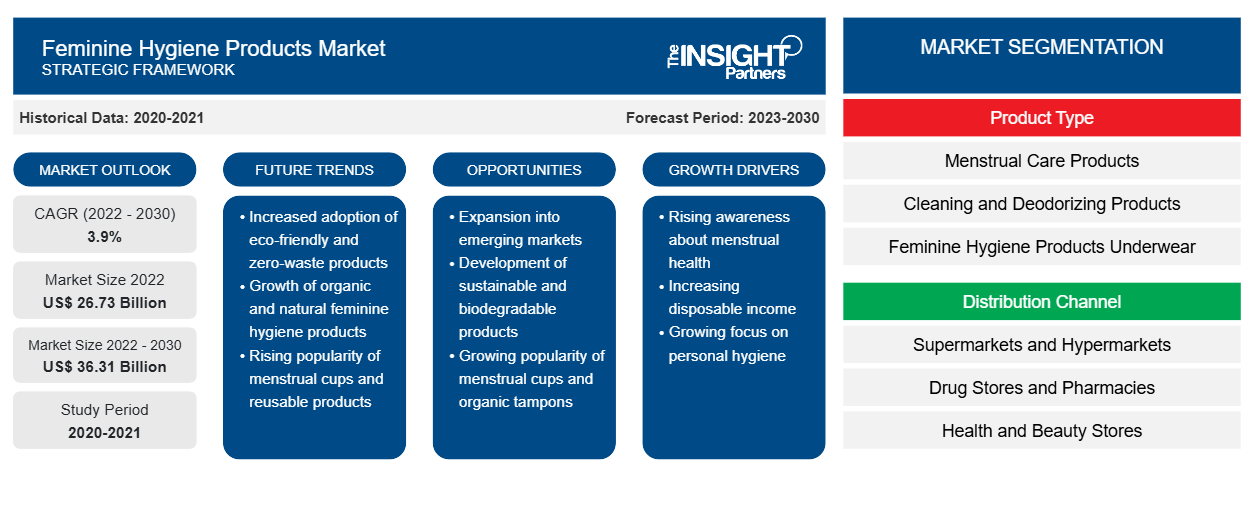

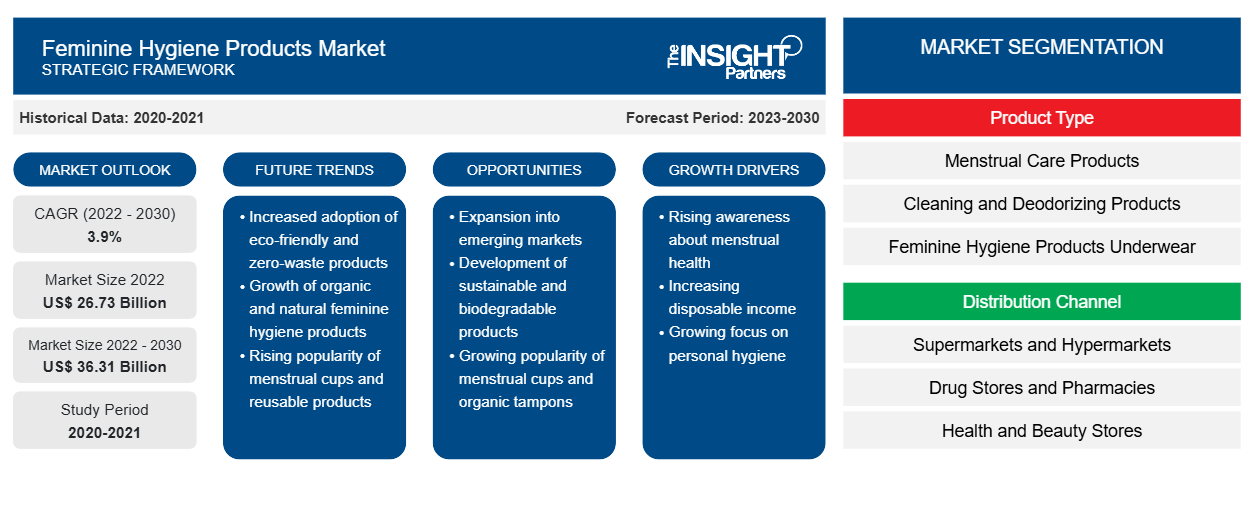

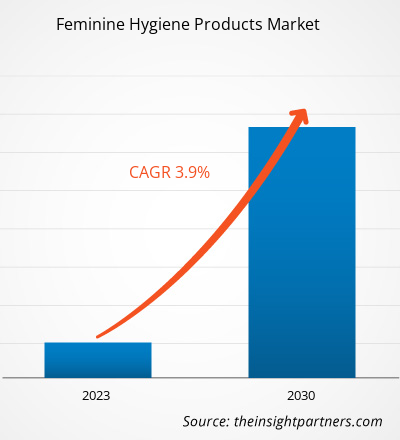

[Research Report] The feminine hygiene products market was valued at US$ 26,733.33 million in 2022 and is projected to reach US$ 36,305.29 million by 2030; it is expected to register a CAGR of 3.9% from 2022 to 2030.

