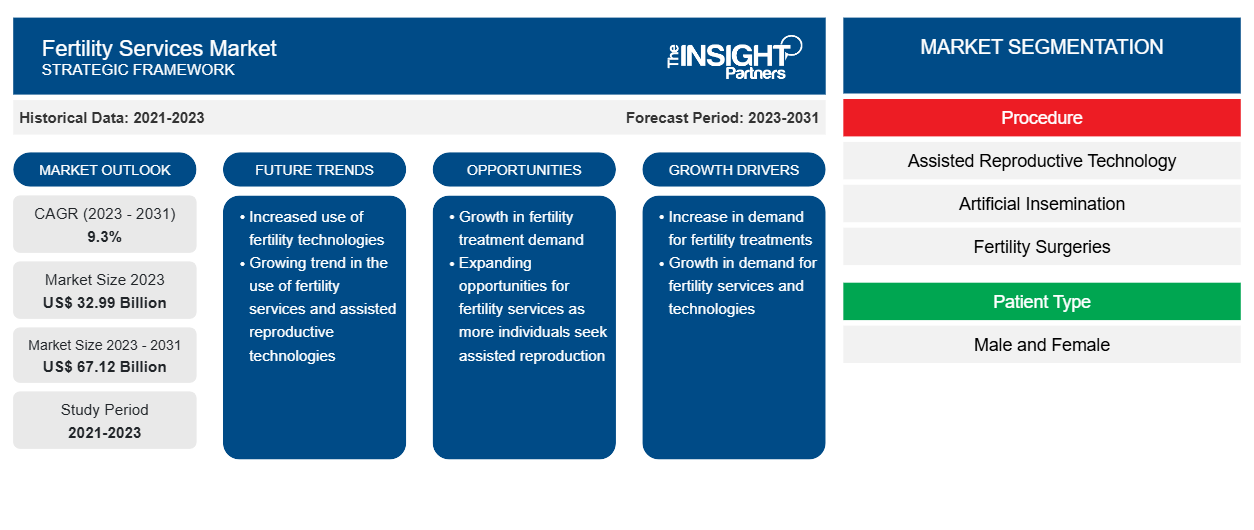

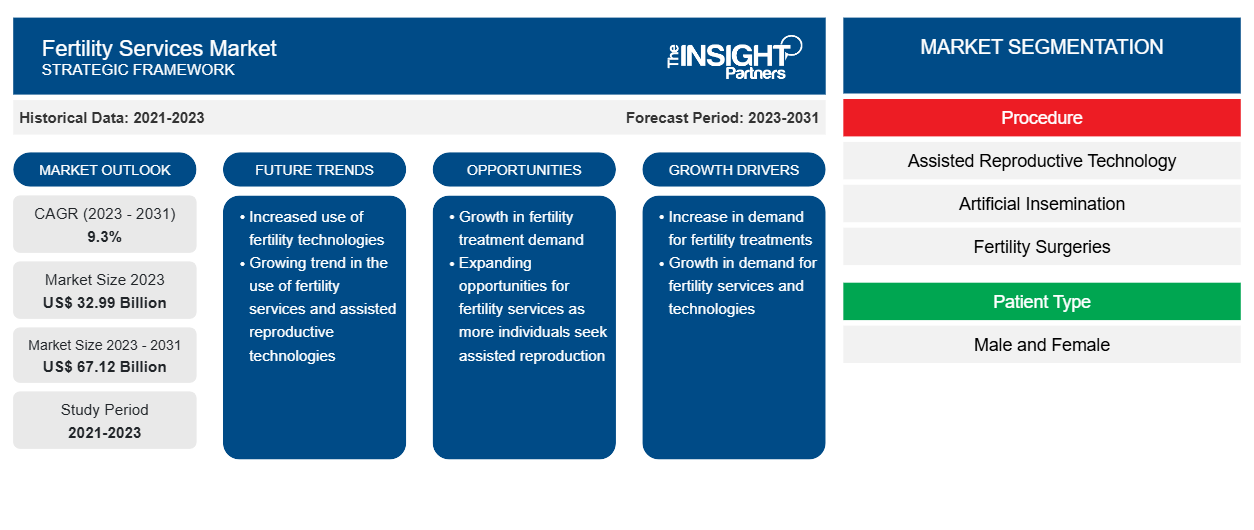

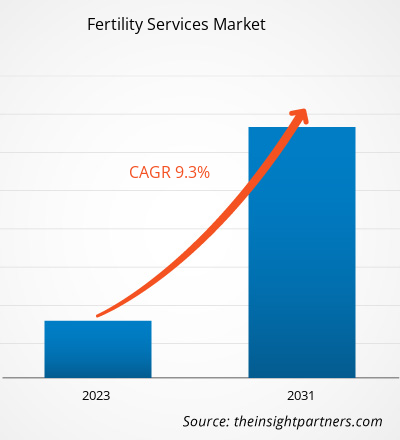

[Research Report] The fertility services market forecast is projected to grow from US$ 32.99 billion in 2023 to US$ 67.12 billion by 2031; the market is estimated to record a CAGR of 9.3% during 2023–2031.

