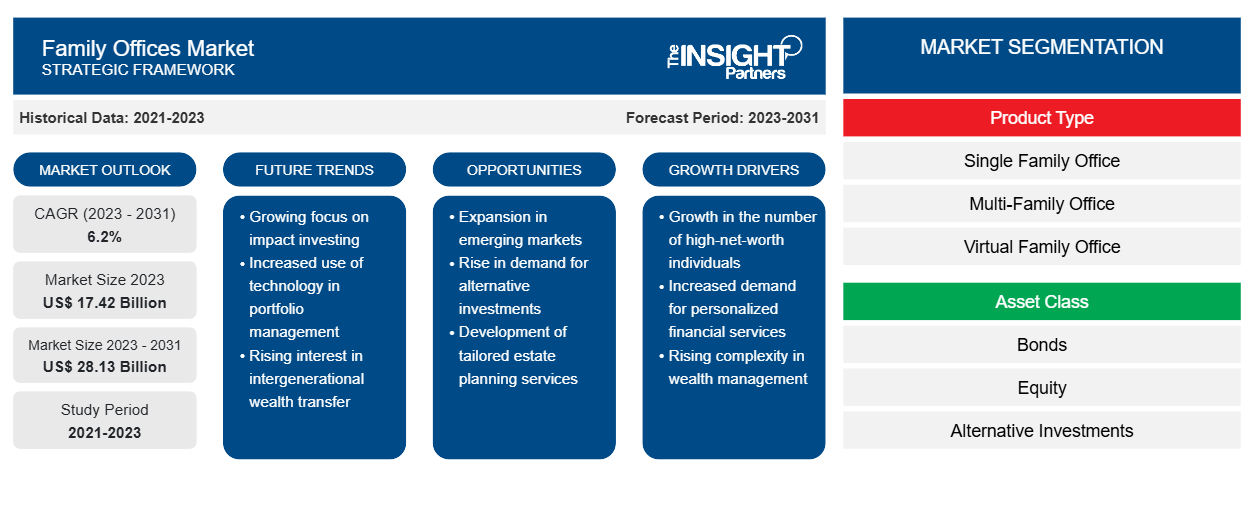

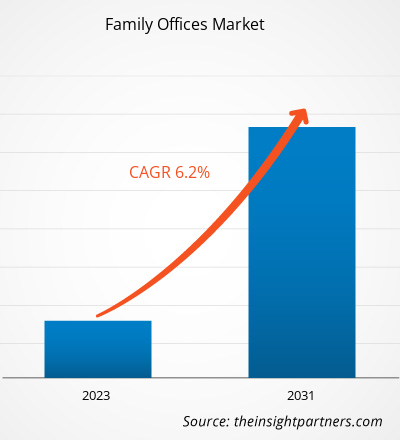

The family offices market size is expected to grow from US$ 17.42 billion in 2023 to US$ 28.13 billion by 2031; it is anticipated to expand at a CAGR of 6.2% from 2023 to 2031. Family offices are changing dramatically as more and more ultra-high-net-worth families want greater control over their investments. The Economist Intelligence Unit and DBS's "Family Office Boom" report claims that family offices are becoming more and more popular due to a number of factors, such as generational shifts, increased wealth concentration, and the desire for more personalized and direct investment strategies.

Family Offices Market Analysis

The report includes growth prospects owing to the current family offices market trends and their foreseeable impact during the forecast period. The extreme concentration of wealth among a few numbers of people and families has been one of the main causes, boosting the growth of the family offices market. The acquisition of significant wealth has necessitated a more sophisticated approach to wealth management, encouraging the formation of family offices to secure these assets. In addition, family offices are now operating in a new era of wealth management that is marked by a stronger focus on sustainability, technological integration, and social impact investing due to the growing influence of millennials and Generation Z. Family offices have therefore modified their tactics to take into account these shifting dynamics, fueling the family offices market growth.

