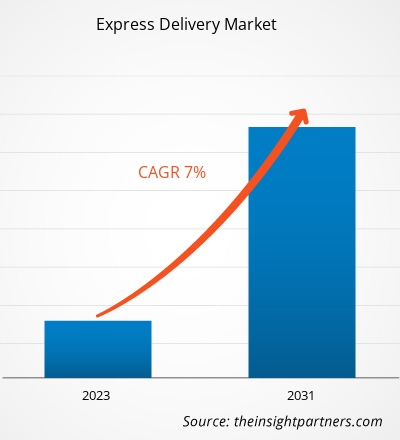

The express delivery market size is projected to reach US$ 551.8 billion by 2031 from US$ 320.6 billion in 2023. The market is expected to register a CAGR of 7.0% in 2023–2031. The rapid growth of the e-commerce industry across the globe, the rise in online sales customer base, and the adoption of express delivery across the globe are among the factors driving the express delivery market.

Express Delivery Market Analysis

The express delivery market is expected to experience considerable growth during the analyzed timeframe, owing to the rising adoption of e-commerce among the global population. The increase in the adoption of smartphones and high penetration of the internet worldwide is positively influencing the adoption of e-commerce sector across the global customer. This has also influenced businesses and companies to adopt e-selling channels or online channels to reach a higher consumer base. In addition, the internet penetration across the globe is influencing the population for adopting online purchase. Brands and e-commerce websites are highly adopting express delivery to offer better customer service by delivering parcels in less time.

Express Delivery Market Overview

The express delivery market is growing rapidly. From warehousing and order fulfillment to transportation and risk management, the logistics needs of engineering and manufacturing (E&M) companies are complex. As construction, development, and infrastructure programs are increasing worldwide, express delivery is playing a greater role in maintaining the operations and flexibility of these companies. In fact, it is the increasingly global operations in the manufacturing industry, as well as increasing development in emerging markets, that makes the rapid movement of goods so crucial. Factories need fast delivery of parts and machines so that production is not interrupted. Such a need for express delivery in the industries is projected to drive t in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Express Delivery Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Express Delivery Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Express Delivery Market Drivers and Opportunities

Rising Investments by Companies on Same-Day Delivery of Consumer Goods

Same-day delivery ensures that the product or goods ordered by the customer is delivered within a few hours or single day, thereby ensuring satisfaction to consumers and loyalty toward the brand for many years. For instance, Amazon—the world's largest online retailer—is extensively supporting same-day delivery or express delivery and has launched the express delivery services in many cities already. However, over the last five years, several same-day delivery proponents have successfully launched new pilots or delivery services and businesses. In addition, big online retailers, including Walmart and Alibaba, made strategic initiatives to integrate same-day delivery into their business model.

Customers have been turned to turn to the online sales channels for their basic to advanced level product requirements owing to the availability of all products on the internet with real ratings, reviews, and best prices, thereby fueling the e-commerce industry growth worldwide. Competition has been increasing with the increase in demand, and customers expect their products to be delivered as early as possible. This is influencing the investment of the companies to take benefit of express delivery over its competitors. Thus, the factors mentioned above are contributing to the increased investments by companies in developing same-day delivery or instant delivery options which in turn is anticipated to drive the express delivery market growth in the coming years.

Increasing Adoption of Express Delivery Services to Offer Better Customer Experience

Large adoption of express delivery has been observed across major industries—such as food & beverages and healthcare—in all major economies worldwide. The demand from the global population to receive the items to be delivered on the same day or to be delivered maximum in a day has increased over the years. For instance, the demand for same-day deliveries from the population for groceries is about 64% of overall producys, healthcare products are 46%, specialty snacks are 42%, alcohol is 41%, and other household products are 28%. The highest adoption of express delivery service is noticed across the healthcare sector. In healthcare, proper prioritization reduces misery and saves lives. There must be access to high-tech medical devices and work around the clock all year round. It is essential to deliver critical samples and medicines on time without being tempered in the process of transportation. In the healthcare sector, high demands for quality, availability, accuracy, and cost control place similarly high expectations on logistic solutions. Thus, the factors mentioned above are likely to influence the growth of the global express delivery market during the forecast period.

Express Delivery Market Report Segmentation Analysis

Key segments that contributed to the derivation of the express delivery market analysis are destination, business type, and end-user.

- Based on destination, the express delivery market has been divided into domestic and international. The domestic segment registered the largest market share in 2023.

- Based on the business type, the express delivery market has been divided into business-to-business and business-to-consumer. The business-to-business segment held a larger market share in 2023.

- On the basis of end-users, the market has been segmented into BFSI, Automotive, Pharmaceuticals, IT and Telecom, Electronics, Retail and E-commerce, and Others. The automotive segment dominated the market in 2023.

Express Delivery Market Share Analysis by Geography

The geographic scope of the express delivery market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

North America has dominated the express delivery market in 2023. The North America region includes the US, Canada, and Mexico. The growth in the e-commerce industry is opportunistic for express delivery market growth in North America. The presence of well-developed countries such as the US, Canada, and Mexico with a strong industry base, and high technology adoption is expected to drive the market growth in the coming years. The presence of fast-growing economies, rising online shopping, and increasing internet penetration are among the prime factors expected to drive the growth of the express delivery market in North America. In addition, according to the Census Bureau of the Department of Commerce, the sales of retail e-commerce industry for the year 2023 are valued at more than US$ 1.1 trillion, which in turn is expected to be the key factor in the express delivery market during the analyzed timeframe.

Express delivery market Report ScopeExpress Delivery Market Regional Insights

The regional trends and factors influencing the Express Delivery Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Express Delivery Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Express Delivery Market

Express Delivery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 320.6 Billion |

| Market Size by 2031 | US$ 551.8 Billion |

| Global CAGR (2023 - 2031) | 7.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Destination

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

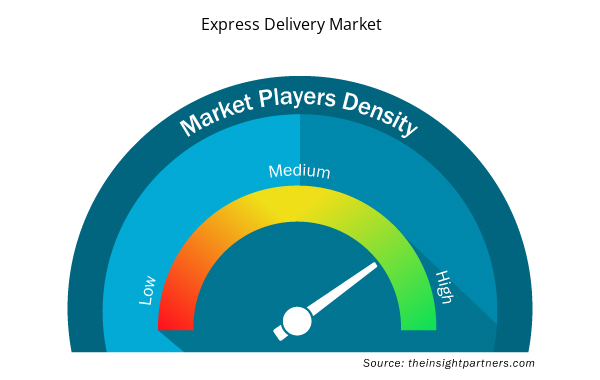

Express Delivery Market Players Density: Understanding Its Impact on Business Dynamics

The Express Delivery Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Express Delivery Market are:

- DHL International GmbH

- United Parcel Service of America, Inc.

- DSV A/S

- FedEx Corporation

- Geodis SA

- ARAMEX

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Express Delivery Market top key players overview

Express delivery market News and Recent Developments

The express delivery market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for express delivery market and strategies:

- In June 2023, Alibaba Logistics unit named Cainiao launched express service. This is aimed at improving e-commerce efficiency to facilitate sales from its e-commerce platform under the brand name Cainiao Express.

- In January 2021, Amazon.com, Inc. bought jets for succesfuly completing it 30-minute delivery dream. Amazon purchased 11 Boeing 767-300 jets for air-cargo division, mostly to get products to prime subscribers.

Express Delivery Market Report Coverage and Deliverables

The “Express Delivery Market Size and Forecast (2021–2031)” report provides a detailed market analysis of the covering below areas:

- Market size and forecast at global, regional, & country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Destination ; Business Type ; and End-User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For