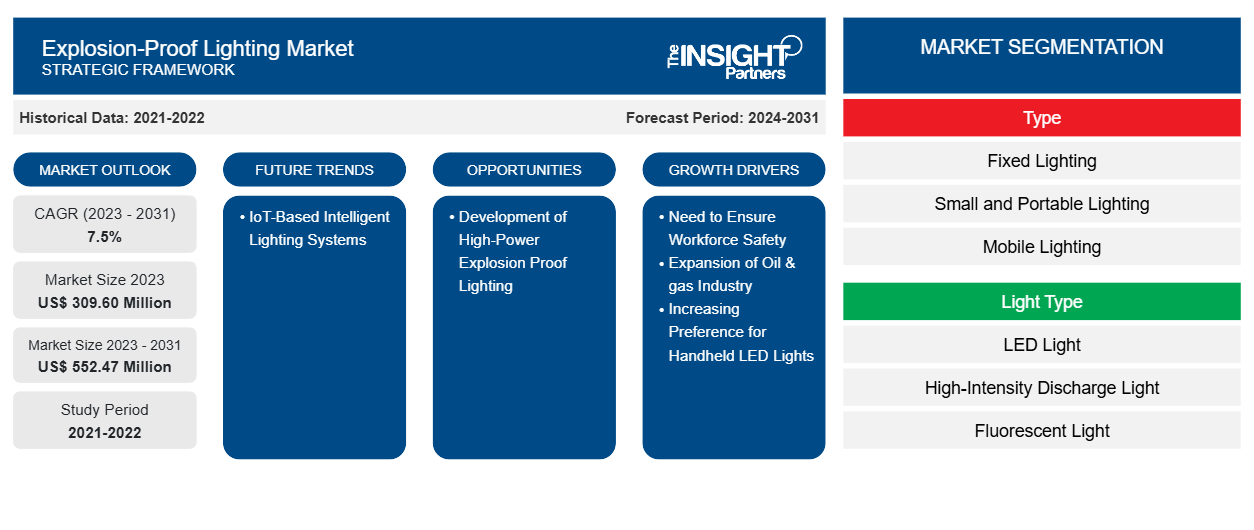

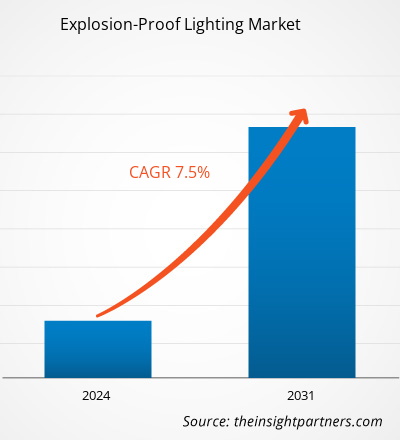

The explosion-proof lighting market size is projected to reach US$ 552.47 million by 2031 from US$ 309.60 million in 2023. The market is expected to register a CAGR of 7.5% during 2023–2031. IoT-based intelligent lighting systems are likely to set trends in the market in the upcoming years.

Explosion-Proof Lighting Market Analysis

Workplace safety and proper maintenance of hazardous locations in industrial and commercial settings have prompted the development and growth of explosion-proof equipment such as lighting. Currently, the market growth is driven by sectors such as oil & gas, chemical, and energy. Certain norms for safety in hazardous locations in these sectors are compelling these sectors to install more certified products.

Explosion-Proof Lighting Market Overview

Hazardous events across diverse industries can be easily tackled by implementing the best practices. Several agencies are responsible for certifying the types of equipment for use in a hazardous area. For instance, in North America, Underwriters Laboratories (UL) and Factory Mutual (FM) usually provide standards, testing, and certification, whereas in Canada, the Canadian Standard Association (CSA) provides approvals. Similarly, in Europe, Equipment for Potentially Explosive Atmospheres (i.e., ATEX) and the International Electrotechnical Commission (IEC) offer standards that are acknowledged worldwide. These organizations do not implement their testing, such as UL, FM, and CSA. However, they notify bodies to perform the testing so as to meet the standards set by them. Several North American players also certify their products to IEC/or ATEX standards in order to sell them internationally. However, the certifications offered by these organizations are quite different from each other.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Explosion-Proof Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Explosion-Proof Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Explosion-Proof Lighting Market Drivers and Opportunities

Expansion of Oil & Gas Industry

The oil & gas industry plays an important role in the economic transformation of various countries. The industry accounts for the largest share of global consumption of energy resources. Natural gas is likely to be one of the fastest-growing fossil fuels in the coming years. Many countries are scaling up their oil production capacities to fulfill their domestic energy demands. According to the International Energy Agency (IEA), global oil demand is expected to rise by 6% during 2022–2028, with significant requirements from the chemicals, energy, power, aviation, and petrochemical industries. The global demand is ultimately expected to reach 105.7 million barrels per day by 2028. A rapidly increasing need for oil among various industries encourages oil & gas industry players to scale up their capacities through plant expansion strategies, which creates the need for explosion-proof equipment, such as lighting, for efficiently monitoring and controlling plant operations by enhancing workers' safety.