Market Insights and Analyst View:

The factors contributing to the growing fertility services market size are the increasing accessibility and availability of healthcare facilities; growing success rates of in vitro fertilization (IVF) using ICSI in men with poor sperm morphology, motility, and low sperm count; and rising healthcare and research spending. Further, the increasing prevalence of infertility-causing medical diseases such as polycystic ovary syndrome (PCOS), endometrial tuberculosis, and sexually transmitted diseases (STDs) are also driving the market growth. Increasing awareness regarding infertility and easier access to better healthcare facilities have also increased demand for these services in developed and emerging countries. The rise in cases of infertility-related diseases has boosted the global market in recent years. Other factors contributing to the growth of the market include increasing disposable incomes, availability of flexible coverage options from health insurance companies, and increased advertising and promotion of reproductive services through television and Internet portals. Also, the report includes growth prospects in light of current fertility services market trends such as growing launches and approvals for fertility services and technological advancements.

Growth Drivers:

Increasing Prevalence of Gynecological Conditions Propels Market Growth

Tubal abnormalities such as blocked fallopian tubes, which are caused by untreated sexually transmitted diseases (STIs) or the consequences of a botched abortion, postpartum sepsis, and abdominal/pelvic surgery can lead to infertility in women. Increasing incidences of various diseases, including endometrial tuberculosis, PCOS, and STDs, that can lead to infertility drive the expansion of the fertility services market. According to the Cureus Journal published in August 2022, the global prevalence of PCOS in the female population is estimated to be between 4 and 20%. The World Health Organization (WHO) estimated that, in 2021, PCOS affected over 116 million women (3.4%) across the world. Furthermore, according to the Lancet article in 2020, the estimated number of women suffering from PCOS in China is 24 million. Thus, this factor boosts the demand for in vitro fertilization (IVF) and various assisted reproductive techniques (ART) for women, which drives the fertility services market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fertility Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fertility Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The fertility services market analysis is carried out on the basis of procedure, patient type, end user, and geography. The market, based on procedure, is segmented into assisted reproductive technology, artificial insemination, and fertility surgeries. The market, based on patient type, is bifurcated into male and female. In terms of end user, the fertility services market is segmented into fertility centers, hospitals & surgical clinics, and others.

Segmental Analysis:

Based on procedure, the fertility services market is segmented into assisted reproductive technology, artificial insemination, and fertility surgeries. The assisted reproductive technology segment accounted for the largest market share in 2023. It is expected to register the highest CAGR during 2023–2031. The market for the assisted reproductive technology segment is further segmented into in vitro fertilization, intracytoplasmic sperm injection, and surrogacy.

The fertility services market, by patient type, is bifurcated into male and female. The female segment held a larger market share in 2023. However, the male segment is anticipated to register a higher CAGR during the forecast period. The increasing stress levels, obesity, smoking, and alcohol consumption are among the factors contributing to male infertility. Furthermore, growing awareness regarding fertility services, increasing R&D expenditure, initiatives by major market players to launch their products, and changing lifestyles fuel the market growth for the male segment.

In terms of end user, the fertility services market is segmented into fertility centers, hospitals & surgical clinics, and others. The fertility centers segment held the largest market share in 2023 and is anticipated to register the highest CAGR during 2023–2031. The increase in the number of fertility clinics worldwide, coupled with technological advancements, boosts the global market growth for this segment. In addition, awareness of infertility treatment among people in developed and emerging countries is increasing rapidly. This has led to an increased number of fertility treatment clinics worldwide, propels the global market growth for the segment. Further, increasing number of professionals who can treat infertility; growing disposable income; and upsurging number of licensed fertility clinics in developing countries such as India, China, and others also boosts the growth of the fertility centers segment.

