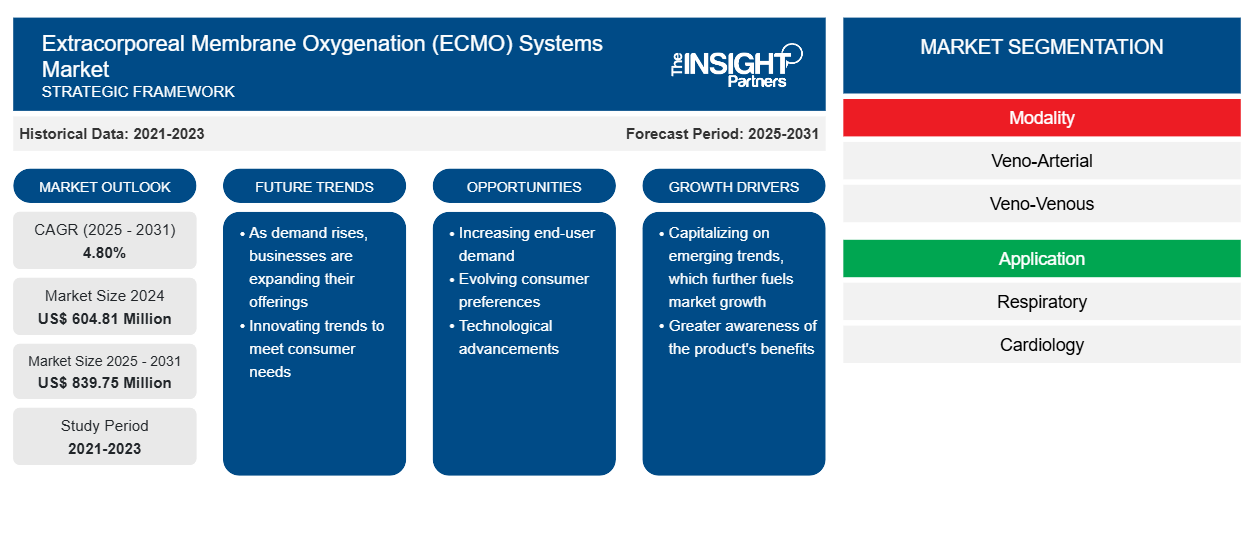

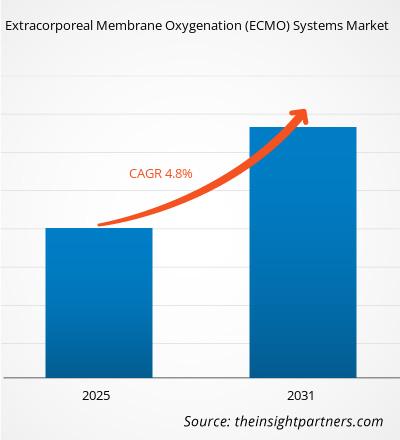

[Research Report] The Extracorporeal Membrane Oxygenation (ECMO) Systems Market Size is expected to grow from US$ 550.68 million in 2022 to US$ 800.03 million by 2031; it is estimated to register the growth rate of 4.8% over the forecast period.

Market Insights and Analyst View:

Extracorporeal Membrane Oxygenation (ECMO) Systems are life support machines that are used to provide temporary assistance to severe respiratory or cardiac failure patients. The ECMO system works by removing blood from the patient’s body, oxygenating it outside of the body, and then returning it to the patient. These systems are used as a last resort when other treatments have failed. They are commonly employed in intensive care units and require specialized training and expertise to operate. ECMO Systems does not cure lung or heart damage; it just takes the load from the lungs and heart, which gives time for the organs to recover during treatment. The increasing prevalence of respiratory and cardiovascular conditions, along with the increase in cardiovascular surgeries among the geriatric population, is expected to drive the ECMO systems market. Moreover, increased use of ECMO systems among neonatal and pediatric patients is expected to create ample opportunities in the ECMO systems market growth.

