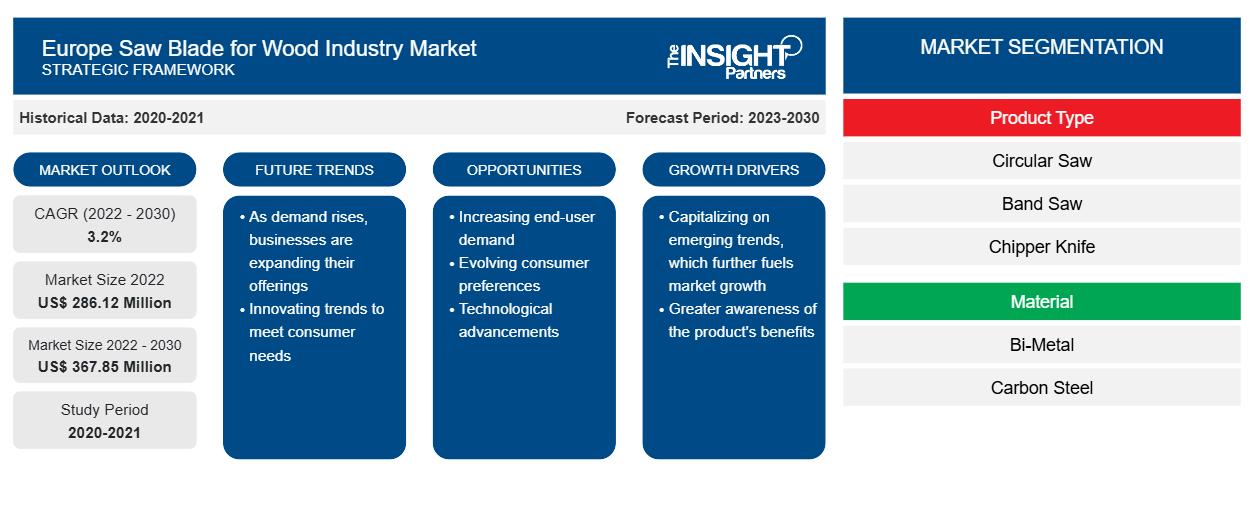

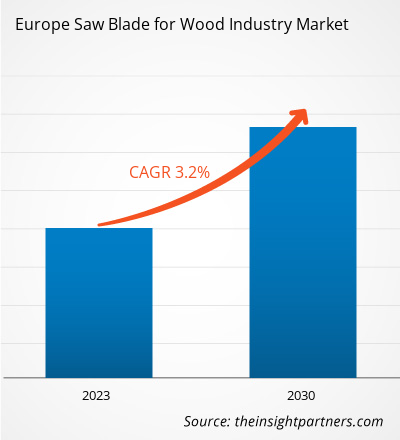

The saw blade for wood industry market was valued at US$ 286.12 million in 2022 and is projected to reach US$ 367.85 million by 2030; it is expected to register a CAGR of 3.2% during 2022–2030.

Analyst Perspective:

In Europe, Italy recorded the highest CAGR of 4.4% followed by the UK and Germany owing to rapidly growing demand for furniture and plywood wooden products for residential purpose, in 2022. According to European Commission, the Italian furniture exports increased by 25.7%, which was valued around US$ 53.5 million in 2022 compared to 2021.

The saw blade market holds a prominent position in the European economy. Wood is mainly preferred for energy generation, furniture, and flooring purposes in Europe. The region is responsible for about 5% of the world's forests. Forests are an economic resource in addition to their ecological worth. Approximately 60% of the forest land is privately owned, while 40% is public in Europe. As a result, the commercialization of wood is higher compared to any other region. Moreover, a majority of the EU's forests (85%) are available for timber supply, which is a critical component of the forest's function in revenue creation, employment, and the transition to a bioeconomy. This has helped the wood product manufacturers to produce wood products without any fluctuation in the raw material supply.

