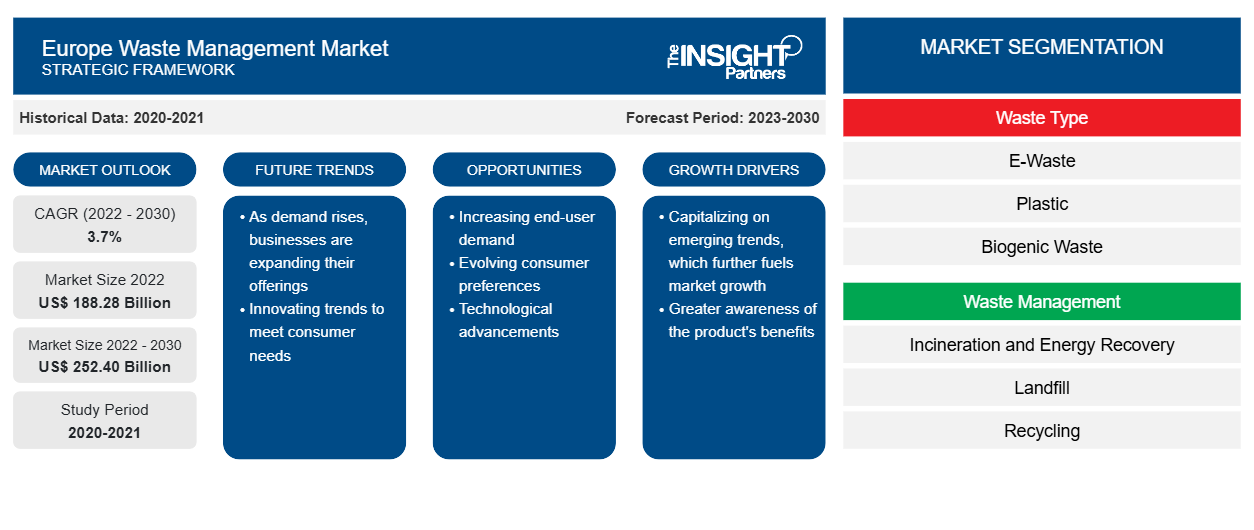

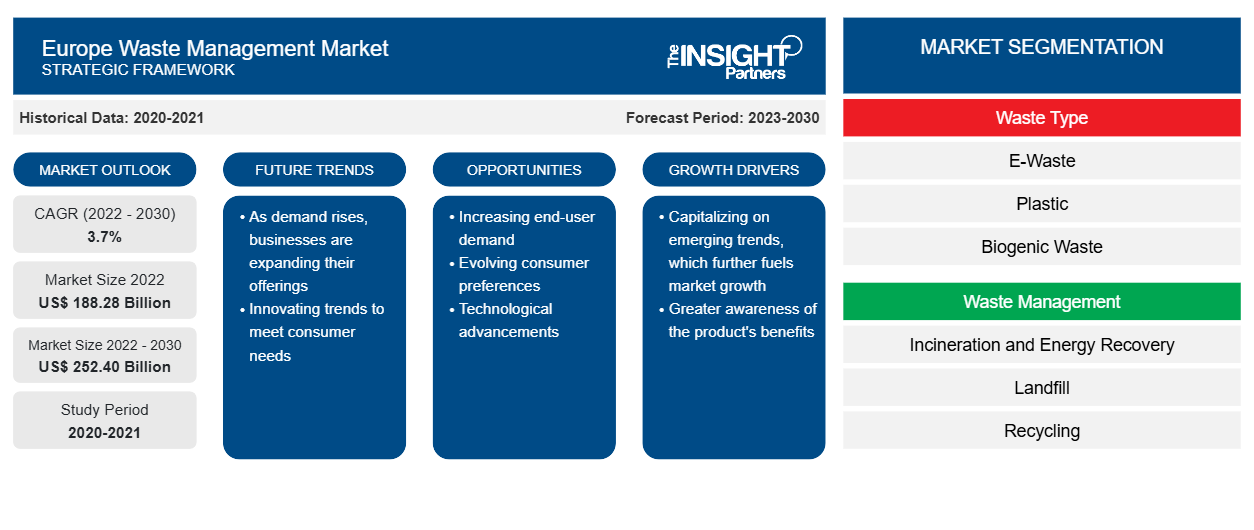

[Research Report] The Europe waste management market size is projected to reach US$ 252.40 billion by 2030 from US$ 188.28 billion in 2022; it is expected to register a CAGR of 3.7% during 2022–2030.

