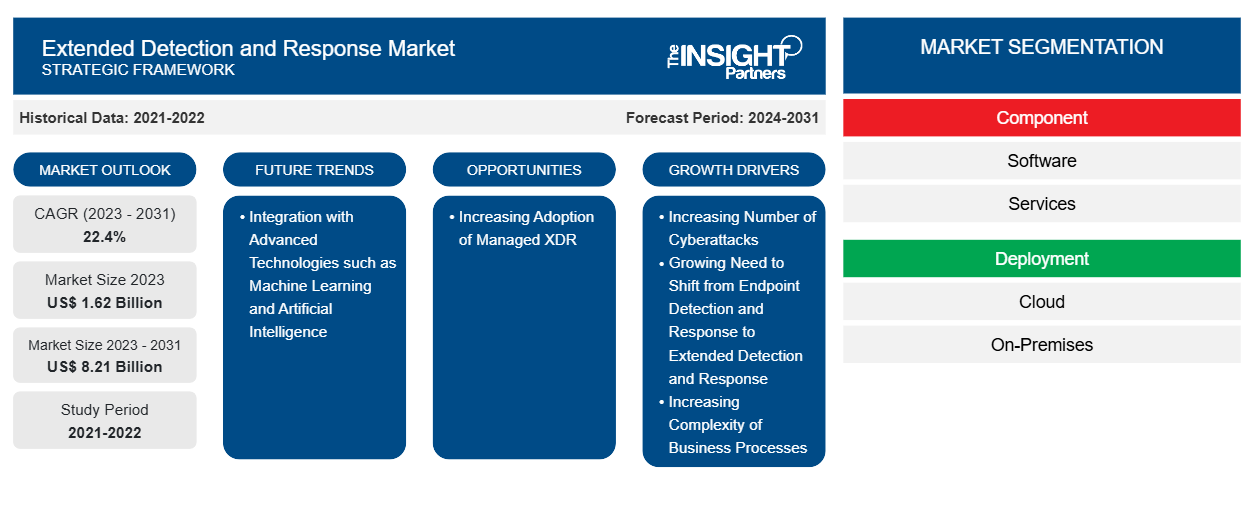

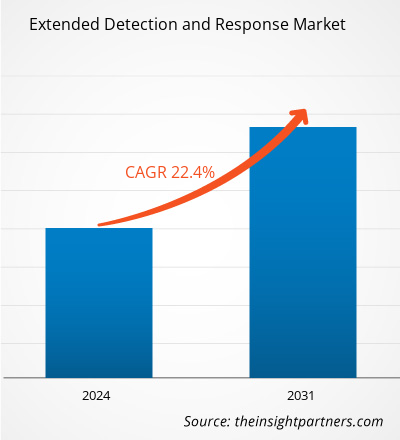

The extended detection and response market size is expected to reach US$ 8.21 billion by 2031 from US$ 1.62 billion in 2023. The market is estimated to record a CAGR of 22.4% from 2023 to 2031. Integration of extended detection and response solutions with advanced technologies such as machine learning and artificial intelligence is likely to remain a key market trend.

Extended Detection and Response Market Analysis

The extended detection and response market is growing rapidly due to the increasing complexity of business processes, the rising number of cyberattacks, and enhanced visibility and awareness of security threats provided by XDR solutions. The demand for extended detection and response solutions is also driven by the increasing use of cloud solutions and services, the rising number of digital transformation projects, and the growing need to improve the cybersecurity landscape. The COVID-19 pandemic has led to a surge in remote work models, which, in turn, increases the need for deep visibility and comprehensive detection and response. This results in XDR solutions becoming more popular as organizations look for ways to secure their networks and data in a distributed work environment. The COVID-19 pandemic also caused many firms to switch from on-premise to cloud computing, which propelled the requirement for extended detection and response solutions.

Extended Detection and Response Market Overview

Extended detection and response (XDR) is a relatively new approach to threat detection and response, which provides comprehensive protection against cyberattacks, illegal access, and misuse. Extended detection and response solution gathers and automatically correlates data from various security layers such as email, endpoints, servers, cloud workloads, and networks. This enables quicker threat identification and better investigation and reaction times. Evolving from its predecessor, endpoint detection and response (EDR), XDR is a comprehensive and integrated approach to threat detection, response, and mitigation. XDR solutions provide various benefits such as broad visibility and contextual understanding, data retention, internal and external traffic analysis, integrated threat intelligence, customizable detection, and ML-based detection.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Extended Detection and Response Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Extended Detection and Response Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Extended Detection and Response Market Drivers and Opportunities