According to the Urwald eV report published in November 2023, 384 businesses across the world reported an average capital expenditure of more than US$ 10 million in oil & gas exploration activities during 2021–2023. The top seven companies that invested in oil & gas exploration were China National Petroleum Corporation (US$ 5.9 billion), China National Offshore Oil Corporation (US$ 3.2 billion), Saudi Aramco (US$ 2.8 billion), Pemex (US$ 2.6 billion), Sinopec Group (US$ 2.4 billion), Pioneer Natural Resources (US$ 2.1 billion), and Shell plc (US$ 2.0 billion). These investments allow them to adopt technologically advanced, smart, and intelligent explosion-proof lighting systems to enhance workers' visibility and protect them from unforeseen incidences. Thus, the expanding oil & gas industry worldwide fuel the explosion-proof lighting market growth.

Development of High-Power Explosion Proof Lighting

Explosion-proof lighting is mostly employed in hazardous and demanding conditions containing combustible gases and dust. These lights have a good explosion-proof function, making them suitable for IIA, IIB, and IIC explosive gas environments. In addition to their primary application in oil & gas, chemicals, pharmaceuticals, energy, and mining industries, they find potential applications in the railway, electric power, metallurgy, petroleum and petrochemicals, chemicals, steel, aviation, and shipbuilding industries, among others. These industries generate a significant demand for high-power explosion-proof lighting to prevent explosions caused by equipment or other accidents at the working sites. High-power explosion-proof lighting products are designed to withstand harsh operating conditions, including high temperatures and extreme heat, making them ideal for use in hazardous locations. Dongguan Ming Yang Lighting Limited provides well-designed, high-power, explosion-proof lighting systems that operate with stability and endurance in high-temperature conditions. These systems feature high-strength aluminum radiators with an air convection structure, which helps withstand heat. A constant current drive, protection against short circuit and overvoltage protection, and high electromagnetic compatibility are among other noteworthy features of this system, which render them suitable for application in hazardous industries such as metallurgy, petroleum, petrochemical, chemicals, steel, oil & gas, marine, and mining. Thus, the development of high-power explosion-proof lighting systems is expected to create lucrative opportunities for the explosion-proof lighting market growth during the forecast period.

Explosion-Proof Lighting Market Report Segmentation Analysis

Key segments that contributed to the derivation of the explosion-proof lighting market analysis are type, light type, and end user.

- Based on type, the market is segmented into fixed lighting, small and portable lighting, and mobile lighting. The fixed lighting segment held the largest market share in 2023.

- By light type, the market is divided into LED light, high-intensity discharge light, fluorescent light, and incandescent light. The LED light segment held the largest market share in 2023.

- In terms of end user, the market is segmented into oil and gas, chemical, pharmaceutical, energy, manufacturing, food and beverages, military and defense, transportation and logistics, clean and medical, paint shop and application technology, agriculture and farming, public and community, and others. The oil and gas segment dominated the market in 2023.

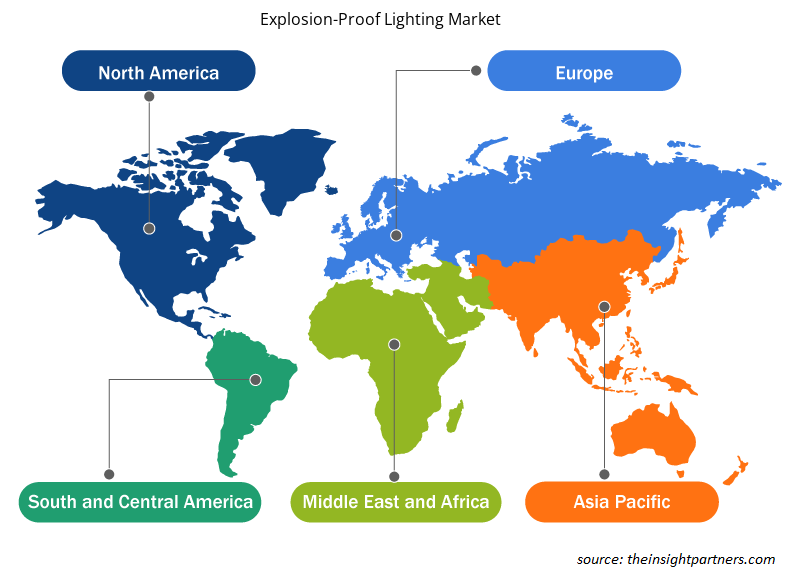

Explosion-Proof Lighting Market Share Analysis by Geography

The geographic scope of the explosion-proof lighting market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