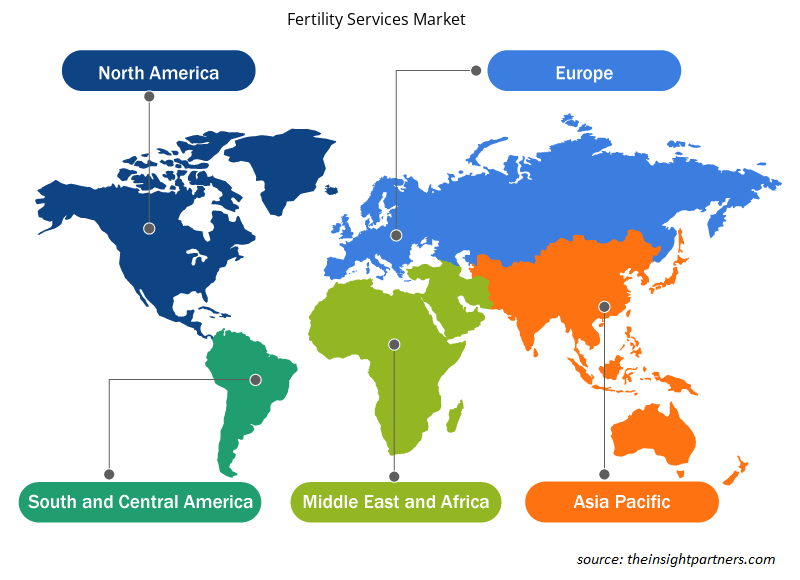

Regional Analysis - Fertility Services Market:

The scope of the fertility services market report focuses on North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). Asia Pacific held the largest market share in 2023 owing to introduction and rapid distribution of several infertility drugs and increasing research activities in infertility.

Europe held the third largest fertility services market share in 2023. The market in this region is segmented into Germany, the UK, Italy, Spain, France, and the Rest of Europe. The presence of numerous domestic market players and the increasing incidences of infertility are among the key factors driving the market growth in this region. Germany is one of the major contributors to the regional market. Europe hosts 40% of all IVF clinics worldwide, which has proven to be a key factor in the success of the European fertility testing and treatment market. In addition, the region has seen significant investments from global leaders. The overall outlook for the European market is promising, with superior IVF technology attracting significant investment from private equity investors. Additionally, do-it-yourself testing has increased access and helped reduce the cost of infertility testing and treatment. Both factors are expected to present lucrative opportunities for the fertility services market growth in the coming years.

The fertility services market in Asia Pacific is expected to record the fastest CAGR of XX% from 2021 to 2031. The market in APAC is segmented into China, Japan, India, Australia, South Korea, and the Rest of APAC. The market in China is growing due to rising medical tourism and improving healthcare infrastructure, which is anticipated to increase the adoption of fertility services in the region. In addition, technological advancements in developing various fertility services by the market players is expected to drive the market's growth in the region. An increase in product launches and rise in approvals for high-tech fertility services are expected to boost regional market growth in the coming years. Due to rising infertility rates in the region, a trend toward later pregnancies, increasing IVF success rates, and growing disposable income, the market in Asia Pacific is expected to grow significantly during the forecast period. IVF is one of the most commonly used methods to support people affected by infertility, including single mothers, couples, and members of the LGBT community. Furthermore, the IVF treatment market in Asia Pacific has sustainable development potential due to the upsurge in fertility tourism. Further, the market growth is expected to be fuelled by the increasing number of fertility clinics and expansion potential in emerging regions.

Fertility Services Market Regional Insights

Fertility Services Market Regional Insights

The regional trends and factors influencing the Fertility Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fertility Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fertility Services Market

Fertility Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 32.99 Billion |

| Market Size by 2031 | US$ 67.12 Billion |

| Global CAGR (2023 - 2031) | 9.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Procedure

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

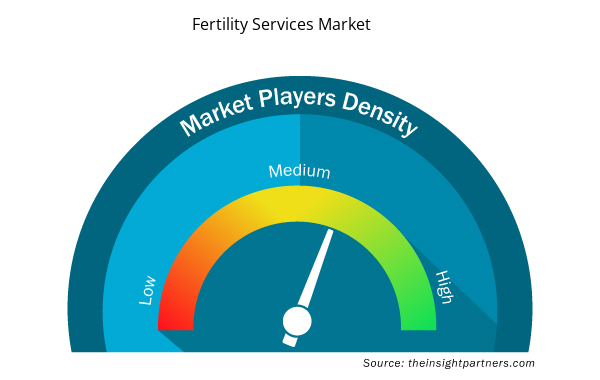

Fertility Services Market Players Density: Understanding Its Impact on Business Dynamics