Family Offices Market Overview

- A family office is a private wealth management organization that advises ultra-high-net-worth people (HNWIs). Family offices provide a comprehensive solution for managing an affluent individual's or family's financial and investing needs, setting them apart from standard wealth management businesses. For instance, many family offices provide budgeting, insurance, wealth transfer planning, tax services, charitable giving, and more, in addition to financial planning and investment management

- Family-owned enterprises may require succession planning structures such as trusts or a foundation for family assets. Owing to the intricacy of these circumstances, clients can make use of a family office to assist with wealth management and interest alignment. Non-financial matters like private education, vacation planning, and other domestic arrangements can also be managed by the family office. Family offices are usually classified as either single-family offices or multi-family offices (MFOs). Single-family offices cater to a single, extremely wealthy household. MFOs are more closely associated with traditional private wealth management activities. They aim to expand their clientele in order to grow their business.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Family Offices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Family Offices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Family Offices Market Driver

Rising Number of High Net Worth Individuals

The number of high net worth individuals (HNWI) is continuously rising worldwide. According to Capgemini’s 2022 World Wealth Report, North America has witnessed the largest increase in HNWI population and wealth, by 13.2% and 13.8%, respectively. Similarly, APAC also witnessed HNWI growth in wealth by 5.4% and population by 4.2%. In addition, according to the same report, in 2021, the US, Japan, Germany, and China comprised around 63.6% of the global HNWI population, which increased by 0.7% from 2020. Also, the Ultra-HNWIs witnessed wealth and population growth of 9.6% and 8.1% respectively. At the same time, the Millionaires Next Door witnessed a population growth of 7.7% and wealth growth of 7.8%. Conversely, the growth in the Mid-Tier Millionaire population and wealth increased to 8.5% and 8.4%. Hence, as family offices can help high net worth individuals in managing financial and investing needs, the demand for family offices is rising worldwide, fueling the growth of the family offices market.

Family Offices Market Report Segmentation Analysis

- Based on product type, the family offices market is segmented into single family office, multi-family office, and virtual family office. The single family office segment is expected to hold a substantial family office market share in 2023.

- A single-family office provides a wide range of services, including specialized tax and compliance regulation and concierge services like real estate investment. To provide complete control over decision-making, a dedicated staff is chosen through family meetings to oversee these offices, thus ensuring high security and customized financial solutions.

- Furthermore, as security and personalized wealth management are crucial for ultra-high net worth families, the need for single family offices is expected to increase in the forecasted period.

- Moreover, a single-family office provides trust to the families that all financial matters are handled responsibly and privately. Thus, all the above factors will propel the growth of the single family office segment.

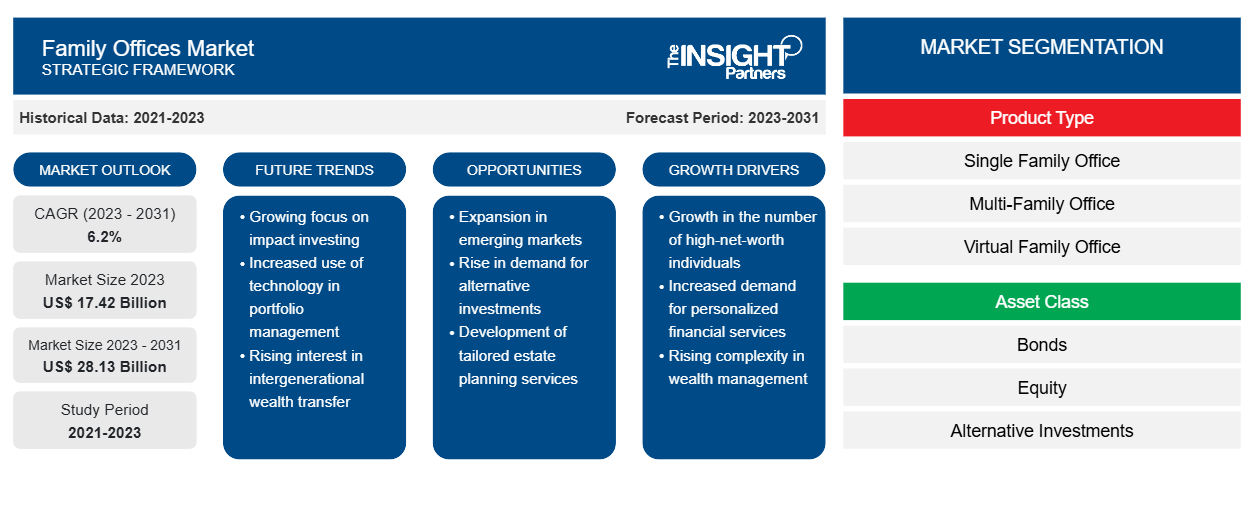

Family Offices Market Share Analysis By Geography

The scope of the family offices market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant family offices market share. The region's significant economic development, growing population, and increasing focus on financial inclusion across diverse economies have contributed to this growth. According to the Spectrem Group, in the US, there were around 11.6 million households that came under HNWI in 2020, which increased by 5.5% from 2019. Thus, the presence of such wealthy populations is driving the family offices market growth in the region.

