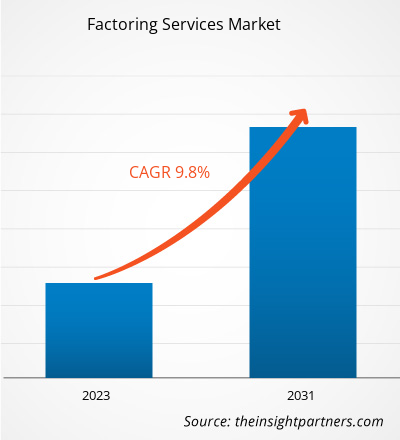

The size is expected to grow from US$ 3,533.88 billion in 2023 to US$ 7,465.70 billion by 2031; it is anticipated to expand at a CAGR of 9.8% from 2023 to 2031.

Factoring Services Market Analysis

The factoring services market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. The factoring services market trends are anticipated to shift in the direction of digital documentation, with AI-based and cloud-based models improving the effectiveness of services post-pandemic, generating strong market opportunities. Increasing public awareness regarding developments in financial technology, such as cryptocurrency, factoring group lobbying and activities, swelling international trade, and extensive usage of digital platforms are some significant factors driving market factoring services growth. Businesses often must wait for clientele to pay, which affects cash flow. Thus, to remediate this delay, factoring businesses provide upfront cash in exchange for account receivables, which makes factoring services more required. Businesses can decrease credit risk and acquire working capital loans with factoring services.

Factoring Services

Industry Overview

- Factoring service is a procedure of collection of receivables and maintains credit control, sales ledgers, and credit protection. Additionally, services are helpful in numerous ways, such as the necessity for secure financing, which is subject to robust fluctuations owing to periodic changes in the marketplace. Furthermore, businesses involved in manufacturing and logistics services make factoring a supreme way of financing, as these organizations have several accounts receivable from other businesses.

- The growing automation in financial services aids financial institutions to streamline their operations and enhance their credit collection procedure by automating time-consuming and repetitive backend operations. Additionally, automation aids in implementing resources for value-added projects and enhances the reliability of financial institutions. With the help of automation solutions, financial organizations have enhanced their operation procedures, precisely accounts receivable processes. Account receivable solutions can incorporate numerous technologies, such as Artificial Intelligence (AI), automation, and machine learning throughout the credit cycle, which aids the institutions to deal with the crisis efficiently.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Factoring Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Factoring Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Factoring Services Market Driver

Growing Financial Industry to Drive Factoring Services Market Growth

- Finance, Competitiveness, and Innovation Global Practice (FCI) are taking steps to increase awareness, including conducting workshops to enlighten the significance of factoring to government bureaucrats and other major stakeholders. It continues to support the establishment of third-party rights safeguards, effective assignment legislation, and promotion of good governance to generate a robust regulatory and legal environment to develop a robust legal infrastructure. As a result, in April 2022, FCI announced the launch of the Edifactoring 2.0 platform, an online platform to support a two-factor business model for associates of FCI through a set of Electronic Document Interchange (EDI) messages. This platform runs on FCI’s legal structure and aids in overcoming challenges in cross-bordering factoring.

- Growth in open account trading opportunities and the requirement for alternative sources of financing for small & medium enterprises (SMEs) to meet instantaneous business goals are boosting the global factoring service market. Furthermore, augmented awareness and understanding of supply chain financing advantages are driving the factoring service market growth. However, the lack of a stringent governing framework for debt recovery mechanisms, foreign currency limitations, and stamp duties are hindering the factoring service market. On the contrary, increases in technological advancements such as automated invoices are anticipated to provide lucrative opportunities for the factoring services market growth during the forecast period.

Factoring Services

Market Report Segmentation Analysis

- Based on category, the factoring services market is segmented into domestic and international. The domestic segment held a significant factoring services market share in 2023.

- The segment growth can be accredited to the rapid implementation of factoring receivable methods method in major industries owing to their efficiency. Additionally, the swelling significance of electronic invoices has subsidized the consolidation of the domestic segment in the factoring services market. Domestic factoring provides businesses with a monthly or weekly analysis of payable and sales invoices. Furthermore, low cost and easy risk coverage provided by the domestic segment in comparison with international factoring support the segment growth.

Factoring Services

Market Regional Analysis

The scope of the factoring services market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is observing rapid growth and is expected to hold a noteworthy factoring services market share in 2022. The Asia Pacific region is projected to observe considerable growth with a significant CAGR during the forecast period owing to the expansion of the manufacturing sector in economies such as China, India, and other Southeast Asian countries.

Factoring Services

Factoring Services Market Regional Insights

The regional trends and factors influencing the Factoring Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Factoring Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Factoring Services Market

Factoring Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3,533.88 Billion |

| Market Size by 2031 | US$ 7,465.70 Billion |

| Global CAGR (2023 - 2031) | 9.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By End-use

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

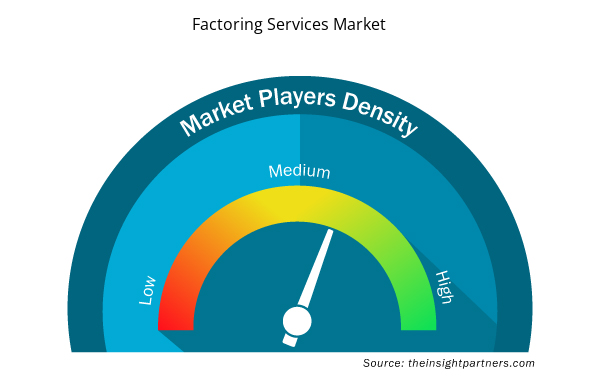

Factoring Services Market Players Density: Understanding Its Impact on Business Dynamics

The Factoring Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Factoring Services Market are:

- altLINE

- ICBC China Barclays Bank PLC

- Deutsche Factoring Bank

- BNP Paribas

- Eurobank

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Factoring Services Market top key players overview

The "Factoring Services Market Analysis" was carried out based on card type and geography. In terms of card type, the market is segmented into signature, platinum, gold, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Factoring Services

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Factoring services market. A few recent key market developments are listed below:

- In March 2023, BNP Paribas entered into partnered with Hokodo to launch a BNPL (Buy now, Pay Later) platform. Large international establishments will be able to deliver their business customers with payment selections through this platform, which makes usage of the B2B BNPL platform from Hokodo and the detailed knowledge and financial steadiness of BNP Paribas. Hokodo and BNP Paribas deliver this leading-edge buy now, pay later feature by employing the best of their cash management and factoring skills.

(Source: BNP Paribas, Company Website)

Factoring Services

Market Report Coverage & Deliverables

The market report "Factoring Services Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Category, Type, Financial Institution, End-use, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global factoring services market are altLINE (The Southern Bank Company), China Construction Bank Corporation, Barclays Bank PLC, BNP Paribas, and Deutsche Factoring Bank.

The global Factoring services market is expected to reach US$ 7465.70 billion by 2031.

The global factoring services market was estimated to be US$ 3,533.88 billion in 2023 and is expected to grow at a CAGR of 9.8% during 2023 - 2031.

Digital advancements in the factoring services market to play a significant role in the global factoring services market in the coming years.

The growing finance industry and increasing initiatives by market players are the major factors that propel the global factoring services market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- altLINE

- ICBC China Barclays Bank PLC

- Deutsche Factoring Bank

- BNP Paribas

- Eurobank

- Hitachi Capital (UK) PLC

- Factor Funding Co.

- HSBC Group

- ICBC China

- China Construction Bank Corporation.

Get Free Sample For

Get Free Sample For