Analyst Perspective:

The growing number of initiatives promoting the usage of waste management solutions in Europe aligns with key principles outlined in the EU waste policy. A fundamental principle involves advancing waste management practices along the “waste hierarchy,” prioritizing waste prevention, preparing for reuse, recycling, and other recovery methods over disposal. With the implementation of these practices, the aim is to foster a circular economy, sustaining resource value within the economic cycle and mitigating the environmental and societal impacts of primary resource extraction. Also, EU legislation establishes legally binding quantitative targets for recycling and preparing for reuse in municipal waste, packaging waste, and waste electrical and electronic equipment (WEEE). The Waste Framework Directive sets ambitious targets for municipal waste recycling, aiming for 55%, 60%, and 65% by 2025, 2030, and 2035, respectively. Similarly, the Packaging and Packaging Waste Directive mandates EU Member States to achieve a minimum recycling rate of 65% for all packaging waste by the end of 2025 and a minimum of 70% by 2030.

These stringent targets reflect the commitment to enhancing waste management practices, driving innovation, and encouraging the adoption of sustainable solutions. As Europe progresses toward meeting these goals, the Europe waste management market is poised for significant growth. Investments in technologies for waste prevention, recycling, and recovery are expected to increase, fostering economic opportunities, and promoting environment-friendly operations. This strategic focus on sustainable waste management aligns with regulatory requirements as well as positions Europe at the forefront of circular economy practices, driving the Europe waste management market.

Market Overview:

The waste management market refers to the industry and economic activities involved in the collection, transportation, processing, recycling, and disposal of various types of waste generated across countries. This market encompasses a wide range of waste materials, including municipal solid waste, industrial waste, hazardous waste, and electronic waste. The primary objective of the Europe waste management market is to implement sustainable and environmentally responsible practices for handling and treating waste materials. The Europe waste management market offers waste collection services, recycling facilities, landfill operations, waste-to-energy plants, and other waste treatment facilities. Regulatory frameworks, environmental policies, and a huge emphasis on sustainable waste management practices are influencing the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Waste Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Waste Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Stringent Environmental Regulations is Driving the Europe Waste Management Market Growth

Many stringent environmental regulations have been established at both national and European Union (EU) levels. The pivotal directives, including the Waste Framework Directive and Landfill Directive, lay out a roadmap for sustainable waste management practices, significantly impacting businesses and market dynamics. The Waste Framework Directive (2008/98/EC) mandated a target of 50% recycling for specific municipal waste types in 2020; the directive has led to a paradigm shift. In 2018, under this directive, the government of Europe established a few ambitious objectives of achieving 55%, 60%, and 65% recycling rates by 2025, 2030, and 2035, respectively. The directive, acting as a regulatory compass, shapes the waste management industry's landscape as well as creates a demand for sustainable and circular economy-focused waste management solutions. Thus, the rise in stringent environmental regulations drives the Europe waste management market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The Europe waste management market analysis is carried out by considering the following segments: waste type, waste management, and end users. Based on waste management, the market is segmented into landfill, incineration and energy recovery, and recycling. The largest Europe waste management market share was held by the recycling segment in 2022.

By waste type, the market is further divided into E-waste, plastic, biogenic waste, and others. The other segment held the largest Europe waste management market share. The other segment is further divided into packaging waste and residual waste. Packaging waste generally includes tinplate, plastic, glass, aluminum, paper, cardboard, paperboard, wood, and others. The packaging process leads to packaging waste; thus, reusing or recycling these valuable (secondary) raw materials conserves natural resources, saves energy, and helps reduce greenhouse gas emissions. The Packaging Act (VerpackG) regulates the separate collection of packaging waste in households across Europe. Plastics, paper cardboard, and beverage cardboard are a few of the packaging waste that witnessed a higher recovery rate in 2020.

Further, revised EU waste legislation requires member states to increase their recycling rates. As of 2022, the goal has been to recycle 50% of waste from private households and small businesses. The EU set new targets for recycling rates, which must reach 60% and 65% by 2030 and 2035, respectively. Organic waste, in particular, holds huge potential, majorly accounting for residual waste. The amount of residual municipal waste generated per year has stabilized at ~113 million metric tons. However, the EU recycling rate grew marginally from 45% in 2015 to 48% in 2020. Achieving the target of 50% residual municipal waste by 2030 would result in reducing this waste by approximately 56.5 million metric tons.

The biogenic waste segment is a key catalyst for the fostering Europe waste management market size. It is driven by a growing emphasis on sustainability, circular economy principles, and renewable energy initiatives. Biogenic waste primarily includes organic materials such as food waste, yard waste, and agricultural residues, which have the potential for beneficial reuse. One notable driver is the increasing adoption of anaerobic digestion and composting technologies. Anaerobic digestion converts biogenic waste into biogas and organic fertilizers, providing a renewable energy source and valuable soil amendments. The process of composting transforms organic waste into nutrient-rich compost, contributing to soil health and promoting sustainable agriculture.

Many countries in Europe are actively promoting separate collection and recycling of biogenic waste to divert it from landfills. This minimizes the environmental impact of landfilling as well as harnesses the energy potential inherent in biogenic materials. National and EU-level policies, such as the Landfill Directive and the Circular Economy Action Plan, highlight the commitment to reducing biogenic waste in landfills and maximizing its resource potential.

