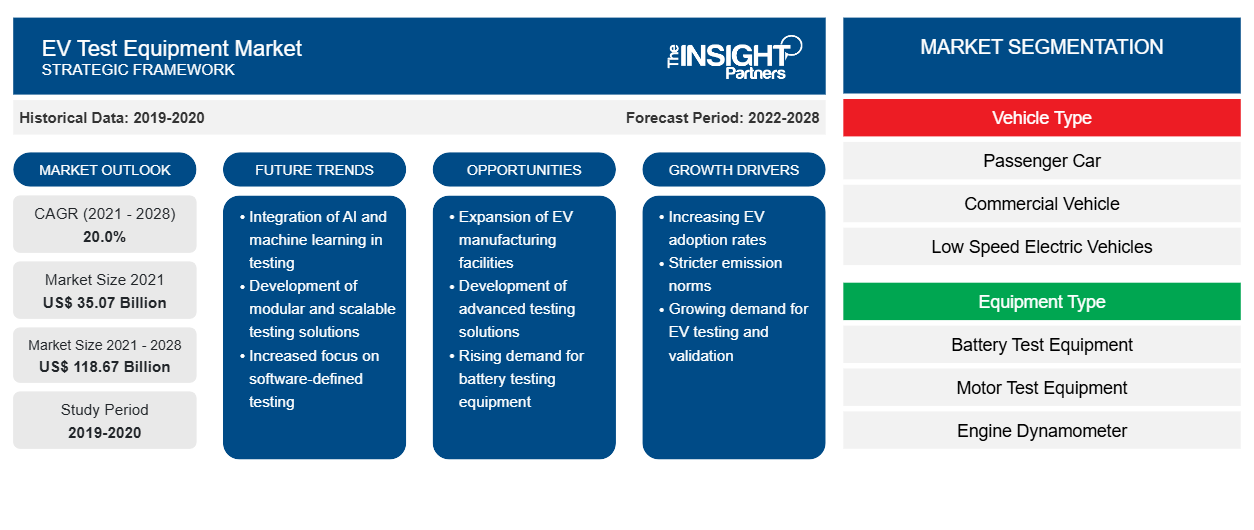

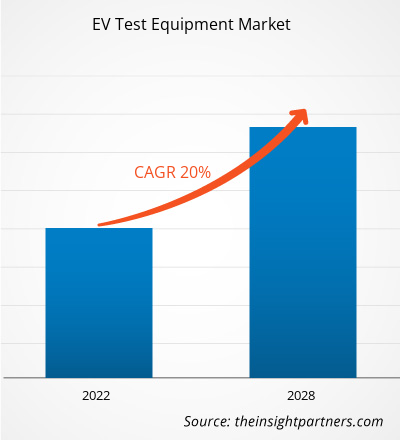

The EV test equipment market is expected to grow from US$ 35,072.54 million in 2021 to US$ 118,671.47 million by 2028; it is estimated to grow at a CAGR of 20.0% from 2022 to 2028.

EV test equipment is used to inspect various EV components such as batteries, motors, and other components to keep automotive parts ahead of the competition, provide guaranteed performance, and ensure customer safety and satisfaction. The test equipment is used in electric vehicles to assess the total vehicle performance, EV battery and charger testing, power electronics testing, and motor and dynamometer testing. Motor testing equipment is used to verify torque or electric signal and the high speed of an electric car, using sensors, voltage probes, and other software.

Electric car sales have been boosted by increased demand for alternative fuel vehicles and connected mobility. To minimize automotive emissions and pollution, several governments have adopted rules that encourage the use of electric vehicles. The EV test equipment market is predicted to develop due to the rising demand for EVs. Moreover, higher voltages allow for faster charging, resulting in the adoption of high-performance batteries, drivetrains, and chargers. As a result, the demand for EV test equipment and software is driven by technological advancements in new battery technologies, increasing demand for electronic functions and features in a vehicle, and stringent emission rules.