Growth Drivers and Challenges:

Cardiopulmonary disorders are mainly affecting the lungs and heart of people. These conditions are classified as chronic obstructive pulmonary disease (COPD) and cardiovascular diseases. Cardiovascular diseases comprise blood vessel diseases, heart arrhythmia problems, coronary artery diseases, and heart defects that affect the blood vessels and heart. Further, COPD consists of chronic bronchitis and emphysema.

As per the American Lung Association, COPD is the prominent cause of death in the US, affecting ~12 million Americans in 2022. According to the WHO, COPD will be the third leading cause of death globally in 2021. The high COPD mortality rate is linked to acute exacerbations that cause failure of respiratory muscles, resulting in the loss of ability to breathe independently, which leads to death from systemic infection and asthma. Further, as per the Burden of Obstructive Lung Disease (BOLD) report, 2021, COPD mortality is projected to rise worldwide over the next 40 years, reaching 5.4 million deaths annually by 2060. Thus, with the rising incidence of COPD, the demand for ECMO systems is also on the rise.

As per the Global Health Data Exchange registry, the worldwide prevalence of congestive heart failure is 64.34 million cases in 2023. The primary risk factors of CVDs include ethnicity, family history, and age; other risk factors include hypertension, obesity, tobacco consumption, high cholesterol, physical inactivity, and diabetes. The WHO estimates that 17.9 million lives are lost due to CVDs annually. Oxygenator devices can be a key assistance to doctors to reduce the mortality rate. In the event of heart failure, the blood oxygen level is maintained with the assistance of an external device, as the heart is unable to maintain proper oxygen levels. Oxygenator devices are used to manage patients with heart failure.

Therefore, the rising prevalence of cardiopulmonary diseases (cardiovascular disorders and COPD) boosts the demand for ECMO systems.

However, there are various risk factors associated with the use of ECMO systems that can affect the patient's condition. Bleeding is one of the risk factors experienced among most of the patients with ECMO systems due to the use of anti-coagulant. Additionally, increased risk of stroke, infections, kidney failure, mechanical failure, and others are also observed in some of the cases, which is likely to hamper the ECMO systems market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Extracorporeal Membrane Oxygenation (ECMO) Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Extracorporeal Membrane Oxygenation (ECMO) Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global ECMO Systems Market Size” is segmented based on modality, application, patient type, end user, and geography. Based on modality, the ECMO systems market is segmented into veno-arterial (VA), veno-venous (VV), and others. Based on application, the ECMO systems market is bifurcated into respiratory and cardiology. Based on patient type, the ECMO systems market is segmented into adult, pediatric, and neonatal. Based on end users, the ECMO systems market is categorized into hospitals and Clinics, cardiac centers, and others. The ECMO systems market based on geography is fragmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on modality, the ECMO systems market size is segmented into veno-arterial (VA), veno-venous (VV), and others. In 2022, the veno-arterial segment held the largest share of the market and is expected to register the fastest rate during the coming years owing to the increased effectiveness and reliability of gas exchange along with widespread use among cardiac arrest patients as it helps with algorithm life support techniques to reestablish blood flow.

Based on application, the ECMO systems market is bifurcated into respiratory and cardiology. In 2022, the respiratory segment held the largest market share and is also expected to grow at the fastest rate during the coming years, owing to the increasing prevalence of respiratory disorders along with smoking and tobacco use, which can cause respiratory failure.

Based on patient type, the ECMO systems market is segmented into adult, pediatric, and neonatal. In 2022, the adult segment held the largest share of the market by patient type. However, the neonatal segment is expected to register the highest growth rate during the coming years owing to the increasing prevalence of respiratory conditions such as pneumonia, respiratory distress syndrome, and others among the neonatal population.

Based on end users, the ECMO systems market is categorized into hospitals and clinics, cardiac centers, and others. In 2022, the hospital and clinics segment held the major market share and is expected to register a significant growth rate during the coming years, owing to the increasing hospital admissions for respiratory conditions to receive treatment and care for the required duration.