Furthermore, the utilization of biogenic waste aligns with carbon reduction goals. The generation of renewable energy from biogas contributes to the diversification of energy sources, minimizing reliance on fossil fuels and mitigating greenhouse gas emissions. As sustainability becomes a top priority, the biogenic waste segment presents opportunities for investments in innovative technologies and infrastructure. The Europe waste management market growth is attributed to the effective management and utilization of biogenic waste, which leads to economic, environmental, and social benefits in the transition toward a more circular and sustainable waste management system.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The scope of the Europe waste management market report covers Germany, France, Italy, Spain, Russia, UK, and the Rest of Europe. In Europe, waste management strategies vary across countries. Germany leads with its efficient recycling system, characterized by high rates of waste separation and recycling. France focuses on waste reduction and recycling but faces challenges due to limited landfill capacity. The UK has made progress in diverting waste from landfills but grapples with disparities in recycling infrastructure among regions. Italy emphasizes recycling and waste-to-energy facilities, alongside efforts to combat illegal dumping. Spain shares similar goals but struggles with inconsistencies in waste management practices across its diverse regions.

Each country is working toward improving waste management to minimize environmental impacts and promote sustainability. Initiatives include investing in infrastructure, implementing stricter regulations, and enhancing public awareness campaigns. Collaboration at both national and international levels fosters knowledge exchange and the adoption of best practices. Despite challenges, European nations remain committed to advancing waste management practices to create cleaner, more resilient communities and protect natural resources for future generations.

Key Player Analysis:

Apart from emphasizing the factors influencing the market, the Europe waste management market report evaluates key players in the market. Seuz SA, Veolia Environnement SA, Stericycle Inc, Stericycle Inc, Augean Plc, Viridor Limited, Biffa Plc, Renewi Plc, Urbaser SA, Fomento De Construcciones Y Contratas SA, Remondis SE & Co Kg are among the key players operating in the Europe waste management market.

Recent Developments:

Organic and inorganic strategies are highly adopted by companies in the Europe waste management market. Further, the players present in the Europe waste management market are focusing on product and service enhancements by integrating advanced features and technologies into their offerings. As per company press releases, a few recent developments by key market players are listed below:

|

|

2023 | Stericycle Inc launched its re-engineered one-gallon SafeDropTM Sharps Mail Back and one-gallon CsRx Controlled Substance Wastage containers. These containers offer a contemporary design, improved ease of use, and a more sustainable product. The SafeDrop Sharps Mail Back container is designed for healthcare providers to manage sharps waste, while the CsRx Controlled Substance Wastage container helps hospitals prevent diversion when disposing of controlled substance wastage. |

2022 | SUEZ, Royal Bafokeng Holdings, and African Infrastructure Investment Managers acquired EnviroServ Proprietary Holdings Limited and its subsidiaries. The acquisition strengthens SUEZ's position as an international leader in industrial and municipal waste treatment activities and strengthens its African presence. |

Europe Waste Management Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 188.28 Billion |

| Market Size by 2030 | US$ 252.40 Billion |

| Global CAGR (2022 - 2030) | 3.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Waste Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Waste Type, Waste Management, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Many stringent environmental regulations have been established at both national and European Union (EU) levels. The pivotal directives, including the Waste Framework Directive and Landfill Directive, lay out a roadmap for sustainable waste management practices, significantly impacting businesses and market dynamics. The Waste Framework Directive (2008/98/EC) mandated a target of 50% recycling for specific municipal waste types in 2020; the directive has led to a paradigm shift.

In Europe, there is an escalating emphasis on sustainability, which has led to a rise in investments in waste management. The heightened awareness about the environmental impact and the imperative to transition toward more sustainable practices have catalyzed a significant shift in financial preferences, favoring projects and companies focused on eco-friendly waste management solutions.

The Ministry of Natural Resources and Environment of the Russian Federation has reported a significant annual generation of municipal solid waste (MSW), estimating it to be ~60 million metric ton, equating to over 400 kg per capita. While the huge volume of waste is not considered the primary challenge, the pressing issue lies in the ability of authorities, individuals, and waste management entities to effectively handle and mitigate the environmental impact of this waste.

The number of waste-to-energy projects is growing in order to reduce dependence on landfills as well as harness energy from waste materials. Waste-to-energy projects, characterized by the conversion of nonrecyclable waste into usable energy forms, emerge as a dynamic and sustainable solution that aligns with the evolving environmental priorities of the European industrial landscape.

Seuz SA, Veolia Environnement SA, Stericycle Inc, Augean Plc, Viridor Limited, Biffa Plc, Renewi Plc, Urbaser SA, Fomento De Construcciones Y Contratas SA, and Remondis SE & Co Kg AS are the top key market players operating in the Europe waste management market.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Europe Waste Management Market

- Seuz SA

- Veolia Environnement SA

- Stericycle Inc

- Augean Plc

- Viridor Limited

- Biffa Plc

- Renewi Plc

- Urbaser SA

- Fomento De Construcciones Y Contratas SA

- Remondis SE & Co Kg

Get Free Sample For

Get Free Sample For