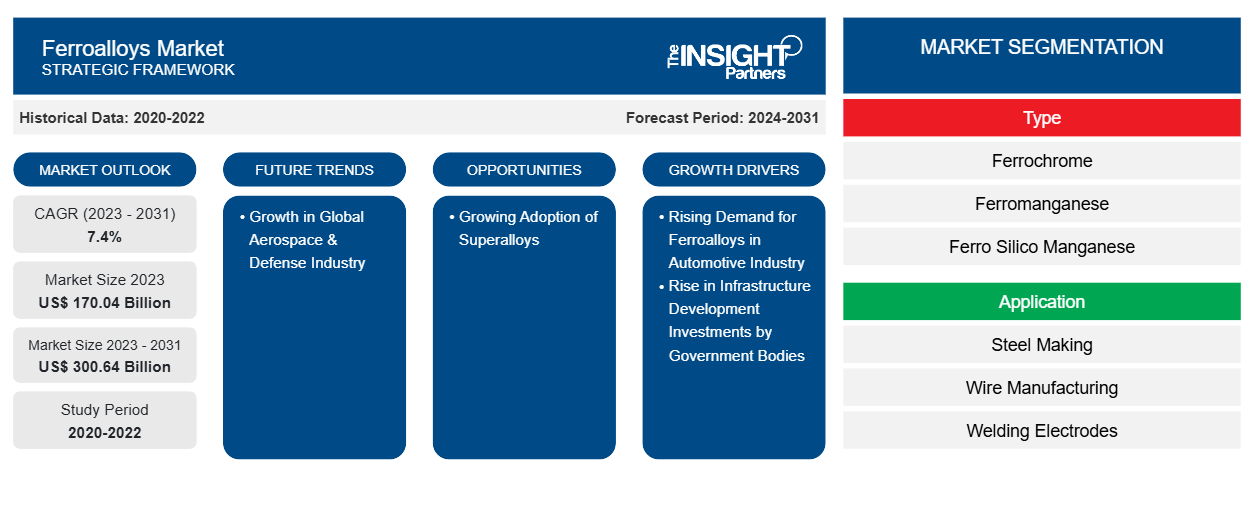

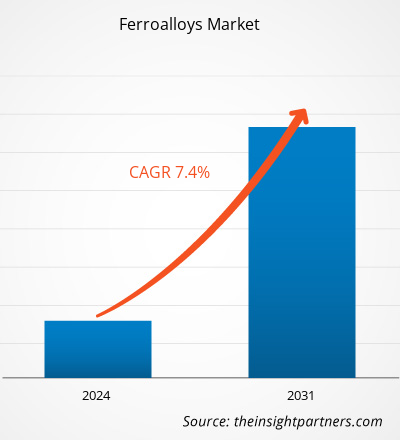

The ferroalloys market was valued at US$ 170.04 billion in 2023 and is expected to reach US$ 300.64 billion by 2031; it is estimated to register a CAGR of 7.4% from 2023 to 2031.

MARKET ANALYSIS

Ferroalloys are a group of alloys of iron containing one or more additional elements other than carbon. Ferroalloys have a high percentage of such elements as manganese, silicon, chromium, aluminum etc. Ferroalloys are mainly used as master alloys in the iron & steel industry since it is the most economical way to introduce an alloying element into the steel melt. Moreover, the global ferroalloys market size is likely to surge by 2030 owing to the growth in the global aerospace & defense industry. The aerospace industry is experiencing significant growth in technological advancements. In the industry, there is a rise in innovative ferroalloy applications, as ferroalloys contribute to fuel efficiency by reducing the overall aircraft weight and improving safety and reliability. The pursuit of sustainable transportation solutions and electrification in the aerospace industry has gained momentum. The utilization of ferroalloys in the production of lightweight, high-capacity batteries for electric aircraft aligns with the global transition toward green aviation.

According to the European Commission, the European Union established Horizon Europe in 2021, a research and innovation program with a total budget of ~US$ 103 billion, which includes aerospace research. Moreover, increased security risks and the need to enhance national border security have prompted governments of various countries to increase investments in defense and ballistic protection. Additionally, the rising demand for wind energy contributes significantly to the ferroalloys market growth.

GROWTH DRIVERS AND CHALLENGES

The rising demand for ferroalloys in the automotive industry contributes to the growing ferroalloys market size. The automotive industry is experiencing robust growth owing to technological advancement and a surge in preference for SUVs, crossovers, and other light trucks. According to the report released by the European Automobile Manufacturers’ Association (ACEA) in January 2023, car production in North America increased by 10.3%, reaching 10.4 million units in 2022 compared to 2021. Similarly, passenger car production in South Korea grew by 7.6%, reaching 3.4 million units in 2022 compared to 2021. The report published by the ACEA stated that global passenger car production accounted for 68 million units in 2022, recording rise of 7.9% compared to 2021.