Asia Pacific held a significant market share in 2023. The Asia Pacific explosion-proof lighting market is segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The region is expected to record the highest CAGR in the market during 2023–2031, and the projected market growth can be ascribed to the expanding mining industry and government support toward the development of smart manufacturing facilities. According to a 2023 report from the International Energy Agency (IEA), India, China, and Indonesia contribute massive shares to global coal production. China’s coal production increased by 3.3% and reached 4,631 metric tons in 2023, surpassing the production levels recorded in 2022 by 417 metric tons. Similarly, India’s coal production rose by 7% and reached 989 metric tons in 2023. Governments of these countries focus on encouraging technological advancements in the mining sector and supporting the development of smart manufacturing facilities, which indicates potential demand for explosion-proof lighting in these industries. As per an article published in NS Energy, the Government of India has plans to start 647 oil & gas projects during 2021–2025 to transform India into a gas-based economy. Further, according to Sinopec, a national oil company, the natural gas demand in China reached 395 bcm in 2022, recording a 7% increase from the 370 bcm demand generated in 2021. Workers in the oil & gas industry often operate in hazardous locations and explosive environments. Thus, the surging number of oil & gas projects fuels the demand for explosion-proof lighting in Asia Pacific to safeguard employees from hazardous gas vapors, flammable liquids, or combustible dust.

Explosion-Proof Lighting Market Regional Insights

The regional trends and factors influencing the Explosion-Proof Lighting Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Explosion-Proof Lighting Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Explosion-Proof Lighting Market

Explosion-Proof Lighting Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 309.60 Million |

| Market Size by 2031 | US$ 552.47 Million |

| Global CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Explosion-Proof Lighting Market Players Density: Understanding Its Impact on Business Dynamics

The Explosion-Proof Lighting Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Explosion-Proof Lighting Market are:

- ABB Ltd

- Hubbell Inc

- Eaton Corp Plc

- Cortem S.p.A.

- Pepperl+Fuchs SE

- Emerson Electric Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Explosion-Proof Lighting Market top key players overview

Explosion-Proof Lighting Market News and Recent Developments

The explosion-proof lighting market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the explosion-proof lighting market are listed below:

- Airfal expanded its ATEX portfolio with the launch of GLASSEX, a luminaire with IP69K and IK07 protection made of glass, a material that has high compatibility with a great number of chemicals, which gives it strong resistance to very corrosive environments. (Source: Airfal, Press Release, April 2021)

- Originally engineered for land-based drilling rigs, Emerson expanded its line of Appleton Rigmaster LED linear luminaires to bring the fixture's low-profile, lightweight and energy-efficient design to new lighting applications. Appleton Rigmasters are now available for explosiveproof, hazardous and ordinary industrial locations, making the luminaires suited for underground tunnels, foundries, warehouses, and food processing plants, among other locations where dirt, dust and moisture are a problem. (Source: Emerson Electric Co, Press Release, January 2023)

Explosion-Proof Lighting Market Report Coverage and Deliverables

The "Explosion-Proof Lighting Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Explosion-proof lighting market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Explosion-proof lighting market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Explosion-proof lighting market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the explosion-proof lighting market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Light Type ; Type ; and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The global explosion proof lighting market is estimated to register a CAGR of 7.5% during the forecast period 2023–2031.

The global explosion proof lighting market is expected to reach US$ 552.47 million by 2031.

IoT-based intelligent lighting systems to play a significant role in the global explosion proof lighting market in the coming years.

The key players holding majority shares in the global explosion proof lighting market are ABB Ltd, Eaton Corp Plc, Cortem S.p.A., Pepperl+Fuchs SE, ABTECH, Signify Holding (Philips), Glamox, TREVOS, a.s., TEP Ex d.o.o., Hubbell Inc, Emerson Electric Co, Rockwell Automation Inc, Adolf Schuch GmbH, Airfal International, LDPI, Inc, R. STAHL AG, NORKA, Alfred PRACHT Lichttechnik GmbH.

North America dominated the explosion proof lighting market in 2023.

Need to ensure workforce safety, expansion of oil & gas industry, and increasing preference for handheld LED lights are the major factors that propel the global explosion proof lighting market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Explosion Proof Lighting Market

- ABB Ltd

- Hubbell Inc

- Eaton Corp Plc

- Cortem S.p.A.

- Pepperl+Fuchs SE

- Emerson Electric Co

- Rockwell Automation Inc

- General Electric Co

- Adolf Schuch GmbH

- Airfal International

- LDPI, Inc

- ABTECH

- Signify Holding (Philips)

- R. STAHL AG

- NORKA

- Glamox

- TREVOS, a.s.

- TEP Ex d.o.o.

- Alfred PRACHT Lichttechnik GmbH

Get Free Sample For

Get Free Sample For