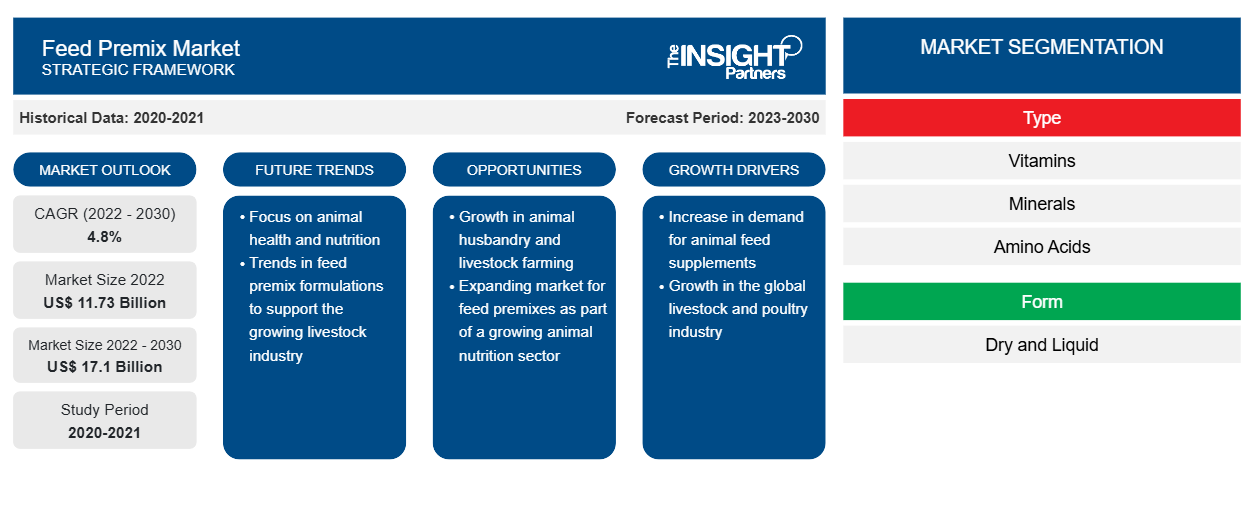

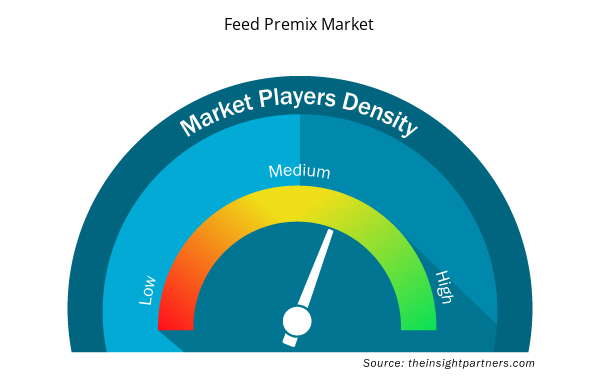

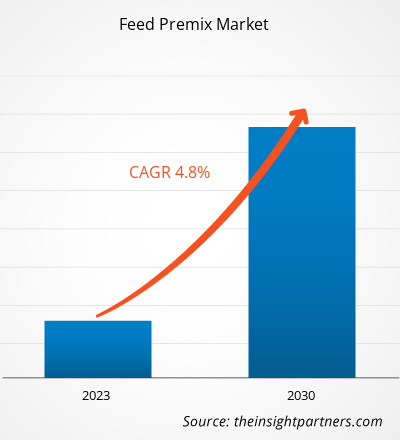

[Research Report] The feed premix market size is projected to grow from US$ 11,732.50 million in 2022 to US$ 17,101.04 million by 2030. The market is expected to record a CAGR of 4.8% from 2022 to 2030.

Market Insights and Analyst View:

Feed premix is a complex mixture of one or more feed additives or nutrients such as amino acids, vitamins, minerals, antioxidants, and antibiotics. These premixes are mixed in feed materials to enhance the nutritional quality of animal feed and to provide essential micronutrients to animals. The demand for feed premixes across the globe is significantly increasing because of the surging demand for compound animal feed and rising awareness regarding the safety of livestock animals. These factors have significantly contributed to the growth of the global feed premix market

Growth Drivers and Challenges:

Industrial livestock production has undergone a significant transformation owing to the increasing demand for meat-based products and dairy products. Animal proteins account for 16% of energy and 34% of the protein in human diets. Livestock production also accounts for ~19% of the value of food production and 30% of the global value of agriculture. The demand for livestock products is driven by changing lifestyles and food preferences, increasing urbanization, growing income, and the rapidly rising world population. These factors significantly contributing to the growing feed premix market across the globe. Moreover, with burgeoning livestock demand, the consumption of protein-rich meat products is surging. Thus, growing consumption of livestock products, such as meat, and increasing milk production have encouraged manufacturers to focus on providing good quality and nutrient-rich feed for livestock. This drives the demand for feed premix as an additive among feed manufacturers and is further expected to propel the feed premix market growth across the globe.

