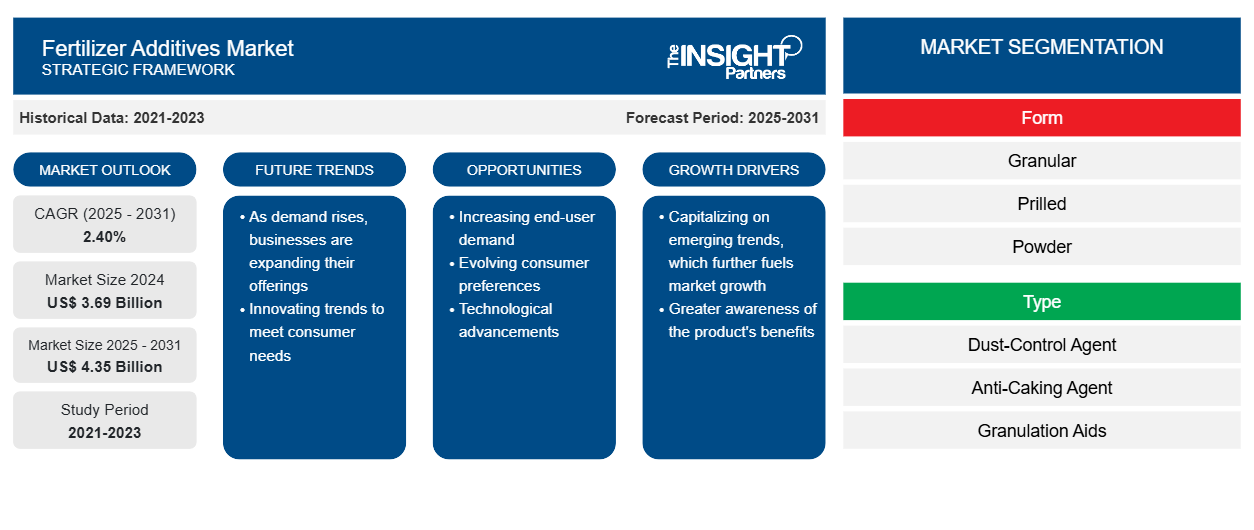

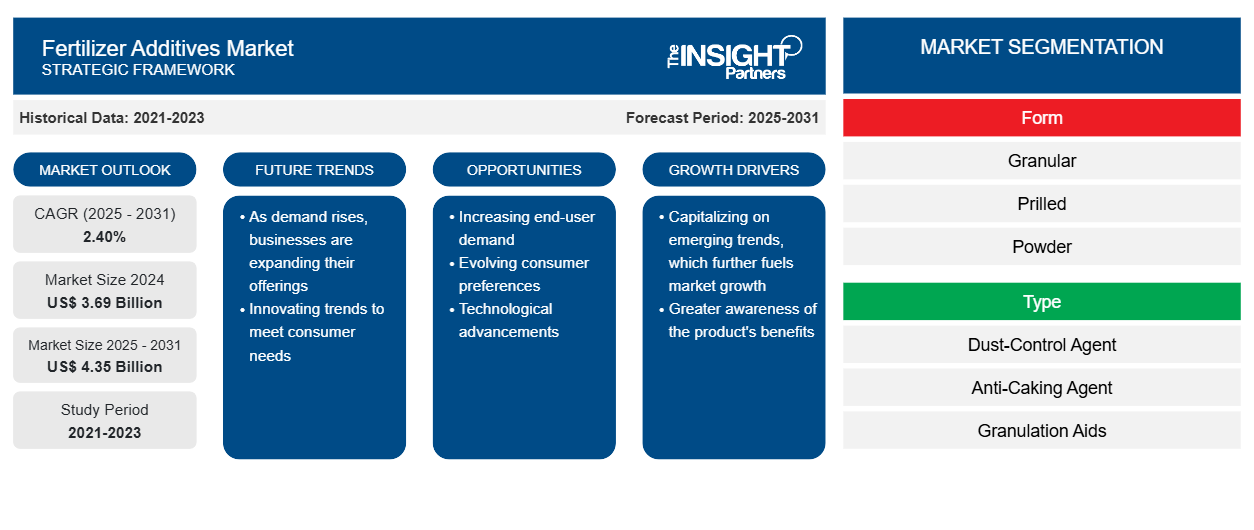

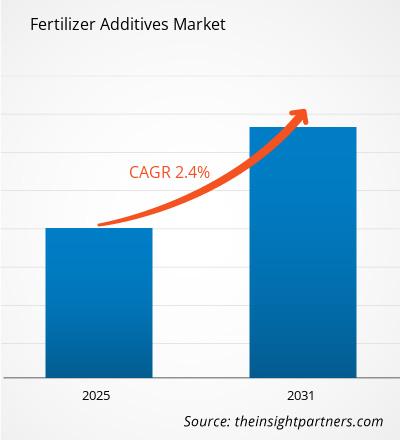

The fertilizer additives market is expected to grow from US$ 3,512.65 million in 2022 to US$ 4,050.19 million by 2031; it is expected to grow at a CAGR of 2.4% from 2022 to 2031.