According to EV-Volumes.com, 2020 was an excellent year for PHEVs, with global BEV and PHEV sales reaching 3.2 million units. Europe registered 1.4 million electric vehicles in 2020, up 137% from 2019, even after the emergence of the COVID-19 pandemic. This increase was remarkably large for a market that was down by 20% year over year. Furthermore, Europe outperformed China in the EV market for the first time since 2015. Furthermore, many businesses are resuming public transportation services, requiring the implementation of numerous safety measures and standards.

The emergence of new software solutions, such as cloud-based digital solutions for real-time fleet management and acceleration in electrification, is shaping the global EV test equipment market. For instance, the charging management software offered by EVBox enables users to track, manage, and optimize their EV driving experience. Hence to monitor this, AI integrated efficient testing solutions will be in major demand over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EV Test Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EV Test Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Europe EV Test Equipment Market

The COVID-19 outbreak and the path to recovery have had various impacts on the road networks. There was an increase in the purchase of EV test equipment across Europe in 2020. For instance, Germany, France, and Italy registered 55% higher electric car sales in Europe during the first half of 2020 than in 2019. The growth of the EV test equipment market in Europe is due to the rising need for manufacturers to comply with stricter European Union CO2 standards for new passenger cars and vans from January 2020. Germany–based VDE Institute specializes in science, standardization, product testing, certification, and application consulting. In 2019, The VDE Institute was appointed as a category A, B, and D technical service by the Federal Motor Vehicle Transport Authority, which enables it to perform tests on electric vehicles based on the Highway Traffic Act, the Vehicle Parts Act, and regulations according to the Agreement of the Economic Commission for a United Nations of Europe (ECE regulations). Testing and certification carried out by the VDE Institute ensure trouble-free mobility and data security in the overall system, which includes the charging infrastructure, charging stations, and wall boxes during a product’s early development phase for final approval (validation) tests. The presence of a large EV market, institutions with decades of experience in testing electrical safety, and growing requirements to test the electronic components integrated into the vehicle is propelling the growth of the EV test equipment market in Europe.

EV Test Equipment Market Insights

Innovative charging station technologies such as turbo charging, terra HP charging, smart charging systems, wireless power transmission, and bi-directional chargers are being developed by EV charging station firms. Such advancements in electric vehicle charging systems necessitate improved testing techniques. Testing systems for EV charging stations are available from companies including ROLEC, DEKRA, and TUV Rheinland. Smart charging is one of the most advanced charging systems. Smart charging allows for load balancing and proportional distribution of available power capacity across all active charging stations. It also facilitates the collection of critical charging data from various stations using a single cloud-based management platform.

Vehicle Type-Based Market Insights

Based on vehicle type, the EV test equipment market is segmented intopassenger car, commercial vehicle, and low speed electric vehicles. In 2021, the passenger car segment accounted for the largest EV test equipment market share.

Equipment Type-Based Market Insights

Based on equipment type, the EV test equipment market is segmented into battery test equipment, motor test equipment, engine dynamometer, chassis dynamometer, transmission dynamometer, fuel injection pump tester, inverter tester, EV drivetrain test, on-board charger, AC/DC EVSE. In 2021, the battery test equipment segment accounted for the largest EV test equipment market share.

Application-Based Market Insights

Based on application, the EV test equipment market is segmented into EV Component and Drivetrain systems, EV charging, and Powertrain. In 2021, the powertrain segment accounted for the largest EV test equipment market share.

End-Users -Based Market Insights

Based on end-users, the EV test equipment market is segmented into OEMs, Tier 1 Suppliers, Research and Academics, Others. In 2021, the tier 1 suppliers segment accounted for the largest EV test equipment market share.

Market players adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the EV test equipment market forecast. A few developments by major players in the EV test equipment market report are listed below:

- NI's Engineering Innovation Centre (EIC) launch in Bangalore was announced in March 2022. The engineering facility will help NI's clients, partners, and startup firms serving the local aerospace and military sector. The EIC will also be utilized to teach the next generation of engineers in the aerospace & military industries about system understanding.

- In 2021, Keysight Technologies, Inc. and Proventia Oy teamed up to develop battery test solutions for electric vehicles (EVs). The partnership between Keysight and Proventia results in a location-independent, safe test facility that can be implemented quickly.

