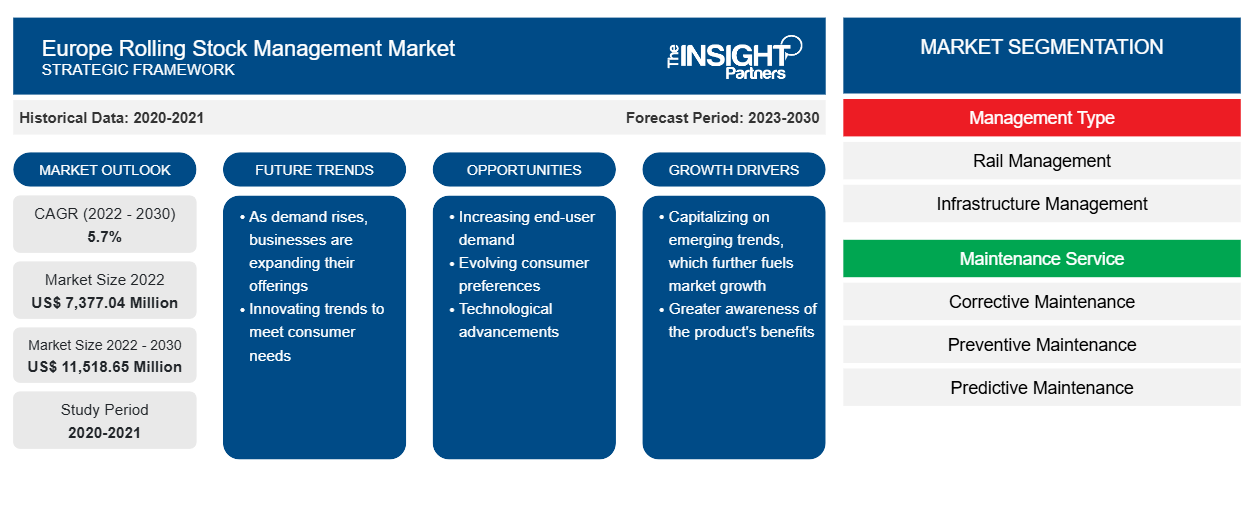

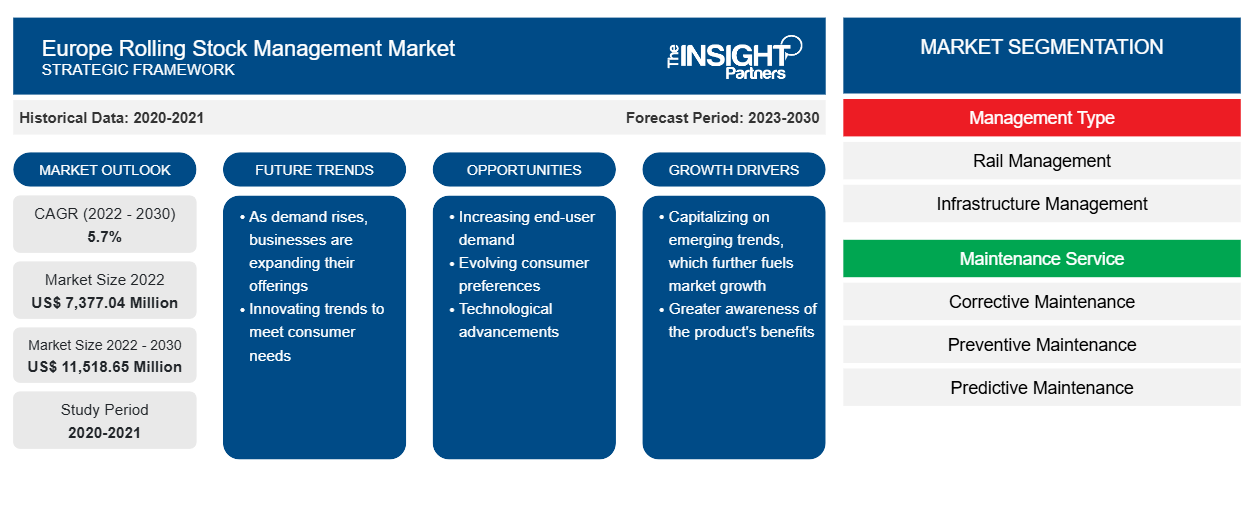

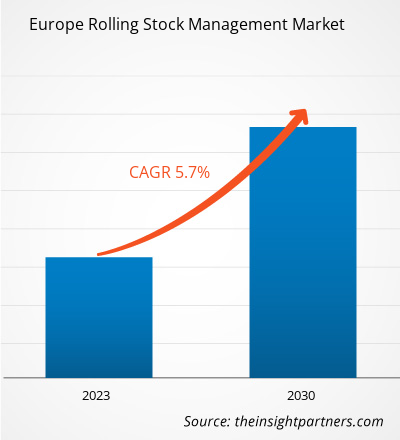

Europe rolling stock management market accounted for US$ 7,377.04 million in the year 2022 and is expected to account for US$ 11,518.65 million in the year 2030; it is expected to grow at a CAGR of 5.7% during the period 2022–2030.

