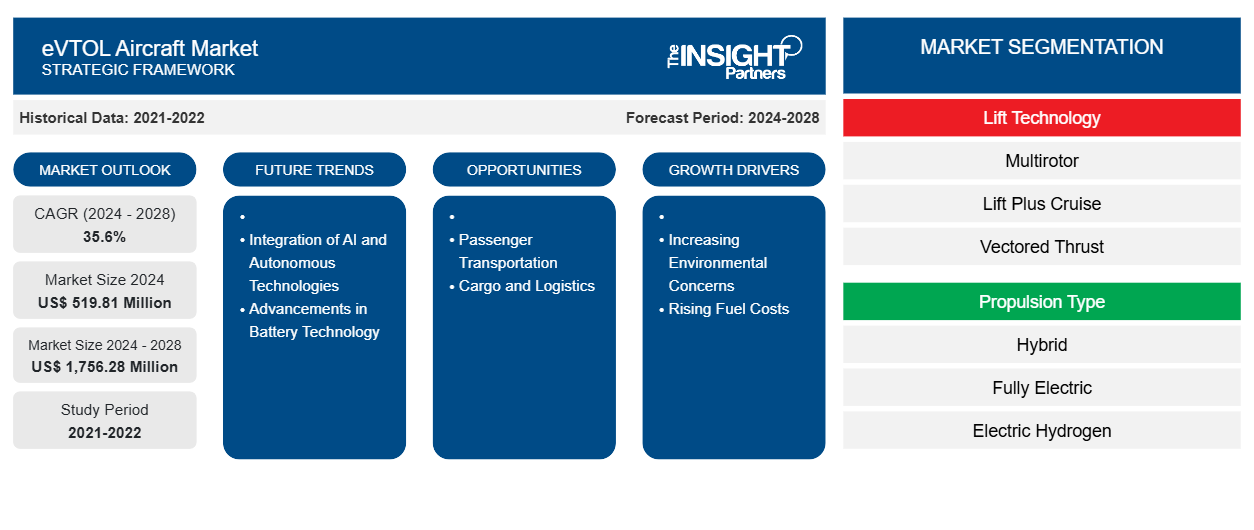

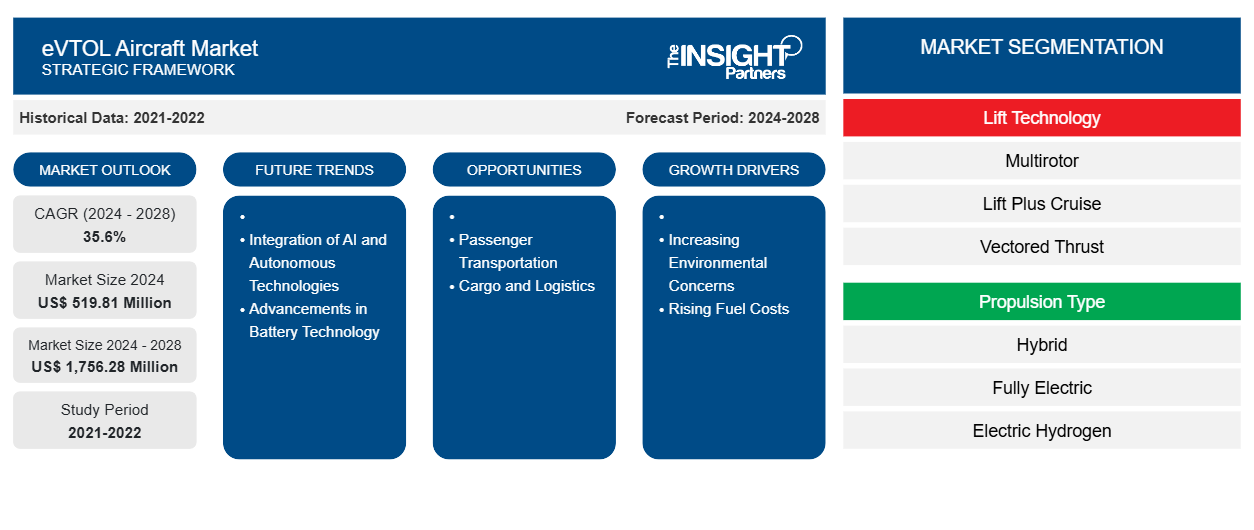

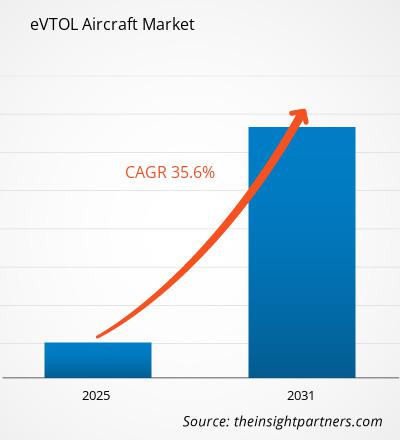

The eVTOL aircraft market is expected to grow from US$ 519.8 million in 2025 to US$ 3,231.4 million by 2031; it is expected to grow at a CAGR of 35.6% from 2025 to 2031.