Market Overview:

Saw blades are replaceable toothed cutting components used in many hand-held devices as well as portable and stationary power tools. The wood industry in Europe is one of the notable industries as it generates a significant portion of the region's economy. As per the data provided by Eurostat in 2022, the gross value added (GVA) of wood-based industries in the EU was US$ 167.04 billion in 2020, accounting for 7.2% of the overall manufacturing industry. In 2020, the gross value added of producing wood and wood products was 37 billion euros. The highest GVA in the EU's wood-based industries was reported for pulp, paper, and production of paper products (34%). Printing and printing-related service activities accounted for 16% of the GVA of wood-based industries, while furniture manufacturing and wood and wood product manufacturing each accounted for between 23% and 27%, respectively.

Wood is primarily used in the construction industry in the form of sawnwood and wood panels. The demand for sawnwood and wood panels is increasing in Europe owing to growth in the construction industry. As per the data provided by the European Organization of Sawmill Industry (EOS) in 2022, production in 2021 reached an all-time high in EOS member countries. The production of sawnwood in 2021 was 86 million cu. Meter. Further, continuous growth in the pulp & paper industry is another factor that drives the demand for wood and wood processing tools in Europe. As per the data published by the European government, the pulp & paper industry in the region reached US$ 130,226 million in 2022, a 21% hike from 2020. Thus, owing to the increasing demand for wood in the construction, paper, and pulp industries, the need for wood processing tools is increasing, ultimately fueling the saw blade market in the European wood industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Saw Blade for Wood Industry Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Saw Blade for Wood Industry Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increased Demand for Wood Products in Construction Industry is Driving the Saw Blade for Wood Industry Market Growth

The construction industry is the notable industry in Europe, accounting for 9% of the total Europe’s GDP. As per the data provided by the European Union in 2019, the construction industry added a value of ~US$ 615 billion in Europe. Growing demand for high-rise residential construction is one of the factors driving the construction industry in the European market. For instance, Germany recorded a revenue of US$ 175 billion in 2020, while the French construction industry’s turnover was US$ 540 billion in 2020. The construction industry is a vital part of the French economy. It holds more than 25% of the total investment and 5% of the country’s GDP.

According to the European Panel Federation (EPF), the production of wood-based panels reached 65 million cu. Meter, compared to 2020 and 2019, which was below 60 million cu. Meter. The wood panel production industry witnessed a 10% growth in 2021. Moreover, as per the European Panel Federation, the construction industry accounted for 38% of the total wood-based panel consumption in 2022. Thus, the increased demand for wood products owing to continuous growth in the construction industry has driven the demand for woodworking tools such as saw blades in the European saw blade market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The product type segment of saw blade for wood industry market includes saw blades that are used in various types of sawing tools, such as circular saw tools, band saw machines, and chipper knives. Circular saw is projected to dominate the saw blade market during the forecast period. The circular saw's motor spins the blade at high speeds, allowing the teeth to cut through materials effortlessly. The high penetration rate of circular saws and continuous product development activities are among the factors driving the market growth of circular blades. Increasing roundwood production across the European countries is driving the saw blade for wood industry market. According to European Commission Report in 2022, the roundwood production reached 510 million cu. Meter, a growth of 26% from the period of 2000 to 2022. The largest harvested wood is present in the Netherlands, Czechia, Slovenia, and Poland. Also, Germany was the largest manufacturer of roundwood in 2022 in the European Union reaching 79 million cu. Meter, followed by Finland and Sweden reaching 77 million cu. Meter and 66 million cu. Meter, respectively. Rising production of roundwood has created massive demand for circular saw blades in the saw blade market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

In Europe, Germany has the largest share in the production of roundwood for the residential and construction sector. According to the European Commission Organization Report in 2022, Germany was the largest production of around 79 million cu. Meter of roundwood, followed by Finland and Sweden producing 77 million cu. Meter and 66 million cu. Meter of roundwood, respectively. The production of roundwood requires the use of saw blades in huge number, which, in turn, drives the saw blade market in Europe for the wood industry.