Analyst Perspective:

Europe has one of the world's largest train networks. The European Union has been planning to double freight rail's model share by 2030 to ease the congestion of major road connections and reduce the transport sector's CO2 emissions. Countries in the region are signing contracts with various companies for rail or infrastructure expansion. Rail transportation plays a key part in Europe's development. As per the International Energy Agency (IEA) report, in 2020, passengers traveled ~378 billion passenger kilometers on European railways, making this region the massive market for rail passenger traffic. This, in turn, will result in a rise in demand for rolling stock management market in Europe.

Market Overview:

Rolling stock refers to railway vehicles that include both powered and unpowered vehicles. It is referred to any railway vehicle that can move on the rail tracks. The rolling stock's maintenance, information tracking, and management are the key features of the rolling stock management system. It maintains the information regarding the running as well as breakdown and inspection records of the rolling stocks. It also stores the records of the rolling stock from its manufacturing to the information regarding its main fittings. The management of the history log of the rolling stock helps the workers, during its inspection and breakdown, to efficiently manage their work.

For instance, in January 2023, UK-based Transport for Wales (TfW) announced the start of its construction of a new Butetown railway station and overhaul of Cardiff Bay station. Therefore, with the expansion of the railway network and infrastructure, the rolling stock management market is expected to grow significantly in the coming years. Similarly, Sinara Transport Machines Holding (STM) established a new railway infrastructure division to offer infrastructure maintenance services in Russia starting in 2022.

The rise in the rail industry is also one of the significant contributors to the rolling stock management market. The rise in the launch of new rail stations and expansion of the rail network generates the need for an efficient rolling stock management system to manage the rolling stock, its route, and maintenance. New station and rail expansion projects are key factors accelerating the rolling stock management market growth.

Based on management type, the rolling stock management market is bifurcated into rail management and infrastructure management. Based on maintenance service, the rolling stock management market is categorized into corrective maintenance, preventive maintenance, and predictive maintenance. The rolling stock management market share, based on region, is categorized into the UK, Russia, and Poland.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Rolling Stock Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Rolling Stock Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Digital transformation of rolling stock management Boosting The rolling Stock Management Market Growth

Digital technologies enable rail operators to streamline operations, improving efficiency. This includes digital scheduling, route optimization, and real-time tracking of rolling stock. As efficiency increases, operators can get more out of their existing rolling stock, reducing the need for additional investments in new trains. Digital technologies enhance the passenger experience. Real-time updates, Wi-Fi connectivity, and digital ticketing systems make rail travel more convenient and attractive to passengers. Satisfied passengers are more likely to use rail services, driving demand for rolling stock. Digital systems also help manage rail infrastructure more effectively as it helps to monitor track conditions, switches, and signals. Improved infrastructure management ensures that rolling stock can operate on well-maintained tracks, reducing wear and tear. Digitalization promotes interoperability between different rail networks and systems. This is crucial in Europe, where cross-border rail travel is common. Interoperable systems facilitate seamless travel and trade, increasing the importance of well-managed rolling stock. The digital transformation of rail transportation in Europe offers numerous benefits, including operational efficiency, safety improvements, enhanced passenger experience, and environmental sustainability. These advantages drive the demand for advanced rolling stock management solutions that leverage digital technologies to optimize operations and asset management. Thus, the increasing awareness regarding the benefits of digital transformation drives the rolling stock management market in Europe.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on management type, the Europe rolling stock management market share is segmented into rail management and infrastructure management.