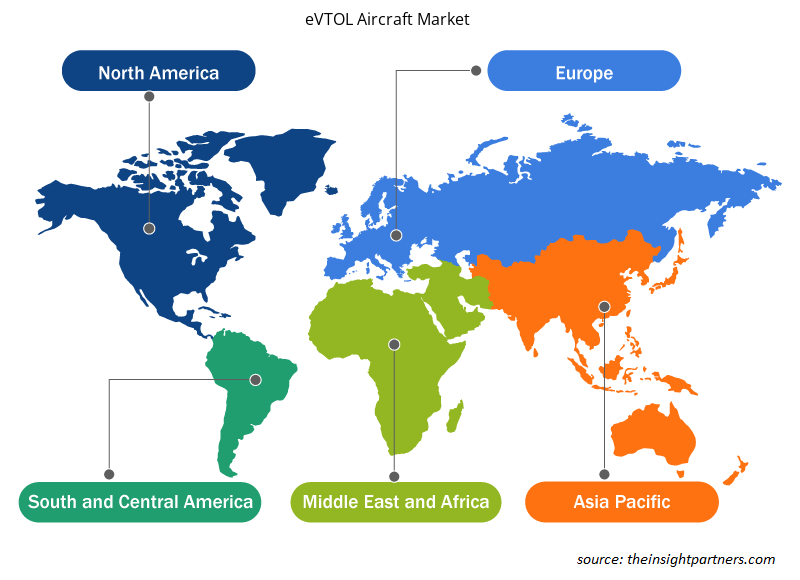

Based on region, the global eVTOL aircraft market is segmented into North America, Europe, Asia Pacific, and the Rest of World. In 2024, Europe is expected to lead the market with a substantial market share, followed by North America. Further, North America is expected to register the highest CAGR in the market from 2025 to 2031.

The eVTOL aircraft market is in the development phase in the European countries; however, the leading companies are strategically working to leverage the market dynamics. For instance, Volocopter GmbH, a German aircraft manufacturer and a leading pioneer of urban air mobility (UAM), had planned to launch the world’s first-ever eVTOL suite of services with the help of passenger air taxis and heavy-lift cargo drones between 2024 and 2026. Also, in March 2022, Jetex and Volocopter signed a strategic partnership agreement to define a safe and sustainable model of urban air mobility. The partnership was established to deploy and operate permanent, economically sustainable, and integrated UAM taxi takeoff and landing infrastructure and services for passenger transportation.

North America is expected to be the fastest-growing region in the global eVTOL aircraft market during the forecast period, according to the market analysis. This is owing to the presence of many eVTOL companies in the region that include vendors such as Archer Aviation, Alakai Skai, Opener Aero, BETA Technologies, Gravitas, Joby Aviation, Wisk Aero LLC., Jaunt Air Mobility, Kittyhawk, and Bell Textron Inc. The eVTOL aircraft market is in the development phase and is expected to grow in the coming years in North America, owing to a rising number of investments and strategic initiatives from key players in the eVTOL aircraft industry. For instance, in February 2021, United Airlines and Archer Aviation announced a partnership to leverage the international carrier's aviation experience. As per the partnership, United Airlines would purchase 200 eVTOL aircraft from Archer. In addition, in June 2021, Vertical Aerospace announced deals worth US$ 4 billion with American Airlines, Virgin Atlantic, and leasing group Avolon for up to 1,000 of its VA-X4 eVTOL aircraft.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

eVTOL Aircraft Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

eVTOL Aircraft Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on eVTOL Aircraft Market

The overall impact of the COVID-19 pandemic on the aviation industry is severe. The global aviation industry is expected to lose ~US$ 200 billion from 2020 to 2022. The impact of the pandemic has led to declined aircraft production, disrupted supply chain during the FY 2020, postponement of new orders, transportation challenges for sourcing materials or parts, and labor challenges for the aviation industry vendors. This had also adversely affected the eVTOL industry. As the eVTOL industry is still in its development phase and is required to have a rising economic growth to sustain the developments across the eVTOL industry, the ongoing projects such as testing, certification, and production of prototypes have been severely impacted during the pandemic.

Market Insights – eVTOL Aircraft Market

Europe leads in the adoption of eVTOL aircraft, technological advancements, and expenditure on eVTOL technologies. This is primarily driving the eVTOL aircraft market growth. The European eVTOL aircraft market has started witnessing rapid recovery for its development. Companies such as Lilium and Volocopter have also witnessed a rising number of pre-orders expected to increase the market size once it is commercialized. For instance, in 2021, Lilium announced that it had already secured a contract worth US$ 1 billion wherein the company is about to provide 220 units of its 5-seater eVTOL aircraft to Luxaviation Group. Moreover, in 2022, Lilium got another pre-order of 150 six-passenger jets that NetJets will provide in the coming years. The lockdown further discontinued the eVTOL aircraft and its prototype production and testing from 2020 to 2021. However, in contrast to the factors mentioned above, the European eVTOL aircraft market players managed to acquire contracts related to eVTOL aircraft development from investors and partners across the region. This further enabled the market players to generate revenues, perform various flight tests and contribute to the eVTOL aircraft market development.