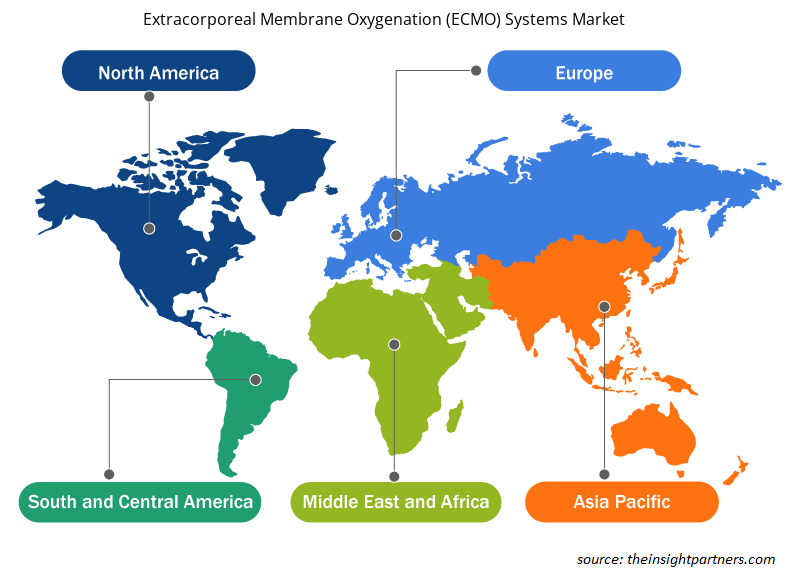

Regional Analysis:

The ECMO systems market encompasses five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest ECMO systems market share, closely followed by Europe, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The major growth factor for the North American market is the rising prevalence of cardiovascular and respiratory disorders in the region. It has increased the incidence of cardiopulmonary disorders such as COPD, chronic bronchitis, congestive heart failure, and others. According to the American Lung Association, there were ~12.5 million people diagnosed with chronic bronchitis, COPD, and emphysema in the US in 2021.

Additionally, the rising incidence and prevalence of these disorders have increased the count of surgical procedures among large patient populations, which has fueled the growth of the ECMO systems market. For instance, in the Lifespan health system study, there were ~500,00 open heart surgeries performed every year in the US. Additionally, the rising prevalence of respiratory failure and infectious diseases is further expected to create demand for ECMO systems.

Furthermore, the increasing prevalence of CVDs is the leading cause of death on the global level, and ECMO systems can be of great assistance in lifesaving in emergencies. As per the WHO, ~17.9 million lives are lost due to CVD every year, and favorable reimbursement policies are also likely to create ample opportunities for the growth of ECMO systems. Therefore, the increasing prevalence and prevalence of cardiopulmonary disorders are expected to lead to the growth of the ECMO systems market during the forecast period.

However, Asia Pacific is registered as the fastest-growing region in the global ECMO systems market. The market in this region is expected to increase significantly in countries such as China, Japan, and India. The market's growth is attributed to the increasing focus of market players in developing economies and supportive government policies. Although the availability of effective and safe prevention strategies worldwide, cardiovascular disease (CVD) remains the leading cause of death and premature death globally. The growth of the market is mainly attributed to the increasing prevalence of atrial fibrillation (AF) in China, the increasing burden of various other heart diseases, and the rising geriatric population across the region are all expected to support market growth. As per the prediction done by the World Heart Federation, cardiovascular events like ischemic heart disease and stroke are expected to rise by 50% among the Chinese population between 2010 and 2031. The Indian Heart Association stated that 50% of heart attacks occur under the age of 50, while 25% of heart attacks occur under 25 years of age. Both the male and female populations in the country equally exhibit the risk of developing heart disease.

Moreover, stroke is one of atrial fibrillation's frequent and devastating complications. About one-third of the patients with atrial fibrillation are asymptomatic, and atrial fibrillation may go undetected in the patients until symptoms develop. As the oxygenator supplies oxygen, by removing carbon dioxide, to the artery during heart surgeries, the heart is relieved from performing pumping duties. Thus, the growing prevalence of cardiovascular disease in the region is fueling the demand for the ECMO systems market.

According to the Frontier Media Public Health report published in June 2022, the most recent Chinese national survey of COPD showed that China accounted for almost 25% of all COPD cases globally. As compared with the survey results ten years ago, the prevalence of COPD has increased by 67% in the aged 40 years or older group and has reached epidemic proportions. Moreover, the beginning of the COVID-19 pandemic in Wuhan City in China led to the development of severe acute respiratory syndrome among the large population, which in turn created the demand for the ECMO systems market. Moreover, during the COVID-19 pandemic, India was the second most affected country in the region, with the second highest number of cases with different waves of COVID-19, which has raised the growth of the ECMO systems market.