Market Insights and Analyst View:

The feminine hygiene products market in Europe is mainly driven by a surge in awareness toward maintaining personal hygiene and increasing initiatives by the governing bodies regarding feminine hygiene. Also, the awareness regarding personal hygiene in women is increasing due to various government initiatives and social media campaigns. These initiatives and campaigns contribute to a better understanding and acceptance of female hygiene products. Therefore, the rise in awareness toward personal hygiene is propelling the growth of the feminine hygiene products market. The regions such as North America, Europe, and Asia Pacific are hub of Edgewell Personal Care Co, Kimberly-Clark Corp, Lune Group Oy Ltd, Me Luna Gmbh, Mooncup Ltd, Ontex BV, Essity Ab, Wuka Ltd, Cotton High Tech SL, and The Procter & Gamble Co, which generate a high demand for feminine hygiene products. Hence, the presence of such companies drives the global feminine hygiene products market growth.

Growth Drivers and Challenges:

Strategic initiatives by key market players have been driving the global feminine hygiene products market growth. Manufacturers are heavily investing in research and development projects, partnerships, expansion plans, and collaborations to launch innovative products to attract a large consumer base. For instance, in June 2020, Pee Safe launched a new range of intimate hygiene products, including undergarment sanitizer spray, reusable sanitary pads, oxo-biodegradable disposable bags, and an intimate hygiene powder. Key market players are adopting strategic initiatives such as mergers and acquisitions to expand their product portfolio and geographical presence. For instance, in November 2022, Edgewell Personal Care company announced the acquisition of Billie Inc. The acquisition was aimed at expanding its product portfolio of premier feminine shave and body care brands.

Additionally, natural and clean hair removal products are gaining popularity worldwide due to the greater awareness of the harmful effects of chemicals and the rising inclination toward using green and clean personal care products. This trend has prompted manufacturers to develop natural products based on customer requirements. For instance, Reckitt Benckiser Group Plc launched the Veet Pure range of hair removal creams in 2022, thereby reformulating its products. The product range includes natural cucumber extracts, aloe vera, and grapeseed oil. Thus, such product launches and other strategies to cater to the increasing consumer demand aids the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Feminine Hygiene Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Feminine Hygiene Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

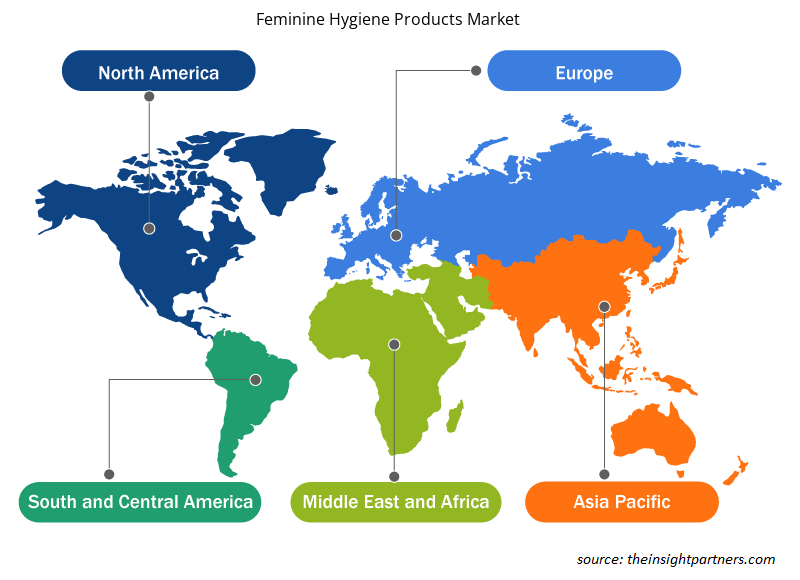

The global feminine hygiene products market is segmented on the basis of product type, distribution channel, and geography. Based on product type, the feminine hygiene products market is segmented into menstrual care products, cleaning and deodorizing products, and feminine hygiene underwear. On the basis of distribution channel, the feminine hygiene products market is segmented into supermarkets and hypermarkets, drug stores and pharmacies, health and beauty stores, online retail, and others. The feminine hygiene products market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on product type, the feminine hygiene products market is segmented into menstrual care products, cleaning and deodorizing products, and feminine hygiene underwear. The menstrual care products segment held a significant share in the feminine hygiene products market growth and is expected to register substantial growth during the forecast period. Menstrual care products, including menstrual pads, period panties, panty liner, feminine wipes, tampons and menstrual cups, sanitary napkins, and sanitary pads, are gaining traction due to the rising awareness about feminine hygiene among females worldwide. In addition, the rising usage of these products is encouraging environmental sensitivity among the population. Hence, the working female professionals and other environment-sensitive populations are adopting menstrual products which are comfortable and disposable.