The eVTOL aircraft market is segmented into lift technology, propulsion type, application, and operation mode. Based on lift technology, the eVTOL aircraft market is segmented into multirotor, lift plus cruise, vectored thrust, and others. Based on propulsion type, the market is segmented into hybrid, fully electric, and electric hydrogen. Based on application, the market is categorized into air taxi; cargo transport; last mile delivery; critical missions; inspection, surveying, and mapping; and others. Based on operation mode, the eVTOL aircraft market is segmented into piloted, optionally piloted, and autonomous.

Airbus (The Netherlands), Bell Textron Inc. (US), Boeing (US), Eve Air Mobility (Brazil), Lilium GmbH (Germany), Opener (US), EHang (China), BETA Technologies (US), Pipistrel Group (Slovenia), Volocopter GmbH (Germany), Joby Aviation Inc. (US), Heart Aerospace (Sweden), and Archer Aviation Inc. (US) are among the players profiled during the study of the eVTOL aircraft market.

eVTOL Aircraft Market Regional Insights

The regional trends and factors influencing the eVTOL Aircraft Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses eVTOL Aircraft Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for eVTOL Aircraft Market

eVTOL Aircraft Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 519.8 Million |

| Market Size by 2031 | US$ 3,231.4 Million |

| Global CAGR (2025 - 2028) | 35.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Lift Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

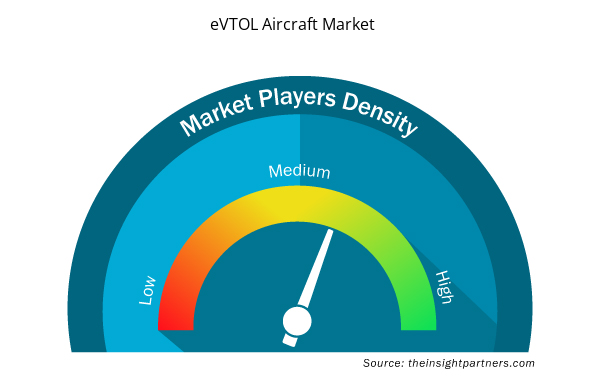

eVTOL Aircraft Market Players Density: Understanding Its Impact on Business Dynamics

The eVTOL Aircraft Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the eVTOL Aircraft Market are:

- Airbus

- Bell Textron Inc.

- Boeing

- Eve Air Mobility

- Lilium GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the eVTOL Aircraft Market top key players overview

The eVTOL aircraft market players are mainly focused on the development of advanced and efficient products, mergers, and partnerships.

- In 2022, Thales partnered with Eve for eVTOL development. Thales announced to support the development of its eVTOL aircraft in Brazil. The strategic partnership involves a series of joint studies over a twelve-month period, which started in January 2022, on the technical, economic, and adaptable feasibility of a 100% electrically powered aircraft.

- In 2021, Heart Aerospace partnered with Arennova Aerospace S.A. to co-design the structure for the new ES-19 electric aircraft – an all-electric aircraft designed to carry nineteen passengers on short regional routes. Aernnova Aerospace S.A. will work with Heart's engineers in designing the wing, the fuselage, and the empennage.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Lift Technology, Propulsion Type, Application, and Operation Mode

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, China, France, Germany, Italy, Japan, MEA, Russian Federation, SAM, South Korea, United Kingdom, United States

Frequently Asked Questions

The estimated global market size for the eVTOL aircraft market in 2024 is expected to be around US$ 519.8 million

Adoption of air taxis due to development of urban air mobility

Development of electric propulsion-based eVTOL aircraft

Germany, US, and France are expected to register high growth rate during the forecast period

Emerging need for green energy-based mode of transportation

Lilium GmbH, EHang, Eve Air Mobility, Joby Aviation, and Volocopter GmbH are the key market players expected to hold a major market share of eVTOL aircraft market in 2024

North America is expected to register highest CAGR in the eVTOL aircraft market during the forecast period (2025-2031)

The US is expected to hold a major market share of eVTOL aircraft market in 2024

Piloted segment is expected to hold a major market share of eVTOL aircraft market in 2024

The eVTOL aircraft market is expected to register an incremental growth value of US$ 2,711.6 million during the forecast period

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - eVTOL Aircraft Market

- Airbus

- Bell Textron Inc.

- Boeing

- Eve Air Mobility

- Lilium GmbH

- Opener

- EHang

- BETA Technologies

- Pipistrel Group

- Volocopter GmbH

- Joby Aviation Inc.

- Heart Aerospace

- Archer Aviation Inc.

Get Free Sample For

Get Free Sample For