The use of fertilizers is one of the oldest methods of improvising agriculture processes. Modern chemical fertilizers contain three essential elements—nitrogen, potassium, and phosphorus (NPK)—that are vital for the nutrition of a plant. The fertilizer additives often include other nutrients such as sulfur, calcium, zinc, boron, copper, iron, and magnesium that are necessary for plant growth. Thus, fertilizer additives play an important role in healthy plant growth as they provide the soil with essential nutrients that often depletes over time. Hence, the new combinations and research and development has been gaining traction as manufacturers are extensively implanting research technologies to innovate new products. Therefore, the innovations by the manufacturers and new product launches further propels the demand for the fertilizer additives market. Fertilizer additives are chemical or natural substances, which are added to increase the efficiency of fertilizers. Fertilizer additives help improve soil quality and prevent the loss of essential nutrients. They also provide antifoaming and anti-caking characteristics to the fertilizer. Hence, the properties associated with the fertilizer’s additive led to fuel the fertilizer additives market growth.

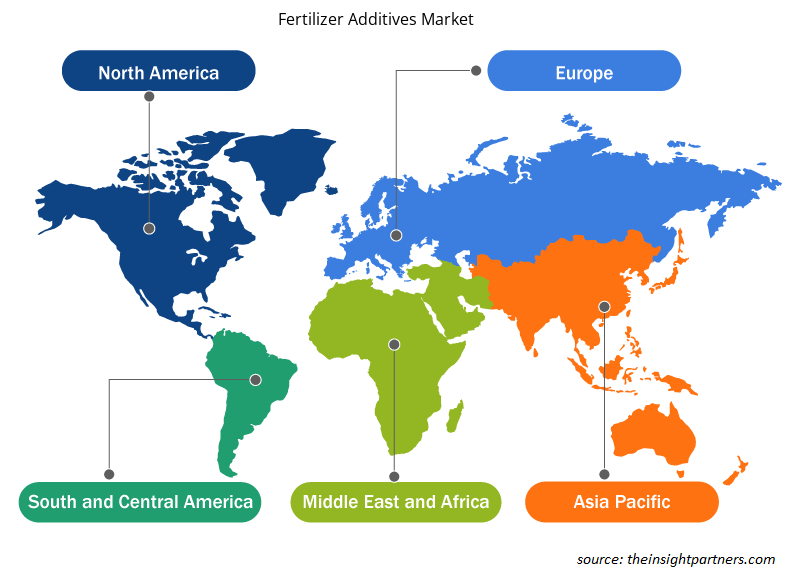

Asia Pacific held the largest share of the fertilizer additives market in 2021, and other regions such as North America, and Europe are expected to grow significantly during the forecast period owing to the factors such as increasing production and productivity, and growing need for food security. The agriculture industry in Asia Pacific follows strict regulations on the use of chemical products for agriculture. Governments of various countries in the region have taken various initiatives to promote the use of biological products for agriculture. Hence, the regulations by many governments has control over the quality of fertilizers and drives the fertilizer additives market growth. The Asia and Pacific Plant Protection Commission (APPPC) has acknowledged the significance of an efficient and transparent exchange of critical information related to plant protection and field conservation. Food and Agricultural Organization (FAO’s) regulatory compliances include mandatory improvements in agricultural productivity, rising standards of living of rural populations by alleviating poverty through agriculture, and overall contribution to the growth of the world economy. FAO provides financial and technical assistance to farmers to motivate them to opt for suitable products for agricultural purposes. Thus, the expanding farming sector in Asia Pacific is expected to support the adoption of fertilizer additives in the coming years which projected to increase the fertilizer additives market share during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fertilizer Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fertilizer Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Research and Development in Fertilizer Industry

Increasing agricultural productivity, growing need to control pest and insects, and doubling of agricultural production and income is attributed to the effective adoption of improved technologies. The yield of any farm is maintained through the optimization of the production factors, including types, rates, methods, and modes of application of fertilizers, soil conditions, crop variety, water irrigation, and conditions in that farm. Among all these parameters, fertilizers contribute the highest to the increased yield. Fertilizers provide additional nutrients for crop growth and support a continuous increase in annual crop production. The fertilizer input in crop production contributes ~40–50% of the total yield increase for most crops. Combining the use of fertilizer additives with advanced science and technologies and growing favorable government policies to support farmers across the world are expected to contribute to the fertilizer additives market growth.