Family Offices Market Regional Insights

Family Offices Market Regional Insights

The regional trends and factors influencing the Family Offices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Family Offices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Family Offices Market

Family Offices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 17.42 Billion |

| Market Size by 2031 | US$ 28.13 Billion |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

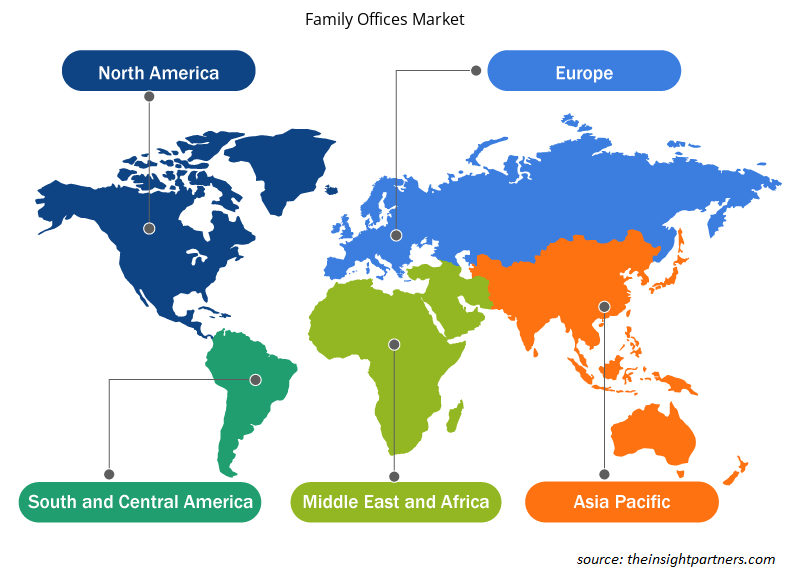

Family Offices Market Players Density: Understanding Its Impact on Business Dynamics

The Family Offices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Family Offices Market are:

- Walton Enterprises LLC

- Cascade Investment

- Bezos Expeditions

- Bayshore Capital

- Mousse Investments Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Family Offices Market top key players overview

The "Family Offices Market Analysis" was carried out based on product type, asset class, and geography. In terms of product type, the market is segmented into single family office, multi-family office, and virtual family office. Based on asset class, the family offices market is segmented into bonds, equity, alternative investments, commodities, and cash or cash equivalents. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Family Offices Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Family Offices Market. A few recent key market developments are listed below:

- In March 2023, Cascade Partners announced the acquisition of BlueWater Partners – a Grand Rapids, MI-based investment banking and restructuring/performance improvement firm. The acquisition of BlueWater Partners will cement Cascade Partners’ strategy to establish its presence in Grand Rapids, West Michigan, and Indiana. In addition, the acquisition will provide an opportunity for Cascade Partners to accelerate their capacity to deliver creative, value-driven solutions to client partners throughout West Michigan.

[Source: Cascade Partners, company Website]

Family Offices Market Report Coverage & Deliverables

The Family Offices Market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Family Offices Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Artwork Management Software Market

- Data Center Cooling Market

- Sleep Apnea Diagnostics Market

- Thermal Energy Storage Market

- Arterial Blood Gas Kits Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Embolization Devices Market

- Health Economics and Outcome Research (HEOR) Services Market

- Glycomics Market

- Foot Orthotic Insoles Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Asset Class and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The growing adoption technological advancements is anticipated to play a significant role in the global family offices market in the coming years.

The global family offices market is expected to reach US$ 28.13 billion by 2031.

The global family offices market was estimated to be US$ 17.42 billion in 2023 and is expected to grow at a CAGR of 6.2 % during the forecast period 2023 - 2031.

The key players holding majority shares in the global family offices market are Walton Enterprises LLC, Cascade Investment, Bezos Expeditions, Bayshore Capital, and Mousse Investments Limited.

Rising number of high net worth individuals is the major factors that propel the global family offices market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Walton Enterprises LLC

- Cascade Investment

- Bezos Expeditions

- Bayshore Capital

- Mousse Investments Limited

- Ballmer Group

- Waycross Investment Management Company

- DFO Management LLC

- Emerson Collective

- Glenmede

Get Free Sample For

Get Free Sample For