The Fertility Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fertility Services Market are:

- CooperSurgical, Inc

- Vitrolife

- Cook Medical

- Care Fertility

- INVO Bioscience

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fertility Services Market top key players overview

Industry Developments and Future Opportunities – Fertility Services Market:

According to the press releases by leading players operating in the fertility services market, a few initiatives are listed below:

- In October 2022, Indira IVF collaborated with Maven Clinic, a US-based company specializing in women's and family health with the help of telemedicine-based virtual clinics. The collaboration aims to provide Maven members in India access to Indira IVF's high-quality clinical care, other benefits, and the best virtual family education care available through the Maven platform. Indira IVF is an India-based chain of specialty infertility clinics.

- In August 2022, Genea Fertility was a Platinum Sponsor at the Australian Jewish Fertility Network's (AJFN) Annual Major Fundraiser.

- In December 2021, Cooper Surgical, a leading provider of women's health solutions, acquired Generate Life Sciences for US$1.6 billion. With this acquisition, Cooper Surgical offers an even greater selection of fertility and OB/GYN centers. Generate Life Sciences is a US-based company that provides donor eggs and sperm to fertility cryopreservation services, fertility treatment centers, and newborn stem cell storage.

- In July 2021, Hamilton Throne Ltd., a global provider of ART research, purchased IVFTECH ApS (IVFtech) and its subsidiary K4 Technology ApS. K4, IVFtech is committed to offer large-capacity laminar flow workstations and incubators for ART. The acquisition cost was US$8 million.

- In May 2021, Virtus Health, a global leader in Assisted Reproductive Services (ARS), announced a strategic collaboration with Drop Bio, an Australian biotechnology and digital health company focused on chronic inflammation, driving advances in the delivery of precision fertility.

- In February 2021, Cooper Surgical, a leading provider of women's health solutions, announced a multi-year strategic collaboration with Virtus Health, a global leader in assisted reproductive services, to drive innovation, digitalization, and advances in fertility treatment.

- In November 2020, Ferring B.V. and Igenomix entered into a research collaboration for four years to develop novel therapeutic products to treat patients affected by pregnancy-related diseases.

Competitive Landscape and Key Companies – Fertility Services Market:

CooperSurgical, Inc.; Vitrolife; Cook Medical; Care Fertility; INVO Bioscience; Carolinas Fertility Institute; Genea Limited; Merck KgaA; LABOTECT GmbH; and Monash IVF Group Limited are the prominent market players profiled in fertility services market report. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Procedure, Patient Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The fertility services market is analyzed on the basis of procedure, patient type, end user. Based on procedure, the fertility services market is segmented into assisted reproductive technology, artificial insemination, and fertility surgeries. The assisted reproductive technology segment accounted for the largest market share in 2023. It is expected to register the highest CAGR during 2023–2031. The fertility services market, by patient type, is bifurcated into male and female. The female segment held a larger market share in 2023. However, the male segment is anticipated to register a higher CAGR during the forecast period. In terms of end user, the fertility services market is segmented into fertility centers, hospitals & surgical clinics, and others. The fertility centers segment held the largest market share in 2023 and is anticipated to register the highest CAGR during 2023–2031.

The fertility services market majorly consists of the players such as CooperSurgical, Inc.; Vitrolife: Cook Medical: Care Fertility: INVO Bioscience: Carolinas Fertility Institute: Genea Limited: Merck KgaA: LABOTECT GmbH: and Monash IVF Group Limited.

Treatments for genetic disorders and infertility problems are part of fertility services to aid conception. The development of assisted reproductive technologies (ART) such as intracytoplasmic sperm injection (ICSI) and in vitro fertilization (IVF) is one of the most significant developments in the fertility services market. These techniques have revolutionized reproductive medicine by making conceiving an embryo outside the body possible, thereby increasing the likelihood of a healthy pregnancy. Other advances include pre-implantation genetic testing, embryo cryopreservation, and egg freezing, providing additional options for couples and individuals pursuing fertility treatments.

The growing social and environmental factors and increasing prevalence of gynecological conditions contribute to the growing fertility services market size. However, high costs associated with fertility services hinder the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Fertility Services Companies

- CooperSurgical, Inc

- Vitrolife

- Cook Medical

- Care Fertility

- INVO Bioscience

- Carolinas Fertility Institute

- Genea Limited

- Merck KgaA

- LABOTECT GmbH

- Monash IVF Group Limited

Get Free Sample For

Get Free Sample For