Menstrual care products are usually disposed of and lead to landfills and generate enormous volumes of waste, which is nonbiodegradable. As a result, it persists in the environment in the form of microplastics, posing a significant threat to aquatic and terrestrial ecosystems. Owing to the increased awareness of this concern, many are switching to reusable menstrual products such as menstrual cups and discs and reusable pads made of cloth. According to an article published on the BBC website and Google Trends Index of Search Terms, searches for reusable period products have spurred every year.

Regional Analysis:

Based on geography, the feminine hygiene products market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global feminine hygiene products market was dominated by North America and recorded ~US$ 5,000 million in 2022. Europe is a second major contributor holding more than 20% share of the global market. Asia Pacific is expected to grow at a CAGR of over 5% during the forecast period. The North America feminine hygiene products market is segmented into the US, Canada, and Mexico. The feminine hygiene products market growth in North America is attributed to a higher standard of living, better sanitation practices, and greater income levels for women. The industry has witnessed continuous innovation in feminine hygiene products, with companies introducing new and improved products to cater to the different needs and preferences of customers. Moreover, the growing concern for environmental issues, such as the increased plastic population and global warming, has encouraged women to opt for sustainable and eco-friendly products. In North America, ~20 billion sanitary napkins, tampons, and applicators are sent to landfills annually. The products such as menstrual cups and cloth pads have gained popularity owing to their cost-effectiveness and reduced environmental impact. Surging demand for sustainable and eco-friendly feminine hygiene products has resulted in product innovation and the launch of products in the market. For instance, In December 2022, Trace Femcare announced the launch of Climate Beneficial Cotton and regenerative hemp fiber tampon. The products addressed the increasing plastic population and global warming caused by non-disposable tampons. Therefore, all the above factors influence the feminine hygiene products market growth across North America.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the feminine hygiene products market are listed below:

- In November 2021, Ontex BV launched its brand NAT in China. The products launched were tampons, towels, pantyliners, and menstruation pants.

- In May 2021, Poise, a Kimberly Clark brand, announced its partnership with Whitney Port and launched its 2-in-1liners and pads.

Feminine Hygiene Products Market Regional Insights

The regional trends and factors influencing the Feminine Hygiene Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Feminine Hygiene Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Feminine Hygiene Products Market

Feminine Hygiene Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 26.73 Billion |

| Market Size by 2030 | US$ 36.31 Billion |

| Global CAGR (2022 - 2030) | 3.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

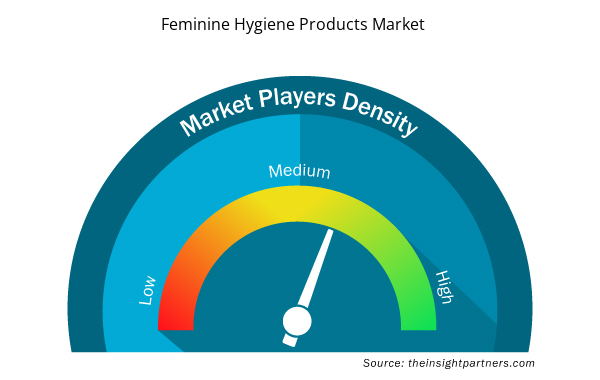

Feminine Hygiene Products Market Players Density: Understanding Its Impact on Business Dynamics

The Feminine Hygiene Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Feminine Hygiene Products Market are:

- Edgewell Personal Care Co.

- Kimberly-Clark Corp

- Lune Group Oy Ltd

- Me Luna GmbH

- Mooncup Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Feminine Hygiene Products Market top key players overview

COVID-19 Impact:

The rising female literacy rate and greater menstrual hygiene awareness primarily drove the feminine hygiene products market before the onset of the COVID-19 pandemic. However, the consumer goods industry experienced adverse impacts of the pandemic during the first quarter of 2020. The COVID-19 pandemic also led to an economic recession in the initial months of 2020, which created financial difficulties for low-income and mid-income consumers. As a result, people only purchased primary essential products—such as groceries and critical medical products—lowering the sales of feminine hygiene products.