Therefore, the growing prevalence of cardiovascular as well as respiratory diseases in the population of Asia Pacific is fueling the demand for ECMO systems.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global ECMO systems market are listed below:

- In January 2023, Chinabridge Medical officially launched the first domestically developed extracorporeal membrane oxygenation (ECMO) machine that will help in the treatment of COVID-19 patients in critical condition and boost the development of the country's high-end medical devices. National Medical Products Administration approves it for emergency use within China.

- In November 2022, LivaNova PLC was granted US Food and Drug Administration (FDA) 510(k) for extracorporeal membrane oxygenation (ECMO), LifeSPARC. LivaNova leveraged existing real-world evidence, inclusive of data collected during the COVID-19 pandemic, to receive this new indication.

- In February 2021, Fresenius Medical Care's Novalung was approved by the FDA for the treatment of acute respiratory or cardiopulmonary failure. Novalung is the first extracorporeal membrane oxygenation (ECMO) system to be cleared for more than six hours of use as extracorporeal life support.

Competitive Landscape and Key Companies:

Some of the major players operating in the global ECMO systems market include LivaNova (Alung Technologies Inc.), Eurosets, Getinge AB, Medtronic PLC, Microport Scientific Corporation, Inspira Technologies, Terumo Medical Corporation, Abbott Laboratories, Fresenius Medical Care Company (Xenios AG), and Chinabridge Medical among others. These companies focus on geographical expansions, new product launches, strategic collaboration, and product approval to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which allows them to serve a large set of customers and subsequently increase their market share.

Report ScopeExtracorporeal Membrane Oxygenation (ECMO) Systems Market Regional Insights

The regional trends and factors influencing the Extracorporeal Membrane Oxygenation (ECMO) Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Extracorporeal Membrane Oxygenation (ECMO) Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Extracorporeal Membrane Oxygenation (ECMO) Systems Market

Extracorporeal Membrane Oxygenation (ECMO) Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 604.81 Million |

| Market Size by 2031 | US$ 839.75 Million |

| Global CAGR (2025 - 2031) | 4.80% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

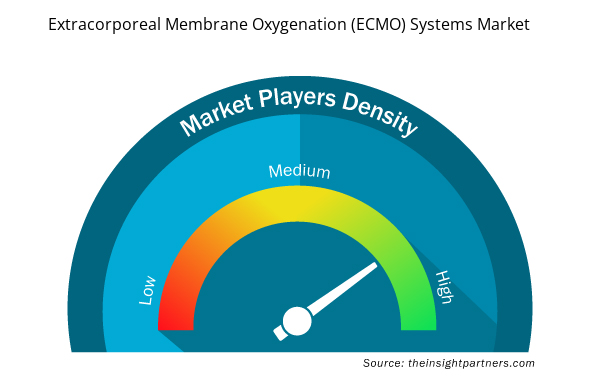

Extracorporeal Membrane Oxygenation (ECMO) Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Extracorporeal Membrane Oxygenation (ECMO) Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Extracorporeal Membrane Oxygenation (ECMO) Systems Market are:

- Getinge Group

- Medtronic plc

- LivaNova PLC

- XENIOS AG

- Terumo Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Extracorporeal Membrane Oxygenation (ECMO) Systems Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Getinge Group

2. Medtronic plc

3. LivaNova PLC

4. XENIOS AG

5. Terumo Corporation

6. MicroPort Scientific Corporation

7. NIPRO Corporation

8. OriGen Biomedical, Inc.

9. ALung Technologies, Inc.

10. EUROSETS S.r.l

11. MAQUET Holding B.V. & Co. KG

12. Sorin Group

13. Medos Medizintechnik AG

14. Abbott Laboratories

15. Braile Biomedical

16. Edwards Lifesciences Corp

17. Elsius Biomedical Inc.

18. Spectrum Medical

Get Free Sample For

Get Free Sample For