The main causes of the rising demand for feed premixes in developing countries have been population growth, urbanization, and a rise in wages in developing countries. According to the Feed Industry Federation (FIF), compound feed production has reached 1000 million tons annually. This growth in production rate is particularly higher in developing countries than in developed countries. Modernizing livestock farms in developing regions to meet the growing demand for animal protein aids the feed premix market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Feed Premix Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Feed Premix Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

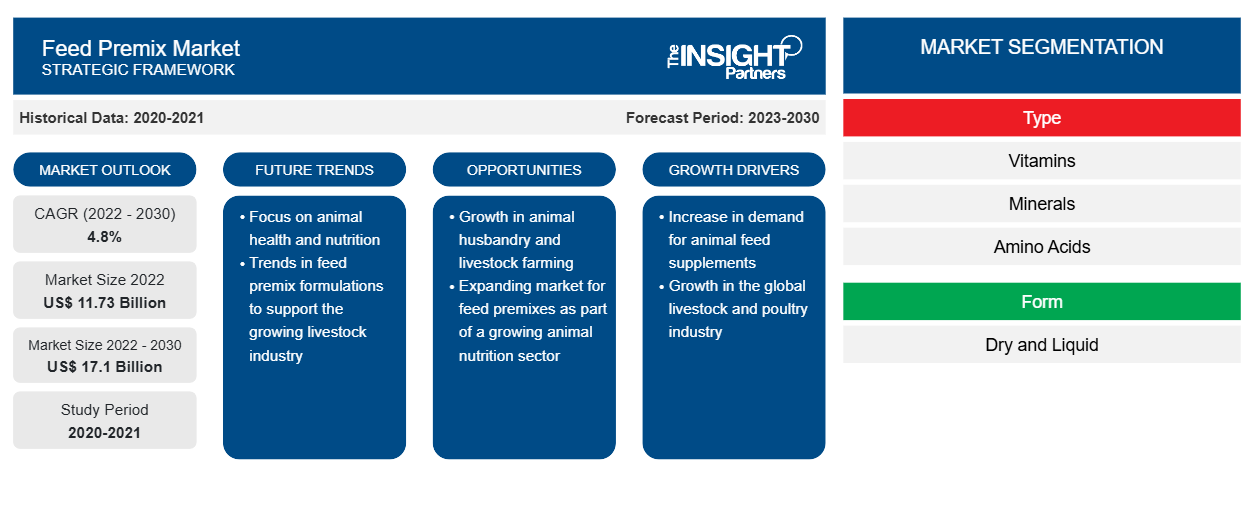

The global feed premix market is segmented based on type, form, livestock, and geography. The market, by type, is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, blends, and others. Based on form, the market is bifurcated into dry and liquid. Based on livestock, the market is segmented into poultry, ruminants, swine, aquaculture, and others. The feed premix market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the feed premix market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, blends, and others. The blends segment holds a significant share of the market. Animal feed manufacturers usually face difficulty in the dosage of each nutrient in animal feed. Thus, feed additive manufacturers offer a blend of various nutrients that assist animal feed manufacturers with convenience. Premix in the form of a blend is one of the prominent segments as it has a balanced proportion of nutrients and animal feed manufacturers usually prefer a custom blend of feed premixes as an additive for their feed solutions. These factors drive the market growth for the blends segment.

Regional Analysis:

Based on geography, the feed premix market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global market; the market in this region was valued at US$ 4,449 million in 2022. The market in North America is expected to register a CAGR of 5.5% during the forecast period. Asia Pacific is the largest producer of animal feed globally. According to Alltech Global, the region produced over 305 million metric tons of animal feed in 2020. Further, the region houses a few major animal stocks farming countries, accelerating the demand for animal feed ingredients such as feed premixes in the region. Moreover, Asia Pacific accounts for the largest human population among all five regions and contains ~60% of the global population. Hence, the region is witnessing strong demand for meat and dairy products, boosting the requirement for livestock production and subsequently favoring the demand for animal feed. The mass consumption of animal feed in the region and growing practices of feeding nutritious feed to livestock drive the feed premix market in the region.