Many businesses recovered as the governments of various countries eased the restrictions after the initial months of lockdown in 2020. The introduction of the COVID-19 vaccine offered further relief from the distressing pandemic situation, leading to a rise in business activities. The resumption of operations in the manufacturing units positively impacted the feminine hygiene products market and led to the recovery of the production of feminine hygiene products. Manufacturers overcame the demand and supply gap as they were permitted to operate at total capacity.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global feminine hygiene products market include Edgewell Personal Care Co, Kimberly-Clark Corp, Lune Group Oy Ltd, Me Luna Gmbh, Mooncup Ltd, Ontex Bv, Essity Ab, Wuka Ltd, Cotton High Tech SL, and The Procter & Gamble Co. among others. These players offer cutting-edge feminine hygiene products with innovative features to deliver a superior experience to consumers.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fixed-Base Operator Market

- Nuclear Waste Management System Market

- Aircraft Landing Gear Market

- Health Economics and Outcome Research (HEOR) Services Market

- Trade Promotion Management Software Market

- Vessel Monitoring System Market

- Maritime Analytics Market

- Cling Films Market

- Fishing Equipment Market

- USB Device Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Norway, Poland, Russian Federation, Saudi Arabia, South Africa, South Korea, Spain, Sweden, Switzerland, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on products type, menstrual care products segment mainly has the largest revenue share. Menstrual care products include sanitary pads/napkins, tampons, menstrual cups, reusable cloth pads, liners, and menstrual discs. Sanitary pads and tampons are among the most widely used products by females during menstruation. They are made of materials such as cellulosic fibers; synthetic polymers such as polyester, polyethylene, and polypropylene; cotton; and superabsorbent polymers. Products made from superabsorbent polymers absorb low to heavy period flow and allow women to perform their daily chores and other physically rigorous activities, such as playing and traveling, without the stress of leakage and stains.

Initiatives by governments and organizations to provide opportunities in the coming years for the feminine hygiene products. The increasing prices of feminine hygiene products owing to higher taxes prevent consumers from buying them. Thus, they search for alternatives, which can hamper their health. However, with increasing awareness about feminine hygiene, various governments of globally are taking various initiatives, such as reducing taxes on feminine hygiene products and distributing them free of cost. For instance, in Germany, the tax rate on sanitary items was cut from 19% to 7% as of 1 January 2020. Ireland levies no value-added tax on tampons, panty liners, and sanitary towels. Ireland is the only EU country with a zero-tax rate on sanitary goods. Thus, reducing taxes on feminine hygiene products accelerates their demand across the region.

Asia Pacific accounted for the largest share of the global feminine hygiene products market. In Europe, the rapidly changing lifestyles of consumers are making them opt for convenient food solutions and ready-to-eat products such as frozen food, feminine hygiene products, biscuits, cookies, etc. The demand for feminine hygiene products is significantly increasing across the region owing to the established status of bakery products as a staple food in many European countries such as Germany, Russia, France, Italy, and the UK, making Europe one of the major markets of feminine hygiene products. Also, the growing health consciousness among Europeans is boosting the demand for feminine hygiene products containing fibers, vitamins and minerals, whole grains, vegetables, and gluten-free bakery products such as gluten-free functional and gluten-free artisanal feminine hygiene products.

Rising awareness of menstrual hygiene are driving the feminine hygiene products market. In recent times, the women population in globally has become more aware of menstrual hygiene, particularly among the working class. Since 2012, several public health organizations have started focusing on menstruation hygiene management (MHM). Grassroots workers, social entrepreneurs, and United Nations agencies are also contributing to this noble cause. For example, in May 2013, WASH United conducted a 28-day social media campaign called "May #MENSTRAVAGANZA" on Twitter to generate awareness about menstruation and MHM. In January 2021, Raigarh district in Chhattisgarh, India, announced the launch of ‘Pavna,’ a unique community-based menstrual hygiene program.

The major players operating in the global feminine hygiene products market are Edgewell Personal Care Co, Kimberly-Clark Corp, Lune Group Oy Ltd, Me Luna GmbH, Mooncup Ltd, Ontex BV, Essity AB, Wuka Ltd, Cotton High Tech SL, The Procter & Gamble Co.

Based on the distribution channel, online retail segment is projected to grow at the fastest CAGR over the forecast period. E-commerce platforms are preferred by consumers owing to the convenience of shopping various products from remote locations, availability of a wide range of products of different brands, exclusive discounts and offers on these sites, and home delivery services (free or paid) offered by these platforms. Additionally, online platforms provide product descriptions, user reviews, and ratings, which help consumers choose the right product. Innovative feminine hygiene products such as menstrual cups, reusable period and incontinence underwear, menstrual discs, and tampon applicators are widely available across e-commerce channels.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Feminine Hygiene Products Market

- Edgewell Personal Care Co.

- Kimberly-Clark Corp

- Lune Group Oy Ltd

- Me Luna GmbH

- Mooncup Ltd

- Ontex BV

- Essity AB

- Wuka Ltd

- Cotton High Tech SL

- The Procter & Gamble Co

Get Free Sample For

Get Free Sample For