As per the data of the Organisation Internationale des Constructeurs d'Automobiles (OICA), countries in North America, South America, and Central America recorded production of over 16.1 million commercial and passenger cars in 2021; the figure has grown by 10%, registering over 17.7 million commercial and passenger cars in 2022. Companies operating in the automotive sector are investing heavily in automobile manufacturing to increase production and sales. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and are projected to grow by 35% in 2023 to reach 14 million. As the automotive industry witnesses a transformative shift toward electric vehicles (EVs), the role of ferroalloys has become more crucial.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ferroalloys Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ferroalloys Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Ferroalloys Market Analysis and Forecast to 2031" is a specialized and in-depth study focusing significantly on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of type, application, and geography. The report provides key statistics on the use of ferroalloys across the region, along with their demand in major countries. In addition, it provides a qualitative assessment of various factors affecting the ferroalloys market growth in major countries. It also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities, which will aid in identifying the major revenue areas. Furthermore, the ferroalloys market trends include the growing adoption of superalloys. Superalloys are high-performance materials engineered to withstand extreme temperatures, corrosion, and mechanical stress, making them ideal for applications in harsh operating conditions. In the aerospace industry, superalloys play a critical role in the production of aircraft engines, gas turbines, and components subjected to high temperatures and mechanical loads. These alloys offer exceptional strength and oxidation resistance, allowing the efficient and reliable operation of jet engines and other propulsion systems. In the energy industry, superalloys are used in gas and steam turbines, and oil and gas exploration equipment. The infrastructure development of renewable energy sources, such as wind and solar power, also boosts the utilization of superalloys in the manufacturing of turbine blades, generator components, and heat exchangers—supporting the transition to clean and sustainable energy sources. The adoption of superalloys is driven by the ongoing research and development efforts aimed at improving the material properties, manufacturing processes, and cost-effectiveness. Advances in alloy design and processing techniques enable the development of a new generation of superalloys with superior performance characteristics.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global ferroalloys market, which helps understand the entire supply chain and various factors influencing the market growth.

SEGMENTAL ANALYSIS

The global ferroalloys market is bifurcated on the basis of type and application. Based on type, the market is segmented into ferrochrome, ferromanganese, ferro silico manganese, special alloys, and others. The special alloys segment accounts for the significant ferroalloys market share. Special alloys, also known as noble alloys, refer to a group of specialized alloys that contain one or more noble metals such as titanium (Ti), zirconium (Zr), tantalum (Ta), niobium (Nb), and vanadium (V), along with iron (Fe) and other elements. The alloys are characterized by their exceptional properties, including high strength, corrosion and heat resistance, and compatibility with various industrial processes. Ferrovanadium is one of the most widely used noble ferroalloys. It typically contains iron, vanadium, and small amounts of other elements such as aluminum (Al) and silicon (Si). Ferrovanadium is primarily used as an additive in the production of high-strength, low-alloy (HSLA) steels, which are widely used in structural applications, automotive components, and machinery manufacturing. The addition of ferrovanadium enhances the strength, toughness, and weldability of steel, making it suitable for demanding applications where durability and reliability are paramount. Ferrotitanium, another noble ferroalloy, is composed of iron and titanium, with trace amounts of carbon and other elements. Ferrotitanium is renowned for its exceptional strength-to-weight ratio, corrosion resistance, and heat resistance, making it an ideal choice for aerospace, defense, automotive, and medical applications.

Based on application, the ferroalloys market is segmented into steel making, wire manufacturing, welding electrodes, superalloys, and others. The welding electrodes segment accounts for the significant ferroalloys market share. Manganese is a key component of welding electrodes, serving as a deoxidizer and desulfurizer to improve the cleanliness and weldability of the molten metal. By scavenging impurities and forming stable oxides, manganese ensures better fusion between the electrode and base metal, resulting in high-quality welds with minimal defects. Silicon, another common ferroalloy in welding electrodes, enhances fluidity and arc stability during the welding process. It also contributes to the deoxidation of the weld pool, thereby reducing the formation of undesirable inclusions and ensuring uniform distribution of alloying elements throughout the weld joint. Carbon, often present in the form of graphite or carbon black, helps regulate the electrical conductivity and arc characteristics of welding electrodes.

