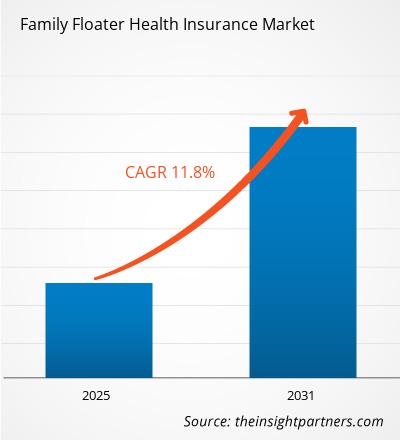

The family floater health insurance market is expected to register a CAGR of 11.8% in 2023–2031. The need for health insurance is growing due to a number of causes, including rising healthcare costs and more awareness. The market is also expanding as a result of the introduction of new technologies in the healthcare industry, which encourages the use of cutting-edge practices and marketing tactics by insurance companies to draw in more clients. The growing incidence of chronic illnesses is another factor driving the growth of the family floater market. For patients and their families, the cost of treating chronic conditions like cancer and heart disease can be extremely expensive. Because of this, a lot of people are opting for health insurance.

Family Floater Health Insurance Market Analysis

The family floater health insurance market combines numerous sophisticated business intelligence (BI) technologies that satisfy the intricate demands of the telecom industry. These comprise developing sales, improving risk management, reducing churn & deception, and decreasing operational costs. Hence, telecom organizations are implementing progressive analytics-driven data solutions for simpler and faster processing of appropriate data, helping them attain accurate and timely insights using network analytics such as predictive analytics and data mining. The increasing requirement for demand for improved revenue control, customer churn prevention, and amplified cyber threats are anticipated to drive market expansion.

Family Floater Health Insurance Market Overview

One kind of insurance that pays for medical costs resulting from a disease is health insurance. These costs may be associated with hospital stays, prescription drug costs, or physician consultation fees. A family floater health insurance policy, also called family health insurance, is one of the various types of health insurance policies available. It provides coverage for every member of the family under a single plan. The sum insured under family health floater insurance floats upon all the family members insured in it. Furthermore, a family floater health insurance plan that ranges coverage to the complete family rather than just an individual. Basically, this insurance policy brings all the members of the family under an umbrella protection plan. Being covered under a floater plan, each family member gets advantages under a larger common pool.

Family Floater Health Insurance Market Drivers and Opportunities

Covers the Entire Family Health Insurance Driving Family Floater Health Insurance Market Growth

With the family floater health insurance plan, a single premium can provide health insurance for every member of the family. Furthermore, the total insured will be divided among all family members in the event that numerous claims are made at the same time. Furthermore, if the individual has a family with more than two members, the policy is advantageous. A family floater health insurance policy, also saves money because one needs to pay one premium to cover every member of the family. Additionally, it pays for all of their medical expenses for a variety of serious problems that could come up in the event that the insured becomes unwell. Furthermore, a family floater plan's sum insured is increased to provide coverage for the entire family.

Technological Advancements in the Field of Insurance to Create Lucrative Opportunities for the Family Floater Health Insurance Market Growth

The family floater health insurance market is anticipated to soar to new heights due to the increasing number of small businesses and technological advancements in the insurance sector. Furthermore, a number of family floater health insurers gather a range of information using predictive analytics to fully comprehend the client's medical history. Technology is used to provide cutting-edge services, such quick and easy insurance policies with lower premium rates, with the goal of increasing customer loyalty and strengthening the company's position in the market.

Family Floater Health Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the family floater health insurance market analysis are component, application, deployment, and Distribution Channel.

- By coverage, the market is segmented into in-patient hospitalization, pre and post-hospitalization costs, day care treatments, and others. By coverage, the in-patient hospitalization segment held the largest market share in 2023. The segment growth is attributed to the adoption of family floater health insurance among patients for in-patient hospitalization in case of treatment or pre-planned surgery or during emergencies.

- By Plan Type, the market is divided into Immediate family plans and extended family plans.

- By Distribution Channel, the market is segmented into insurance companies, banks, agents and brokers, and others.

Family Floater Health Insurance Market Share Analysis by Geography

The geographic scope of the family floater health insurance market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The Asia-Pacific area holds a significant market share in the health insurance sector due to rising healthcare costs, which raises demand for family floater health insurance on the international market. China led the market due to its status as the second most populous country and the fact that almost 95% of its people are enrolled in public health insurance programs. India is estimated to register the fastest growth rate over the forecast period.

Family Floater Health Insurance Market Report Scope

Family Floater Health Insurance Market News and Recent Developments

The family floater health insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- July 2021 - Niva Bupa and Axis Bank partnered to provide all-inclusive health insurance. The collaboration will prioritize customer-centricity, product innovation, digitization, and execution to drive success in the upcoming stage. (Niva Bupa, Press Release)

Family Floater Health Insurance Market Report Coverage and Deliverables

The "Family Floater Health Insurance Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Family Floater Health Insurance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 11.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For