized based on the parcels and products' weight, size, and durability. Companies offering standard services ensure deliveries within two to three days from the processed date, making them cost-effective. Also, traditional services can be personalized according to the customers' requirements based on extra or fewer delivery miles. It also offers traceability of the parcel to the customers that can see the real-time movement of their parcel and ensure safe and on-time delivery. The growth of the market is due to a boom in the purchase of medicines and medical products.

Based on end user, the Europe medical courier market is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The hospitals and clinics segment held the largest share of the market in 2022 and in home support is anticipated to register the highest CAGR of 6.6% in the market during the forecast period. Hospitals and clinics are among the most significant users of medical courier services in Europe. For instance, according to the Pathology Facts and Figures published by The Royal College of Pathologists 2023 data, general practitioners receive ~50 million reports from the labs annually. This reflects the use of medical courier services to transport pathology reports from labs to clinics. Similarly, hospitals are expected to constantly need medical supplies, pharmaceuticals stocks, administrative stationeries, and accessories for medical equipment. Also, increasing number of diagnostics and therapeutic procedures are performed in the hospitals. The number of people visiting hospitals has increased following the COVID-19 pandemic. According to the NHS, as of January 2023, the number of people waiting for hospital treatment increased to 7.2 million. Thus, hospital visits are projected to rise significantly in the coming future, simultaneously increasing the usage of medical couriers to send medical reports to specialized hospitals or clinics for second opinions. Thus, the segment is anticipated to record the fastest growth during the forecast period.

Regional Analysis:

Based on region, Europe medical courier market is segmented into five key countries: Germany, France, Italy, UK, Russia, and Rest of Europe. In 2022, Germany contributed the largest share of Europe medical courier market size. The UK is estimated to register the highest CAGR during the forecast period.

According to data by Statista, in 2021, 23.7 kidney transplants per million were carried out in Germany. Kidney transplants are the most common organ transplant procedure in Germany, ahead of liver and heart transplants, with a rate of 9.9 and 3.9 per million population, respectively.

As per the data by The World Bank Group, in 2021, diabetes prevalence (% of the population ages 20 to 79) in Germany was 6.9%.

Several companies operating in the medical courier industry is taking strategic initiatives such as expansions. For instance, in April 2023, UPS Healthcare has opened its first dedicated healthcare logistics facility in Giessen, Germany. This new facility will be capable of supporting storage of a range healthcare products at 2C to 8C, 15C to 25C and up to -20C degrees. Organ procurement organizations and hospitals depend on couriers to get lifesaving personnel and assets from point A to point B. Thus, the medical courier market in Germany is expected to grow due to rising numbers of kidney transplants and growing chronic diseases such as diabetes.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in Europe medical courier market are listed below:

- In April 2023, UPS Healthcare opened its first dedicated healthcare logistics facility in Giessen, Germany, creating up to 150 new jobs. The 293,000 sq feet (27,200m2) GMP and GDP-compliant space will house over 30,000 pallet positions capable of storing a range of healthcare products at 2C to 8C, 15C to 25C, and up to -20C degrees.

- In April 2023, UPS Healthcare expanded its healthcare logistics facility in Blonie, Poland, creating up to 150 new jobs. This facility has added over 17,000m2 of space and houses up to 23,000 pallet positions for the handling and storage of temperature-sensitive treatments from 2 to 8 degrees Celsius to 15 to 25 degrees Celsius

- In March 2023, In October 2022, Med Logistics Group Ltd partnered with Skyfarer and University Hospitals Coventry and Warwickshire (UHCW) NHS Trust to conduct a trial for Beyond Visual Line of Sight (BVLOS) drone in the UK. The drone is first-of-its-kind, and the trial was completed under secure CAA-approved airspace called "The Medical Logistics UK Corridor”

Competitive Landscape and Key Companies:

ERS Transition Ltd., Send Direct Ltd., Med Logistics Group Ltd., CitySprint (UK) Ltd, United Parcel Service Inc, FedEx Corp, Aylesford couriers Ltd, Reliant Couriers & Haulage Ltd, Coulson Venturers Ltd, and Deutsche Post AG are the prominent Europe medical courier market companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Europe Medical Courier Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,163.44 Million |

| Market Size by 2030 | US$ 3,207.44 Million |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Destination, Service, End Users, and Region

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For