REGIONAL ANALYSIS

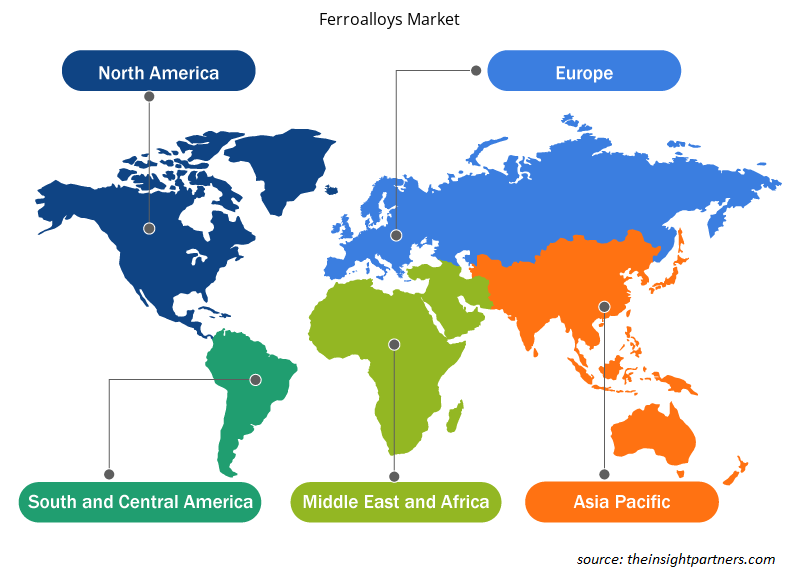

The report provides a detailed overview of the global ferroalloys market with respect to major regions, including North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America (SAM). Asia Pacific accounted for the largest market share and was valued at ∼US$ 110 billion in 2023. The region's extensive steel manufacturing industry drives substantial demand for ferroalloys, particularly ferrochrome, ferromanganese, and ferrosilicon, which are major raw materials in the steel-making industry. India boasts a strong steel industry fueled by infrastructure development, automotive manufacturing, and construction activities. The market in Europe is expected to reach ∼US$ 40 billion by 2031, while the ferroalloys market in North America is expected to record a CAGR of ~6% from 2023 to 2031.

Ferroalloys Market Regional Insights

Ferroalloys Market Regional Insights

The regional trends and factors influencing the Ferroalloys Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ferroalloys Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ferroalloys Market

Ferroalloys Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 170.04 Billion |

| Market Size by 2031 | US$ 300.64 Billion |

| Global CAGR (2023 - 2031) | 7.4% |

| Historical Data | 2020-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Ferroalloys Market Players Density: Understanding Its Impact on Business Dynamics

The Ferroalloys Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ferroalloys Market are:

- Glencore Plc

- Samancor Chrome

- Jindal Stainless Ltd

- Ferro Alloys Corporation Limited (FACOR)

- Erdos Group

- Pertama Ferroalloys Sdn Bhd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ferroalloys Market top key players overview

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Glencore Plc, Samancor Chrome, Jindal Stainless Ltd, Ferro Alloys Corporation Limited (FACOR), Erdos Group, Pertama Ferroalloys Sdn Bhd, Brahm Group, Tata Steel Ltd, Nikopol Ferroalloy Plant, and Nava Limited are among the prominent players profiled in the ferroalloys market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The ferroalloys market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

According to the press releases, a few initiatives taken by the key players operating in the ferroalloys market are listed below:

- In 2024, Rhovan, a Glencore Ferroalloys-managed vanadium mining and processing facility located near Brits in the North West province, South Africa, commenced construction of a 25MW solar photovoltaic (PV) plant. Once completed, the energy produced by the PV plant was fed into Rhovan’s network and was expected to supply approximately 30% of the operations’ annual energy demand.

- In 2022, Tata Steel acquired ferroalloys producing assets of Odisha-based Stork Ferro and Mineral Industries for ~US$ 18 million in an all-cash deal. An asset transfer agreement had already been signed between the two companies as a part of Tata Steel's strategic expansion plans in the ferro alloys sector.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Personality Assessment Solution Market

- Medical Second Opinion Market

- Employment Screening Services Market

- Medical Collagen Market

- High Speed Cable Market

- Customer Care BPO Market

- Smart Parking Market

- Occupational Health Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Adaptive Traffic Control System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global ferroalloys market are Glencore Plc, Samancor Chrome, Jindal Stainless Ltd, Ferro Alloys Corporation Limited (FACOR), Erdos Group, Pertama Ferroalloys Sdn Bhd, Brahm Group, Tata Steel Ltd, Nikopol Ferroalloy Plant, and Nava Limited.

Ferromanganese is an alloy composed of manganese (~80–85%) and iron (approximately 15–20%), along with trace amounts of other elements such as carbon, silicon, and phosphorus. It is a crucial component in the steelmaking industry, where it serves as a deoxidizer and desulfurizer, enhancing the mechanical properties such as the strength, malleability, and corrosion resistance of steel.

Asia Pacific accounted for the largest market share in 2023. The region's extensive steel manufacturing industry drives substantial demand for ferroalloys, particularly ferrochrome, ferromanganese, and ferrosilicon, which are major raw materials in the steel-making industry. India has a strong steel industry fueled by infrastructure development, automotive manufacturing, and construction activities.

The automotive industry is experiencing robust growth owing to technological advancement and a surge in preference for SUVs, crossovers, and other light trucks. According to the report released by the European Automobile Manufacturers’ Association (ACEA) in January 2023, car production in North America increased by 10.3%, reaching 10.4 million units in 2022 compared to 2021.

Ferroalloys are added to molten steel during the steelmaking process to achieve specific characteristics tailored to various applications. One of the most common ferroalloys used in steelmaking is ferrochrome; it contains chromium and is instrumental in imparting corrosion resistance, hardness, and high-temperature strength to stainless steel.

The aerospace industry is experiencing significant growth in technological advancements. In the industry, there is a rise in innovative ferroalloy applications, as ferroalloys contribute to fuel efficiency by reducing the overall aircraft weight and improving safety and reliability. The pursuit of sustainable transportation solutions and electrification in the aerospace industry has gained momentum.

Get Free Sample For

Get Free Sample For