Key Player Analysis:

Robert Rontgen GmbH, SNA Europe, Wespa Metallsagenfabrik Simonds Industries, Koll & Cie GmbH & Co. KG., Saw and Tool Factory WAPIENICA Sp Zoo, RUKO GmbH, FABA SA, Aspi Spolka ZOO Spolka Komandytowa, Kanefusa Europe BV, Pilana Wood SRO, Ake Knebel GmbH & Co KG, Ledermann GmbH & Co KG, Metabowerke GmbH, GDA SRL, TKM Austria GmbH, and Leitz GmbH & Co KG are among the prominent saw blade for wood industry market players in the saw blade market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the saw blade market to meet the growing customer demand. The saw blade for wood industry market players present in the saw blade market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key the saw blade market players are listed below:

Year | News |

Oct-2020 | Shenzhen Welldon Tools Co., Ltd. launched diamond saw blades for domestic and international carving markets in September. Diameter of the blade is 200mm. Sharpness and durability have been improved significantly to reduce the operating intensity of workers while saving cost for business owners. |

Oct-2023 | The series is developed by Engr. Giorgio Pozzo, founder of Freud and designer of the Diablo saw blade line. ITK X-Treme Chorme is the only premium industrial quality full featured saw blade on the market offered at the same mid-price point as the competitors' contractor grade blades. |

Europe Saw Blade for Wood Industry Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 286.12 Million |

| Market Size by 2030 | US$ 367.85 Million |

| Global CAGR (2022 - 2030) | 3.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Data Interchange Market

- Authentication and Brand Protection Market

- Thermal Energy Storage Market

- Constipation Treatment Market

- Cosmetic Bioactive Ingredients Market

- Sleep Apnea Diagnostics Market

- Molecular Diagnostics Market

- Enteral Nutrition Market

- High Speed Cable Market

- Medical Second Opinion Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Material, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

In Europe, Germany has the largest share in the production of roundwood for the residential and construction sector. According to the European Commission Organization Report in 2022, Germany was the largest production of around 79 million m3 of roundwood followed by Finland and followed by Sweden producing 77 and 66 million m3 of round wood. These roundwood production requires saw blades in huge amount which drives the saw blade market in Europe for the wood industry.

The construction industry is the notable industry in Europe, accounting for 9% of the total Europe's GDP. As per the data provided by the European Union in 2019, the construction industry added a value of ~US$ 615 billion in Europe. Growing demand for high-rise residential construction is one of the factors driving the construction industry in the European market.

The adoption of wooden pallets in the region is more common compared to plastic pallets due to increased awareness about sustainability. Further, the demand for wood pallets and packaging is increasing mainly due to continuous growth in the retail and e-commerce industry. The retail industry is the most important industrial ecosystem, accounting for 11.5% of the total European Union value added.

Robert Rontgen GmbH, SNA Europe, Wespa Metallsagenfabrik Simonds Industries, RUKO GmbH, GDA srl, and Leitz GmbH & Co KG are the top key market players operating in the Europe saw blade for wood industry market.

The manufacturing of saw blades in its early days included smelting copper and casting it in a blade cast. However, as the technology improved, copper was replaced by steel. In the modern era, many saw blade and tool manufacturers are focusing on undertaking research and development strategies to develop innovative blade materials that are more efficient and effective for working in diverse conditions.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Europe Saw Blade for Wood Industry Market

- Robert Rontgen GmbH

- SNA Europe

- Wespa Metallsagenfabrik Simonds Industries

- Koll & Cie GmbH & Co. KG.

- Saw and Tool Factory WAPIENICA Sp Zoo

- RUKO GmbH

- FABA SA

- Aspi Spolka ZOO Spolka Komandytowa

- Kanefusa Europe BV

- Leitz GmbH & Co KG

- Pilana Wood SRO

- Ake Knebel GmbH & Co KG

- Ledermann GmbH & Co KG

- Metabowerke GmbH

- GDA SRL

- TKM Austria GmbH

Get Free Sample For

Get Free Sample For