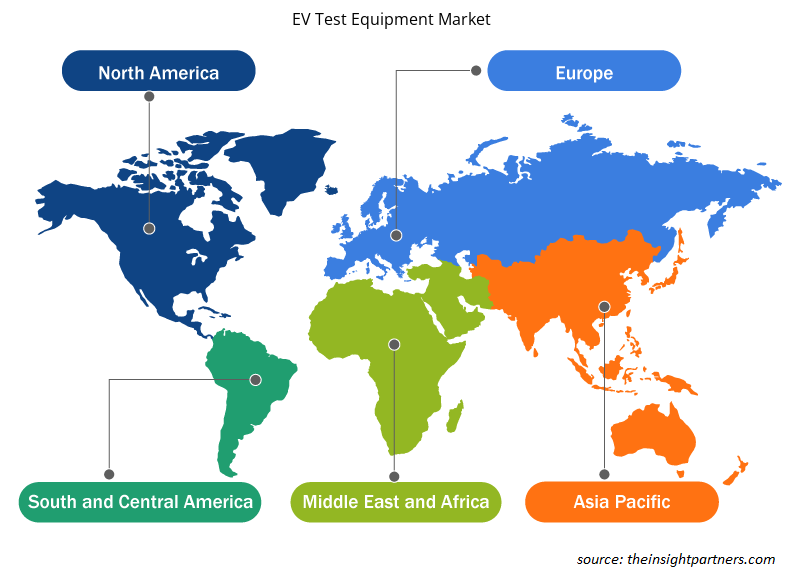

EV Test Equipment Market Regional Insights

The regional trends and factors influencing the EV Test Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses EV Test Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for EV Test Equipment Market

EV Test Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 35.07 Billion |

| Market Size by 2028 | US$ 118.67 Billion |

| Global CAGR (2021 - 2028) | 20.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

EV Test Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The EV Test Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the EV Test Equipment Market are:

- National Instruments Corporation

- Horiba Ltd.

- Arbin Instruments

- Maccor Inc.

- KEYSIGHT TECHNOLOGIES, INC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the EV Test Equipment Market top key players overview

Company Profiles

- National Instruments Corporation

- Horiba Ltd

- Arbin Instruments

- Maccor Inc

- KEYSIGHT TECHNOLOGIES, INC

- Froude, Inc

- Dynomerk Controls

- Comemso electronics GmbH

- Durr Group

- TÜV RHEINLAND

- INTERTEK GROUP PLC

- TOYO SYSTEM CO., LTD

- WONIK PNE CO., LTD

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type, Equipment Type, Application, and End-Users

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Surge in global production and sales of EVs and support from governments are driving the growth of the EV test equipment market.

The market opportunity lies in developing countries. Developing countries have become a hub of opportunity for various markets, including the EV test equipment market. Further, integration of new technologies is presenting significant potential for the future growth of the EV test equipment market players.

In 2021, APAC led the market with a substantial revenue share, followed by Europe and North America. APAC is a prospective market for EV test equipment manufacturers.

Based on vehicle type, the EV test equipment market is segmented into passenger car, commercial vehicle, and low speed electric vehicles. In 2021, the passenger car segment led the EV test equipment market, accounting for the largest share in the market.

The major five companies in the EV test equipment market include National Instruments Corporation; KUKA AG; KEYSIGHT TECHNOLOGIES, INC.; teamtechnik Group; and TOYO SYSTEM CO., LTD.

Based on application, the EV test equipment market is segmented into EV component and drivetrain system, EV charging, and powertrain. In 2021, the powertrain segment led the EV test equipment market, accounting for the largest share in the market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - EV Test Equipment Market

- National Instruments Corporation

- Horiba Ltd.

- Arbin Instruments

- Maccor Inc.

- KEYSIGHT TECHNOLOGIES, INC.

- Froude, Inc

- Dynomerk Controls

- Comemso electronics GmbH

- Durr Group

- TÜV RHEINLAND

- INTERTEK GROUP PLC

- TOYO SYSTEM CO., LTD

- WONIK PNE CO., LTD

Get Free Sample For

Get Free Sample For