Efficient rail management is crucial in optimizing the performance of the rolling stock. The implementation of rail management provides conditioning-based monitoring and predictive analytics that help rail operators reduce downtime, improve reliability, and extend the rolling stock's lifespan. These management systems are focused on enhancing operational efficiency by optimizing train schedules and minimizing delays. Therefore, rolling stock management market players are deploying solutions for better rail management. For instance, in May 2021, MV Technology Solutions Pty Ltd, in partnership with HaslerRail AG, provided a real-time remote diagnostics system to Adelaide train fleets. The HaslerRails EVAplus software for rail data management provides real-time remote monitoring of maintainers and operators. The demand for such solutions is increasing with the rise in fleet size. For instance, according to Indian Railways, the locomotive fleet size was 12,734 units as of March 2021 and increased to 13,215 units as of March 2022. Such an increase in the rolling stock fleet leads to an increase in operation and movements, further rolling stock management market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The rolling stock management market in the UK is primarily focused on ensuring the safe, reliable, and efficient operation of trains and rail vehicles. It includes maintenance, servicing, repair, refurbishment, and rolling stock upgrades. Several companies and organizations are involved in rolling stock management in the UK. These include train operating companies (TOCs), rolling stock leasing companies (ROSCOs), maintenance and repair providers, and government agencies such as Network Rail. Further, the UK government is also focusing on improving the railway infrastructure of the UK, which is one of the significant drivers of the Europe rolling stock management market share. For instance, in May 2023, the UK government unveiled a US$ 77.17 million funding initiative to enhance train reliability in Manchester. This financial package will be directed toward constructing a third platform at Salford Crescent Station and the comprehensive improvement of rail tracks in Northern Manchester. The funding will be used to construct a third platform at Salford Crescent station and complete track improvement work across North Manchester. These initiatives are part of ongoing maintenance, upgrades, and modernization efforts for rail infrastructure, which are essential for rolling stock management. Thus, the government's funding package for rail infrastructure in Manchester significantly contributes to the UK rolling stock management market.

Key Player Analysis:

Alstom SA, Hitachi Rail Ltd, ABB Ltd, Mitsubishi Electric Corp, Siemens Mobility GmbH, Talgo SA, Thales SA, Toshiba Infrastructure Systems and Solutions Corp, Trimble Inc, and LocoTech LLC are the prominent market participants in the rolling stock management market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the rolling stock management market. The market initiative is a strategy adopted by businesses to expand their footprint and to meet the growing customer demand. The key rolling stock management market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key rolling stock management market players are listed below:

Year | News |

Mar-2023 | Alstom has inked a contract with the Port Authority of New York and New Jersey and Newark Liberty International Airport to provide operations and maintenance services for its Innovia monorail system, known as AirTrain Newark, for the next seven years, until January 2030. The contract is valued at ~ US$ 263.15 million and includes an option for one additional year. |

Jan 2022 | Alstom was awarded a renewed contract with VR Sweden to maintain 30 regional trains in Sweden. Alstom will provide fleet maintenance to VR Sweden, the new operator of the trains, for Tåg I Bergslagen's fleet, which links the four Bergslag counties. |

Europe Rolling Stock Management Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7,377.04 Million |

| Market Size by 2030 | US$ 11,518.65 Million |

| Global CAGR (2022 - 2030) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Management Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Management Type, and Maintenance Service

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Alstom SA, Hitachi Rail Ltd, Mitsubishi Electric Corp, Siemens Mobility GmbH, and Talgo SA are the top key market players operating in the Europe rolling stock management market.

The integration of big data analytics and cloud computing represents a significant opportunity for the rolling stock management market in Europe. It enhances operational efficiency, safety, and passenger experience while providing data-driven insights for better decision-making. As the adoption of these technologies grows, the rolling stock management market is likely to experience continued expansion and innovation, ultimately delivering more efficient and reliable rail transportation systems.

The increasing investment in rail projects across Europe is driving the need for advanced rolling stock management solutions. As rail networks expand and modernize, the rolling stock management market in Europe is poised for significant growth, presenting opportunities for technology providers and service companies to meet the evolving needs of the rail industry.

The adoption of predictive and condition monitoring technologies in rolling stock management improves operational efficiency and safety and aligns with Europe's commitment to sustainable and efficient transportation systems. Thus, constant technological advancements positively influence the Europe rolling stock management market.

The rolling stock management market in the UK is primarily focused on ensuring the safe, reliable, and efficient operation of trains and rail vehicles. It includes maintenance, servicing, repair, refurbishment, and rolling stock upgrades. Several companies and organizations are involved in rolling stock management in the UK.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Europe Rolling Stock Management Market

- Alstom SA

- Hitachi Rail Ltd

- ABB Ltd

- Mitsubishi Electric Corp

- Siemens Mobility GmbH

- Talgo SA

- Thales SA

- Toshiba Infrastructure Systems and Solutions Corp

- Trimble Inc

- LocoTech LLC

Get Free Sample For

Get Free Sample For