Form-Based Insights

Based on form, the fertilizer additives market is segmented into granular, prilled, and powder. The prilled segment is projected to account for the largest market share during the forecast period. Prilling is a method of producing uniform spherical particles from molten solids, robust solutions, or slurries. Prills are formed by allowing drops of the melted prill substance to congeal or freeze in mid-air after being dripped from the top of a tall prilling tower. Low-density prills are more porous than high-density prills and are preferred for industrial use, while high-density prills are utilized as fertilizer. A few agrochemicals such as urea are often manufactured in prilled form. Ammonium nitrate fertilizers, urea, and NPK fertilizers are generally available in prills form. Prilled urea is widely preferred because it is more resistant to breaking down when being blended with other components of the fertilizer. Hence, the prilled segment has a significant role and the use of prilled form further increase the fertilizer additives market share.

Type-Based Insights

Based on type, the fertilizer additives market is segmented into dust-control agent, anti-caking agent, granulation aids, coloring agent, corrosion inhibitors, and others. The dust-control agent segment is projected to register the highest CAGR in the market during the forecast period. Throughout the entire fertilizer manufacturing process, including storage and packaging, fertilizer undergoes many threats that can influence its effectiveness and shelf-life. One of the riskiest problems is fertilizer dust. Fertilizer dust can produce health risks for facility workers, increase a facility’s probable for combustion fires. To control these hazardous effects of fertilizer dust control solutions are implemented. Fertilizer dust can have a substantial, long-term negative impact on the manufacturing facility. Generally, there are two methods to control fertilizer dust one is collection, and another is suppression. Dust collection includes using a machine or system to capture and dispose of the dust. Dust collection methods involve exhaust hoods, duct systems, dust collectors, and fan or motor systems. These methods can be costly and there is no universal standard governing these products.

A few Key players operating in the fertilizer additives market are Arkema Group; Solvay; KAO CORPORATION; Chemipol S.A.; Chemsol LLC; Clariant; Dorf Ketal; Michelman, Inc.; Omex Agriculture, Inc.; and Novochem Group. These players are engaged in developing products with reduced health risks to meet emerging consumer trends and abide by regulatory frameworks. They are involved in mergers and acquisitions, business expansions, and partnerships to expand their market share.

Report Spotlights

- Progressive industry trends in the fertilizer additives market to help players develop effective long-term strategies

- Business growth strategies adopted to secure growth in developed and developing markets

- Quantitative analysis of the fertilizer additives market from 2022 to 2031

- Estimation of global demand for probiotics

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook and factors governing the growth of the fertilizer additives market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- Size of the fertilizer additives market at various nodes

- Detailed overview and segmentation of the market and the fertilizer additives industry dynamics

- Size of the growth in various regions with promising growth opportunities

Fertilizer Additives Market Regional Insights

The regional trends and factors influencing the Fertilizer Additives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fertilizer Additives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fertilizer Additives Market

Fertilizer Additives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.69 Billion |

| Market Size by 2031 | US$ 4.35 Billion |

| Global CAGR (2025 - 2031) | 2.40% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Fertilizer Additives Market Players Density: Understanding Its Impact on Business Dynamics

The Fertilizer Additives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fertilizer Additives Market are:

- Arkema Group

- Solvay

- Kao Corporation

- Chemipol S.A.

- Chemsol LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fertilizer Additives Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Collagen Peptides Market

- Aircraft Wire and Cable Market

- Digital Language Learning Market

- Third Party Logistics Market

- Nuclear Decommissioning Services Market

- Europe Tortilla Market

- Unit Heater Market

- Wind Turbine Composites Market

- Rare Neurological Disease Treatment Market

- Military Rubber Tracks Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Form, and Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

- Arkema Group

- Solvay

- Kao Corporation

- Chemipol S.A.

- Chemsol LLC

- Clariant

- Dorf Ketal

- Michelman, Inc.

- Omex Agriculture, Inc.

- Novochem Group

Get Free Sample For

Get Free Sample For