Europe accounts for nearly ~20% of the market share. The feed premix market in Europe is witnessing strong growth due to the growing industrialization of meat production and the increasing demand for nutritional animal feed. Livestock owners are adopting healthy feed ingredients to produce healthy, quality, and nutritious animal meat products. Furthermore, Europe is known for its large variety of animal stocks and high demand for meat. As per the Eurostat (European Union), in 2020, Europe had nearly 146 million pigs, 76 million bovine animals, and 75 million sheep and goat stock. Such a huge stock of livestock animals requires enough animal feed, which is increasing the demand for feed premix. Thus, the mass production of animal feed and its consumption due to growing livestock are boosting the demand for nutritious feed additives such as feed premix. Thus, owing to all the factors mentioned above, the feed premix market is expected to grow significantly in Europe during the forecast period.

Industry Developments and Future Opportunities:

Initiatives taken by key players operating in the feed premix market are listed below:

- In June 2022, Nutreco N.V. received a US$ 4.8 million grant from the Bill & Melinda Gates Foundation to implement sustainable feed production in Sub-Saharan Africa. This will help improve the ESG initiatives of the company.

- In 2021, ADM acquired Vietnamese premix player Golden Farm Production & Commerce Company Limited. This strengthens its industrial and commercial coverage in a key feed market such as Vietnam.

Feed Premix Market Regional Insights

Feed Premix Market Regional Insights

The regional trends and factors influencing the Feed Premix Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Feed Premix Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Feed Premix Market

Feed Premix Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 11.73 Billion |

| Market Size by 2030 | US$ 17.1 Billion |

| Global CAGR (2022 - 2030) | 4.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Feed Premix Market Players Density: Understanding Its Impact on Business Dynamics

The Feed Premix Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Feed Premix Market are:

- Danish Agro AMBA

- Agrifirm Group BV

- Nutreco NV

- Archer-Daniels-Midland Co

- Cargill Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Feed Premix Market top key players overview

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several animal feed manufacturing companies. The shutdown of manufacturing units disturbed global supply chains, production activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in their product sales in 2020, which hampered the feed premix market. The shortage of workforce, import-export ban, and limited supply of raw materials also led to a halt in operations and processes across the globe during the COVID-19 pandemic. These factors negatively impacted the market growth in the pandemic.

However, in 2021, various economies resumed operations as several governments revoked the previously imposed restrictions, which positively impacted the global marketplace. Moreover, manufacturers were permitted to operate at full capacities, which helped them overcome the demand and supply gaps.

Competitive Landscape and Key Companies:

Danish Agro AMBA, Agrifirm Group BV, Nutreco NV, Archer-Daniels-Midland Co, Cargill Inc, Koninklijke DSM NV, Dansk Landbrugs Grovvareselskab amba, NuSana BV, De Heus Voeders BV, and Kemin Industries Inc are among the prominent players operating in the global feed premix market. These market players adopt strategic development initiatives to expand their businesses, further driving the feed premix market growth.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Diaper Packaging Machine Market

- Asset Integrity Management Market

- Third Party Logistics Market

- Cosmetic Bioactive Ingredients Market

- Advanced Planning and Scheduling Software Market

- Human Microbiome Market

- Hair Extensions Market

- Arterial Blood Gas Kits Market

- Automotive Fabric Market

- Hydrolyzed Collagen Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Form, Livestock, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Danish Agro AMBA, Agrifirm Group BV, Nutreco NV, Archer-Daniels-Midland Co, Cargill Inc, Koninklijke DSM NV, Dansk Landbrugs Grovvareselskab amba, NuSana BV, De Heus Voeders BV, Kemin Industries Inc are a few players operating in the global feed premix market.

North America is estimated to register the fastest CAGR in the global feed premix market over the forecast period. The mass production of animal feed in North America and the rise in food safety concerns, especially about meat and dairy products, have led to the increased consumption of nutritional animal feed infused with various nutrients in the form of feed premix in the region.

In 2022, Asia Pacific held the largest share of the global feed premix market. the region is witnessing strong demand for meat and dairy products, boosting the requirement for livestock production and subsequently favoring the demand for animal feed additives such as feed premixes.

Based on type, the blends segment held the largest share in the global feed premix market in 2022 as it has balance proportion of nutrients, and the animal feed manufacturers usually prefer custom blend of feed premixes as an additive for their feed solutions. This factor, thereby, drives the growth of the segment.

Based on livestock, the segment is estimated to register the fastest CAGR in the global feed premix market over the forecast period. The growing aquaculture industry and rising awareness about the nutritional requirements of fish and other aquaculture animals boost the segment’s share.

Increasing livestock production and feed fortification the two key factors driving the feed premix market growth.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Feed Premix Market

- Danish Agro AMBA

- Agrifirm Group BV

- Nutreco NV

- Archer-Daniels-Midland Co

- Cargill Inc

- Koninklijke DSM NV

- Dansk Landbrugs Grovvareselskab amba

- NuSana BV

- De Heus Voeders BV

- Kemin Industries Inc

Get Free Sample For

Get Free Sample For