Increasing Number of Cyberattacks

Cyberattacks were considered the fifth top-rated risk in 2020, and cases continue to rise with technological advancements. Computer malware, data breaches, and denial of service (DoS) are a few examples of cyberattacks. During the COVID-19 pandemic, cybercriminals took advantage of misaligned networks as businesses were shifting to remote working environments. According to OneLogin, cybercrime costs more than US$ 1 trillion worldwide, as 37% of organizations were affected by ransomware and 61% were affected by malware attacks in 2020. Between 2019 and 2020, cyberattacks in the US increased by 139% as the country registered 145.2 million cases in Q3 2020. Malware attacks increased by 358% in 2020 compared to 2019. Similarly, according to the Clusit Report, cyberattacks across the globe increased by 10% in 2021 compared to the previous year. For instance, according to AAG, the UK had the highest number of cybercrime victims per million internet users (4,783 users) in 2022, an increase of 40% over 2020 figures. The average cost of a cyber breach was US$ 3 trillion in 2015, and it is predicted that this value is expected to reach US$ 10.5 trillion by 2025.

Cyber threats are considered a major concern as various organizations continue to operate in a digital environment. They have severe consequences for individuals, corporations, and governments. The rise in the number of cyberattacks has increased the importance of cybersecurity in safeguarding critical infrastructures and ensuring the safety of individuals and organizations. Organizations are increasingly becoming aware of the need to safeguard their critical assets from unauthorized access and potential breaches. Extended detection and response has emerged as an important solution that companies can adopt to defend against online attacks. Thus, the increasing number of cyberattacks across enterprises drives the extended detection and response market.

Increasing Adoption of Managed XDR

Managed XDR refers to a service model that provides a subscription-based XDR capability delivered by a third-party provider. Organizations looking to add XDR value to their current security teams and solutions find managed XDR solutions appealing. Organizations using managed XDR (MXDR) solutions can benefit from lower complexity, cost, and risk associated with outsourcing in addition to the advantages of XDR, such as enhanced visibility, detection, and reaction. In order to improve security results, managed XDR solutions will also give users access to professional advice, best practices, and threat intelligence. In addition, key companies in the market are increasingly engaging themselves in various strategic decisions such as product launches and partnerships. For instance, in May 2024, Sekuro launched a managed extended detection and response (XDR) platform, offering sovereign architecture and adaptive intelligence. In May 2024, Noventiq achieved Microsoft-verified MXDR solution status. By achieving this status, Noventiq has proven its robust MXDR services, including a security operations center (SOC) with 24/7/365 proactive hunting, monitoring, and response capabilities, all built on tight integrations with the Microsoft Security platform. Similarly, in June 2023, Critical Start announced the launch of its new managed XDR offering, which unifies Critical Start's award-winning MDR service with a cloud-delivered collection, storage, and search platform for security-relevant log sources. In December 2023, BlackBerry Limited announced an update to its BlackBerry Guard MDR service to deliver MXDR service. Thus, the increasing adoption of MXDR is expected to provide lucrative opportunities for the players operating in the extended detection and response market growth in the coming years.

Extended Detection and Response Market Report Segmentation Analysis

Key segments that contributed to the derivation of the extended detection and response market analysis are component, deployment, enterprise size, and end user.

- Based on component, the extended detection and response market is bifurcated into software and services. The software segment dominated the market in 2023.

- By deployment, the market is bifurcated into cloud and on-premises. The cloud segment dominated the market in 2023.

- Based on enterprise size, the market is segmented into large enterprises and SMEs. The large enterprises segment dominated the market in 2023.

- Based on end user, the market is segmented into IT & telecom, BFSI, manufacturing, retail and eCommerce, healthcare, and others. The IT & telecom segment dominated the market in 2023.

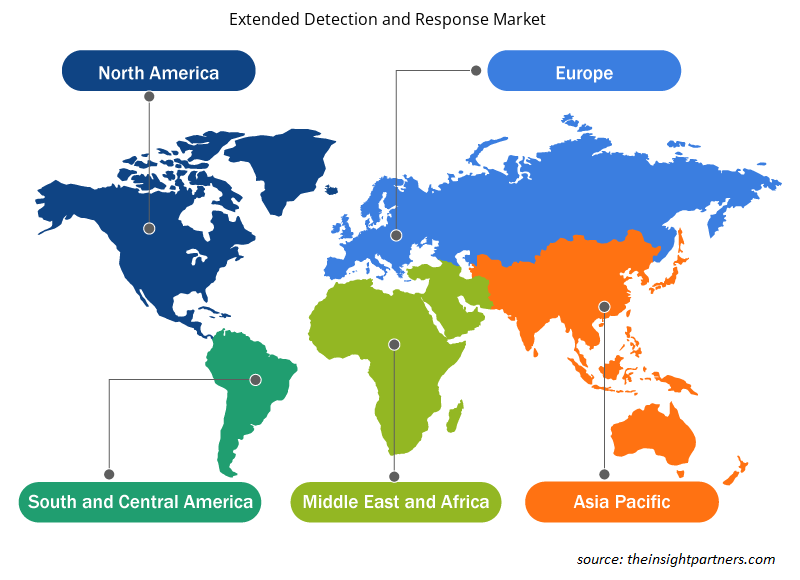

Extended Detection and Response Market Share Analysis by Geography

- The extended detection and response market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- The North America extended detection and response market is segmented into the US, Canada, and Mexico. North America is one of the fastest-growing regions in terms of technological innovations and advanced technology adoption. In the past three years, the region has witnessed huge adoption of emerging technologies such as blockchain, artificial intelligence (AI), and machine learning (ML) across all major industry verticals. The North America extended detection and response market trends include the increasing penetration of digitization in various industries and a rising number of cyberattacks.

Extended Detection and Response Market Regional Insights

The regional trends and factors influencing the Extended Detection and Response Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Extended Detection and Response Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Extended Detection and Response Market

Extended Detection and Response Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.62 Billion |

| Market Size by 2031 | US$ 8.21 Billion |

| Global CAGR (2023 - 2031) | 22.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Extended Detection and Response Market Players Density: Understanding Its Impact on Business Dynamics

The Extended Detection and Response Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Extended Detection and Response Market are:

- Broadcom Inc

- Palo Alto Networks Inc

- SentinelOne Inc

- Microsoft Corp

- Sophos Ltd.

- Cisco Systems Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Extended Detection and Response Market top key players overview

Extended Detection and Response Market News and Recent Developments

The extended detection and response market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the extended detection and response market are listed below:

- Broadcom Inc. announced its accelerate program, delivered through sole-provider distribution agreements. An expansion of the Broadcom Global Cybersecurity Aggregator Program, the Accelerate Program is aimed at providing enhanced service levels for more Broadcom software solutions delivered to a broader range of Broadcom customers across multiple geographies.

(Source: Broadcom Inc, Press Release, March 2024)

- Palo Alto Networks announced the ability for customers to integrate their custom machine learning models, seamlessly integrating third-party EDR data and leveraging cloud detection and response capabilities. Cortex XSIAM now offers Palo Alto Networks customers the flexibility and customization to create a security solution that aligns perfectly with their organization's goals. The integration of SOC capabilities, such as SIEM, XDR, SOAR, and ASM, into a single platform is a game changer for security operations. With Cortex XSIAM, organizations get dramatically better security and turbocharged SOC performance.

(Source: Palo Alto Networks, Press Release, May 2024)

Extended Detection and Response Market Report Coverage and Deliverables

The "Extended Detection and Response Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Extended detection and response market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Extended detection and response market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Extended detection and response market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the extended detection and response market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Virtual Production Market

- Nuclear Waste Management System Market

- Medical Enzyme Technology Market

- Health Economics and Outcome Research (HEOR) Services Market

- Dealer Management System Market

- Occupational Health Market

- Data Annotation Tools Market

- Bathroom Vanities Market

- Rare Neurological Disease Treatment Market

- Nurse Call Systems Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Enterprise Size, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players, holding majority shares, in extended detection and response market includes Microsoft; Cisco Systems, Inc.; Palo Alto Networks; SentinelOne; and Broadcom Inc.

Asia Pacific is anticipated to grow with the highest CAGR over the forecast period 2024-2031.

The North America held the largest market share in 2023, followed by Europe and Asia Pacific.

The extended detection and response market was valued at US$ 1.62 billion in 2023 and is projected to reach US$ 8.21 billion by 2031; it is expected to grow at a CAGR of 22.4% during 2023–2031.

Increasing number of cyberattacks, growing need to shift from endpoint detection and response to extended detection and response, and increasing complexity of business processes are the driving factors impacting the extended detection and response market.

Integration with advanced technologies such as machine learning and artificial intelligence is the future trends of the extended detection and response market.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Extended Detection and Response Market

- Broadcom Inc

- Palo Alto Networks Inc

- SentinelOne Inc

- Microsoft Corp

- Sophos Ltd.

- Cisco Systems Inc

- International Business Machines Corp

- Check Point Software Technologies Ltd

- Fortinet Inc

- Cybereason Inc

Get Free Sample For

Get Free Sample For